ChrisHepburn/E+ through Getty Photos

Introduction

Persimmon PLC (OTCPK:PSMMF) is the UK’s largest housebuilder, with a multi-decade observe report of worthwhile progress. Not like most of its friends, it averted diluting closely after the monetary disaster, and therefore has an admirable long-term efficiency chart. Certainly, shareholders who invested on the flip of the millennium would have made an annualized return of ~14%: not dangerous for an quaint enterprise like this, with no tech danger and no actual disruption. And even higher, noting that the return I simply talked about was generated after the inventory has spent the final yr in freefall, dropping 60% of its worth!

I consider ahead returns from at this time look even higher than that, and therefore it’s a compelling alternative for buyers with a long-term perspective.

On this piece, I’ll argue three issues:

Persimmon is a top quality enterprise; the “finest at school” housebuilder, with robust economics and a enterprise mannequin which works by the cycle Investor’s greatest fears in regards to the enterprise are overstated; everyone seems to be preventing the final struggle and evaluating at this time to 2008. We’re not even shut, and Persimmon is positioned extremely effectively for any potential downturn The valuation is filth low cost; filth low cost on a cashflow perspective, filth low cost on an earnings perspective, and filth low cost on an asset perspective

For my part, these are “holy grail” investments. You get every thing you could possibly ask for. You don’t have to compromise on enterprise high quality or valuation. You get each.

You simply have to look by loads of brief time period noise, potential volatility, and be keen to purchase when different individuals don’t have the abdomen. Everyone knows that that is when the true cash is made: you don’t get alternative like this when everybody agrees that the sky has no clouds.

Enterprise mannequin

Persimmon 2021 Annual Report

The UK housebuilders operate equally to the U.S. ones. To provide an outline, in case you’re not acquainted, it seems like this:

They purchase land: both outright, or with choices agreements to reduce upfront money flows. Generally this land has planning permission to construct instantly; that is costlier, however clearly means you will get to work instantly. Generally, it’s going to require the subsequent step They work land by the planning system: aiming to maximise the worth of their land by optimizing the quantity and sort of houses, and customarily including worth by having fun with the premium that comes from taking brownfield or agricultural land and turning it into residential They market and promote new houses on these developments: housebuilders don’t have a tendency to make use of conventional property brokers – they don’t wish to pay the charges. However they do extensively record properties on-line, use native newspaper promoting, and promote “on-site” They construct, practically all the time “to-order”: Persimmon and others basically handle their websites such that their build-rate kind of matches their gross sales price. They construct when orders are within the bag; if orders aren’t coming in, they’ll cease constructing

It’s that straightforward. It’s an easy enterprise mannequin.

Persimmon principally builds conventional brick homes, just like the sort you’ll see within the image simply above. That is really a shot of one in all Persimmon’s current developments, not too removed from London. Since they principally intention on the entry-level of the market, taking pictures at first-time patrons, they’re sometimes semi-detached or terraced: that means you’ll share partitions along with your neighbors. This retains prices down, and is a distinction from the standard U.S. strategy.

The enterprise retains circa 4.5 years of land provide available. This provides it sufficient depth of stock and plot kind to take care of a excessive constructing price, with out burdening the stability sheet with an excessive amount of deadweight.

Monetary historical past

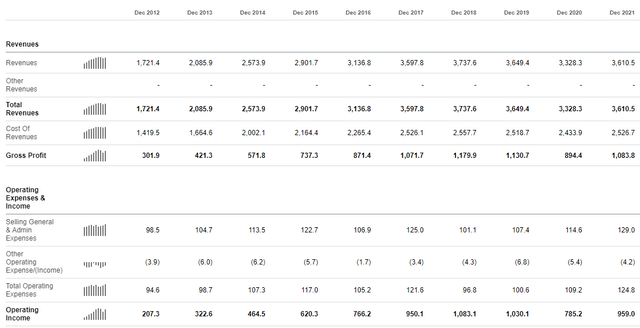

Persimmon’s monetary historical past is glowing, as you’ll be able to see from Looking for Alpha’s monetary snapshots:

Looking for Alpha

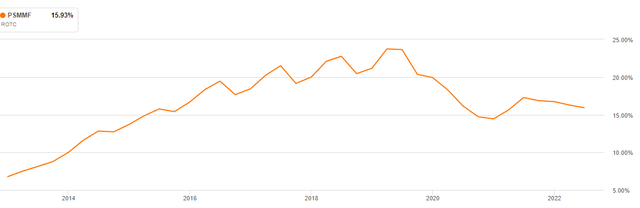

Constant income progress and constant EBIT progress are good bedrocks for constant share value progress. Higher but, they’ve managed it with a robust return on fairness by the interval:

Looking for Alpha

That return on fairness has pushed maybe probably the most enticing characteristic of Persimmon as a enterprise: its superlative historical past of shareholder returns. In opposition to a present market capitalization of £4.2bn, Persimmon has distributed £3.0bn within the final 5 years alone. That’s whereas investing within the enterprise and delivering the expansion you see above.

The group’s capital return technique is to distribute actually extra money, and in sometimes British spirit, the definition of “extra money” is rather more conservative than friends throughout the pond. Persimmon has had no debt for the final decade. Presently, it insists on holding £700m of money (circa 1x EBIT) as a buffer towards uncertainty. Given no debt and £3bn of land and WIP on its present asset aspect, I believe they’re fairly safe.

Clearly, one thing should be flawed. That is too good to be true.

Let’s deal with that head on, then. What’s the market so scared about, such that Persimmon is down 60% from its peak and obtainable at these ranges?

Recessionary fears

The reply right here is easy, and it’s the identical motive U.S. housebuilders are cratering: everyone seems to be panicking about recession, and panicking about rising rates of interest.

I’m not going to disclaim that these are actual points going through housebuilders.

I do wish to present some context about why I believe Persimmon is healthier positioned than most to face these points, and why I believe that – whereas profitability will in all probability dip within the short-term – within the medium time period, Persimmon will come again stronger.

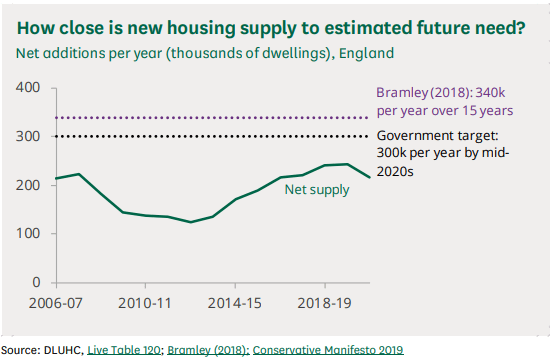

My first remark is that there’s a structural undersupply of housing within the UK, which helps costs and offers a giant, unhappy pool of demand. Assume children not leaving dwelling, individuals in home shares and undesired multi-generational households.

It is a actual problem. There’s a nice report from the UK Authorities on it right here:

https://researchbriefings.information.parliament.uk/paperwork/CBP-7671/CBP-7671.pdf

UK Parliament

I’ve included maybe a very powerful chart from the paper above. It reveals the Bramley estimate of the UK’s housing want (340k) and the present internet provide, which is considerably under the required stage. Worse: there’s a important historic backlog.

My second remark is that Persimmon is without doubt one of the best-placed to fulfill that persistent undersupply. As I’ll shortly present within the comparator evaluation, Persimmon construct low cost, starter homes which serve to handle probably the most undersupplied a part of the market. They’re more likely to be beneficiaries of Authorities coverage, which is (at the same time as I write this) pivoting to as soon as once more emphasize the necessary of serving to housebuilders construct. See the next article by the BBC: “Michael Gove commits to 300,000 houses goal.”

Lastly, I observe that – as late as August 2022 – Persimmon was nonetheless reporting a superb demand atmosphere. Whereas I don’t doubt issues have moderated since then, significantly because of the political chaos in Westminster in late September, it’s reassuring to notice that lengthy after individuals have been calling for doom and gloom, the group was saying that:

“Demand is powerful with the Group’s common non-public gross sales price within the interval round 1% forward year-on-year and a sturdy ahead order e-book of £2.32bn.”

and

“Strong begin to the second half; common non-public gross sales charges for the primary seven weeks 11% down yr on yr towards a robust comparator and as we return to a extra regular seasonal sample, and up 8% on 2019 being the newest, extra typical buying and selling yr.”

Persimmon’s stability sheet and powerful profitability metrics (gross revenue margin of ~30%, working revenue margin of ~27%) signifies that any downturn is, basically, a timing problem. Gross margins that fats imply that Persimmon might take up even a 2008 state of affairs, which noticed home costs falling by 20%, while remaining worthwhile. And that’s – actually – a worst case.

The housing market has remained surprisingly strong, at the same time as charges have risen and the so-called “value of dwelling disaster” has began to chunk. My hunch is that the British want for homeownership and the pool of latent demand is so massive that Persimmon will outperform fears.

Even when it doesn’t, Persimmon is positioned such that it’s going to come out of any downturn preventing match.

Comp Evaluation

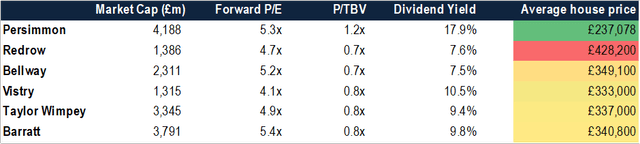

Creator

As promised, I embody a comp desk above which reveals Persimmon towards its UK housebuilding friends.

If you wish to personal any of them, I cannot argue with you. They’re all filth low cost. Buyers may think about hedging their bets by proudly owning a number of of the others, too.

However, for my cash, Persimmon is the best high quality enterprise. It definitely is on monetary metrics, its historic observe report is the very best, and that differential by way of common home value will insulate it in more durable instances. Paying a marginal increased value on an earnings and price-to-book foundation appears a simple commerce off.

My mannequin

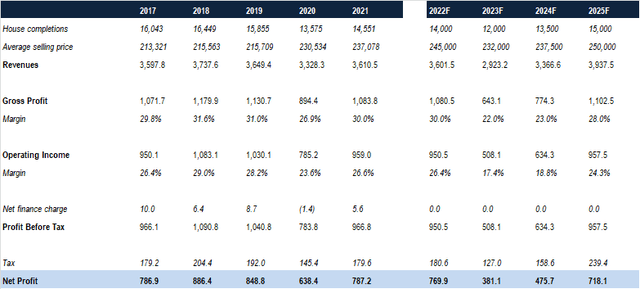

Creator

Proven above is my simplified mannequin which considers how the subsequent few years may look. 2022’s numbers are nearly within the bag, so there may be not an enormous quantity of probably variance. The group’s strong order e-book will see it by the rest of this yr, and assist subsequent.

There are just a few key inputs, which I’ll describe and clarify under:

Home completions I’ve assumed a ~20% drop in home gross sales in 2023, pushed by problem within the mortgage market. This may appear low, however as talked about elsewhere, the entry-level value level can be useful on this respect. It’s additionally necessary to notice that there was a big shift away from fastened price mortgages (that are extremely costly in the mean time) and towards lower-cost tracker mortgages, which has enabled clients to retain related month-to-month funds. It will help demand. Common promoting value I think about costs falling from £245k in 2022 to £232k in 2023. If this doesn’t sound like a big drop, notice that UK normal inflation is at present round 10%. In actual phrases, this could be a big drop in home costs. Even my “normalization” to £250k in 2025 would suggest home costs falling very considerably in actual phrases from 2020 – 2025. Gross margins Basically observe the home value reductions detailed above TaxRises to replicate the UK growing company tax to 25%, efficient subsequent yr

I believe this mannequin captures an inexpensive “base case” state of affairs, with some harsh however life like assumptions in regards to the state of the housing market, and profitability which by no means returns to its 2025 peak.

If I used to be requested to be extra bullish, I might notice that the enterprise’s land positions have been predominantly constructed up within the 2015-2020 interval, earlier than the present excessive ranges of inflation, and therefore that there’s really scope for very important gross margin growth when circumstances normalize.

However let’s not get too excited. We don’t have to!

Let’s once more floor ourselves with the dangers, earlier than we end off discussing potential returns for buyers at this time.

Dangers

If you happen to’ve made it this far, the dangers to this funding can be abundantly apparent to you.

The dangers should not stability sheet-based: Persimmon has an enormous pile of internet money. I additionally suppose there isn’t any affordable state of affairs the place the enterprise is ever really threatened. Gross margins of 30% are greater than sufficient to soak up a state of affairs worse than the worldwide monetary disaster.

However there are dangers to our earnings figures, and to simply reiterate what we talked about above, think about that:

The quantity of gross sales might fall additional than I’ve suggestedIf the Financial institution of England pushes charges too onerous, it’s going to create a state of affairs the place first time patrons can’t entry the housing market. I don’t suppose they wish to do that: however it’s doable. Costs may collapse There may be, after all, a risk that I haven’t been pessimistic sufficient – and housing falls additional than I believe it’s going to. That mentioned, brick housing within the UK is basically a non-depreciating asset. It lasts for lots of of years and culturally is seen as being the easiest way of saving on your retirement and guaranteeing intergenerational wealth. I don’t see that altering any time quickly. For many years, each dip has been purchased. Worldwide buyers may face foreign money points 12 months-to-date, the Sterling has fallen by 14% towards the greenback. It is a stark reminder of one of many dangers of investing in worldwide property. … though enterprising buyers is perhaps licking their lips on the probability of shopping for into the Sterling at a depressed stage: definitely, UK company takeovers are on the rise as international companies attempt to snap up bargains.

I can be watching the trajectory of UK home costs rigorously. I view this as probably the most vital danger issue.

Potential Returns

If you happen to refer again to my mannequin, you’ll see that I believe Persimmon can be incomes ~£720m in 2025.

Pricing is extra artwork than science, however let’s take a look at the historic P/E buying and selling vary of Persimmon to estimate what it is perhaps valued at in a “regular” market:

Looking for Alpha

I might peg 12x as being an inexpensive estimate of the “regular” stage. It would not appear too formidable a goal for a superb enterprise.

If we have been to hit my internet revenue estimate of £720m and return to that ratio, Persimmon can be buying and selling with a market cap of £8.6bn in 2025. Let’s not neglect that basically the entire internet revenue will translate into money technology, given the group’s good free money circulation conversion and the dearth of necessity for quickly ramping investments in what can be a troublesome few years. That needs to be round £1.6bn within the intervening three years.

Therefore, I consider that an funding in Persimmon at this time – at roughly £13 – will flip into round £27. That is nonetheless under it is prior share value peak. It should additionally generate £5.10 of dividends throughout the maintain interval.

Put it collectively, and this generates a 35.2% IRR. It’s a superb return; however you’re working when everybody else is working for the hills. You wish to be getting paid for it!

Conclusion

Persimmon is a winner. It’s a enterprise which has been by the wringer, by a wide range of financial environments, by political upheaval and administration staff adjustments, and constantly come out stronger. Its success isn’t constructed on being within the “proper place on the proper time.”

Now could be, assuredly, not the precise time. We’ve mentioned that, too.

However at first, I mentioned I hoped to influence you of three issues: that Persimmon is an effective enterprise; that investor fears are exaggerated; and that the enterprise is accessible for a discount basement value.

My evaluation is that, in the event you throw all the professionals and cons into the nice judgement sport that’s investing, Persimmon is as compelling as they arrive.

Editor’s Observe: This text was submitted as a part of Looking for Alpha’s Prime Ex-US Inventory Choose competitors, which runs by November 7. This competitors is open to all customers and contributors; click on right here to seek out out extra and submit your article at this time!