mikkelwilliam

Netflix Vs The Gaming Trade

Netflix (NASDAQ:NFLX) is trying to enter the online game market by internally creating a AAA title, in line with latest job listings. Nevertheless, there are various points which will come up with this choice. This text will lay down my view of the trade and the way Netflix ought to pursue the event of a online game internally, significantly with reference to competitors. I additionally counsel an acquisition of Valve Company will present much more short-and-long-term synergies for Netflix. If the unlikely deal fails to happen, Netflix can nonetheless study classes about this nuanced and troublesome to handle trade.

Some readers may very well be stunned to listen to that Netflix already provides a small number of video games to play on their cellular app. The listing consists of principally informal indie and youngsters’s video games so there may be room for enchancment. As reported by CNBC, utilization as of August 2022 was solely a blip on the radar: 23.3 million downloads and 1.7 million day by day customers in comparison with the 221 million or extra subscribers. Primarily, Netflix’s present objectives for his or her video games are to combine the present TV and film mental property they’ve as both cellular or PC video games.

CNBC

For my part, there aren’t presently, and unlikely to be any, blockbusters on the platform, whether or not by way of subscriber progress or market worth. That is because of the easy nature of the present choices and video games, recognition of the choices, and competitors with different online game friends. Will the addition of a AAA recreation to the cellular platform create a viable fee of return when competitors is rife and success is a raffle?

Trendy Gaming Traits

Whereas expanded improvement will enable for a high-value gaming platform by way of rising recognition and gross sales, the economics of the primary recreation have to be optimized to create future money flows to reinvest within the improvement pipeline. The sport should reap the benefits of present gaming trade economics. To grasp what Netflix must do I’ll talk about the current tendencies and influences.

Wanting on the market, there are a number of main segments to concentrate on within the trendy period:

The yearly or frequent launch video games: Name of Responsibility (ATVI), sports activities video games (EA), Nintendo (OTCPK:NTDOY) collection (Mario Kart, Tremendous Mario Bros, Pokemon, and so on.), and so on. Worth is derived from gross sales of the sport, nearly to the extent of a yearly subscription.

Esports: CSGO (Valve), League of Legends (OTCPK:TCEHY), Overwatch (ATVI), Dota (Valve), Fortnite (EPIC), and so on. Worth is derived from occasions, streaming, and in-game gadgets, significantly beauty skins.

Cell Video games: Honor of Kings/Enviornment of Valor (OTCPK:TCEHY), Sweet Crush (ATVI), Genshin Affect, Roblox (RBLX), and so on. Worth is derived from in-game gross sales and perpetual updates, particularly with playing by way of “gacha” mechanics.

AAA: Purple Lifeless Redemption (TTWO), Resident Evil (OTCPK:CCOEY), Grand Theft Auto (TTWO), God of Conflict (SONY), Murderer’s Creed (OTCPK:UBSFY), Diablo (ATVI), Borderlands, Darkish Souls, Elder Scrolls, and so on. Whereas releases are rare, typically 3 or extra years aside, the lasting affect of those video games permits for recurring money flows over time. Most worth lies in IP, however takes years to earn a number one place.

Indie Blockbusters: Minecraft (MSFT), Terraria, The Witcher 3 (OTCPK:OTGLY), Human Fall Flat, Fort Crashers, Amongst Us, and so on. Netflix’s present choices are indie, however the chance of reaching equal success is extraordinarily low with out extra spending on advertising and marketing. Though, as soon as established, an indie recreation can flip right into a AAA collection.

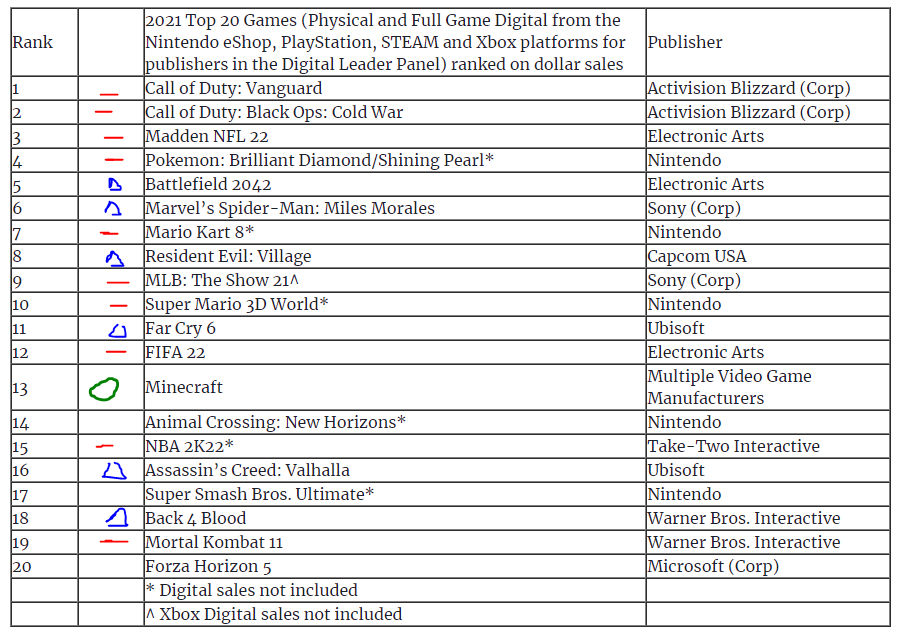

So, with Netflix trying to rent a crew to construct a “AAA PC recreation”, now we have to foretell what place the corporate will take. In 2021, the principle theme was the dominance of the perpetual launch class, significantly CoD and sports activities titles, and I don’t see Netflix concentrating on this section. Within the picture of the highest 2021 video games by gross sales under, I marked the annual titles in pink, AAA titles in blue, and Minecraft in inexperienced. Nevertheless, it is very important be aware that the information is just for PC and console copy gross sales, and doesn’t embody in-game gross sales, cellular video games, and ecosystem revenues (Esports leagues, merchandise, commercial, and so on.).

The info means that Netflix has stiff competitors within the AAA house and that even AAA titles have problem competing with the frequent launch titles. It’s going to take Netflix a long time and billions in investments to succeed in that degree, and present profitability will likely be pushed to the restrict. Nevertheless, Netflix shouldn’t be a low-level indie developer doomed to earn lower than $1 million in whole earnings, as advertising and marketing with their present base will enable for no less than a decent return typically. Netflix has been profitable in producing their very own IP for TV and films, however time will inform for his or her foray into gaming.

NPD

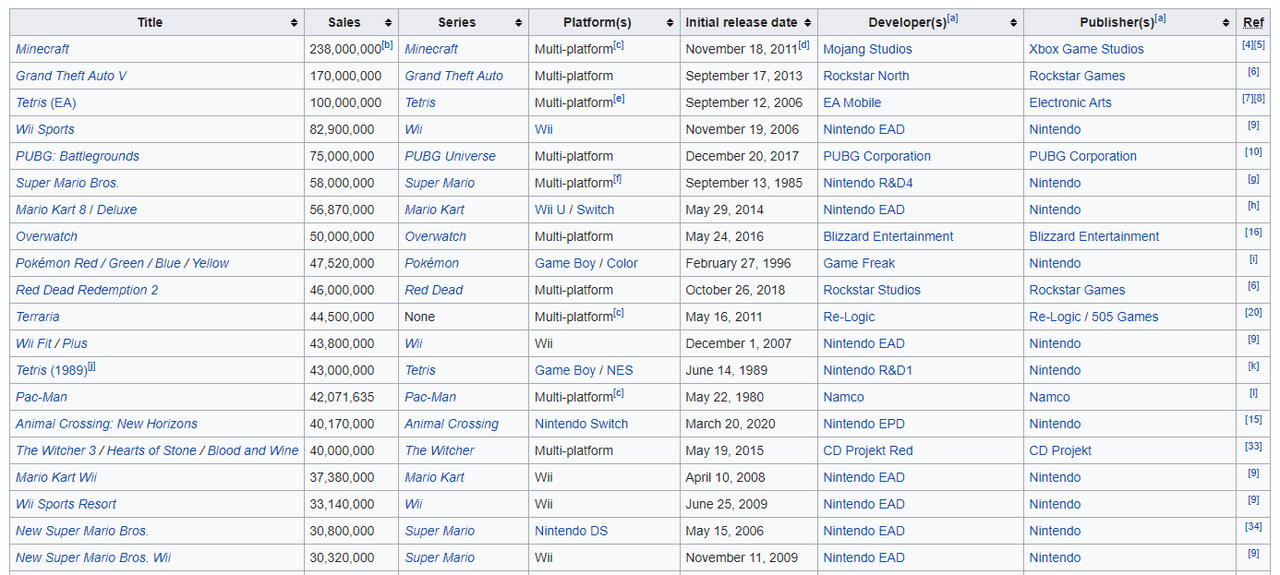

I imagine the long-term gross sales knowledge is healthier suited to counsel the difficulties that Netflix faces. Of the highest 20 all-time gross sales, over 50% of the titles had been launched previous to 2010, and 20% had been printed previous to 2000. This means that one of many components of success is longevity, and so Netflix has this problem to face. To not point out that other than a number of titles, most high 20 all-time video games are from established gamers or are reiterations of earlier titles. Additionally, one other consideration is the truth that many of those video games are/had been included in bundles or with the {hardware} (Wii Sports activities, console exclusives, and so on.), and I discover it unlikely that Netflix will launch {hardware} or that rivals will enable for packages to incorporate Netflix IP.

Wikipedia

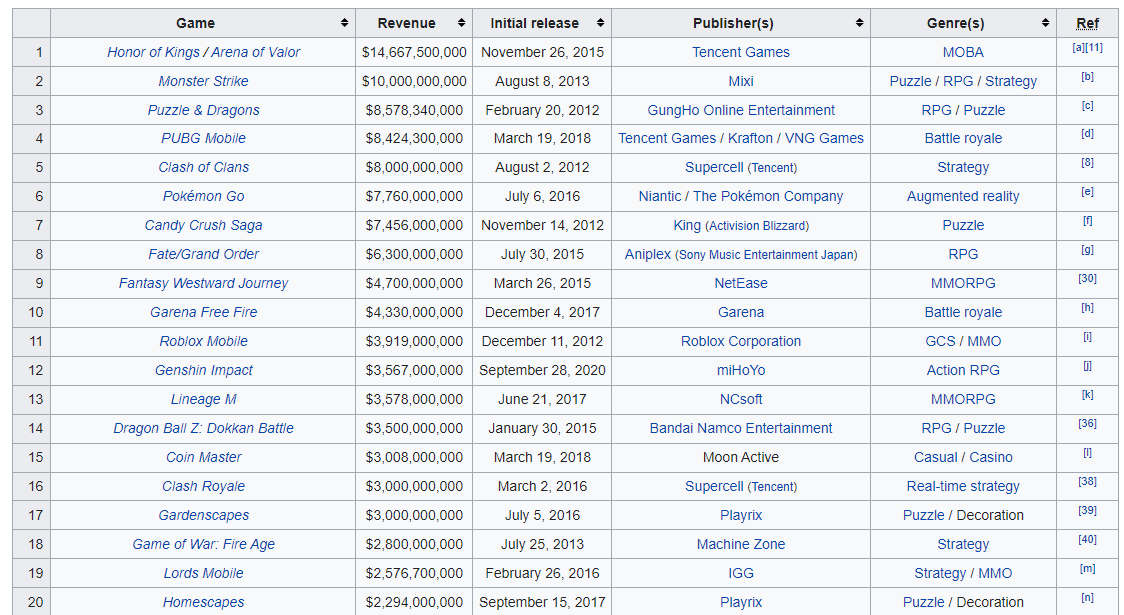

Nevertheless, there may be one space of the trendy market that I discover Netflix could also be finest suited to enter: cellular video games with in-game purchases. Regardless of being solely a decade or so previous, knowledge exhibits that the cellular recreation trade is kind of worthwhile with eight titles incomes over $5 billion in revenues so far (see under). Cell video games additionally include advantages of scale, with most individuals having telephones however not everybody proudly owning a PC or console. The video games are additionally much less useful resource intensive, with easy video games comparable to Sweet Crush or different puzzle video games. We are able to additionally see that competitors is much less intensive because the trade stays dominated by smaller entities other than Tencent, and this may occasionally enable Netflix’s recognition, story-telling expertise, and IP to shine.

One technique that Netflix ought to comply with is the case of Genshin Affect, developed and printed by Shanghai-based Mihoyo. This small crew has seen a fast explosion in recognition over the previous two years since launch due to a recreation that has a frequently expanded well-liked story, has gacha mechanics to drive revenues (a subject for an additional day, however can tie in with a Netflix subscription), and maybe most significantly, is enjoyable to play. This has allowed the crew to earn an astounding common of $1 billion USD per six months, and these revenues are increasing worldwide, set to proceed for years to come back based mostly on the story, and establishes a positive-feedback loop of spending due to the in-game content material (free-to-play, however spending makes the sport extra enjoyable).

Wikipedia

Maybe Distribution Could be Higher?

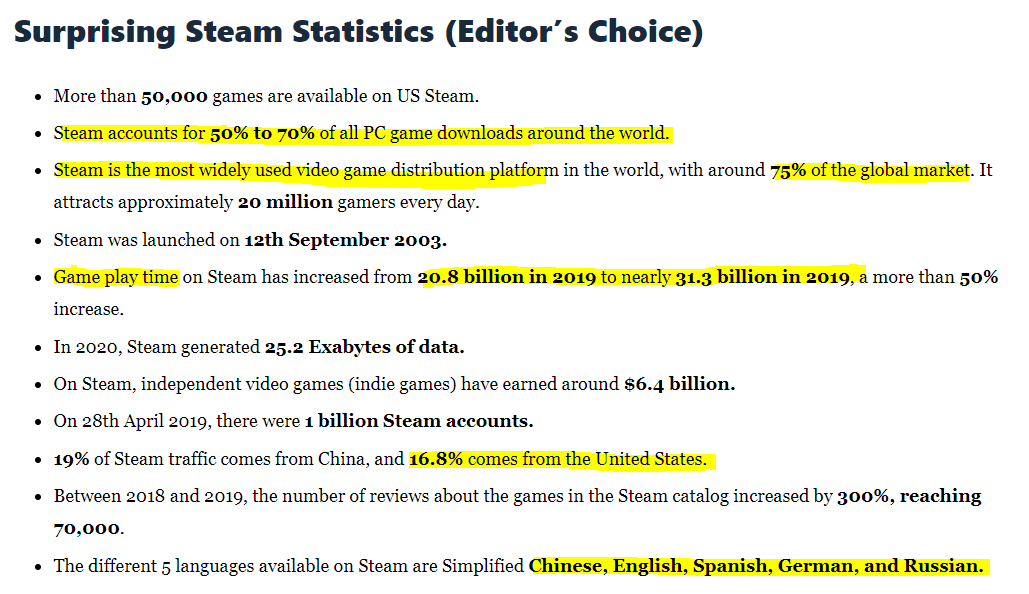

There’s one obvious difficulty that I’m positive has been addressed by administration, however nonetheless stays unknown: since Netflix is a distribution platform, why not purchase the main online game platform, Steam? Steam is the main PC recreation distribution platform by an enormous margin. All main platforms concede to promoting their video games on the platform, permitting proprietor Valve to realize entry to deriving worth from an enormous participant base. One exception is Epic Video games’ Fortnite, however the spending required to deliver customers to the Epic Video games Retailer is immense. This consists of $11.6 million on free video games to realize 5 million subscribers and $146 million to maintain Borderlands 3 and different video games off of Steam. Regardless of the competitors, Steam stays dominant, and I spotlight some key knowledge under.

Enterprise Apps Immediately

Different Valve advantages embody the truth that Valve additionally has a particularly well-liked IP base that features Counter Strike, Half Life, Left 4 Lifeless, Dota, and Portal. Specifically, Half Life is a story-driven collection that will profit from a Netflix/Valve pairing due to growth into TV or film mediums. Additionally, Valve has simply launched their extremely rated Steam Deck, a handheld console that permits customers to play all their favourite Steam video games away from the PC. Using AMD (AMD) processor expertise, the Steam Deck blows the Nintendo Change out of the water by way of efficiency, and should turn into a serious competitor within the handheld section.

Feasibility and Proof

Whereas it’s seemingly a troublesome process to work out the kinks by way of competitors and integration, I imagine {that a} Valve and Netflix partnership or merger would profit either side. The foremost difficulty would be the subscription and I don’t see Steam ever forcing one on customers. Nevertheless, I can see {that a} Netflix subscription may very well be used to entry choose video games free of charge, equally to PS Plus, XBOX Recreation Move, and so forth The 2 entities might additionally proceed to function on their very own, however the integration and growth of IP between the 2 entities might present sufficient synergies to make the deal worthwhile for each events.

On the again of the comparatively stunning Activision-Blizzard acquisition by Microsoft, all the gaming trade is remodeling quickly. Whereas 2020 and 2021 had been beautiful years for the trade, a pull-back in demand has allowed valuations to fall into 2022. This results in alternatives for the big gamers to grab up indie or mid-size mental property cheaply. Whereas Netflix has acquired six indie recreation studios so far, none of them provide money flows of a significant quantity. It’s clear that Netflix is simply making an attempt to realize expertise and take a look at the waters, however a serious transaction could also be looming. I don’t anticipate the interior manufacturing of a AAA title would be the finish of the road.

Think about the returns on funding that will be attainable if Netflix now acquires Valve and Steam and markets their small indie video games in entrance of tens of millions of customers. I believe the chance is unimaginable, albeit pretty dangerous by way of antitrust and investor sentiment. Nevertheless, I do see knowledge that will counsel that there’s a small chance of a Valve acquisition occurring. First, Netflix had a reasonably profitable adaptation of Esport League of Legends by way of the present Arcane, however developer Riot Video games is owned by Tencent. Then there was the Valve IP anime cross on Netflix, DOTA: Dragon’s Blood, which has already completed airing three seasons on the platform. Lastly, Netflix was even a sponsor for a CS:GO match in Denmark, the Blast Premier Fall Finals.

Conclusion

The proof is evident that Netflix is quickly transferring into the gaming trade and is profitable to this point regardless of the small scale. It is usually clear that Netflix is aware of Valve, proprietor of the main PC recreation market Steam, and the worth of the IP they maintain. The tens of millions of day by day customers and capabilities of the platform, together with IP synergies of transferring throughout platforms would supply worth past the present ranges. As of Could 2022, Valve was valued at $7.7 billion USD in line with Bloomberg, or 1.5x present Netflix Internet Earnings. As such, the acquisition is possible, wouldn’t add an excessive amount of debt, and will likely be web optimistic after the transition interval. The one main headwind I see is Valve Proprietor Gabe Newell’s reluctance to go public.

As such, I sit up for the potential for this acquisition occurring. Regardless of that, I’ll stay on the sidelines by way of an funding into Netflix. Though, the corporate is doing properly to take a measured tempo to operational enhancements comparable to online game design and the just about 50% rise in share value over the previous six months is clearly a results of secure operational efficiency. I’ll solely turn into an investor if the mentioned deal is introduced or extra details about the online game platform is launched.

Thanks for studying.