Up to date on July eighth, 2022 by Bob Ciura

Spreadsheet knowledge up to date day by day

Grasp Restricted Partnerships – or MLPs, for brief – are a number of the most misunderstood funding autos within the public markets. And that’s a disgrace, as a result of the everyday MLP presents:

Tax-advantaged revenue

Excessive yields effectively in extra of market averages

The majority of company money flows returned to shareholders by distributions

An instance of a ‘regular’ MLP is a corporation concerned within the midstream power trade. Midstream power corporations are within the enterprise of transporting oil, primarily although pipelines. Pipeline corporations make up the overwhelming majority of MLPs.

Since MLPs broadly provide excessive yields, they’re naturally interesting for revenue traders. With this in thoughts, we created a full downloadable record of practically 100 MLPs in our protection universe.

You’ll be able to obtain the Excel spreadsheet (together with related monetary metrics like dividend yield and payout ratios) by clicking on the hyperlink under:

This complete article covers MLPs in depth, together with the historical past of MLPs, distinctive tax penalties and danger elements of MLPs, in addition to our 7 top-ranked MLPs immediately.

The desk of contents under permits for simple navigation of the article:

Desk of Contents

The Historical past of Grasp Restricted Partnerships

MLPs have been created in 1981 to permit sure enterprise partnerships to subject publicly traded possession pursuits.

The primary MLP was Apache Oil Firm, which was shortly adopted by different power MLPs, after which actual property MLPs.

The MLP area expanded quickly till an important many corporations from numerous industries operated as MLPs – together with the Boston Celtics basketball workforce.

One essential development over time, is that power MLPs have grown from being roughly one-third of the overall MLP universe to containing the overwhelming majority of those securities.

Furthermore, the power MLP universe has developed to be targeted on midstream power operations. Midstream partnerships have grown to be roughly half of the overall variety of power MLPs.

MLP Tax Penalties

Grasp restricted partnerships are tax-advantaged funding autos. They’re taxed otherwise than companies. MLPs are pass-through entities. They aren’t taxed on the entity stage.

As a substitute, all cash distributed from the MLP to unit holders is taxed on the particular person stage.

Distributions are ‘handed by’ as a result of MLP traders are literally restricted companions within the MLP, not shareholders. Due to this, MLP traders are known as unit holders, not shareholders.

And, the cash MLPs pay out to unit holders known as a distribution (not a dividend).

The cash handed by from the MLP to unit holders is classed as both:

MLPs are inclined to have numerous depreciation and different non-cash prices. This implies they typically have revenue that’s far decrease than the amount of money they will really distribute. The money distributed much less the MLPs revenue is a return of capital.

A return of capital shouldn’t be technically revenue, from an accounting and tax perspective. As a substitute, it’s thought of because the MLP really returning a portion of its property to unit holders.

Now right here’s the attention-grabbing half… Returns of capital cut back your price foundation. Which means taxes for returns of capital are solely due whenever you promote your MLP models. Returns of capital are tax-deferred.

Be aware: Return of capital taxes are additionally due within the occasion that your price foundation is lower than $0. This solely occurs for very long-term holding, usually round 10 years or extra.

Every particular person MLP is totally different, however on common an MLPs distribution is often round 80% to 90% a return of capital, and 10% to twenty% peculiar revenue.

This works out very effectively from a tax perspective. The pictures under evaluate what occurs when an organization and an MLP every have the identical amount of money to ship to traders.

Be aware 1: Taxes are by no means easy. Some affordable assumptions needed to be made to simplify the desk above. These are listed under:

Company federal revenue tax fee of 21%

Company state revenue tax fee of 5%

Certified dividend tax fee of 20%

Distributable money is 80% a return of capital, 20% peculiar revenue

Private federal tax fee of twenty-two% much less 20% for passive entity tax break(19.6% complete as an alternative of twenty-two%)

Private state tax fee of 5% much less 20% for passive entity tax break(4% complete as an alternative of 5%)

Lengthy-term capital positive factors tax fee of 20% much less 20% for passive entity tax break(16% complete as an alternative of 20%)

Be aware 2: The 20% passive revenue entity tax break will expire in 2025.

Be aware 3: Within the MLP instance, if the utmost private tax fee of 37% is used, the distribution in any case taxes is $8.05.

Be aware 4: Within the MLP instance, the accrued price foundation discount tax is due when the MLP is offered, not yearly come tax time.

Because the tables above present, MLPs are much more environment friendly autos for returning money to shareholders relative to companies. Moreover, within the instance above $9.57 out of $10.00 distribution can be saved by the MLP investor till they offered as a result of the majority of taxes are from returns of capital and never due till the MLP is offered.

Return of capital and different points mentioned above don’t matter when MLPs are held in a retirement account.

There’s a totally different subject with holding MLPs in a retirement account, nevertheless. This consists of 401(ok), IRA, and Roth IRA accounts, amongst others.

When retirement plans conduct or put money into a enterprise exercise, they have to file separate tax kinds to report Unrelated Enterprise Earnings (UBI) and will owe Unrelated Enterprise Taxable Earnings (UBTI). UBTI tax brackets go as much as 37% (the highest private fee).

MLPs subject Okay-1 kinds for tax reporting. Okay-1s report enterprise revenue, expense, and loss to house owners. Subsequently, MLPs held in retirement accounts should qualify for taxes.

If UBI for all holdings in your retirement account is over $1,000, you have to have your retirement account supplier (usually, your brokerage) file Kind 990-T.

It would be best to file type 990-T as effectively if in case you have a UBI loss to get a loss carryforward for subsequent tax years. Failure to file type 990-T and pay UBIT can result in extreme penalties.

Happily, UBIs are sometimes damaging. It’s a pretty uncommon prevalence to owe taxes on UBI.

The topic of MLP taxation might be difficult and complicated. Hiring a tax skilled to help in making ready taxes is a viable possibility for coping with the complexity.

The underside line is that this: MLPs are tax-advantaged autos which can be suited to traders in search of present revenue. It’s effective to carry them in both taxable or non-taxable (retirement) accounts.

Since retirement accounts are already tax-deferred, holding MLPs in taxable accounts means that you can ‘get credit score’ for the complete results of their distinctive construction.

4 Benefits & 6 Disadvantages of Investing in MLPs

MLPs are a singular asset class. In consequence, there are a number of benefits and downsides to investing in MLPs. Many of those benefits and downsides are distinctive particularly to MLPs.

Benefits of MLPs

Benefit #1: Decrease taxes

MLPs are tax-advantaged securities, as mentioned within the “Tax Penalties” part above. Relying in your particular person tax bracket, MLPs are capable of generate round 40% extra after-tax revenue for each pre-tax greenback they resolve to distribute, versus Companies.

Benefit #2: Tax-deferred revenue by returns of capital

Along with decrease taxes usually, 80% to 90% of the everyday MLPs distributions are labeled as returns of capital. Taxes usually are not 0wed (until price foundation falls under 0) on return of capital distributions till the MLP is offered.

This creates the favorable scenario of tax-deferred revenue.

Tax-deferred revenue is particularly useful for retirees as return on capital taxes could not must be paid all through retirement.

Benefit #3: Diversification from different asset courses

Investing in MLPs offers added diversification in a balanced portfolio. Diversification might be measured by the correlation in return collection between asset courses.

MLPs are wonderful diversifiers, having both a close to zero or damaging correlation to company bonds, authorities bonds, and gold.

Moreover, they’ve a correlation coefficient of lower than 0.5 to each REITs and the S&P 500. This makes MLPs a superb addition to a diversified portfolio.

Benefit #4: Usually very excessive yields

MLPs are inclined to have excessive yields far in extra of the broader market. As of this writing, the S&P 500 yields ~2.1%, whereas the Alerian MLP ETF (AMLP) yields over 25%. Many particular person MLPs have yields above 10%.

Disadvantages of MLPs

Drawback #1: Sophisticated tax scenario

MLPs can create a headache come tax season. MLPs subject Okay-1’s and are usually extra time-consuming and complex to accurately calculate taxes than ‘regular’ shares.

Drawback #2: Potential extra paperwork if held in a retirement account

As well as, MLPs create further paperwork and problems when invested by a retirement account as a result of they doubtlessly create unrelated enterprise revenue (UBI). See the “Tax Penalties” part above for extra on this.

Drawback #3: Little diversification throughout the MLP asset class

Whereas MLPs present important diversification versus different asset courses, there may be little diversification throughout the MLP construction.

The overwhelming majority of publicly traded MLPs are oil and fuel pipeline companies. There are some exceptions, however usually MLP traders are investing in power pipelines and never a lot else.

Due to this, it will be unwise to allocate all or a majority of 1’s portfolio to this asset class.

Drawback #4: Incentive Distribution Rights (IDRs)

MLP traders are restricted companions within the partnership. The MLP type additionally has a common companion.

The overall companion is often the administration and possession group that controls the MLP, even when they personal a really small share of the particular MLP.

Incentive Distribution Rights, or IDRs, are used to ‘incentivize’ the final companion to develop the MLP.

IDRs usually allocate higher percentages of money flows to go to the final companion (and to not the restricted companions) because the MLP grows its money flows.

This reduces the MLPs skill to develop its distributions, placing a handicap on distribution will increase.

It ought to be famous that not all MLPs have IDRs, however the majority do.

Drawback #5: Elevated danger of distribution cuts as a consequence of excessive payout ratios

One of many large benefits of investing in MLPs is their excessive yields. Sadly, excessive yields fairly often include excessive payout ratios.

Most MLPs distribute practically all the money flows they make to unit holders. Normally, this can be a optimistic.

Nevertheless, it creates little or no room for error.

The pipeline enterprise is usually secure, but when money flows decline unexpectedly, there may be nearly no margin of security at many MLPs. Even a short-term disturbance in enterprise outcomes can necessitate a discount within the distribution.

Drawback #6: Development Via Debt & Share Issuances

Since MLPs usually distribute just about all of their money flows as distributions, there may be little or no cash left over to truly develop the partnership.

And most MLPs attempt to develop each the partnership, and distributions, over time. To do that, the MLP’s administration should faucet capital markets by both issuing new models or taking up extra debt.

When new models are issued, current unit holders are diluted; their share of possession within the MLP is diminished.

When new debt is issued, more money flows should be used to cowl curiosity funds as an alternative of going into the pockets of restricted companions by distributions.

If an MLPs administration workforce begins initiatives with decrease returns than the price of their debt or fairness capital, it destroys unit holder worth. This can be a actual danger to contemplate when investing in MLPs.

The 7 Finest MLPs Immediately

The 7 greatest MLPs are ranked and analyzed under utilizing anticipated complete returns from the Certain Evaluation Analysis Database. Anticipated complete returns consist of three components:

Return from change in valuation a number of

Return from distribution yield

Return from development on a per-unit foundation

The highest MLPs record was screened additional on a qualitative evaluation of an organization’s dividend danger.

Particularly, MLPs with a Dividend Danger rating of ‘F’ or ‘D’ based on the Certain Evaluation Analysis Database have been omitted from the record.

Moreover, MLPs with present distribution yields under 2% weren’t thought of. This display makes the record extra enticing to revenue traders.

Proceed studying for detailed evaluation on every of our prime MLPs, ranked based on anticipated 5-year annual returns, but additionally ranked additional by debt ranges and power of property.

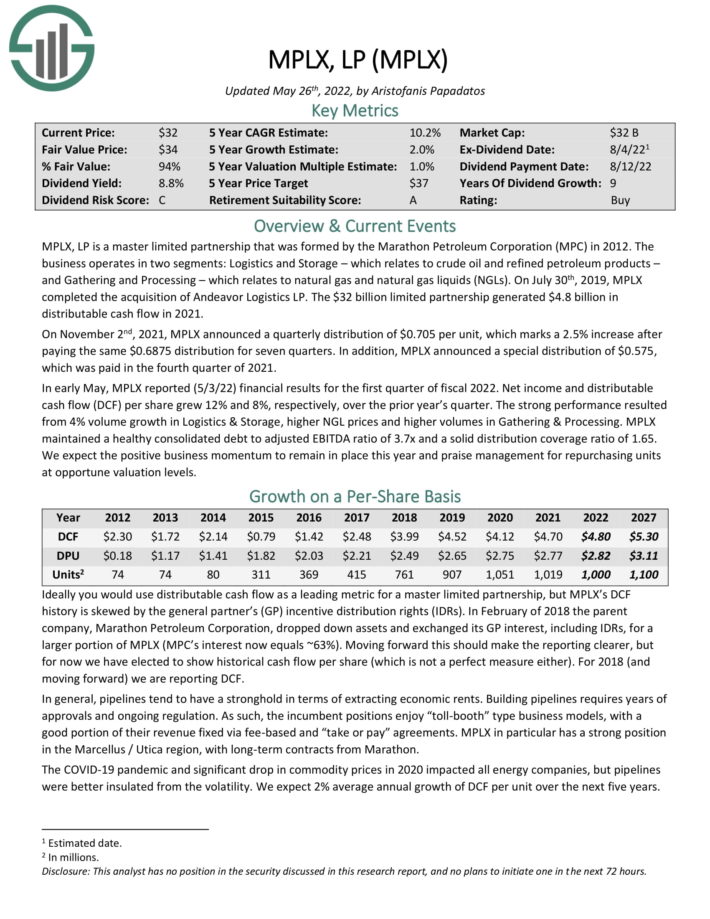

MLP #7: MPLX LP (MPLX)

5-year anticipated annual returns: 12.6%

MPLX, LP is a Grasp Restricted Partnership that was shaped by the Marathon Petroleum Company (MPC) in 2012.

The enterprise operates in two segments: Logistics and Storage – which pertains to crude oil and refined petroleum merchandise – and Gathering and Processing – which pertains to pure fuel and pure fuel liquids (NGLs). In 2019, MPLX acquired Andeavor Logistics LP.

You’ll be able to see highlights of the corporate’s first-quarter report within the picture under:

Supply: Investor Presentation

In early Might, MPLX reported (5/3/22) monetary outcomes for the primary quarter of fiscal 2022. Internet revenue and distributable money circulation (DCF) per share grew 12% and eight%, respectively, over the prior 12 months’s quarter. The sturdy efficiency resulted from 4% quantity development in Logistics & Storage, greater NGL costs and better volumes in Gathering & Processing.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.7x and a stable distribution protection ratio of 1.65.

We count on complete annual returns of 12.6% per 12 months for MPLX, pushed by the 9.5% distribution yield, anticipated annual DCF-per-unit development of two%, and a ~1.1% annual increase from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPLX (preview of web page 1 of three proven under):

MLP #6: Genesis Power LP (GEL)

5-year anticipated annual returns: 12.8%

Genesis Power is a diversified midstream power restricted partnership, which generates 48% of its working revenue from offshore pipeline transportation, 29% from sodium minerals and sulfur providers, 17% from onshore services and 6% from marine transportation.

In early Might, Genesis Power reported (5/4/22) monetary outcomes for the primary quarter of fiscal 2022. The offshore pipeline section suffered from elevated downtime however the soda enterprise continued to get better from the pandemic, with elevated demand leading to worth raises. In consequence, Genesis Power narrowed its loss per unit from -$0.28 in final 12 months’s quarter to -$0.04.

Furthermore, Genesis Power posted distributable money circulation of $55.7 million and thus it enhanced its distribution protection ratio from 2.8x within the earlier quarter to three.0x. The pandemic has begun to subside and thus we consider that the more serious is behind this MLP. Administration expects a continued restoration in volumes within the Gulf of Mexico and within the soda enterprise.

We count on 6% annual DCF-per-unit development, whereas the MLP additionally presents a 7.3% yield. Nevertheless, models seem considerably overvalued proper now. Complete returns are estimated at 12.8% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on GEL (preview of web page 1 of three proven under):

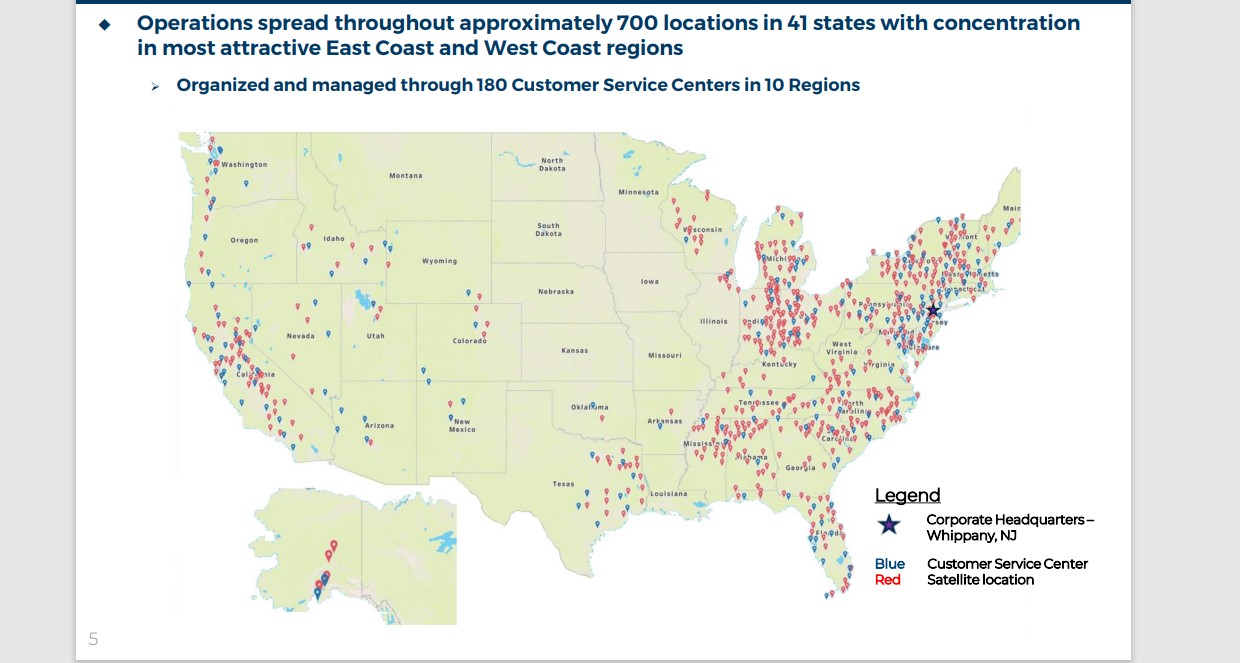

MLP #5: Suburban Propane Companions (SPH)

5-year anticipated annual returns: 13.8%

Suburban Propane has been in operation since 1928 and have become a Grasp Restricted Partnership in 1996. The partnership providers many of the U.S. with propane and different power sources, with propane making up round 90% of complete income. It ought to generate about $1.3 billion in income this 12 months.

The partnership has about 3,200 full-time workers in 41 states, serving roughly 1 million clients.

Supply: Investor Presentation

Suburban reported second quarter earnings on Might fifth, 2022, and outcomes have been higher than anticipated on each income and earnings. Earnings-per-share got here to $2.74, which was 70 cents higher than anticipated. That was up from $2.03 within the year-ago interval. Adjusted EBITDA, which is our most well-liked earnings measurement for Suburban, was up 0.3% to $173 million.

Income was up 9.5% to $588 million, which was attributable to a small decline in quantity greater than offset by a large improve in pricing. Retail propane gallons sod have been 159 million, down 5.8% year-over-year, primarily as a consequence of document heat temperatures in December.

As well as, Suburban cited unseasonably heat and inconsistent temperatures all through the quarter, in addition to buyer conservation as a consequence of excessive commodity costs. Temperatures have been 7% hotter than regular in the course of the quarter in Suburban’s service areas

We count on 13.8% annual returns for SPH, based mostly on ~1% annual DCF-per-unit development, the 8.3% distribution yield, and a ~4.5% annual increase from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPH (preview of web page 1 of three proven under):

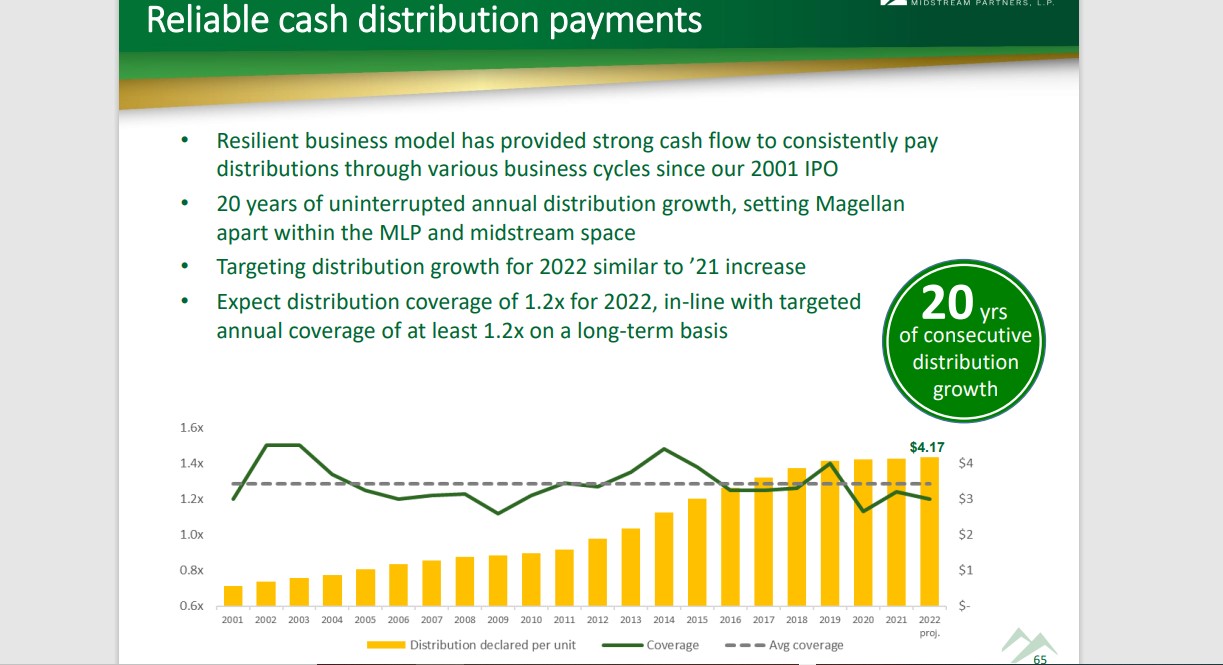

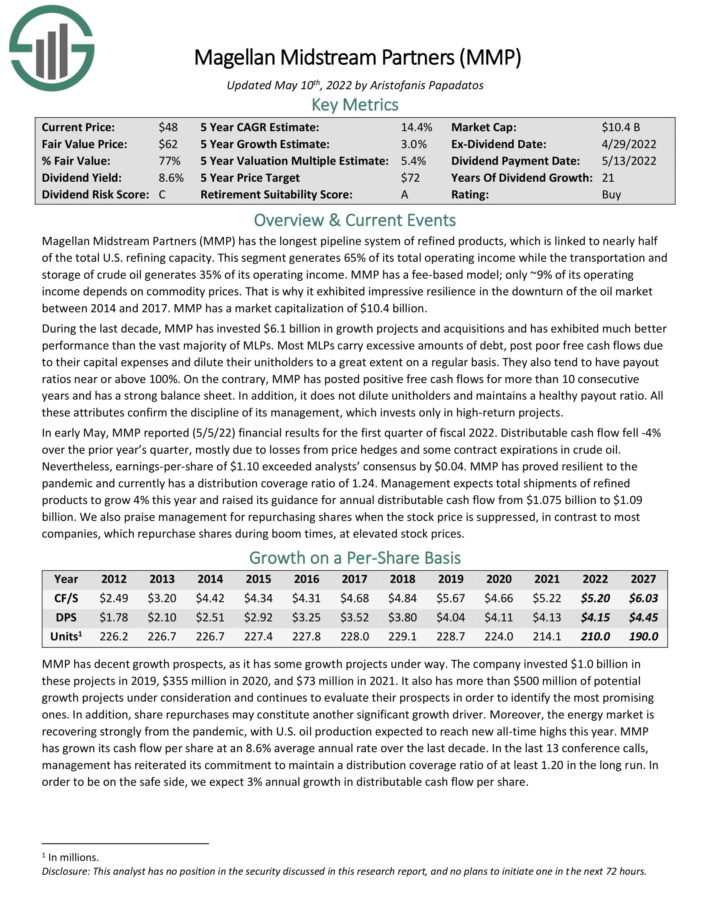

MLP #4: Magellan Midstream Companions LP (MMP)

5-year anticipated annual returns: 14.6%

Magellan has the longest pipeline system of refined merchandise, which is linked to just about half of the overall U.S. refining capability.

This section generates ~65% of its complete working revenue whereas the transportation and storage of crude oil generates ~35% of its working revenue. MMP has a fee-based mannequin; solely ~10% of its working revenue will depend on commodity costs.

MMP has a protracted historical past of regular distributions:

Supply: Investor Presentation

In early Might, MMP reported (5/5/22) monetary outcomes for the primary quarter of fiscal 2022. Distributable money circulation fell -4% over the prior 12 months’s quarter, largely as a consequence of losses from worth hedges and a few contract expirations in crude oil. Nonetheless, earnings-per-share of $1.10 exceeded analysts’ consensus by $0.04. MMP has proved resilient to the pandemic and presently has a distribution protection ratio of 1.24.

Administration expects complete shipments of refined merchandise to develop 4% this 12 months and raised its steering for annual distributable money circulation from $1.075 billion to $1.09 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on MMP (preview of web page 1 of three proven under):

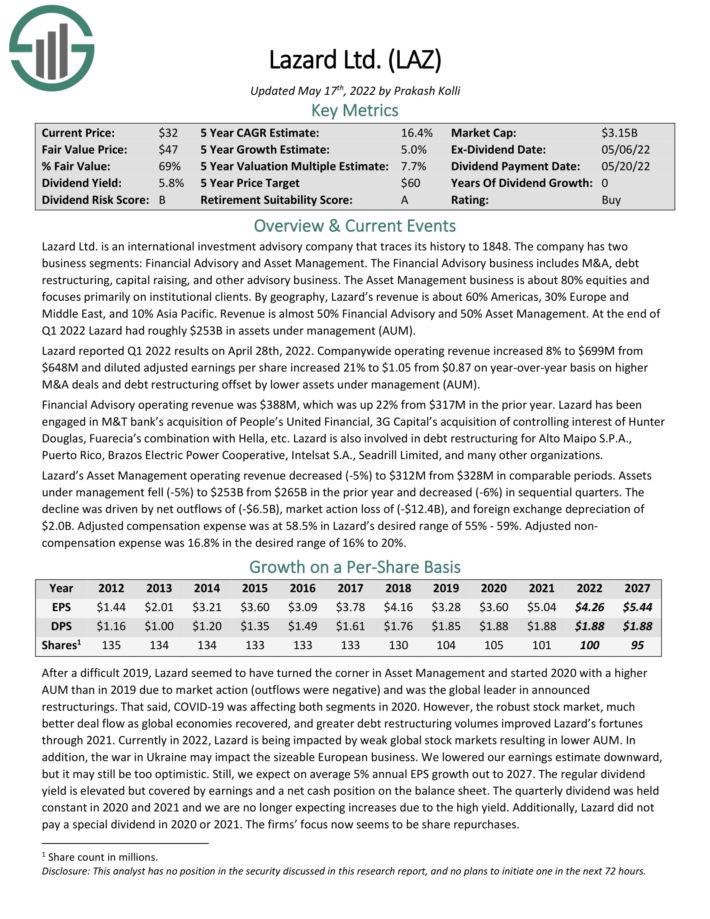

MLP #3: Lazard Ltd. (LAZ)

5-year anticipated annual returns: 14.9%

Lazard is likely one of the few MLPs that doesn’t function within the power sector. As a substitute, is a world funding advisory firm that traces its historical past to 1848.

The corporate has two enterprise segments which can be Financial Advisory and Asset Management. The Financial Advisory enterprise consists of M&A, debt restructuring, capital elevating, and different advisory enterprise. The Asset Administration enterprise is about 80% equities and focuses totally on institutional purchasers.

You’ll be able to see the highlights of the corporate’s first-quarter efficiency within the picture under:

Supply: Investor Presentation

Lazard’s aggressive benefit is derived from its fame for excellence and integrity, worldwide attain, range in asset administration, long-term relationships, and talent to advise on advanced transactions. The corporate is commonly the go to agency for advanced international M&A transactions and restructuring. The corporate’s fame additionally permits it to draw prime expertise, which is essential within the advisory enterprise. Notably its managing administrators have on common over 25 years of expertise.

Lazard’s prime and backside traces and thus inventory worth is delicate to the financial cycle and markets. Lazard is a comparatively small participant within the asset administration enterprise, which is present process consolidation. Scale is essential in asset administration for profitability. Earnings per share declined considerably over the past recession however quickly recovered.

We count on annual returns of 14.9% per 12 months for Lazard, as a consequence of a mixture of 5% EPS development, the 5.4% yield, and a ~4.5% increase from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Lazard (preview of web page 1 of three proven under):

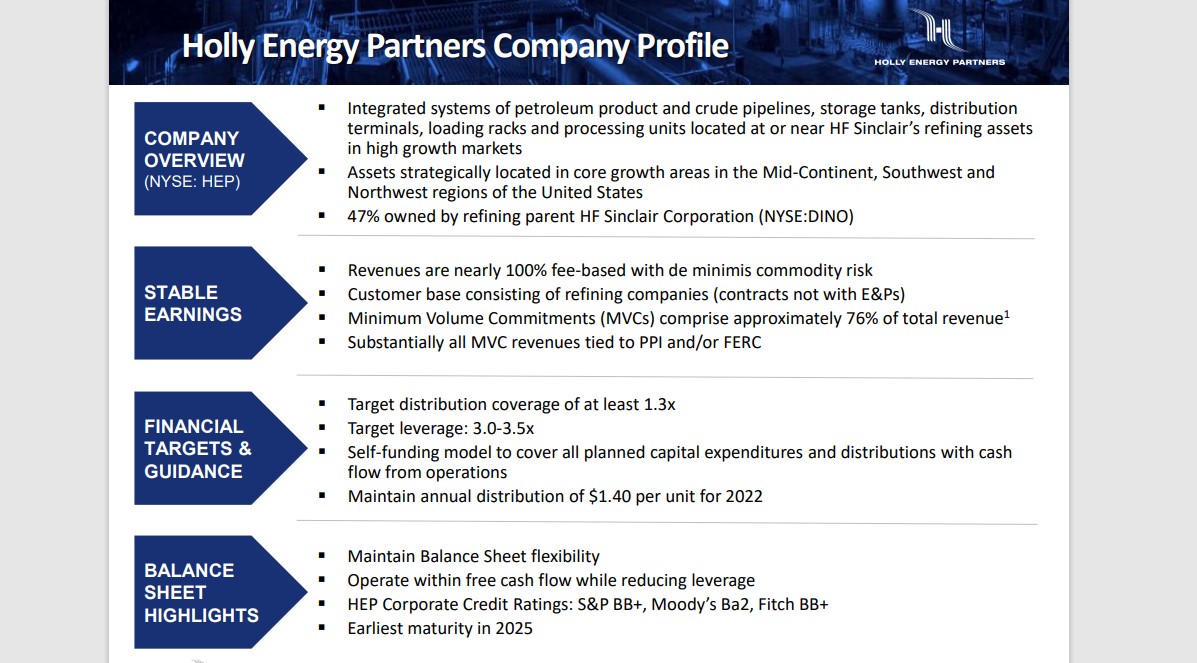

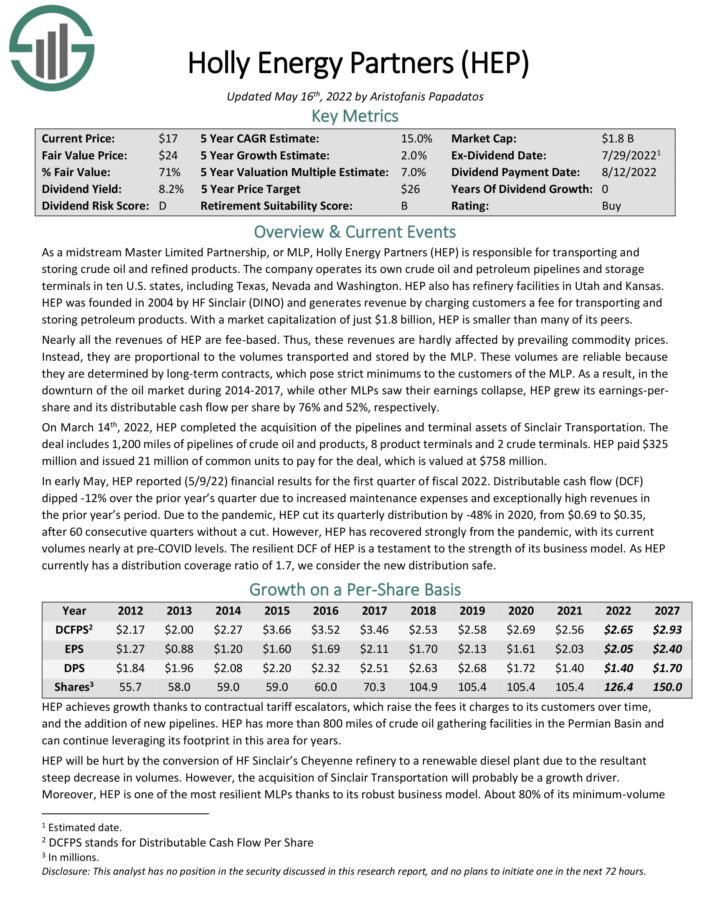

MLP #2: Holly Power Companions (HEP)

5-year anticipated annual returns: 15.7%

Holly Power Companions is liable for transporting and storing crude oil and refined merchandise. The corporate operates its personal crude oil and petroleum pipelines and storage terminals in ten U.S. states, together with Texas, Nevada and Washington. HEP additionally has refinery services in Utah and Kansas.

Almost all of the revenues of HEP are fee-based. Thus, these revenues are hardly affected by prevailing commodity costs. As a substitute, they’re proportional to the volumes transported and saved by the MLP. These volumes are dependable as a result of they’re decided by long-term contracts, which pose strict minimums to the shoppers of the MLP.

In consequence, within the downturn of the oil market throughout 2014-2017, whereas different MLPs noticed their earnings collapse, HEP grew its earnings-pershare and its distributable money circulation per share by 76% and 52%, respectively.

On March 14th, 2022, HEP accomplished the acquisition of the pipelines and terminal property of Sinclair Transportation. The deal consists of 1,200 miles of pipelines of crude oil and merchandise, 8 product terminals and a couple of crude terminals. HEP paid $325 million and issued 21 million of frequent models to pay for the deal, which is valued at $758 million.

Supply: Investor Presentation

In early Might, HEP reported (5/9/22) monetary outcomes for the primary quarter of fiscal 2022. Distributable money circulation dipped -12% over the prior 12 months’s quarter as a consequence of elevated upkeep bills and exceptionally excessive revenues within the prior 12 months’s interval.

As a result of pandemic, HEP reduce its quarterly distribution by -48% in 2020, from $0.69 to $0.35, after 60 consecutive quarters and not using a reduce.

Nevertheless, HEP has recovered strongly from the pandemic, with its present volumes practically at pre-COVID ranges. The resilient DCF of HEP is a testomony to the power of its enterprise mannequin. As HEP presently has a distribution protection ratio of 1.7, we take into account the brand new distribution secure.

Click on right here to obtain our most up-to-date Certain Evaluation report on HEP (preview of web page 1 of three proven under):

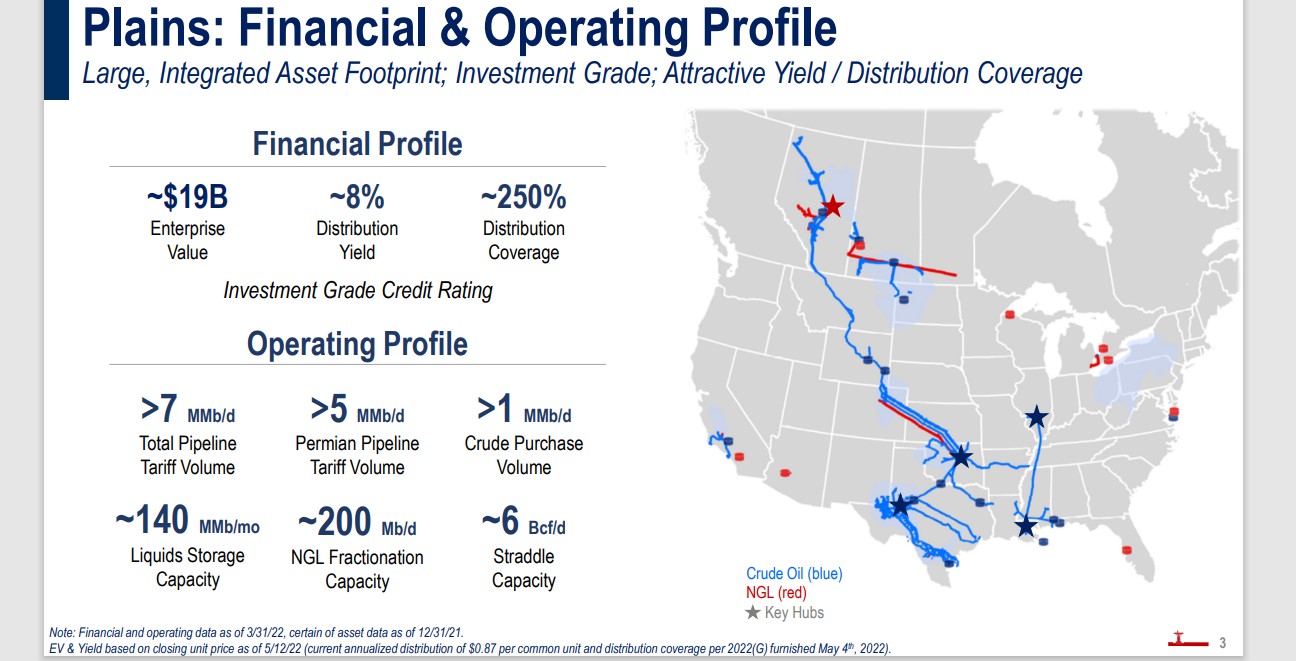

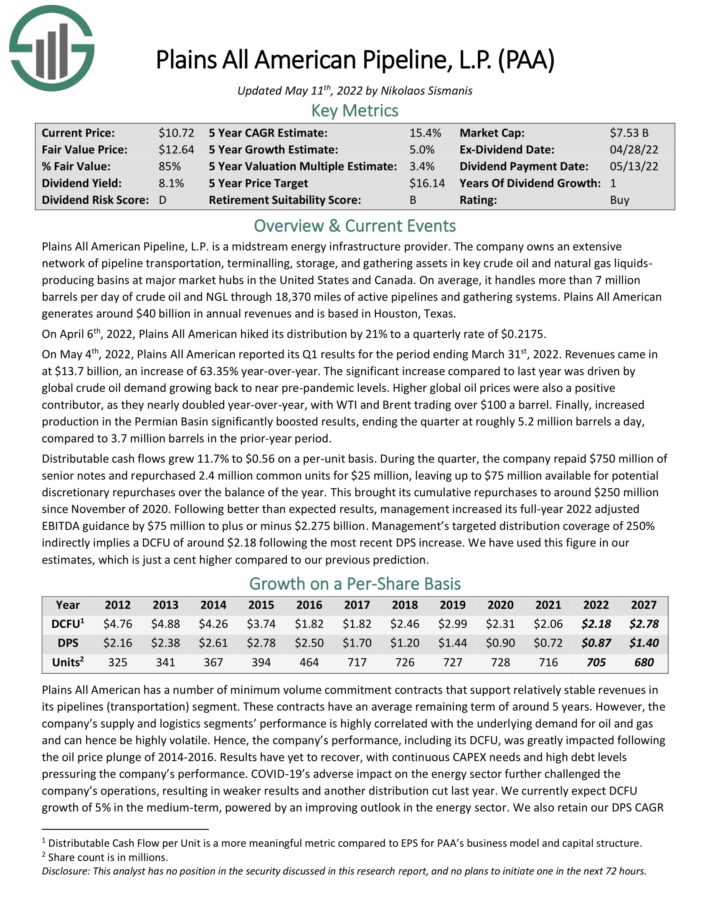

MLP #1: Plains All American Pipeline LP (PAA)

5-year anticipated annual returns: 17.1%

Plains All American Pipeline is a midstream power infrastructure supplier. The corporate owns an in depth community of pipeline transportation, terminals, storage, and gathering property in key crude oil and pure fuel liquids producing basins at main market hubs in america and Canada.

On common, it handles greater than 7 million barrels per day of crude oil and NGL by 18,370 miles of energetic pipelines and gathering programs. Plains All American generates round $40 billion in annual revenues and is predicated in Houston, Texas.

Supply: Investor Presentation

On April sixth, 2022, Plains All American hiked its distribution by 21% to a quarterly fee of $0.2175.

On Might 4th, 2022, Plains All American reported its Q1 outcomes. Revenues got here in at $13.7 billion, a rise of 63.35% year-over-year. The numerous improve in comparison with final 12 months was pushed by international crude oil demand rising again to close pre-pandemic ranges. Increased international oil costs have been additionally a optimistic contributor, as they practically doubled year-over-year, with WTI and Brent buying and selling over $100 a barrel.

Lastly, elevated manufacturing within the Permian Basin considerably boosted outcomes, ending the quarter at roughly 5.2 million barrels a day, in comparison with 3.7 million barrels within the prior-year interval. Distributable money flows grew 11.7% to $0.56 on a per-unit foundation.

Following higher than anticipated outcomes, administration elevated its full-year 2022 adjusted EBITDA steering by $75 million to plus or minus $2.275 billion. Administration’s focused distribution protection of 250% not directly implies a DCFU of round $2.18 following the newest DPS improve.

We count on 17.1% annual returns for PAA, pushed by the 8.4% yield, in addition to 5% annual DCF-per-unit development and a ~3.7% increase from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on PAA (preview of web page 1 of three proven under):

MLP ETFs, ETNs, & Mutual Funds

There are 3 main methods to put money into MLPs:

By investing in models of particular person publicly traded MLPs

By investing in a MLP ETF or mutual fund

By investing in a MLP ETN

Be aware: ETN stands for ‘trade traded be aware’

The distinction between investing instantly in an organization (regular inventory investing) versus investing in a mutual fund or ETF may be very clear. It’s merely investing in a single safety versus a bunch of securities.

ETNs are totally different. In contrast to mutual funds or ETFs, ETNs don’t really personal any underlying shares or models of actual companies. As a substitute, ETNs are monetary devices backed by the monetary establishment (usually a big financial institution) that issued them. They completely monitor the worth of an index. The drawback to ETNs is that they expose traders to the potential for a complete loss if the backing establishment have been to go bankrupt.

The benefit to investing in a MLP ETN is that distribution revenue is tracked, however paid through a 1099. This eliminates the tax disadvantages of MLPs (no Okay-1s, UBTI, and many others.). This distinctive function could attraction to traders who don’t need to trouble with a extra difficult tax scenario. The J.P. Morgan Alerian MLP ETN makes a sensible choice on this case.

Buying particular person securities is preferable for a lot of, because it permits traders to focus on their greatest concepts. However ETFs have their place as effectively, particularly for traders in search of diversification advantages.

Closing Ideas

Grasp Restricted Partnerships are a misunderstood asset class. They provide diversification, tax-advantaged and tax-deferred revenue, excessive yields, and have traditionally generated wonderful complete returns. You’ll be able to obtain your free copy of all MLPs by clicking on the hyperlink under:

The asset class is probably going under-appreciated due to its extra difficult tax standing.

MLPs are usually enticing for revenue traders, as a consequence of their excessive yields.

As at all times, traders must conduct their very own due diligence relating to the distinctive tax results and danger elements earlier than buying MLPs.

The MLPs on this record might be a superb place to seek out long-term shopping for alternatives among the many beaten-down MLPs. To see the highest-yielding MLPs, click on right here.

Moreover, MLPs usually are not the one approach to discover excessive ranges of revenue. The next lists include many extra shares that repeatedly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].