Torsten Asmus

By Lily Chung, Supervisor, Fastened Earnings and Multi Asset Product and Analysis and Alan Meng, Sustainable Fastened Earnings Analysis Lead

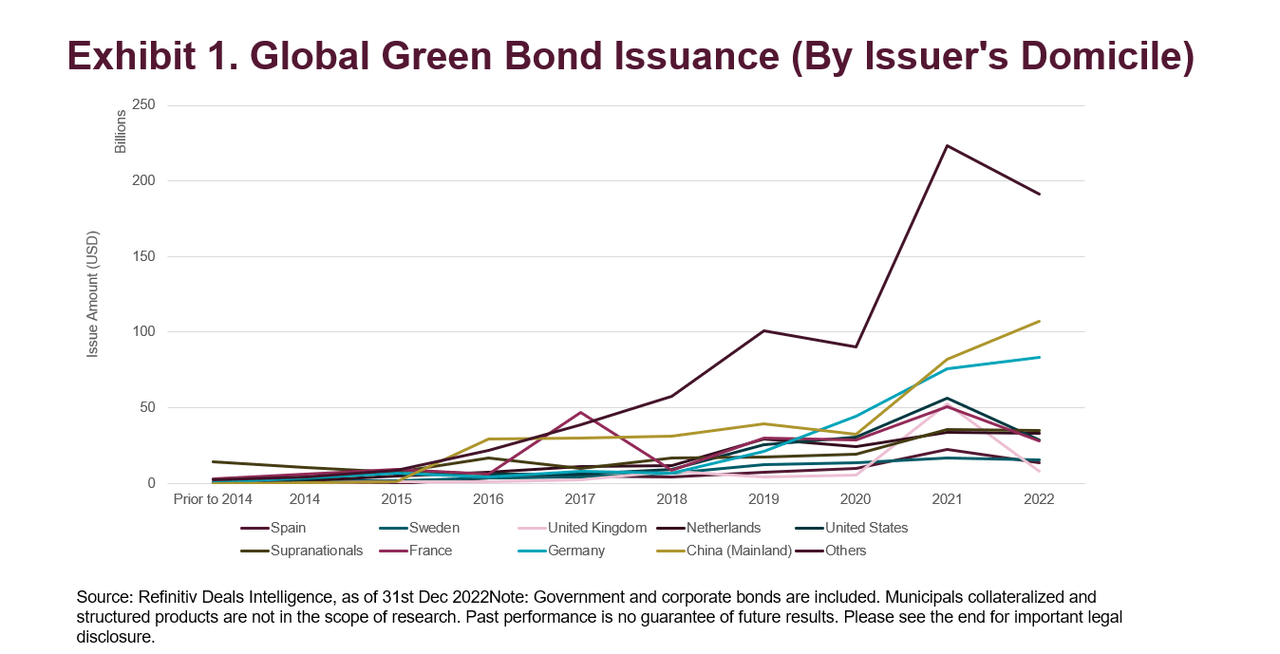

Whereas international inexperienced bond markets noticed a notable slowdown – significantly in Europe and the USA due to rising rate of interest and geopolitical conflicts, China’s onshore inexperienced bond market sustained its momentum in 2022.

The European market has been a key driving power in inexperienced bond growth since its inception in 2007. Nevertheless, regardless of China’s late entry in 2014, its inexperienced bond market has witnessed exceptional development and has quickly grow to be one of many largest markets on the earth. It has additionally survived international volatility. Regardless of reaching the $2 trillion milestone in cumulative issuance in 2022, the worldwide inexperienced bond market noticed a decline within the second half of final 12 months as central banks turned to tightening financial insurance policies. Whereas issuances from supranational remained unchanged, European and US inexperienced bond markets noticed essentially the most notable slowdown, with France down by 44.8% and the US down by 49.5%[i]. In distinction, China’s inexperienced bond market continued its momentum, posting a development charge of 30% in 2022.

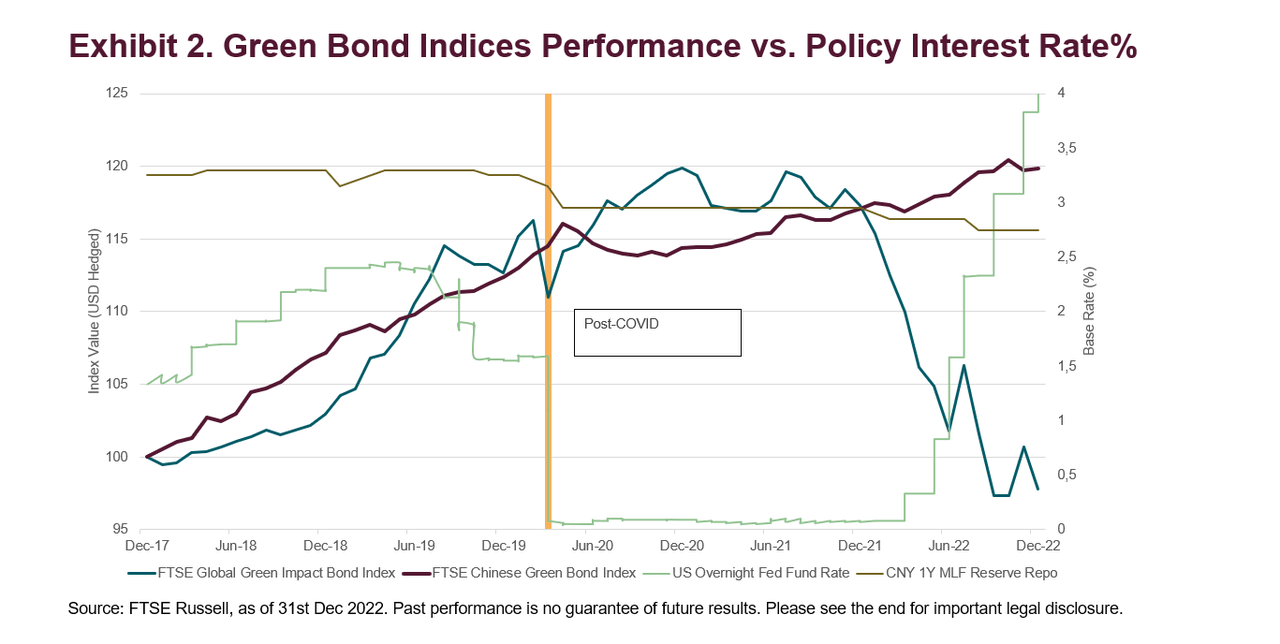

In terms of efficiency, our evaluation of index values of the FTSE International Inexperienced Influence Bond Index (International Inexperienced) and FTSE Chinese language Inexperienced Bond Index (Chinese language Inexperienced) over the previous 5 years exhibits that the Chinese language Inexperienced is notably much less unstable than the International Inexperienced.

International Inexperienced is closely influenced by macroeconomic circumstances, with 64.7% of bonds denominated in EUR and 18.9% in USD. The U.S. Federal Reserve’s (FED) aggressive chopping of rates of interest between 2019 and 2020 served as a powerful stimulus, resulting in a rise within the worth of all belongings, together with the International Inexperienced, which rose 12% to achieve 119.88. However, the tide turned as geopolitical battle persists and the overheating inflation pressured central banks to boost rates of interest throughout the globe. In 2022, Fed aggressively raised 425 bps in simply 9 months, inflicting International Inexperienced to drop 18.6% in comparison with its peak in July 2021.

However, China maintained a comparatively secure financial coverage, contributing to regular development of China Inexperienced from 117.08 to 119.85, representing a 2.4% enhance in 2022. China Inexperienced outperformed International Inexperienced and confirmed sturdy resilience throughout the pandemic. As a consequence of its decrease volatility and low correlation with the Developed Markets, some buyers choose the Chinese language fixed-income marketplace for portfolio diversification.

Understanding the panorama of China’s home inexperienced bond tips

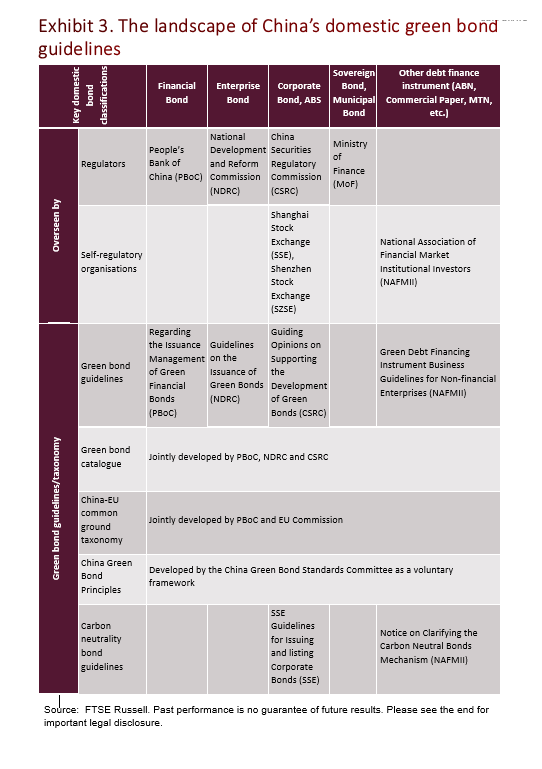

Regardless of being one of many largest inexperienced bond markets, looking for to navigate China’s inexperienced bond tips stays difficult for some worldwide buyers. The complexity stems from the fragmentation nature of China’s total bond market rules. Primarily based on the issuer sorts and the bond traits, bond choices are labeled into differing types and are below the oversight of various regulators. For instance, Monetary Bonds (bonds issued by banks and different monetary establishments) are overseen by the Folks’s Financial institution of China (PBoC), and Company Bonds (bonds issued by non-financial corporates) are regulated by China Securities Regulatory Fee (CSRC). The ‘inexperienced bond label’ solely serves as an addition to the essential bond options, and issuers in China’s home inexperienced bond market are nonetheless topic to the oversight of corresponding regulators. For instance, Inexperienced Monetary Bonds, similar to all their vanilla counterparts, are nonetheless regulated by the PBoC.

There have been varied inexperienced bond tips in China’s bond regulatory panorama (Exhibit 3). The important thing growth in recent times, nevertheless, is the convergence of those tips and taxonomies, which have been seen in two areas. Firstly, the standardisation of inexperienced bond issuing and reporting guidelines has been mirrored by the discharge of China Inexperienced Bond Ideas (China GBP) As a set of voluntary guidelines that complement present rules, the China GBP will assist bridge the gaps between the extensively accepted ICMA Inexperienced Bond Ideas and varied Chinese language inexperienced bond tips. Secondly, there have been harmonisations of the eligible inexperienced challenge definitions with the replace of the China Inexperienced Bond Catalogue and the discharge of the China-EU Frequent Floor Taxonomy, signaling a constructive step in direction of additional harmonisation each domestically and internationally.

As well as, whereas many Chinese language inexperienced bonds tackle wider environmental points comparable to air air pollution discount, the rules on issuing ‘Carbon Neutrality’ bonds rolled out by each NAFMII and Shanghai Inventory Trade mirror that Local weather Change mitigation has grow to be a key precedence contributing to China’s Internet Zero dedication.

Supply: FTSE Russell. Previous efficiency isn’t any assure of future outcomes. Please see the top for vital authorized disclosure.

What to anticipate subsequent in China’s home inexperienced bond market?

China goals to peak its carbon emission earlier than 2030 and obtain carbon neutrality by 2060. This requires fast transitions in key industries comparable to in power and manufacturing. It’s estimated that China faces a funding hole of not less than $14 trillion (RMB 100 trillion) over the following 30 years[i], creating an enormous alternative for local weather change mitigation and transition finance within the type of debt financing.

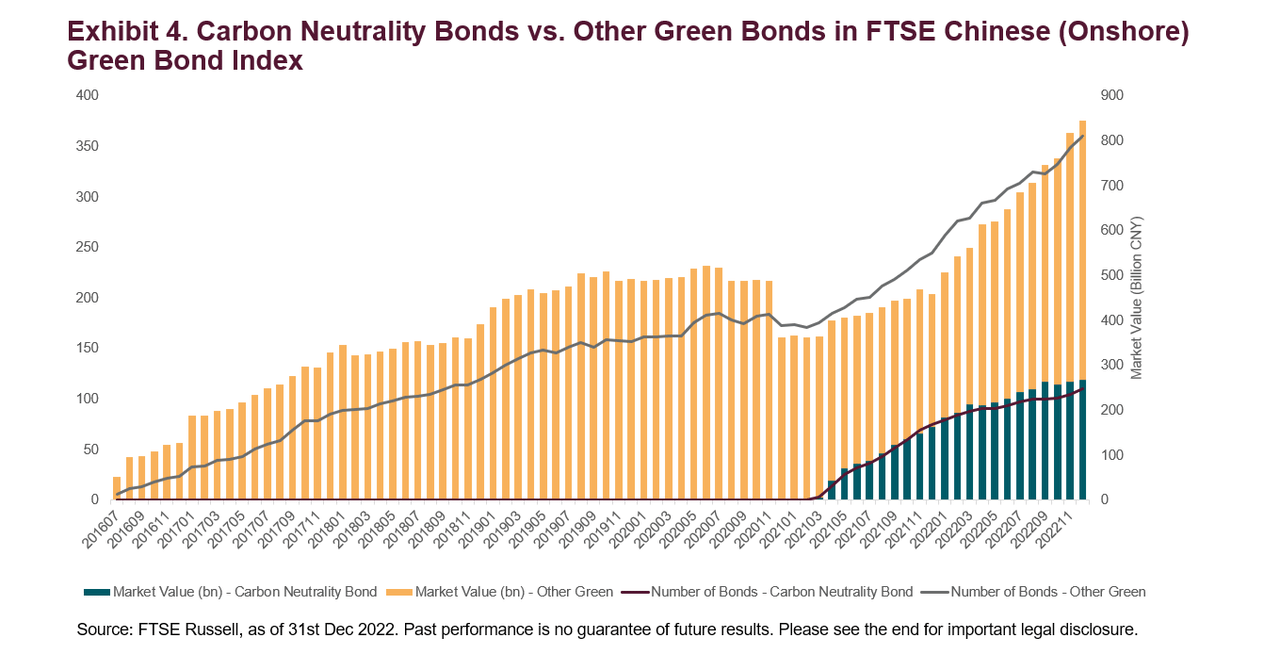

The rising variety of ‘Carbon Neutrality’ bonds (Exhibit 4) which can be devoted to mitigating local weather change and the emergence of tips have highlighted the convergence of market demand and regulatory targets. Because the market evolves, the requirements for these bonds are anticipated to grow to be extra stringent and well-defined. This, together with developments in taxonomy harmonisation and the growing adoption of China GBP, presents new alternatives for fixed-income buyers in search of decarbonisation alternatives with better transparency.

FTSE Russell has launched the FTSE Chinese language (Onshore CNY) Inexperienced Bond Index Sequence which measures the efficiency of the onshore Chinese language yuan-denominated, fixed-rate governments, companies and company debt issued in mainland China which can be labelled inexperienced. The index collection has complete protection with indexes accessible assembly China’s native definition of “inexperienced” in addition to indexes that embody bonds assembly internationally acknowledged Local weather Bonds Initiative (CBI) requirements. The newly launched FTSE 0+ Years Fastened Earnings Index Sequence tracks the universe of securities that meet the eligibility standards by way of to maturity, permitting for a seamless transition for index customers seeking to higher replicate their hold-to-maturity methods. Alongside the market growth, FTSE will proceed to offer analysis and introduce merchandise that mirror key options.

[i] China’s Transition to a Low-Carbon Economic system and Local weather Resilience Wants Shifts in Assets and Applied sciences (worldbank.org)

[i] Word: The US inexperienced municipal bonds have additionally noticed a drop by 35% to from $20.6 billion achieved in 2021 to $13.2billion in 2022, in keeping with Local weather Bonds Initiative information.

© 2023 London Inventory Trade Group plc and its relevant group undertakings (the “LSE Group”). The LSE Group contains (1) FTSE Worldwide Restricted (“FTSE”), (2) Frank Russell Firm (“Russell”), (3) FTSE International Debt Capital Markets Inc. and FTSE International Debt Capital Markets Restricted (collectively, “FTSE Canada”), (4) FTSE Fastened Earnings Europe Restricted (“FTSE FI Europe”), (5) FTSE Fastened Earnings LLC (“FTSE FI”), (6) The Yield E-book Inc (“YB”) and (7) Past Scores S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a buying and selling identify of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield E-book®”, “Past Scores®” and all different logos and repair marks used herein (whether or not registered or unregistered) are logos and/or service marks owned or licensed by the relevant member of the LSE Group or their respective licensors and are owned, or used below licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE Worldwide Restricted is authorised and controlled by the Monetary Conduct Authority as a benchmark administrator.

All data is offered for data functions solely. All data and information contained on this publication is obtained by the LSE Group, from sources believed by it to be correct and dependable. Due to the potential of human and mechanical error in addition to different components, nevertheless, such data and information is offered “as is” with out guarantee of any type. No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors make any declare, prediction, guarantee or illustration by any means, expressly or impliedly, both as to the accuracy, timeliness, completeness, merchantability of any data or of outcomes to be obtained from using FTSE Russell merchandise, together with however not restricted to indexes, information and analytics, or the health or suitability of the FTSE Russell merchandise for any explicit goal to which they is perhaps put. Any illustration of historic information accessible by way of FTSE Russell merchandise is offered for data functions solely and isn’t a dependable indicator of future efficiency.

No accountability or legal responsibility could be accepted by any member of the LSE Group nor their respective administrators, officers, workers, companions or licensors for (A) any loss or injury in entire or partly brought on by, ensuing from, or regarding any error (negligent or in any other case) or different circumstance concerned in procuring, gathering, compiling, deciphering, analysing, enhancing, transcribing, transmitting, speaking or delivering any such data or information or from use of this doc or hyperlinks to this doc or (B) any direct, oblique, particular, consequential or incidental damages by any means, even when any member of the LSE Group is suggested prematurely of the potential of such damages, ensuing from using, or lack of ability to make use of, such data.

No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors present funding recommendation and nothing on this doc ought to be taken as constituting monetary or funding recommendation. No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors make any illustration relating to the advisability of investing in any asset or whether or not such funding creates any authorized or compliance dangers for the investor. A call to put money into any such asset shouldn’t be made in reliance on any data herein. Indexes can’t be invested in straight. Inclusion of an asset in an index will not be a advice to purchase, promote or maintain that asset nor affirmation that any explicit investor could lawfully purchase, promote or maintain the asset or an index containing the asset. The final data contained on this publication shouldn’t be acted upon with out acquiring particular authorized, tax, and funding recommendation from a licensed skilled.

Previous efficiency isn’t any assure of future outcomes. Charts and graphs are offered for illustrative functions solely. Index returns proven could not characterize the outcomes of the particular buying and selling of investable belongings. Sure returns proven could mirror back-tested efficiency. All efficiency offered previous to the index inception date is back-tested efficiency. Again-tested efficiency will not be precise efficiency, however is hypothetical. The back-test calculations are primarily based on the identical methodology that was in impact when the index was formally launched. Nevertheless, back-tested information could mirror the applying of the index methodology with the advantage of hindsight, and the historic calculations of an index could change from month to month primarily based on revisions to the underlying financial information used within the calculation of the index.

This doc could comprise forward-looking assessments. These are primarily based upon plenty of assumptions regarding future circumstances that in the end could show to be inaccurate. Such forward-looking assessments are topic to dangers and uncertainties and could also be affected by varied components that will trigger precise outcomes to vary materially. No member of the LSE Group nor their licensors assume any obligation to and don’t undertake to replace forward-looking assessments.

No a part of this data could also be reproduced, saved in a retrieval system or transmitted in any type or by any means, digital, mechanical, photocopying, recording or in any other case, with out prior written permission of the relevant member of the LSE Group. Use and distribution of the LSE Group information requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Authentic Put up

Editor’s Word: The abstract bullets for this text have been chosen by Searching for Alpha editors.