andresr/E+ through Getty Pictures

PAVmed (NASDAQ:PAVM) reveals how dangerous small-cap progress shares might be, sadly. We noticed, and nonetheless see, plenty of potential as they’ve numerous applied sciences and units which might be promising and a few of these are already FDA authorised.

Then they did one thing good, they began to deal with PAVmed as a type of holding firm with centralized providers, with the plan of making public choices for these divisions which have been in industrial or near-commercial stage.

This has an a variety of benefits:

Shared sources and efficiencies in central capabilities Monetizing their most mature options while nonetheless holding a majority stake Tapping the capital markets with out diluting the shares of PAVmed

The markets have been additionally on board with this because the inventory worth went to $10 however the enthusiasm for small progress shares has turned 180 levels and execution delays did additional harm.

FinViz

Nonetheless, we expect the corporate nonetheless has lots going for it and at $1 there may be room for restoration within the share worth if the corporate executes in line with plan.

Lucid

The primary division that was put in the marketplace was Lucid (LUCD), which has commercial-stage EsoCheck/Guard the one nonendoscopic biomarker screening check for treating gastroesophageal reflux illness who’re prone to growing esophageal precancer and most cancers, particularly extremely deadly esophageal adenocarcinoma. The EsoCheck/EsoGuard is an easy various for an invasive endoscopy. Or, from the LUCD Q1/22CC: “Lucid Diagnostics is a commercial-stage most cancers prevention diagnostics firm centered on the thousands and thousands of power heartburn sufferers who’re prone to growing extremely deadly esophageal most cancers. In contrast to different widespread cancers, mortality charges are excessive even of their earlier phases. So stopping deaths requires us to detect esophageal pre-cancer, which happens in roughly 5% to fifteen% of that threat power heartburn sufferers.” PAVmed has a 76% stake value $65M. The ACG (American School of Gastroenterology) lately up to date its medical guideline together with non-endoscopic biomarker screening. EsoCheck/Guard is the one one in the marketplace. Prior hesitations about girls needing checks disappeared, greater than doubling the goal inhabitants. Medicare contractor Palmetto GBA’s MoIDX program revealed a foundational LDC (native Medicare protection dedication) for public overview offering standards for a class of testing. This occurred earlier than the American School tips so it did not take its suggestion for non-endoscopic biomarker testing on board however the public overview will seemingly take these ACG suggestions onboard. Lucid executed 533 EsoGuard checks in Q1 +500% Y/Y +76% Q/Q. Its gross sales power is increasing. The corporate is increasing its check facilities, now in 7 western cities, 9 extra deliberate this yr unexpectedly (these check facilities are largely only a gross sales rep and a practitioner, and a small workplace). In a few of these cities, they have already got a presence. “Single nurse practitioner can moderately carry out 20 EsoCheck procedures on a standard workday. Every check middle covers its private and medical workplace lease prices with solely a few reimbursed checks per week.” (LUCD Q1/22CC). The pilot EsoGuard telemedicine program launched on Dec/21, promoting in Phoenix. Lucid DX Labs is now CLIA licensed (Feb/22) so the corporate can transition from the industrial lab (requiring fastened month-to-month funds). The transition towards direct billing will trigger a pause in out-of-network receipts. Reimbursement: our first industrial payer settlement with MediNcrease Well being Plans (8M lives) EsoGuard $2.5K (Medicare $1.9K and out of community between $1K and $1.3K). There may be additionally progress with Medicare reimbursement.

Veris Well being

Launched in June 2021 with the acquisition of Oncodisc PAVmed has an 81% stake. Veris Well being is a digital well being firm growing the primary clever implantable vascular entry port with biologic sensors and wi-fi communication to enhance customized most cancers care by distant affected person monitoring. “The Veris Expertise is designed to permit oncologists to detect early indicators of widespread cancer-related problems, present longitudinal traits of physiologic and medical information, provide data-driven threat administration instruments for precision oncology and incorporate extra prospects for substantial worth creation by information monetization and biotherapeutic medical trial assist.” (Q1/22CC) It runs on a SaaS service leveraging current reimbursement codes for distant affected person monitoring It has a partnership with Microsoft (MSFT). The primary industrial launch will likely be later this yr. Its core is offered by three interconnected software program platforms, a affected person good app, a cloud-based software program platform to which the app uploads and an app for the medical staff to interact with the cloud-based platform. Hiring 4 consultants, who’re additionally obtainable for PAVmed platform. There are additionally three gadget initiatives, Mercury, Venus and Solis “Veris Photo voltaic combines the software program platform with current wearable and linked medical units. This may permit us to launch the primary industrial product and get worthwhile preliminary real-world expertise with the software program platform and interact with early adopters. We’re on schedule to launch Veris Photo voltaic later this yr.” (Q1/22CC) Veris Mercury is their very own implantable good gadget. The launch is anticipated subsequent yr. Veris Venus “will provide the absolutely built-in clever vascular entry port using lots of the identical elements Venus Mercury – as Veris Mercury, excuse me. We’ll search to advance this product by the FDA’s de novo pathway, however EU rules for the built-in gadget will likely be much less onerous and will permit a basic Europe first technique” (Q1/22CC).

CarpX

Restricted industrial launch, ready for product enhancements Improvement of a next-generation CarpX gadget that includes built-in ultrasound imaging, facilitating the process. FDA submission 2023

NextFlo

The small redesign hasn’t but delivered repeatability of information consistency so FDA submission continues to be a way off

PortIO

The primary maintenance-free long-term vascular entry gadget First medical trial in Colombia ongoing

EsoCure

endoscopically deal with esophageal precancer Animal research present it compares favorably to Medtronic’s Barrick gadget (market-leading)

Enterprise improvement

The corporate has a R&D pipeline for brand new merchandise in varied phases of improvement Employed an skilled supervisor For doable M&A, administration sees good alternatives in areas which might be synergistic (notably good gadget applied sciences), valuations a lot lowered

Funds

There was $189K EsoGuard income from fastened contract ResearchDX (which terminated 25/2/22), however going ahead they invoice payers straight with their very own lab. Whereas March had a file variety of check, they did not invoice in the course of the month, ready for Q2 for the brand new income cycle supplier comes on-line.

So suppose they did 200 checks in March and the few days of February at $1K-$1.3K every, they’re operating at $250K a month and that quantity is unquestionably going to extend with extra checks and better reimbursement protection.

The amount of EsoGuard checks payable on the CMS price required to fulfill the 2022 income estimates offered by the 4 protecting analysts is achievable, in line with administration.

Income in Q1 was simply $200K. Administration argues that gross margins might be within the vary of 60%+ when income scales. Lucid’s OpEx is 60%+ of PAVmed’s OpEx, which elevated from $8.1M in Q1/21 to $19.3M this quarter. With out stock-based comp, OpEx is simply $11.7M ($8.2M from Lucid).

There was some improve in S&M (largely at Lucid) however G&A and R&D will likely be related in remainder of the yr. The web loss was $16.9M (EPS -$0.20) vs $9.4M (-$0.13) in Q1/21. There have been $5.2M in non-cash fees so non-GAAP loss was $11.7M (-$0.14 per share).

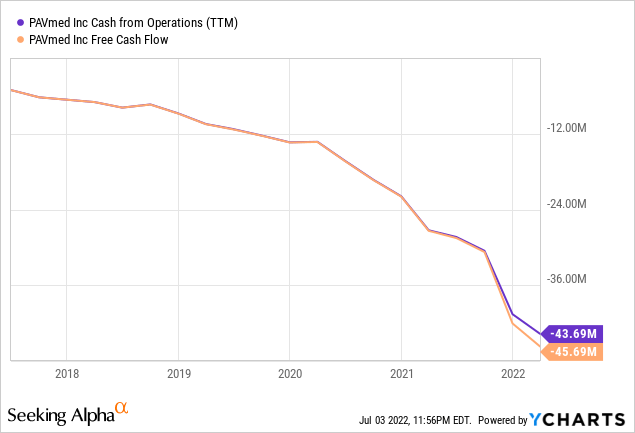

The corporate had $64.7M in money and equivalents on the finish of Q1 versus $77.3M at finish of This autumn/21. Add to that the $24.5M of internet proceeds from convertible debt issued in April this yr, so money is sort of $90M now. The issue is in fact this:

After which there may be this:

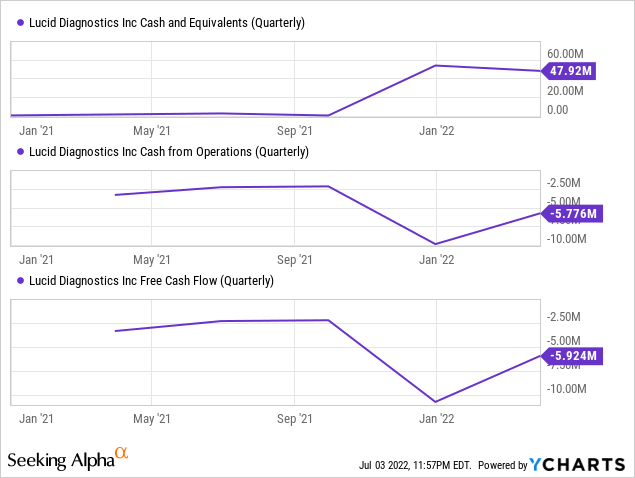

Lucid had $8.1M in OpEx (ex stock-based compensation), with $48M in money and a $50M program with Cantor Fritz for use on the firm’s description, they in all probability have not less than six quarters of money and that might be extra.

If they’ll scale the testing in that interval they may not want all that a lot extra financing, these check facilities have a really low breakeven level, so this is not an unrealistic state of affairs.

Valuation

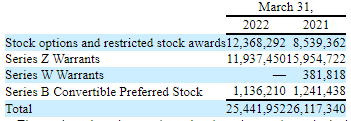

PAVM Q1/22 10Q

Contemplate the next metrics:

88M shares out + 25.4M choices, warrants and so forth. Market cap $105M Money $90M

So mainly, the corporate trades just a bit above money, and weren’t even together with the $65M stake in Lucid. However with the money bleed continuing at tempo, they might want to scale the EsoCheck testing to scale and optimistic information about reimbursement can even assist.

Conclusion

There are a lot of transferring elements, however we discover the core mannequin of getting PAVmed as a type of holding firm, promoting elements of its divisions when the expertise is prepared for commercialization fairly engaging.

We expect that the 76% stake in Lucid alone might be value greater than the entire firm proper now, but it surely relies on how briskly they’ll scale up the testing and e-book progress with reimbursement.

We expect that Veris Well being might be one other success, but it surely’s early days but. CarpX has potential, however progress has been slower than anticipated.

The chance is in fact the corporate operating out of money. That is not occurring inside a yr, so there may be time to ramp their revenues.