17 housing tendencies that outlined the 12 months, together with file dwelling costs and sky-high mortgage charges

The 2022 housing market was nothing wanting outstanding. The pandemic and ensuing distant work continued to outline how, when, and the place folks purchased houses. The median U.S. dwelling value hit a file excessive earlier than falling barely. Rising rents stretched renters’ budgets. Excessive inflation put elevated stress on nearly everybody. For the primary time in historical past, mortgage charges doubled within the span of only one 12 months. The record goes on

On the whole, 2022 was a response to the dramatic actual property growth in 2021. The 12 months began with a surge in costs and progress throughout the board earlier than falling alongside file inflation within the fall. November and December noticed a a lot slower and seasonally-expected housing market, with year-over-year modifications in lease costs, home costs, and rates of interest both falling or slowing down.

Beneath is a non-exhaustive record of knowledge factors and visuals that outlined the 2022 housing market.

1. Residence costs rose to an all-time excessive

In Could, the standard dwelling bought for $430,365, a file excessive since data started in 1963, shattering 2021’s excessive of $386,000. In March, the median sale value rose 16.8% 12 months over 12 months, the most important share enhance during the last 5 years. Following the pandemic, demand skyrocketed whereas provide remained traditionally low, inflicting a extreme housing scarcity and value growth that continued all through 2021 and peaked halfway via 2022. In April and Could, mortgage charges rose to fight rising inflation, which started reversing housing tendencies from earlier within the 12 months.

Regardless of a shortly cooling housing market, costs are nonetheless larger immediately than any earlier 12 months on file.

2. San Francisco was the costliest metro space for homebuyers in 2022

The median sale value of a house in San Francisco was $1,505,000 in 2022, up 0.3% 12 months over 12 months. For one week in April, the median value reached a excessive of $1,700,000, just under 2021’s all-time excessive of $1,728,000. Because the 12 months went on, costs dropped nearer to pre-pandemic ranges, which is able to possible proceed till mortgage charges fall additional.

Six of the highest ten most costly metros have been in California.

Many Florida metros skilled the most important year-over-year value progress, together with Tampa (18%), Orlando (14.9%), Jacksonville (14.7%), and Miami (14.2%).

Tampa had the most important year-over-year value progress of all massive metros within the nation.

The highest ten most costly cities to purchase a house in 2022

Metropolis

Median sale value

Yr-over-year change

San Francisco, CA

$1,505,000

+0.3%

San Jose, CA

$1,435,000

+7.2%

Anaheim, CA

$970,000

+10.4%

Oakland, CA

$939,000

+4.2%

Los Angeles, CA

$850,000

+7.0%

San Diego, CA

$815,000

+10.3%

Seattle, WA

$777,000

+9.3%

New York, NY

$683,000

+5.5%

Boston, MA

$650,000

+7.7%

Nassau County, NY

$600,000

+5.8%

Information consists of the yearly aggregated median sale costs out of all houses bought in every of the 50 largest metropolitan areas. Information doesn’t take note of native median incomes and residential affordability.

3. Detroit was the least costly metro space for homebuyers in 2022

The median sale value for a house in Detroit was $165,000 in 2022, up 3.3% 12 months over 12 months. Residence costs in Detroit hit $213,000 for every week in June, making it the costliest month of the 12 months however nonetheless practically 50% decrease than the nationwide median. On the whole, year-over-year value will increase in 2022 have been smaller throughout most main metros than in 2021, and progress dipped additional heading into the primary week of December.

The highest ten least costly metros have been all positioned within the Rust Belt, a geographic area close to the Nice Lakes.

Philadelphia was the one massive metro that skilled a value lower in 2022.

Kansas Metropolis, MO was the eleventh least costly metro, and the primary non-Rust-Belt metro on the record.

The highest ten least costly cities to purchase a house in 2022

Metropolis

Median sale value

Yr-over-year change

Detroit, MI

$165,000

+3.3%

Cleveland, OH

$185,000

+5.4%

Pittsburgh, PA

$205,000

+2.4%

St. Louis, MO

$235,000

+9.6%

Cincinnati, OH

$239,000

+7.7%

Philadelphia, PA

$249,900

-0.01%

Milwaukee, WI

$260,000

+4.8%

Warren, MI

$262,000

+4.5%

Indianapolis, IN

$275,000

+11.6%

Columbus, OH

$290,000

+10.3%

Information consists of the yearly aggregated median sale costs out of all houses bought in every of the 50 largest metropolitan areas. Information doesn’t take note of native median incomes and residential affordability.

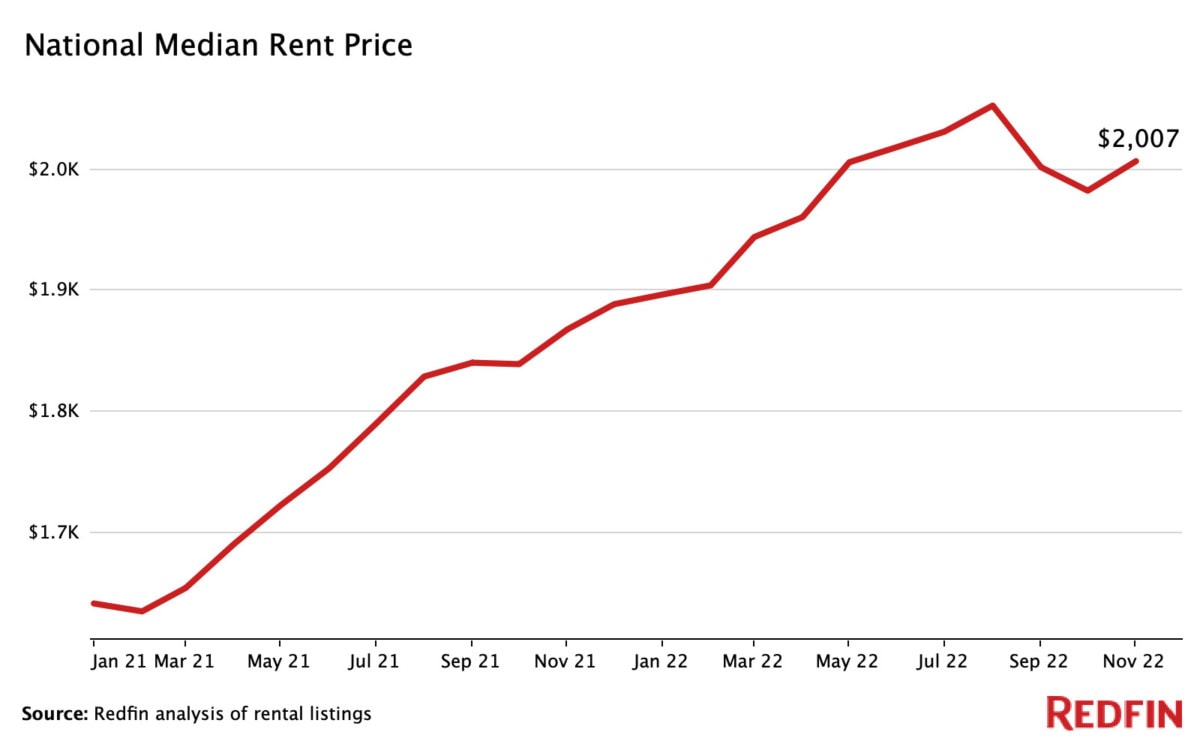

4. Lease costs rose dramatically as provide struggled to maintain up with demand

Lease costs in 2022 have been 12.8% larger than they have been in 2021. Nationwide, the median lease value rose to $2,053 in August earlier than dipping barely, the very best on file and a 12.3% enhance year-over-year. Following the pandemic, lease costs skyrocketed largely due to a lack of provide and a growth in demand, each of that are simply now balancing out.

Median lease costs in New York rose to over $4,000, retaining its dominance as the costliest metro for renters within the nation.

Lots of the least costly metros skilled the very best year-over-year lease will increase, together with Oklahoma Metropolis (23.3%), Cincinnati (17.6%), and Pittsburgh (14.8%).

Oklahoma Metropolis skilled the very best year-over-year lease will increase within the nation.

Lease progress has persistently outpaced wages for many years, however the latest information states {that a} staggering 40% of renters spent greater than 30% of their revenue on lease from 2017-2021.

There are at the moment over 1.1 million rental items beneath building within the U.S., which is able to come obtainable for lease over the subsequent 12 months, serving to to alleviate a part of the housing scarcity.

“We anticipate rents to fall in practically each a part of the nation by the center of 2023 as provide begins overtaking demand,” notes Taylor Marr, Redfin Deputy Chief Economist. “Whereas renters sometimes get the perfect deal throughout the winter months as demand is decrease, rents are persevering with to ease. Due to this, there received’t be as a lot of a seasonal enhance come spring, and thus persistence for a great deal will repay. And don’t be afraid to barter; some landlords could also be open to concessions like a free month’s lease or free parking.”

The highest ten most costly cities for renters in 2022

Metropolis

Median lease value

Yr-over-year change

New York, NY

$4,043

+10.8%

Boston, MA

$3,764

+3.1%

San Francisco, CA

$3,749

+7.6%

San Jose, CA

$3,558

+7.3%

Los Angeles, CA

$3,435

+0.8%

San Diego, CA

$3,345

+8.2%

Miami, FL

$3,098

+8.7%

Seattle, WA

$2,994

+7.0%

Sacramento, CA

$2,749

+6.7%

Denver, CO

$2,700

+4.6%

The highest ten least costly cities for renters in 2022

Metropolis

Median lease value

Yr-over-year change

Oklahoma Metropolis, OK

$1,308

+23.3%

Louisville, KY

$1,372

+13.2%

San Antonio, TX

$1,442

+12.4%

Cleveland, OH

$1,447

+4.7%

Indianapolis, IN

$1,454

+13.9%

Kansas Metropolis, MO

$1,456

+3.1%

St. Louis, MO

$1,547

+4.8%

Buffalo, NY

$1,555

+9.7%

Columbus, OH

$1,571

+4.8%

Memphis, TN

$1,581

+9.5%

Information consists of the 2022 aggregated median lease costs for every of the 50 largest metropolitan areas in comparison with 2021 information from the identical interval. Information is the median of all 0-3 bed room rental houses.

5. Homebuyers trying to relocate favored Solar-Belt cities

24.1% of homebuyers appeared to maneuver to a special metro throughout the three months ending in November. That is on par with the file excessive of 24.2% within the third quarter and up from 19.1% in 2019.

Homebuyers appeared to maneuver to sunny, comparatively reasonably priced areas, with Miami, Tampa, Las Vegas, and Phoenix being the most well-liked locations.

Homebuyers appeared to maneuver away from costly coastal metros like San Francisco, Los Angeles, and New York, which topped the record.

100% of houses in lots of widespread relocation metros skilled extreme drought prior to now 12 months, together with Phoenix, Las Vegas, and Sacramento.

“Just like 2021, continued progress in distant work and a need for housing affordability drove relocation patterns in 2022,” Marr continues. “Nevertheless, tendencies in some widespread locations reversed course after they turned too widespread, aggressive, and costly. Cities like Salt Lake Metropolis, Phoenix, Tucson, Dallas, and San Antonio all declined in reputation in 2022.”

Information is the % of Redfin.com customers trying to find houses outdoors their metro. Information is the 12 months median mixture of a number of three month shifting aggregates and doesn’t embrace September-December. Sustain with the newest migration information right here.

6. Inflation rose at a file tempo, affecting each aspect of the housing market

The costs of products and providers rose to six.48% 12 months over 12 months in November, the very best share since August 1982 and greater than double the speed from November 2021. In actual fact, inflation charges have doubled in comparison with the earlier 12 months in each month since June. Rising costs severely restricted shopper spending and slowed practically each aspect of the housing market.

To fight the historic inflation, the Fed raised its goal rate of interest to 4.5%, the very best in 15 years.

Skyrocketing rates of interest prompted mortgage charges to rise and elevated fears of a recession, holding homebuyers out of the housing market.

Inflation rose the quickest in pandemic boomtowns due partly to the sudden leap in home costs, which is a key contributor to inflation.

Information courtesy of FRED. Information measures core CPI (much less meals and power) via November 2022.

7. Mortgage charges ballooned to almost 7% in response to file inflation

After many years of falling mortgage charges, in 2022, charges climbed to almost 7% in each October and November, larger than any level since 2002. In actual fact, from October 2021 to October 2022, mortgage charges doubled in a single 12 months for the primary time in historical past.

Because the 12 months got here to an in depth, optimistic inflation information helped scale back housing rates of interest to under 7%.

In widespread migration metros like Phoenix, Las Vegas, and Austin, larger mortgage charges and costly dwelling costs damage consumers probably the most.

In Phoenix, for instance, as mortgage charges climbed in Could and June, solely 21.5% of houses have been reasonably priced to consumers with a $2,500 month-to-month mortgage funds – a 28.5% drop from 2021.

Excessive inflation and rising mortgage charges typically deter consumers, however should you’re in a position to afford it, possession stands out as the higher choice. “Homeownership is a long-term funding that may result in important web value beneficial properties, even with charges above 6%,” advises Dean Hayes, Space Gross sales Supervisor with Bay Fairness, a Redfin firm. “Mortgage charges will possible go down within the new 12 months, that means extra dwelling consumers will return to the market, creating elevated competitors and fewer room for negotiation.”

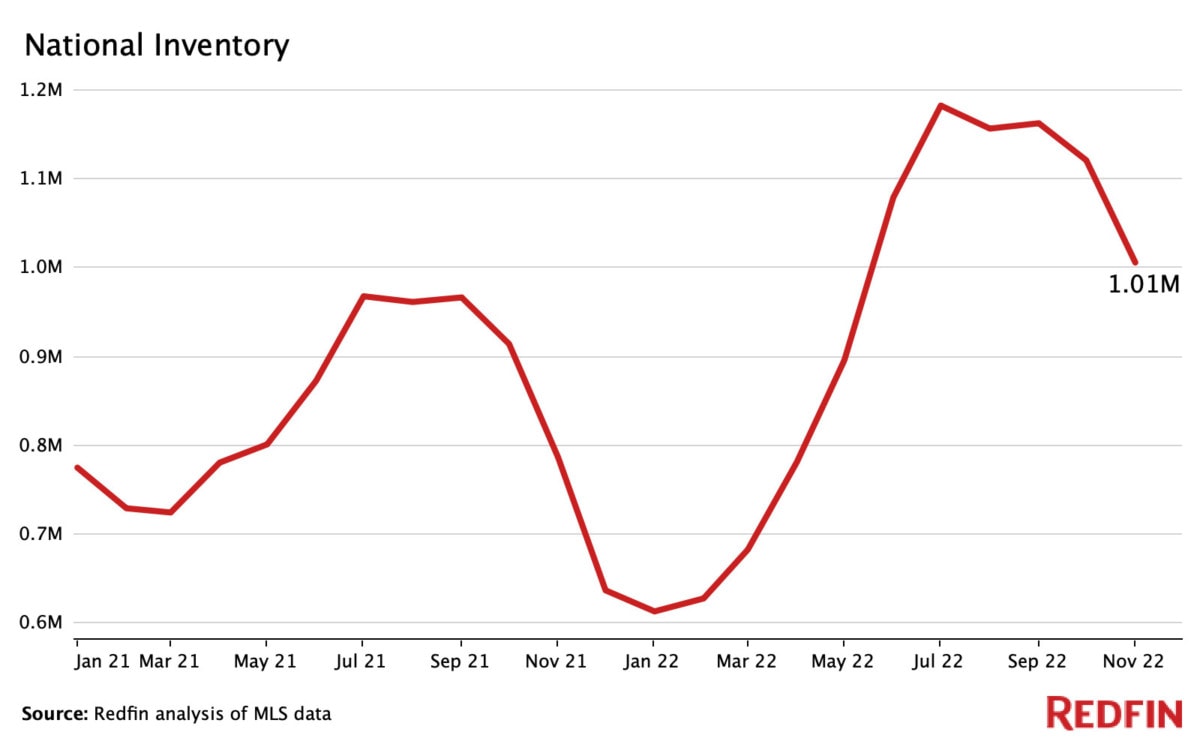

8. Housing stock rose after hitting a file low

10.7 million houses have been listed on the market via November, up 11.2% in comparison with the 9.5 million houses listed via November in 2021. Within the three months ending November 2022, the variety of houses on the market elevated by 15% 12 months over 12 months, the most important enhance on file.

As mortgage charges rose alongside inflation, extra consumers determined to remain put, permitting stock to extend. Since December 2019, stock has declined 12 months over 12 months till it lastly rose in June 2022.

“Patrons have extra leverage now than they’ve since 2010,” advises San Francisco Redfin agent Josh Felder. “Even with larger mortgage charges, should you intend to remain put for longer than 5 years, it’s an important funding. Properties are forecast to nonetheless recognize, even in mild of present circumstances. Sellers ought to perceive that the market remains to be shifting. Properties don’t promote in 5 days, properly over record value, anymore.”

Stock and provide are calculated in rolling 90-day durations, e.g., January 2022 information is the three-month interval from November 1, 2021, via January 31, 2022.

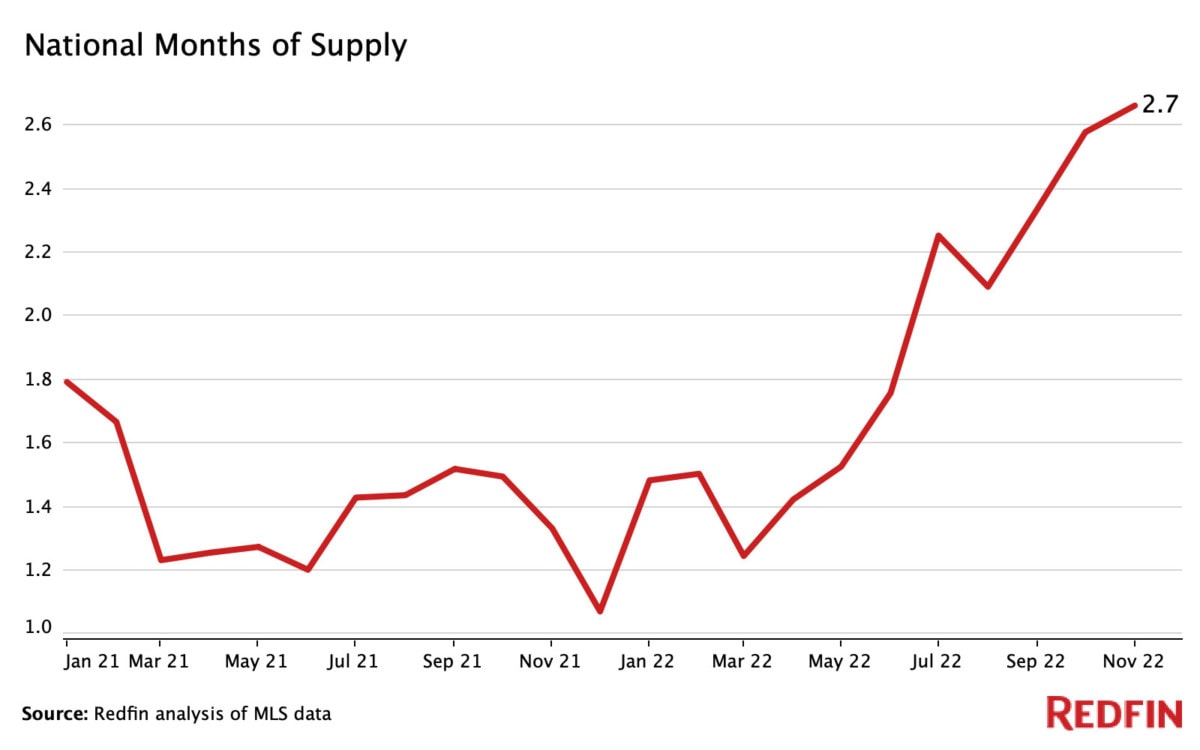

9. Months of provide dropped to a near-record low of simply 1.2 months

Whereas stock measures the variety of houses at the moment obtainable on the market, months of provide measures the period of time it might take these houses to promote. 4 to 5 months of housing provide is taken into account the optimum benchmark. Lower than three months of housing provide typically signifies that there are extra consumers than sellers, whereas a better quantity means there are extra sellers than consumers. Stock and provide sometimes transfer collectively.

Nationwide, months of housing provide dipped to simply over 1.2 months in March earlier than slowly rebounding in the summertime. Yr over 12 months, months of provide has declined nearly each month since January 2020.

As consumers retreated attributable to excessive inflation and rates of interest, months of provide started to develop in July and August, reaching 2.3 months of provide by September.

In Seattle, months of provide reached a near-record low of simply 15.5 days in January and February, the bottom of any main metropolitan space.

“We’re shortly working again towards a balanced market, which is three to 6 months of stock,” says Seattle-area Redfin agent Brian Shields. “We’ve been in a vendor’s market with lower than 5 months of stock for a number of years, till halfway via this 12 months. Patrons now have much more selections than they did final Spring.”

Stock and provide are calculated in 90-day durations, e.g., January 2022 information is the three-month interval from November 1, 2021, via January 31, 2022.

10. New building took up a rising share of housing stock

There have been 1.25 million privately-owned new houses constructed within the U.S. via November 2022, up 3% from a 12 months in the past. As inflation rose and the market slowed, builders started slowing their manufacturing to dump what they already had.

New building has been taking over a rising portion of general housing provide since 2011, when constructing rebounded after the monetary disaster. This pattern intensified in 2021 and solely just lately started to decelerate. “For those who’re a purchaser, think about new building houses,” advises Kim Stearns, a Northern Idaho Redfin agent. “Due to a list buildup, many builders have one to 4 houses they might love to shut on and can typically provide incentives.”

Over 63% of latest builds have been single-family houses, up 2% 12 months over 12 months

New building begins dropped from their peak of 164,000 in April to 111,000 in November

Information courtesy of Census.gov.

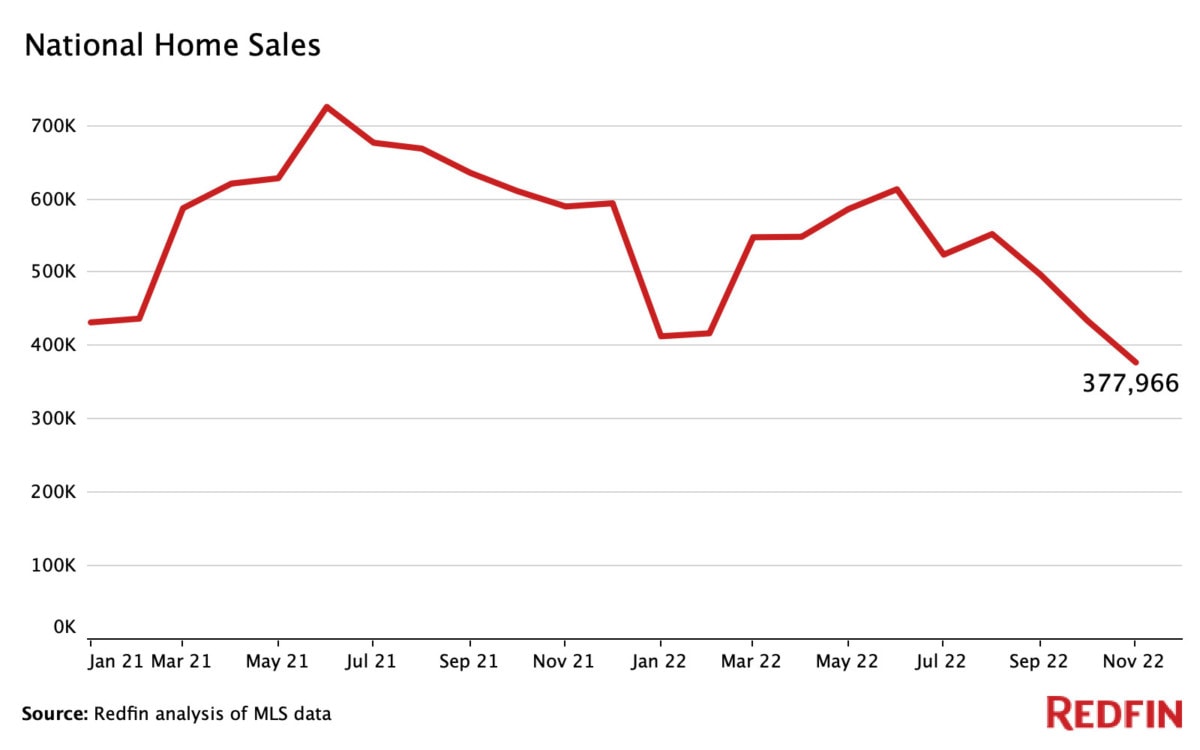

11. Residence gross sales fell practically 17% 12 months over 12 months

5.62 million U.S. houses bought via November, down 16.6% 12 months over 12 months, a pointy lower from the 6.74 million bought in 2021 throughout the identical interval. On the whole, between 4 and 7 million houses promote per 12 months, with the historic common sitting at simply over 5 million. Yr-over-year dwelling gross sales decreased in each month of 2022, with October and November posting the sharpest declines.

Simply 376,000 houses bought in November, down 37.4% 12 months over 12 months and a seasonally-adjusted historic low (since 2001).

June was the busiest month with 626,641 houses bought, a 15.2% year-over-year dip.

Information was collected via November.

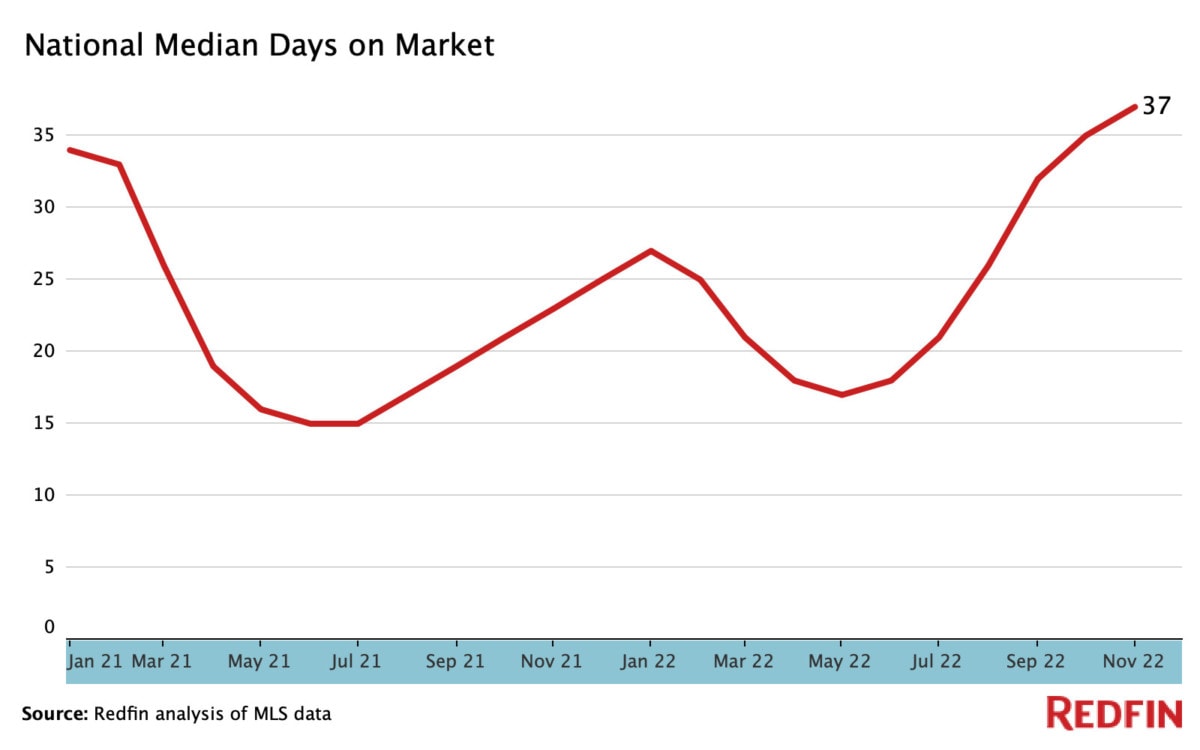

12. Median days on market rose at a file tempo, signaling a dramatic turnaround from 2021’s breakneck tempo

In 2022, houses spent a median of simply 24 days available on the market, an 8.4% enhance 12 months over 12 months in comparison with the 22 days available on the market in 2021. Since 2020, a housing provide crunch has been attributable to provide chain points, a power lack of homebuilding, and a rise in demand. In 2022, time available on the market ticked up as homebuilding started to catch as much as demand and excessive mortgage and inflation charges restricted consumers’ spending energy.

“Resulting from a slowing economic system and layoffs within the tech sector close to the top of the 12 months, many consumers paused their dwelling search attributable to affordability and job safety,” notes Frank Vettesse III, a San Francisco Redfin agent. “This was one in every of many components that contributed to the dramatic slowdown in gross sales.”

Could was the busiest month of the 12 months, with houses spending a median of simply 17 days available on the market.

Within the 4 weeks ending December 4th, houses spent a median of 37 days available on the market, the slowest month of 2022 and the most important year-over-year slowdown on file.

13. 14% of energetic dwelling listings skilled value drops

On common, 14% of energetic houses on the market had value drops in 2022, up 4.7% 12 months over 12 months. In October, 22.6% of listings had value drops, a decades-long excessive. In actual fact, from February via July, the variety of houses with value drops rose from 5.7% to 19.5%, a record-fast enhance. “The shift was dramatic,” says Christy Seaside, a Seattle-area Redfin agent. “The consumers who didn’t safe a house throughout the peak of competitors are actually bidding low. For instance, the identical sort of dwelling that consumers have been prepared to supply $200,000 over record value are actually providing $200,000 under record value.”

In Denver, 47% of houses skilled reductions in value, the very best share of any main metropolis.

Though value drops have been frequent, median sale costs nonetheless elevated in nearly each metro within the county.

Many pandemic-era migration hotspots, comparable to Tampa, Las Vegas, and West Palm Seaside, had a big share of listings with value drops as properly.

“As sellers with stale listings turned more and more anxious to get their properties bought, we noticed a steep rise in value drops via the summer time right here in Washington State,” says Darlene Haselton, a Tacoma, WA Redfin agent. “At the moment, houses which can be recent available on the market are beginning to transfer extra shortly. As mortgage charges dip additional, in-demand properties might begin receiving a number of gives.”

The highest 5 cities with the very best share of value drops in 2022

Information consists of the median value drops out of all energetic listings in every of the 50 largest metropolitan areas.

14. 55% of houses had a bidding struggle

55% of houses had bidding wars in 2022, down from 64% in 2021. Coastal metros skilled the very best charges of bidding wars, together with Boston (69.8%) and Los Angeles (67.7%).

Nevertheless, nationwide, bidding wars fell from 72% to 35% from February to November. A worsening economic system, larger mortgage charges, and a rise in provide contributed to the slowdown.

Shauna Pendleton, a Boise, ID Redfin agent, advises sellers to be affected person and look ahead to mortgage charges to drop. “Until a house is priced $100,000 or extra beneath market worth, bidding wars are principally non-existent. Our workforce nonetheless hears of some multiple-offer conditions; in these instances, it’s sometimes a luxurious dwelling in a high-demand neighborhood that’s priced very aggressively.”

The highest 5 metros with the very best share of bidding wars in 2022

Information consists of the median share of bidding wars throughout energetic listings in every of the 50 largest metropolitan areas.

15. Over 30% of houses have been bought with money in 2022

30.7% of houses have been bought with all money, up 2% 12 months over 12 months. In October (the latest information obtainable), 32% of houses have been paid for with all money, up 2% 12 months over 12 months and the very best share since 2014.

Florida was the most well-liked state for all-cash purchases, particularly Jacksonville and West Palm Seaside.

Costly west coast metros, together with Oakland, San Jose, and Seattle, had the bottom share of all-cash purchases.

Information is from a Redfin evaluation of county data throughout 39 of probably the most populous U.S. metropolitan areas, relationship again via 2011. Information doesn’t embrace November or December.

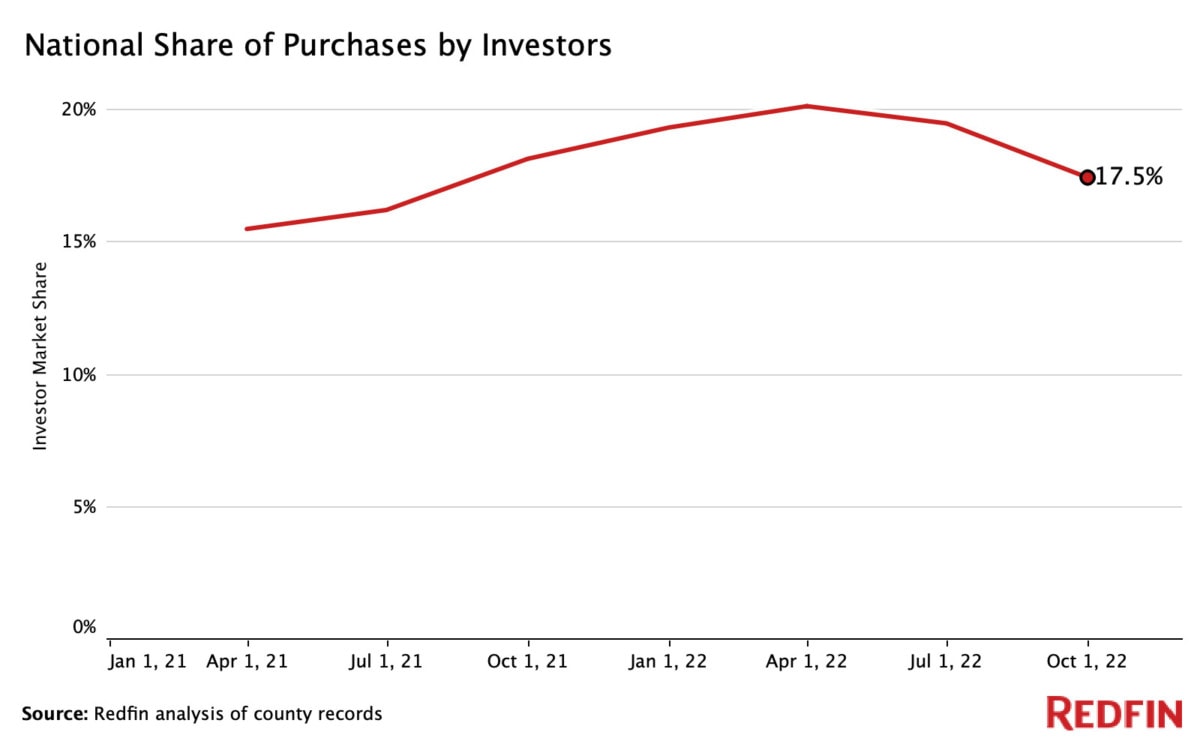

16. Actual property traders bought practically 20% of accessible listings, a brand new file

Vying to capitalize on the housing and rental growth, traders bought 233,701 houses in 2022 via September, a record-breaking 19.1% of all listings. Multifamily residential properties constituted the most important share of investor market share, with a median of 30% of those properties being bought by traders.

Pandemic boomtowns turned the most important investor hotspots, particularly in Solar-Belt metros.

The highest 5 metros with the most important investor market shares in 2022

Information is analyzed on a quarterly foundation and consists of all property sorts except in any other case acknowledged. Whole share is the typical of knowledge from January-September. Information doesn’t embrace the final quarter of 2022.

17. Luxurious dwelling gross sales skilled their largest year-over-year decline on file

In 2022, there have been 258,733 luxurious houses bought within the U.S., down 27% 12 months over 12 months and the most important decline since 2012. Energetic listings dropped even additional, falling by 32.7% 12 months over 12 months. The median sale value for a luxurious dwelling was $1,080,000, up 14.8% 12 months over 12 months. Costs reached their peak of $1,120,000 throughout the three months ending Could, a 15.7% year-over-year enhance. Nevertheless, value progress, listings, and gross sales slowed considerably as demand cooled later within the 12 months.

Within the three months ending November thirtieth, luxurious dwelling gross sales fell by 38.1%, the most important drop on file.

Luxurious houses spent a median of 32 days available on the market via November, up 28.9% 12 months over 12 months

Tampa was the quickest rising luxurious market, with costs rising by 32.3% 12 months over 12 months

Luxurious dwelling gross sales declined by 47% in San Jose, the most important fall of any main metro

“In Seattle, luxurious listings noticed the most important reductions in value,” continues Seattle agent Christy Seaside. “Within the present market, most sellers with a value level of $1.5 million or larger want to organize to make their dwelling stand out among the many competitors. As a rule, sellers are having to barter their value and phrases with consumers.”

Luxurious houses are outlined as the highest 5% of listings in a given market. Values are three month shifting aggregates ending on the date proven, e.g., November 2022 spans September, October, and November 2022. Information doesn’t embrace the three months ending December 31.

Wanting ahead

The 2022 housing market was chaotic, however what does Redfin predict for 2023? Learn our 2023 Housing Market Predictions to be taught extra.

All information was compiled by the week ending December 23, 2022. Information is aggregated from January to November and doesn’t embrace December except acknowledged in any other case. All information is from Redfin, FRED, and/or public data. For questions on metrics, learn our metrics definitions web page.