Igor Kutyaev

Who is that this Fund for?

This fund is an easy and low-cost option to achieve broad publicity to international fairness markets. iShares Core Fairness ETF Portfolio (TSX:XEQT:CA) holds over 9,000 equities from throughout the globe, with publicity to all main inventory markets. All-in-one exchange-traded funds (“ETFs”) are sometimes billed as excellent merchandise for newbie traders, these with small portfolios, and traders who don’t have the curiosity, talent or inclination to handle a inventory portfolio. I disagree with this premise. Even skilled inventory pickers can use a backstop.

All traders should be correctly diversified throughout sectors, geographies and asset courses. Reaching correct diversification whereas nonetheless allocating adequate capital to construct up chubby positions in high-confidence concepts generally is a problem.

Utilizing broad index ETFs to make sure correct diversification can enable an investor to focus their time, analysis and capital to their finest concepts. I don’t have the time or experience to have an edge in all markets and sectors. The most effective use of my analysis time and capital is to deal with investments in industries and markets the place I’m extra educated and skilled. For instance, at any given time, I would maintain 15 high-conviction positions, not sufficient to take care of correct diversification throughout sectors and markets.

For that reason, I feel that the easiest way I can add alpha to my portfolio is to have a portion of my portfolio monitoring a broad index of shares and a portion devoted to my highest conviction concepts. These ratios might differ by investor primarily based on confidence and portfolio measurement. This iteration of a “core and discover” technique is my most well-liked portfolio building.

About XEQT:CA

iShares Core Fairness ETF Portfolio fund is comprised of 4 underlying BlackRock iShares ETFs that comprise a complete of 9,448 particular person fairness holdings. These 4 constituent funds are:

iShares Core S&P Complete U.S. Inventory Market ETF iShares Core S&P/TSX Capped Composite Index ETF iShares Core MSCI EAFE IMI Index ETF iShares Core MSCI Rising Markets ETF.

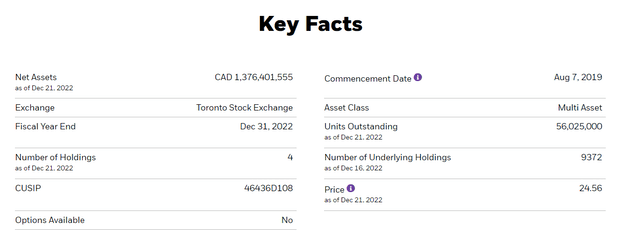

XEQT:CA trades on the Toronto Inventory Change with common every day quantity of 218,524 items. The fund started buying and selling on August 7, 2019 and has since gathered $1.34B in internet asset worth.

The fund has a administration payment of 0.18% with a complete MER of 0.20%. This payment is inclusive of all funds represented in XEQT:CAs underlying holdings. This payment is 0.04% decrease than its closest competitor from Vanguard, Vanguard All-Fairness ETF Portfolio (VEQT:CA), which has an MER of 0.24%. XEQT:CA’s trailing 12-month yield is 2.05%, greater than the present yield of the S&P 500 at 1.64%.

The fund’s said funding goal is to:

“[P]rovide long-term capital progress by investing primarily in a number of exchange-traded funds managed by BlackRock Canada or an affiliate that present publicity to fairness securities.”

Over the previous three calendar years, the fund has returned 11.7%, 19.6% and -13.4% respectively.

XEQT Efficiency (Yahoo Finance)

XEQT:CA is a part of the iShares Core ETF Portfolios. This suite of merchandise presents a spread of portfolio options with varied mounted earnings/fairness allocations. I’m specializing in the 100% fairness iteration for this evaluation.

XEQT Key Information (iShares)

Diversification

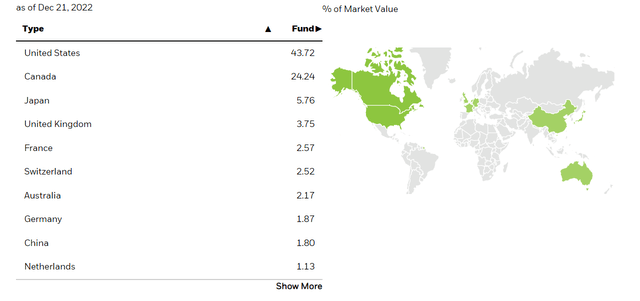

XEQT:CA’s publicity to over 9,000 firms is greater than double the variety of listed companies within the U.S. The developed North American markets account for lower than 5% of worldwide inhabitants. For correct geographic diversification, it’s essential to make sure broad publicity to developed markets exterior of North America in addition to rising economies. Whereas developed markets are properly represented on this fund, rising markets publicity is mild, at solely 5.3%.

XEQT Geographic Allocation (iShares)

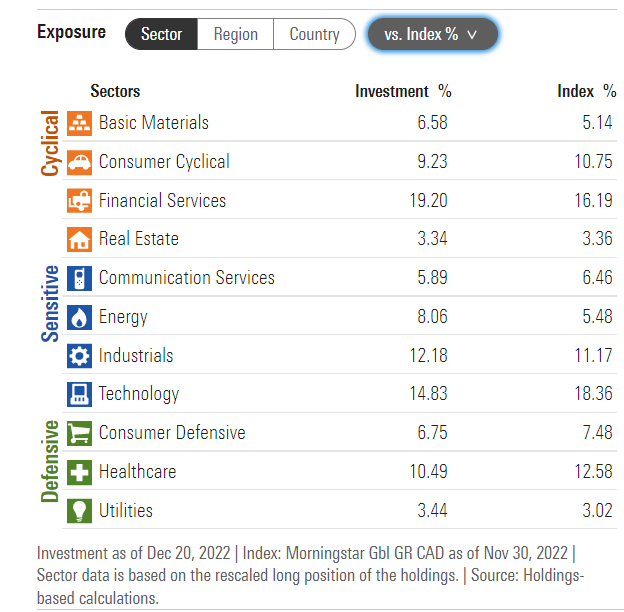

Along with geography, the fund is properly balanced throughout sectors. Nobody sector has a better than 20% weighting, and solely Monetary Companies has a weighting of greater than 15%.

XEQT Sector Allocation (iShares)

Decreasing Volatility

For any portfolio comprised of 100% fairness, there’s going to be volatility. Each Vanguard and iShares provide associated merchandise with various mixes of mounted earnings and equities primarily based on investor wants. Even with a 100% fairness allocation, XEQT:CA is designed to cut back volatility with out including mounted earnings.

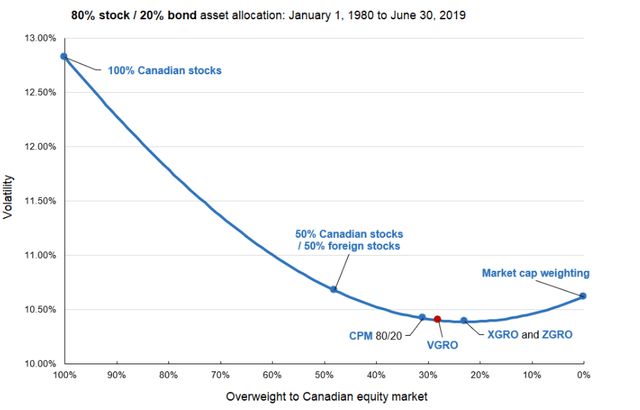

One apparent query traders would have about XEQT:CA’s geographic allocation, is why is it so chubby Canadian equities? Canadian equities account for round 2.7% of the worldwide fairness market, nonetheless, XEQT:CA has a 24% weighting. The reply to that is volatility dampening.

A 2021 analysis paper from Vanguard discovered that together with worldwide equities in a portfolio tends to lower volatility danger and improve anticipated returns to some extent. Ben Felix of PWL Capital notes that particularly for Canadian traders:

Vanguard discovered that the utmost anticipated volatility discount was achieved when a Canadian investor allotted 50%–60% of their fairness portfolio to non-Canadian shares. Allocating greater than that truly elevated volatility.

Volatility and Diversification (PWL Capital)

The graph above identifies the optimum weighting of Canadian shares in an all-in-one asset allocation ETF to cut back total volatility. The candy spot is a weighting of roughly 20-30% Canadian shares. The Vanguard analysis on diversification and volatility concluded:

In every market we examined, our evaluation indicated that volatility was decreased most with an allocation to worldwide equities of between 35% and 55%. Whereas this commentary might assist traders decide the suitable mixture of home and worldwide equities, volatility discount will not be the one issue to contemplate.

Charges and Taxes

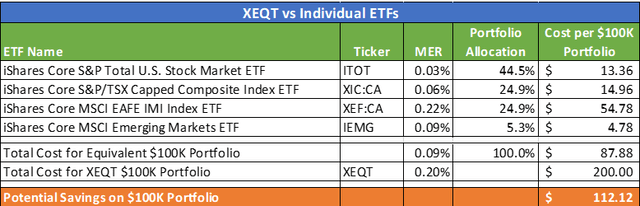

Whereas the diversification and automated rebalancing are some great benefits of this product, it’s not completely environment friendly. The 0.20% MER is comparatively low price, nonetheless particular person traders can discover financial savings by replicating XEQT:CA and holding the underlying ETFs straight. Whereas this technique may greater than halve the MER to 0.09%, traders would want to contemplate the fee and energy to observe and rebalance.

Financial savings by holding underlying ETFs (Writer)

Utilizing XEQT:CA comes with a tax drag in withholding taxes for Canadian traders that can differ by account sort. For instance, the iShares tax calculator means that the tax drag for holding this all-in-one fund is 0.22% for RRSPs. This drag is the results of proudly owning U.S. securities via a Canadian listed fund, that is much less environment friendly than holding a U.S. listed ETF in an registered account.

Related Merchandise

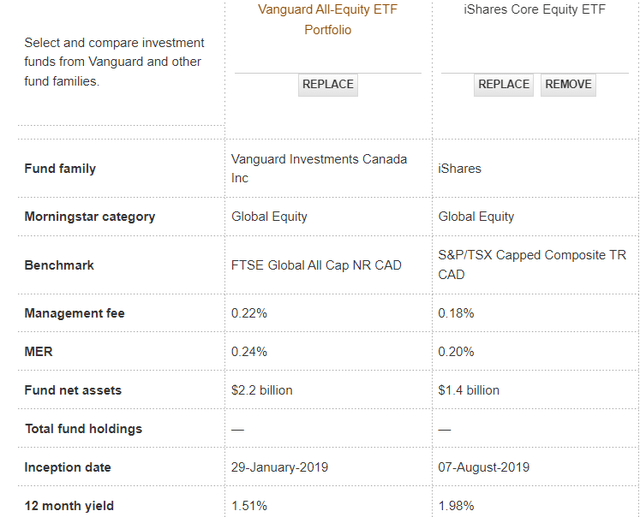

The closest competitor to XEQT:CA is Vanguard’s VEQT:CA. This fund launched just a few months earlier than the iShares XEQT:CA in 2019 has amassed $2.2B in property underneath administration (“AUM”) in comparison with XEQT:CA’s $1.4B. Vanguard’s model has even better diversification, with over 13,000 shares within the portfolio. Whereas this covers a broader swathe of the investable universe, there are diminishing returns on including securities held in such small fractions.

Two notable variations between Vanguard’s VEQT:CA and the iShares XEQT:CA are charges and geographic allocations. VEQT:CA has an MER of 0.24%, in comparison with XEQT:CA’s 0.20%, a distinction of about $40 on each $100,000 invested. Vanguard’s fund has roughly 30% Canadian fairness in comparison with the XEQT:CA allocation of 24%. VEQT:CA additionally has a bit of extra publicity to rising markets and a barely lighter U.S. fairness weighting.

VEQT comparability (Vanguard)

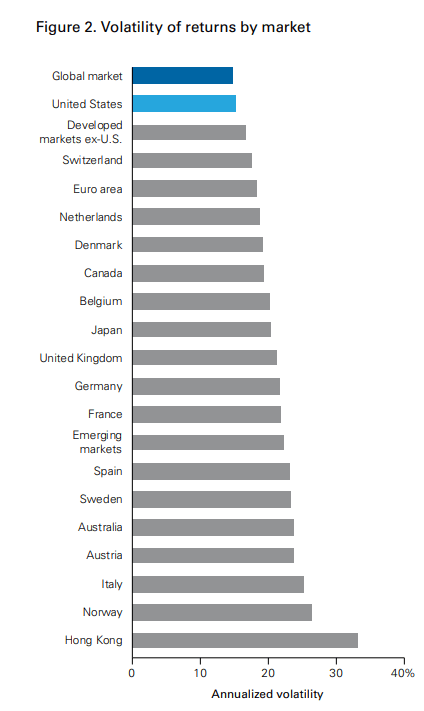

For broad publicity to international equities with out the overweighting on Canadian shares, one may use the Vanguard Complete World Inventory Index Fund (VT) or iShares MSCI All Nation World Index Fund (ACWI). The most important distinction is XEQT:CA and VEQT:CA are chubby Canada between 24-30%, whereas VT and ACWI maintain Canada round its international market cap of round 3%. Whereas these funds lose the volatility benefit of overweighting Canadian equities, holding a globally diversified basket of equities is already much less risky than any single nationwide market.

Volatility by market (Vanguard)

Investor Takeaways

Holding XEQT:CA is my most well-liked method of guaranteeing that I keep properly diversified. This enables me to deal with a smaller variety of direct holdings the place I see the best alternative. This low price all-in-one ETF is designed to cut back total volatility. This overweighting of Canadian equities and publicity to worldwide markets ends in XEQT:CA yielding roughly 40 bp greater than an S&P 500 index.