Taiyou Nomachi/DigitalVision through Getty Pictures

Funding Thesis

Costco Wholesale Company (NASDAQ:COST) traders should not be fooled by the pessimistic market response, for the reason that inventory market has additionally been noticeably flat since October’s CPI outcomes and Powell’s dovish commentary. There might be extra volatility within the short-term, because of the overly bullish November labor market and service business studies, considerably worsened by the November CPI report launched on 13 December and, consequently, the Feds supposed 50 foundation factors hike on 14 December. Nonetheless, we select to take a look at the brilliant aspect, regardless of the excessive chance of a recession in 2023 and the raised terminal charges to over 6%.

With the addition of two new areas in China by the top of FY2023, COST will possible report a outstanding increase in gross sales over the following few quarters, considerably aided by China’s surprising reopening cadence. Analysts are already projecting a flurry of ‘revenge’ spending, with the nation’s GDP recovering tremendously to five% by 2023, in opposition to the projected 3% in 2022 and the earlier 6% in 2019.

Although COST has not traditionally damaged down its particular geographical income in regard to China, the worldwide phase has beforehand accounted for 13.2% of the corporate’s income in FY2022. Its recognition within the nation is to not be reckoned with as nicely, for the reason that first retailer opening in 2019 has beforehand triggered an early closure and a three-hour jam because of the huge client urge for food. Given how China has been underneath lockdown for the previous three years, we reckon the pent-up demand to be considerably over the roof certainly.

COST Continues To Execute Brilliantly

COST Income, Gross %, EBIT %, Web Revenue ( in billion $ ) %, and EPS

S&P Capital IQ

Inflationary pressures haven’t spared COST, because of the notable -0.5 proportion level YoY affect on the gross margins in FQ1’23. Nonetheless, we should additionally spotlight that these numbers characterize a notable 0.4 level QoQ growth, pointing to the mastery of its world provide chain to date. Its EBIT margins have additionally improved by 0.1 level QoQ, regardless of the rising working prices. Thereby, pointing to the power of the administration’s working price effectivity, triggering a 4.37% YoY growth on its EPS to $3.10.

Moreover, the quarter’s end result features a -$0.15 cost because of the downsizing of its constitution transport actions although a $0.12 profit on Inventory-Primarily based Compensation. Subsequently, it isn’t fairly a good YoY comparability, given the -$0.03 EPS shortfall from the FQ1’22 outcomes, of a -$0.2 write-off and $0.21 profit on Inventory-Primarily based Compensation. Mixed with FX headwinds of -$0.12 per share, it’s instantly evident that COST has continued to carry out brilliantly.

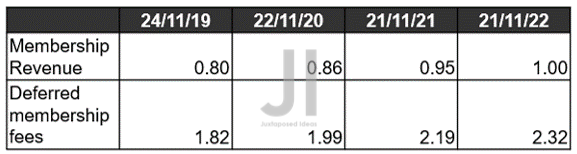

COST Membership Progress ( in billion $ )

S&P Capital IQ

Moreover, its membership income continues to increase excellently by 5.26% YoY in FQ1’23, regardless of the more durable YoY comparability and supposed peak recessionary fears. We should once more spotlight the FX headwinds in its membership revenues by as much as -$32M for the quarter, which might have indicated an adj YoY progress of over 9%. Mixed with the sturdy deferred membership charges of $2.32B, it seems that there isn’t a demand destruction at COST certainly, as renewal charges within the UCAN area stay wonderful at 92.5%, with the worldwide fee coming in sizzling at 90.4%.

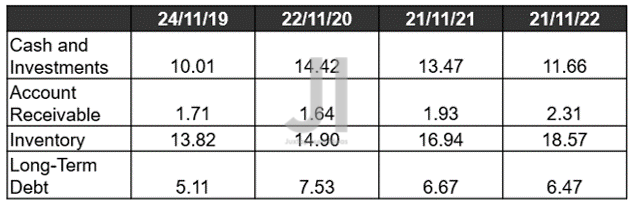

COST Money/ Funding, Stock, and Debt ( in billion $ )

S&P Capital IQ

COST’s steadiness sheet stays stellar, with $11.66B of speedy liquidity and $2.31B of accounts receivable for FQ1’23. Whereas stock has additionally elevated by 3.74% QoQ and 9.62% YoY to $18.57B, we’re not involved as nicely, for the reason that firm continues to maneuver $54.43B price of inventories for the most recent quarter, whereas sustaining its debt ranges at $6.47B. Spectacular certainly.

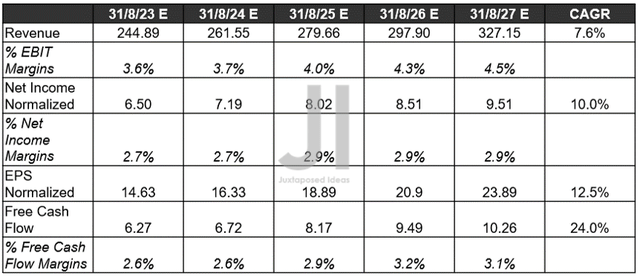

COST Projected Income, Web Revenue ( in billion $ ) %, EBIT %, EPS, FCF %, and Dividend

S&P Capital IQ

Moreover, the rising pessimism concerning the slowing financial progress has not impacted COST’s prime and bottom-line progress by FY2027 in any respect. The truth is, Mr. Market has notably upgraded its Free Money Move era by 6.49% for the following two years, doubtlessly triggering an improved dividend payout forward. We’ll see.

Within the meantime, we encourage you to learn our earlier article, which might assist you higher perceive its place and market alternatives.

Costco: Ready For A Low cost That Is By no means Coming Costco: Extra Costly Than Ever – Possibly Its Premium Is Justified

So, Is COST Inventory A Purchase, Promote, Or Maintain?

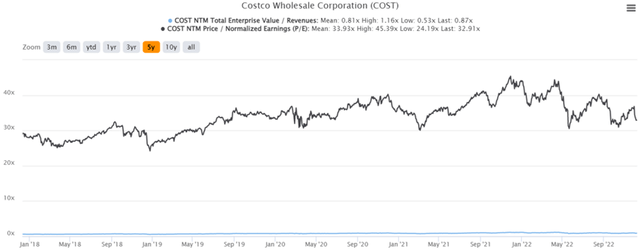

COST 5Y EV/Income and P/E Valuations

S&P Capital IQ

COST is presently buying and selling at an EV/NTM Income of 0.87x and NTM P/E of 32.91x, comparatively in step with its 5Y imply of 0.81x and 33.93x, respectively. In any other case, under-valued based mostly on its YTD imply of 0.96x and 37.18x, respectively.

COST YTD Inventory Worth

In search of Alpha

Moreover, the COST inventory is buying and selling at $480 (after-market), down -21.6% from its 52 weeks excessive of $612.27, although at a premium of 18.07% from its 52 weeks low of $406.51. Consensus estimates stay bullish about COST’s prospects as nicely, on account of their worth goal of $555.00 and a 15.28% upside from present costs. Mixed with the components mentioned above, we proceed to fee COST inventory as a Purchase on the low $400s, for an improved margin of security and subsequent decade portfolio progress. In any other case, there may be all the time no hurt nibbling at each dip, relying on particular person traders’ greenback price common. Good luck, all.