Revealed on January fifteenth, 2023 by Felix Martinez

Canadian Imperial Financial institution of Commerce (CM) has paid a rising dividend for 12 years. The inventory worth of CM had decreased by 40% since its excessive in January 2022. On the present worth, the corporate inventory appears to be engaging.

This important markdown within the share worth and the constant dividend raises have resulted in a major enhance in CM’s dividend yield. The corporate now boasts a excessive dividend yield of 5.8%. One should delve into the corporate’s financials to find out whether or not the financial institution can maintain this dividend.

We’ve got created a spreadsheet of high-dividend shares with dividend yields of 5% or extra.

You may obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text will analyze the Canadian Imperial Financial institution of Commerce (CM).

Enterprise Overview

Canadian Imperial Financial institution of Commerce is a world monetary establishment that gives banking and different monetary providers to people, small companies, firms, and institutional purchasers. CIBC is targeted on the Canadian market. The financial institution was based in 1961 and is headquartered in Toronto, Canada. The financial institution experiences its earnings within the Canadian greenback.

CIBC reported its fiscal This autumn 2022 earnings outcomes on December 1st, 2022. Its income climbed 6% to C$5,388 million in opposition to fiscal This autumn 2021. Sadly, larger provision for credit score losses (PCL) (up C$358 million) and better non-interest bills (up 11%) weighed on earnings.

Adjusted internet earnings declined 17% to C$1,308 million. Adjusted earnings-per-share (“EPS”) additionally fell 17% to C$1.39. PCL elevated on account of an unfavorable financial outlook. Traders don’t should be too alarmed, although, because the mortgage loss ratio was nonetheless very low at 0.16%. The financial institution’s adjusted return on fairness (“ROE”) was 11.2%, down from 14.7% a 12 months in the past.

The financial institution’s capital place stays secure, with a Frequent Fairness Tier 1 ratio of 11.7% versus 12.4% a 12 months in the past. CIBC’s outcomes had been combined throughout its companies for the complete fiscal 12 months. The Canadian Private and Enterprise Banking phase noticed adjusted internet earnings falling 4% to C$2,396 million, the Canadian Industrial Banking and Wealth Administration phase elevated adjusted internet earnings by 14% to C$1,895 million, however smaller U.S. Industrial Banking and Wealth Administration phase noticed adjusted internet earnings falling 17% to C$810 million, and Capital Markets phase’s adjusted internet earnings rose 3% to C$1,908 million.

Altogether, in fiscal 2022, adjusted EPS fell 2% to C$7.05, which translated to US$5.25. It additionally elevated its quarterly dividend by 2.4% to C$0.85 per share. We provoke our 2023 EPS estimate at US$5.20.

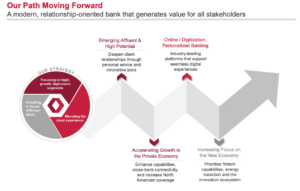

Supply: Investor Presentation

Progress Prospects

In Could 2022, the financial institution inventory had a two-for-one inventory cut up, which is why its EPS and dividend-per-share seem a lot decrease in 2022. Inventory splits don’t change the valuation of the inventory.

The Canadian financial institution’s medium-term purpose is to develop adjusted EPS by 5-10% per 12 months. Nonetheless, its earnings and dividends have been bumpy as a result of overseas trade fluctuations between the U.S. and Canadian greenback.

From 2013 to 2022, the financial institution elevated its EPS and DPS by 2.7% and three.4% per 12 months in US {dollars}. Additionally, from 2017-2022, its EPS and DPS progress charges had been 4.0% and 5.4%, respectively.

As fee hikes happen in Canada and the U.S., we see mortgage progress of 4% in 2022 and in 2023, a lot decrease than in 2022, as we forecast a slowdown in financial progress. We see a normalization in credit score prices, with internet charge-offs rising in 2023 and 2024, as we forecast a minor recession towards the top of 2023.

Supply: Investor Presentation

Aggressive Benefits

CIBC shouldn’t be the most important financial institution in its main market of Canada, as it’s the fifth largest, nor within the U.S. This isn’t essentially a headwind, as each banking markets are giant sufficient for various gamers.

Because of a deal with client banking, particularly mortgages, that are often insured in Canada, CIBC has a comparatively low-risk portfolio relative to different banks. Its efficiency within the final monetary disaster was not good, however not as disastrous as that of lots of its North American friends.

The corporate doesn’t have a number one market share in its home operations, limiting a few of its value benefits. It has a historical past of upper credit score prices associated to poor funding and lending choices.

Dividend Evaluation

The corporate pays a $0.63 quarterly dividend, which has been rising over 12 years. The corporate has a 5-year dividend progress fee of 4.8%. On the present share worth, CM has a excessive dividend yield of 5.6%, which is above its five-year common of two.4%.

Primarily based on our EPS estimate of $5.09 for 2023, the corporate is forecasted to pay out about 50.6% of earnings in dividends. Whereas this isn’t a excessive payout ratio, it’s far more than the corporate has paid out prior to now. Previously, the corporate usually had a low 40% dividend payout ratio. At the moment, the dividend doesn’t look like in peril.

We at the moment anticipate first rate earnings progress over the subsequent 5 years of about 4% yearly, which ought to proceed to assist the corporate develop its dividend.

Remaining Ideas

Canadian Imperial Financial institution of Commerce is a high-quality financial institution that has confirmed to be an impressive dividend progress inventory all through the years. The present dividend yield and valuation are engaging, and we count on the corporate to ship over a 12% annual fee of return over the subsequent 5 years.

The 12% annual return will come from the 5.8% dividend, the five-year earnings progress fee of 4%, and a PE growth of about 3.7%.

If you’re fascinated about discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them usually:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].