patpitchaya/iStock by way of Getty Photos

Thesis

PGIM Excessive Yield Bond Fund (NYSE:ISD) is a excessive yield CEF from PGIM Investments. As per its literature:

The Fund seeks to offer a excessive stage of present earnings by investing primarily in under investment-grade fastened earnings devices.

The fund employs a low leverage ratio of 20%, and has a excessive allocation to “BB” credit, components which make this fund a little bit of a conservative one when it comes to threat. In right now’s surroundings conservative is an effective factor. The fund is granular, with all issuers under a 2% portfolio threshold, and the utmost trade focus at a ten% stage.

The fund is down virtually -15% on a complete return foundation this 12 months, however compares favorably to its friends, each on a 12 months so far foundation in addition to on longer time frames. The automobile represents a leveraged tackle a portfolio of excessive yield bonds, with a conservative sturdy development (low leverage, granular profile). The CEF is down this 12 months because of the violent rise in charges and credit score spreads, however will outperform within the coming years.

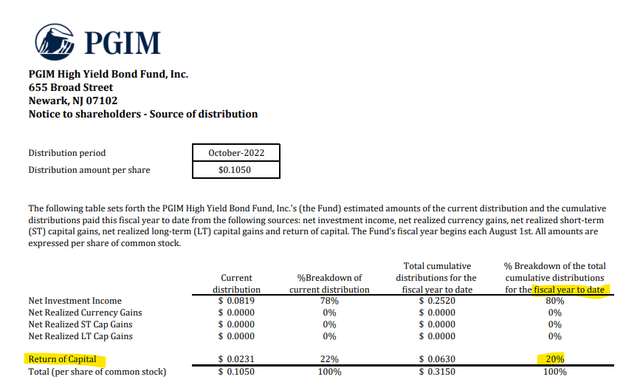

The fund is at the moment yielding 10%, however it isn’t totally supported. As of the newest Part 19a assertion, solely 80% of the dividend was composed of curiosity earnings, with the remaining representing return of capital. Whereas notable, the ROC proportion shouldn’t be excessive. We like this fund, its granularity and composition. It’s a basic construct for a sturdy long run leveraged excessive yield publicity.

ISD Holdings

The fund holds a portfolio of primarily under funding grade bonds:

Rankings (Fund Reality Sheet)

We are able to see from the above pie charts that “BB” and “B” credit account for many of the holdings, including as much as over 69% of the fund. This can be a conservative composition, with the “CCC” bucket under a ten% threshold.

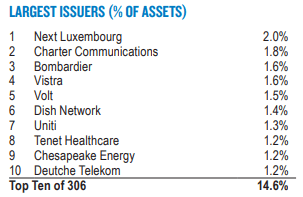

The fund’s composition may be very granular, with a low allocation to particular person issuers:

Issuers (Fund Reality Sheet)

We don’t prefer to see particular person credit exceeding a 3% to five% portfolio allocation, as a result of a sudden default in a kind of names would have a major affect on the portfolio. It isn’t the case right here.

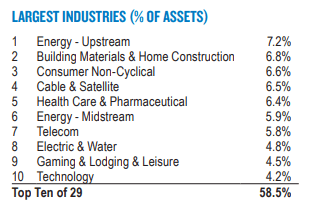

From an trade/sector stand-point the construct is equally granular:

Business (Fund Reality Sheet)

We like the truth that Power is the biggest sectoral composition, given the structural up-cycle for this sector. Finally credit in sectors with robust money circulation producing capabilities will outperform long run.

Efficiency

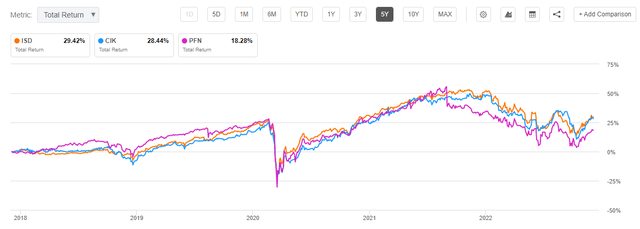

The fund is down 12 months so far, however in step with different excessive yield friends:

Complete Return (Looking for Alpha)

We are able to see your complete cohort being down -12% to -15% this 12 months as a result of charges and credit score spreads. ISD performs on a long run foundation as nicely:

Complete Return (Looking for Alpha)

What’s fascinating about this graph is the tightness of the cohort distribution – there aren’t any important outliers right here. The three funds we’re had a really comparable efficiency, with PFN barely underperforming as of late. These are funds from three giant, well-known asset managers, with a superb observe document and model. ISD stacks up there.

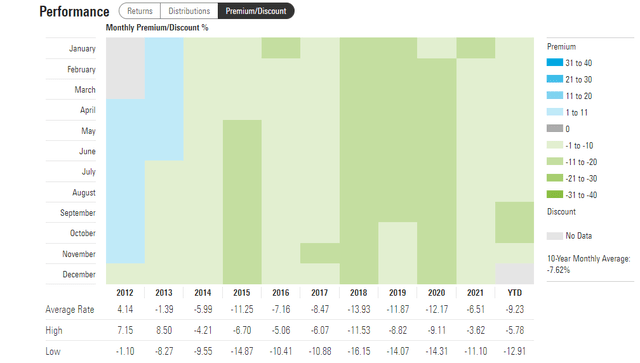

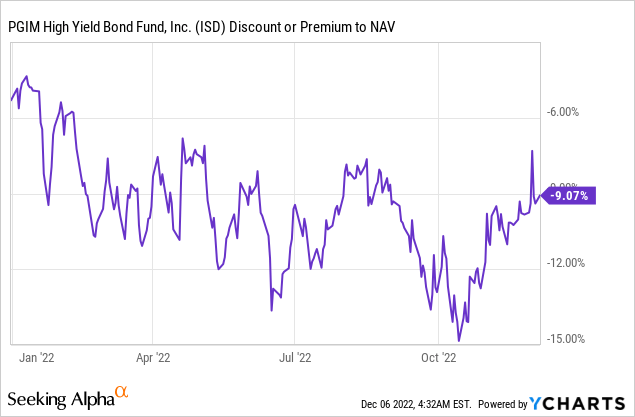

Premium / Low cost to NAV

The fund often trades at a reduction to NAV:

Premium/Low cost to NAV (Morningstar)

We are able to see how ISD traditionally has averaged a -7% low cost to web asset worth. The final time this fund traded at a premium was in 2013.

The fund has a excessive beta to risk-off environments:

Because the market bought off in June and September, the fund’s low cost to NAV widened considerably. Count on extra of the identical in the course of the subsequent bout of the present bear market. It’s fascinating to notice the volatility across the fund’s low cost to NAV – for the reason that backside in October, the fund’s low cost narrowed by virtually 6%. That’s virtually 7 months of curiosity earnings if holding the CEF outright.

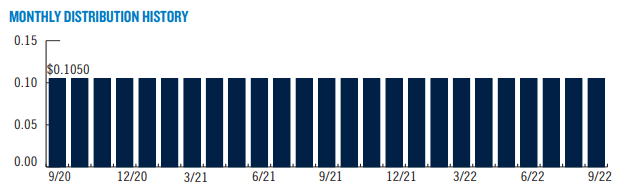

Distributions

The fund has a month-to-month $0.105 distribution:

Distribution Historical past (Fund Web site)

We are able to see that the CEF has not modified its month-to-month dividend for a considerable period of time.

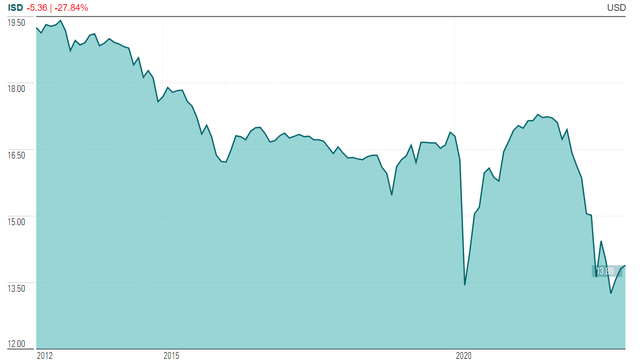

The distribution shouldn’t be completely supported, with an annual -2.7% give-up previously decade:

NAV Efficiency (CEFConnect)

This reality is confirmed by the latest Part 19a assertion, the place curiosity earnings has elevated, however nonetheless accounts for less than 80% of the distribution:

Part 19a Discover (Fund)

Conclusion

PGIM Excessive Yield Bond Fund is a excessive yield CEF from PGIM Investments. The fund focuses on fastened paying excessive yield bonds within the U.S. The automobile is down -15% this 12 months because of the rise in charges and credit score spreads. ISD is conservatively constructed, with a granular portfolio strategy and a low leverage ratio of solely 20%. Lengthy-term, the fund’s efficiency matches different nicely regarded CEFs within the house, and its conservative construct is a plus for right now’s surroundings. The fund is buying and selling at a -9% low cost at the moment, and has tended to commerce under web asset worth traditionally. Whereas now 80% lined, the CEF’s 10% yield shouldn’t be totally supported. ISD is an effective selection for buyers in search of a extra conservative construct within the U.S. excessive yield house, and it’ll have a brilliant 2023 and 2024 forward of it.