Greenback Index pulls again from a 3 day excessive and finds help on the 110.82 space forward of a key charge choice from the FED.

Greenback

The Greenback begins the brand new week on the again of a 3 day run up in the direction of the 111.60 space after transferring from the low of the vary positioned across the 109.20 space. Because the aforementioned exuberance seen within the Greenback, worth has pulled again in the direction of the 110.82 space and this may be attributed to market contributors being cautious forward of the FED rate of interest choice on Wednesday the place a 75-basis level charge hike is basically anticipated. Moreover, employment knowledge is due on Friday within the type of NFP knowledge, which is including to the indecision seen within the index.

Technical Evaluation (H4)

By way of market construction, worth is in an uptrend, printing higher-highs and higher-lows. Present worth motion is locked in a spread between 109.95–114.55, with the bulls largely answerable for the dynamic, due to the potential bullish worth motion sample being printed out within the type of a giant descending channel. If confirmed, worth will print out an impulsive wave and bulls might doubtlessly drive worth to the prime quality.

Euro

The Euro kicks off the week failing to defend a three-week low amid a cautious strategy from the market. This conservative sentiment might be immediately linked to greenback dynamics, in every week the place key U.S knowledge is predicted to take centre stage within the type of rate of interest selections, NFP, manufacturing PMI, and S&P international manufacturing PMI, in addition to JOLTS job openings for the month of September. Key takeaways from this knowledge will probably govern which route the Euro takes from this juncture.

Technical Evaluation (H4)

Technical Evaluation (H4)

By way of market construction, worth is in a downtrend, printing out lower-lows and lower-highs. Present worth motion appears to be printing out a bigger potential bearish continuation sample (rising channel), which might solely be confirmed by an impulsive break of construction under the decrease trendline. Affirmation of the above will give sellers the impetus wanted to check the low of the vary across the 0.9500 space.

Pound

Sterling begins the week bouncing from a three-day low forward of the important thing FED knowledge launch. This exuberance might be attributed to an improved threat sentiment as buyers shrink back from extreme bets on the Greenback forward of the rate of interest choice anticipated on Wednesday. Moreover, the current upside momentum might be derived from the anticipated charge choice from the BoE, the place a double-digit enhance is predicted, in a bid to struggle off report excessive inflation.

Technical Evaluation (H4)

Technical Evaluation (H4)

By way of market construction, worth is in a downtrend, printing lower-lows and lower-highs. Present worth motion is printing out a possible bigger bearish continuation sample (ascending triangle). The sample will solely be confirmed by an impulsive break of the decrease trendline, which is able to give bears the impetus to check the decrease finish of the vary positioned across the 1.0400 space.

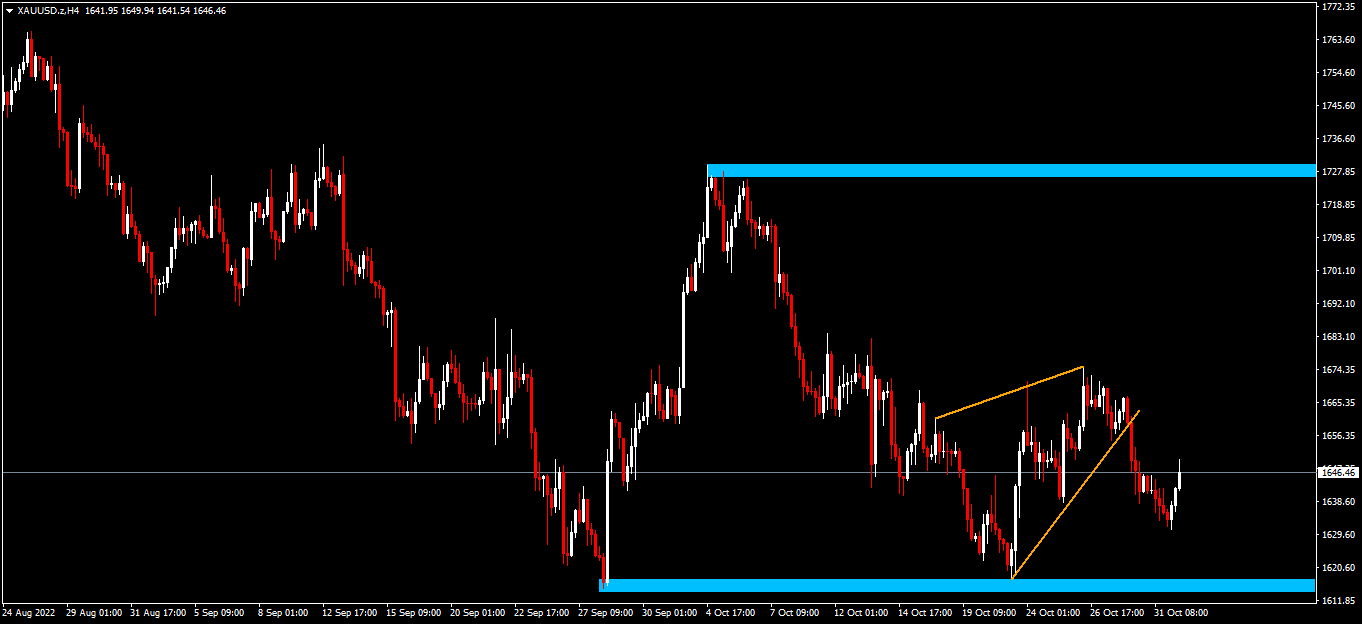

Gold

Gold heads into the brand new week pulling again from a 7-day low amid an improved threat sentiment forward of the two-day Federal Reserve assembly. This renewed shopping for curiosity within the yellow steel might be attributed to a weaker Greenback in addition to the report by the WGC (World Gold Council), which confirmed that the demand for Gold elevated by 23% from the identical time final yr, and this is among the causes buyers are making the most of this renewed optimism pushed by the information.

Technical Evaluation (H4)

By way of market construction, Gold continues to be in a downtrend and persevering with to print out subsequent bearish continuation patterns. At present the worth is locked in a spread between $1,610–$1,727, with the present worth motion printing out a possible bearish continuation sample within the type of a rising wedge. If the sample is confirmed, sellers will probably drive worth in the direction of the low of the vary.

Ofentse Waisi

Monetary Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.