Parabolic Cease and Reverse is a technical evaluation device that plenty of energetic merchants might discover helpful. It’s favored by futures merchants that need to all the time have a place open.

PSAR, parabolic cease and reverse, is among the extra advanced indicators. It was initially supposed to be used within the futures market however like most good buying and selling instruments is relevant to any type of buying and selling with a chart of costs. The unique use was for hedging positions. Some futures buying and selling, these whose job it’s to purchase and promote bodily commodities not simply speculators, requires a place to be open on a regular basis to hedge towards future worth fluctuations. In case of those professionals, when a bullish place is closed a bearish place have to be opened and vice versa. The issue of understanding when to open and shut these positions might be solved, a minimum of in principle, with the assistance of PSAR.

The indicator was developed by J. Welles Wilder jr. and takes worth motion in addition to time decay under consideration inside the equation. It shows as a dot above or beneath every intervals worth motion and is used as help/resistance targets and for entry and exit alerts.

A futures dealer would observe its alerts like this: when the dots are beneath the candlesticks lengthy positions are opened. When costs transfer beneath a dot the development is reversed and merchants contemplate opening quick positions. Every time the dot switches sides a brand new place is opened. An choices, foreign exchange or CFD dealer might open a place with every change though this isn’t all the time the most effective method. Many occasions massive parts of the transfer have already occurred, particularly in case you are utilizing a brief time period time-frame, so ready for pull backs/aid rallies and checks of help/resistance is normally a good suggestion. Targets for this help/resistance is the PSAR.

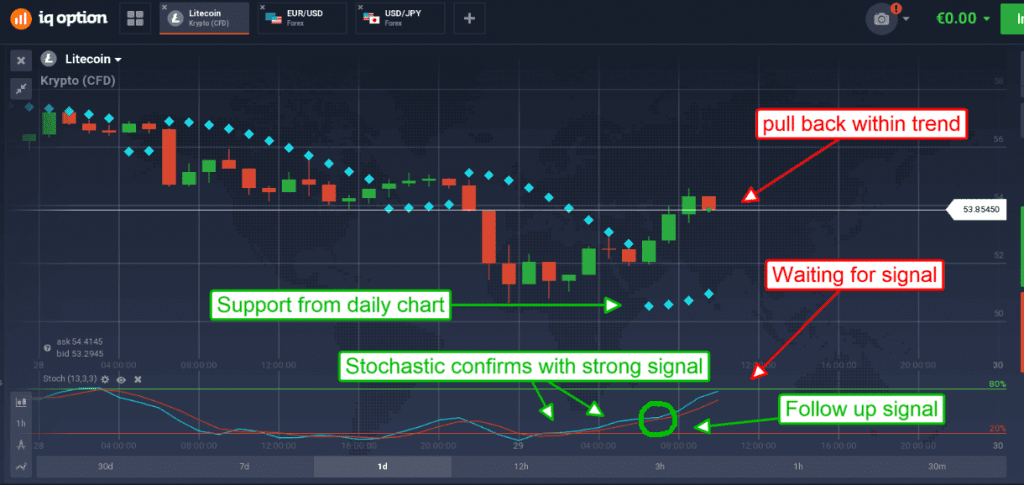

The indicator, like all others, is a chilly and heartless one giving each bull and bear alerts in both type of market. For this reason some type of extra evaluation is required to weed out false and fewer possible buying and selling alerts. On this occasion a a number of time-frame method with PSAR might work, some merchants additionally want so as to add stochastic to the combo. On this occasion we’ll use the each day chart and PSAR to set the buying and selling route for at the moment after which transfer right down to an hourly or 30 minute chart and stochastic for entry alerts. Within the chart above you may see that Litecoin is buying and selling above its dot which makes at the moment a bullish day. As well as, the present candle has already moved down to check help and confirmed. We then transfer right down to the hourly chart to attend for entry alerts for purchasing calls or opening lengthy positions.

The chart beneath exhibits an asset already in rally mode, having bounced up from help. This transfer is confirmed by a powerful entry sign in stochastic which continues to be on the rise and shifting towards the higher sign line.

At the moment the factor to do is anticipate the subsequent stochastic sign as a result of there’s already one in play, entry right here is questionable. The subsequent stochastic sign could be a bullish crossover or any dip of %Ok to check/bounce from %D. Bullish crossovers embody %D crossing the higher sign line or %Ok dipping beneath after which crossing again above %D. The period of the sign could possibly be as quick as 1 hour or so long as a number of days, relying on market circumstances.

[cta_en link=”https://iqoption.com/lp/ultimate-trading/?aff=88&aftrack=active1802″ name=”Trade here”][/cta_en]