Spreadsheet information up to date every day

Up to date on October 14th, 2022 by Bob Ciura

Particular person merchandise, companies, and even whole industries (newspapers, typewriters, horse and buggy) exit of favor and develop into out of date.

Maybe greater than some other trade, agriculture is right here to remain. Agriculture began round 14,000 years in the past. It’s a protected guess we shall be practising agriculture far into the longer term.

And, the expansion of the worldwide inhabitants is tied to growing agricultural effectivity. The agricultural revolution allowed higher inhabitants progress (and led to the economic revolution).

As the worldwide inhabitants grows, so does the necessity for improved agricultural manufacturing. This creates a long-term demand driver for agriculture shares.

You possibly can obtain the whole record of all 43 agriculture shares (together with vital monetary metrics resembling price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the hyperlink beneath:

The agriculture shares record was derived from two main exchange-traded funds. These are the AgTech & Meals Innovation ETF (KROP) and the iShares World Agriculture Index ETF (COW).

Investing in farm and agriculture shares means investing in an trade that:

Has secure long-term demand

Has withstood the take a look at of time, and is extraordinarily prone to be round far into the longer term

Advantages from advancing expertise

This text analyzes 7 of the very best agriculture shares intimately. You possibly can shortly navigate the article utilizing the desk of contents beneath.

Desk of Contents

We now have ranked our 7 favourite agriculture shares beneath. The shares are ranked based on anticipated returns over the following 5 years, so as of lowest to highest.

Even higher, all 7 agriculture shares pay dividends to shareholders, making them engaging for earnings traders. traders ought to view this as a beginning off level to extra analysis.

Agriculture Inventory #7: Tractor Provide Firm (TSCO)

5-year anticipated annual returns: 8.9%

Tractor Provide Firm is a retail inventory that sells farm and ranch merchandise. Its clients embrace leisure farmers & ranchers, tradesmen and small companies. Its choices embrace clothes, pet provides, trailers and equipment, garden & backyard provides, heating methods, instruments, fencing, lawnmowers, and energy turbines.

Tractor Provide reported its second-quarter earnings outcomes on July twenty first, 2022. Internet gross sales elevated 8.4% to $3.90 billion from $3.60 billion within the year-ago interval. Comparable retailer gross sales progress elevated 5.5% as a consequence of comparable common ticket progress of seven.5% and comparable common transaction depend decline of two.0%.

Supply: Investor Presentation

Diluted earnings per share elevated 10.7% to $3.53 year-over-year. Internet earnings elevated 7.1% to $396.5 million year-over-year. Lastly, the corporate elevated its steerage for fiscal 2022 with web gross sales of $13.95 billion to $14.05 billion, comparable retailer gross sales progress of +5.2% to +5.8%, working margin fee of roughly 10.2%, web earnings of $1.065 billion to $1.085 billion, and earnings per diluted share of $9.48 to $9.60.

We anticipate annual returns of 8.9% per yr, consisting of 9.4% anticipated EPS progress, the 1.8% dividend yield, partially offset by a small adverse annual return from a declining P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on TSCO (preview of web page 1 of three proven beneath):

Agriculture Inventory #6: The Toro Firm (TTC)

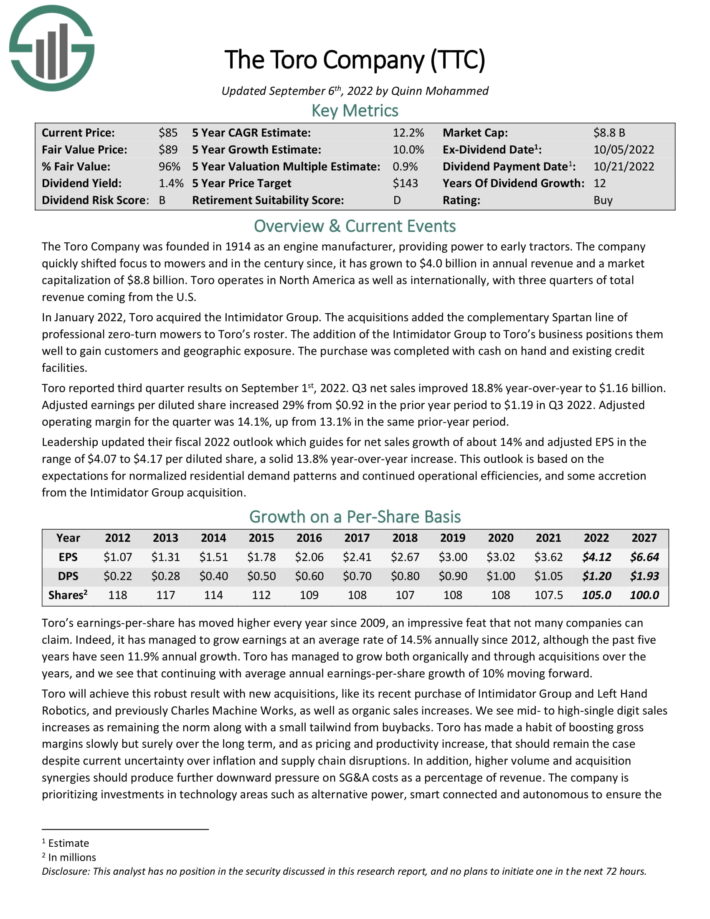

5-year anticipated annual returns: 9.7%

The Toro Firm was based in 1914 as an engine producer, offering energy to early tractors. The corporate shortly shifted focus to mowers and within the century since, it has grown to $3.4 billion in annual income. Toro operates in North America in addition to internationally, with three quarters of whole income coming from the USA.

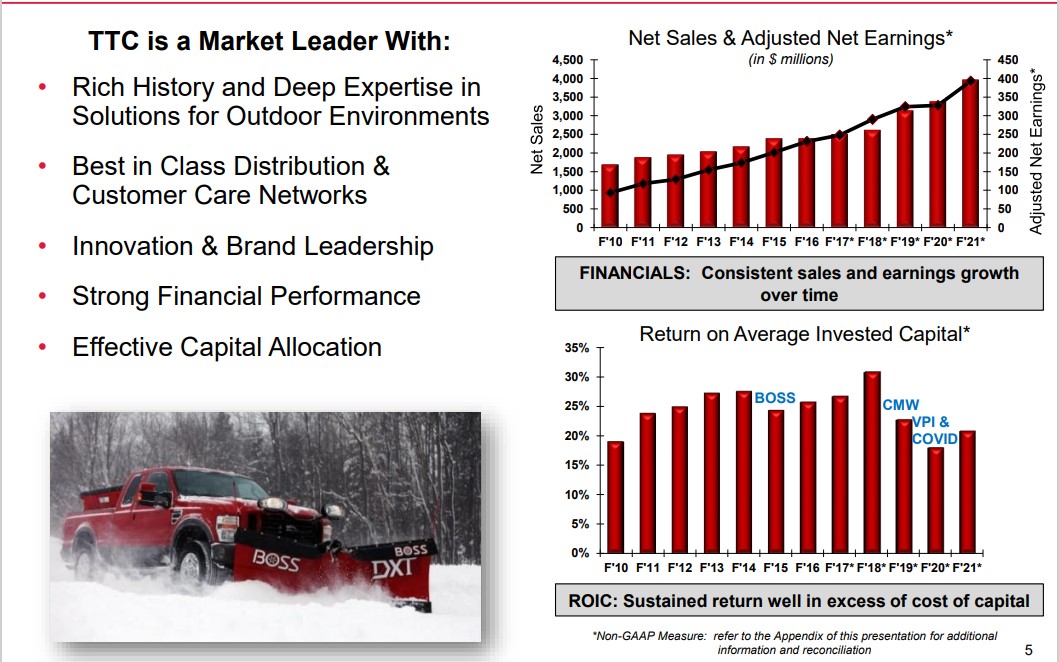

Supply: Investor Presentation

In January 2022, Toro acquired the Intimidator Group. The acquisitions added the complementary Spartan line {of professional} zero-turn mowers to Toro’s roster. The addition of the Intimidator Group to Toro’s enterprise positions them properly to achieve clients and geographic publicity. The acquisition was accomplished with money available and present credit score services.

Toro reported third quarter outcomes on September 1st, 2022. Q3 web gross sales improved 18.8% year-over-year to $1.16 billion. Adjusted earnings per diluted share elevated 29% from $0.92 within the prior yr interval to $1.19 in Q3 2022. Adjusted working margin for the quarter was 14.1%, up from 13.1% in the identical prior-year interval.

Management up to date their fiscal 2022 outlook which guides for web gross sales progress of about 14% and adjusted EPS within the vary of $4.07 to $4.17 per diluted share, a strong 13.8% year-over-year enhance. This outlook relies on the expectations for normalized residential demand patterns and continued operational efficiencies, and a few accretion from the Intimidator Group acquisition.

We anticipate annual returns of 9.7% per yr over the following 5 years, pushed by 10% EPS progress, the 1.2% dividend yield, and a small discount as a consequence of a declining P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on The Toro Firm (preview of web page 1 of three proven beneath):

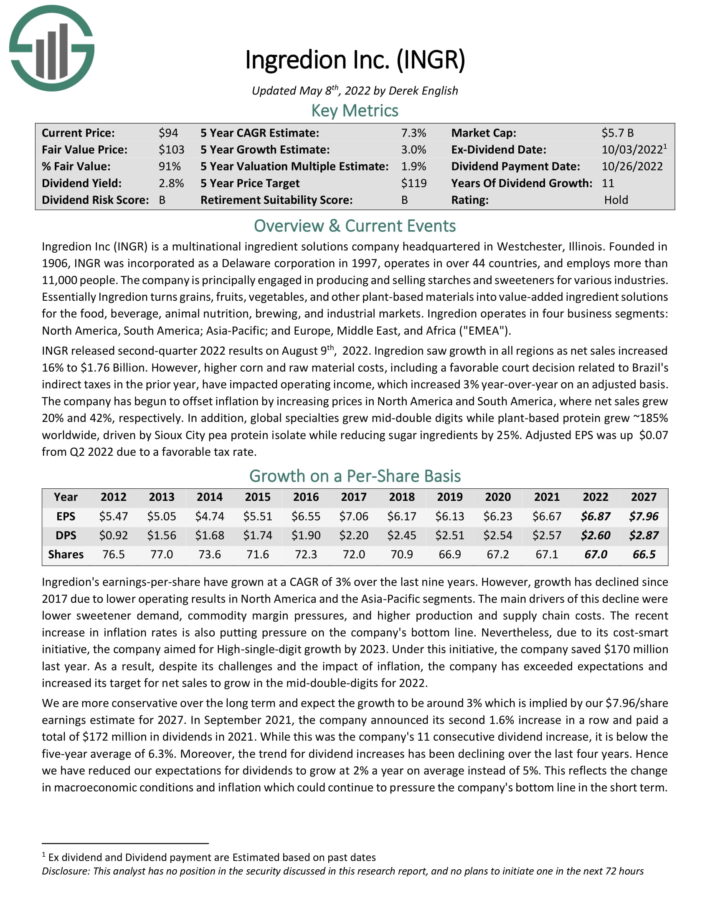

Agriculture Inventory #5: Ingredion Inc. (INGR)

5-year anticipated annual returns: 9.9%

Ingredion is a multinational ingredient options firm. It operates in over 44 nations, and employs greater than 11,000 folks. The corporate is principally engaged in producing and promoting starches and sweeteners for numerous industries.

Primarily, Ingredion turns grains, fruits, greens, and different plant-based supplies into value-added ingredient options for the meals, beverage, animal diet, brewing, and industrial markets. Ingredion operates in 4 enterprise segments: North America, South America; Asia-Pacific; and Europe, Center East, and Africa (“EMEA”).

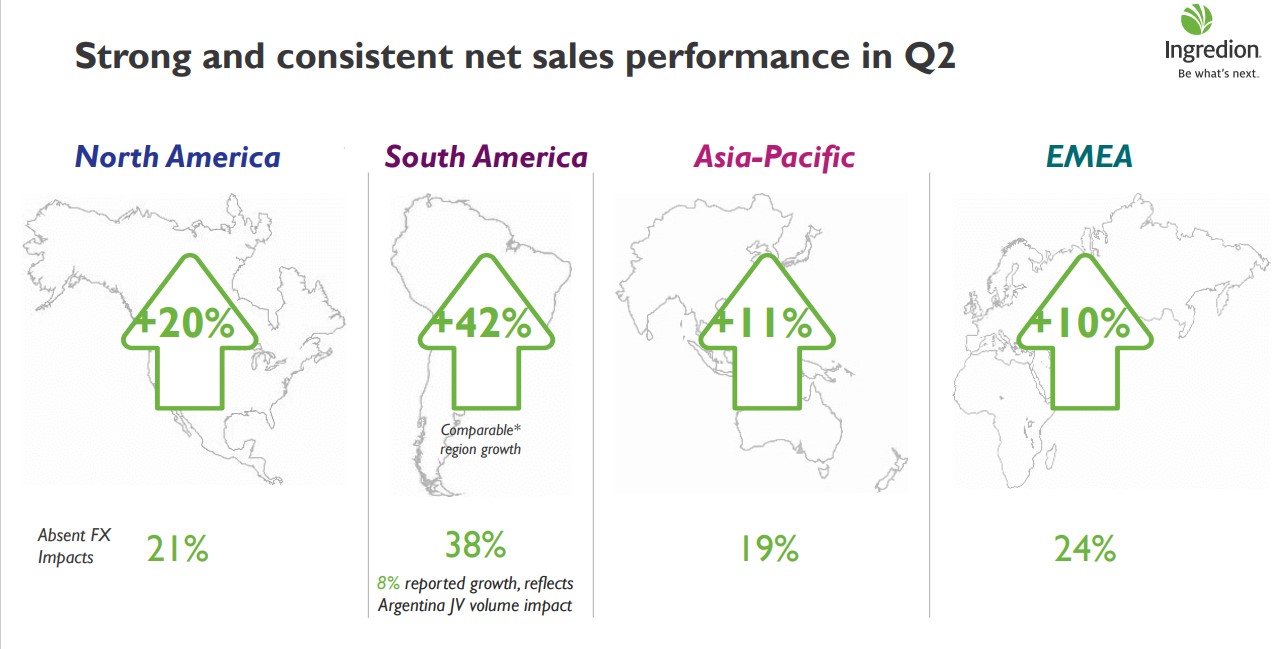

INGR launched second-quarter 2022 outcomes on August ninth, 2022. Ingredion noticed progress in all areas as web gross sales elevated 16% to $1.76 billion.

Supply: Investor Presentation

Nevertheless, larger corn and uncooked materials prices, together with a good courtroom determination associated to Brazil’s oblique taxes within the prior yr, have impacted working earnings, which elevated 3% year-over-year on an adjusted foundation.

The corporate has begun to offset inflation by growing costs in North America and South America, the place web gross sales grew 20% and 42%, respectively. As well as, world specialties grew mid-double digits whereas plant-based protein grew ~185% worldwide, pushed by Sioux Metropolis pea protein isolate whereas lowering sugar components by 25%. Adjusted EPS was up $0.07 from Q2 2022 as a consequence of a good tax fee.

We anticipate annual returns of 9.9% per yr, as a consequence of 3% anticipated EPS progress, the three.4% dividend yield, and a 3.5% annual return from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on INGR (preview of web page 1 of three proven beneath):

Agriculture Inventory #4: FMC Company (FMC)

5-year anticipated annual returns: 10.9%

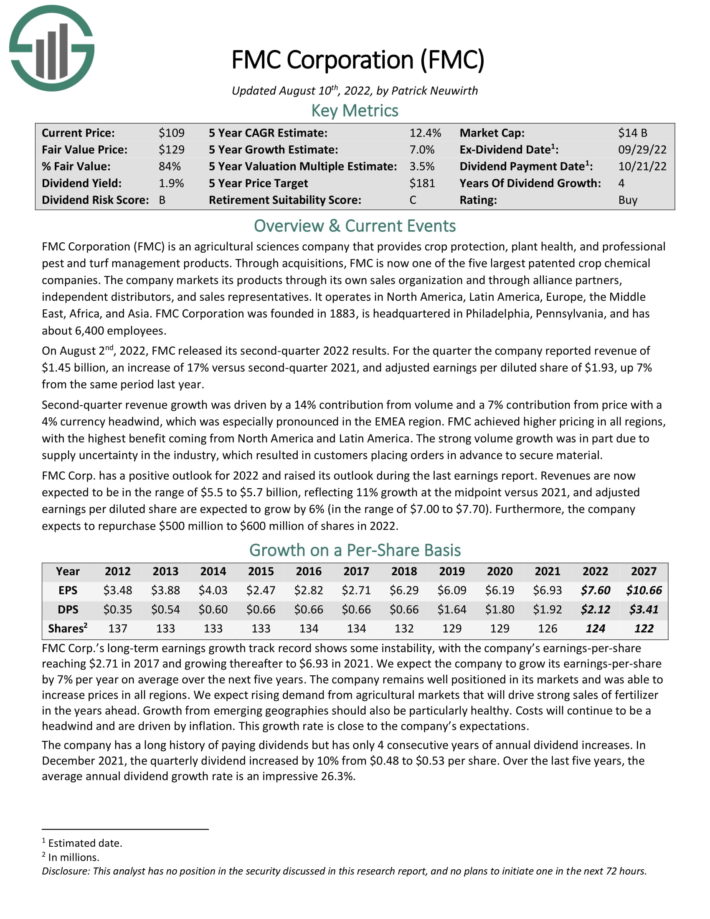

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. By means of acquisitions, FMC is now one of many 5 largest patented crop chemical firms.

The corporate markets its merchandise by way of its personal gross sales group and thru alliance companions, impartial distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

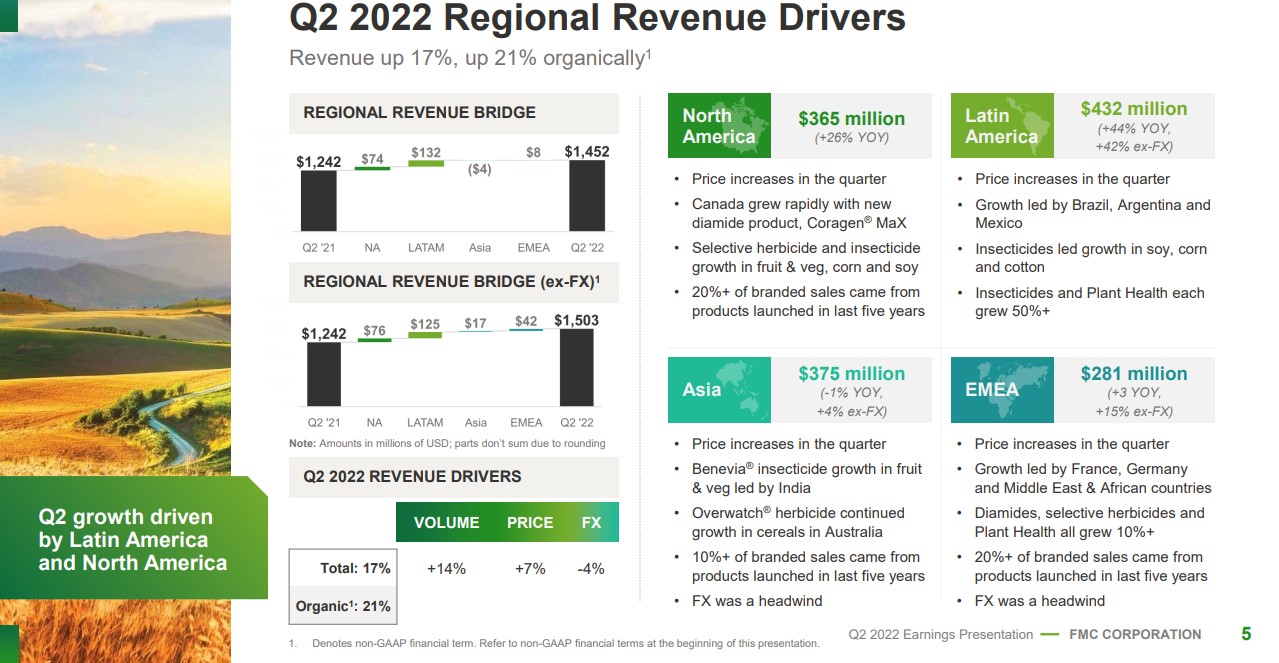

On August 2nd, 2022, FMC launched its second-quarter 2022 outcomes. For the quarter the corporate reported income of $1.45 billion, a rise of 17% versus second-quarter 2021, and adjusted earnings per diluted share of $1.93, up 7% from the identical interval final yr.

Supply: Investor Presentation

Second-quarter income progress was pushed by a 14% contribution from quantity and a 7% contribution from value with a 4% forex headwind, which was particularly pronounced within the EMEA area. FMC achieved larger pricing in all areas, with the best profit coming from North America and Latin America. The robust quantity progress was partly as a consequence of provide uncertainty within the trade, which resulted in clients putting orders prematurely to safe materials.

FMC Corp. has a constructive outlook for 2022 and raised its outlook over the past earnings report. Revenues at the moment are anticipated to be within the vary of $5.5 to $5.7 billion, reflecting 11% progress on the midpoint versus 2021, and adjusted earnings per diluted share are anticipated to develop by 6% (within the vary of $7.00 to $7.70). Moreover, the corporate expects to repurchase $500 million to $600 million of shares in 2022.

We anticipate annual returns of 10.9% per yr, pushed by 7% anticipated EPS progress and the 1.8% dividend yield, in addition to a ~2.1% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMC (preview of web page 1 of three proven beneath):

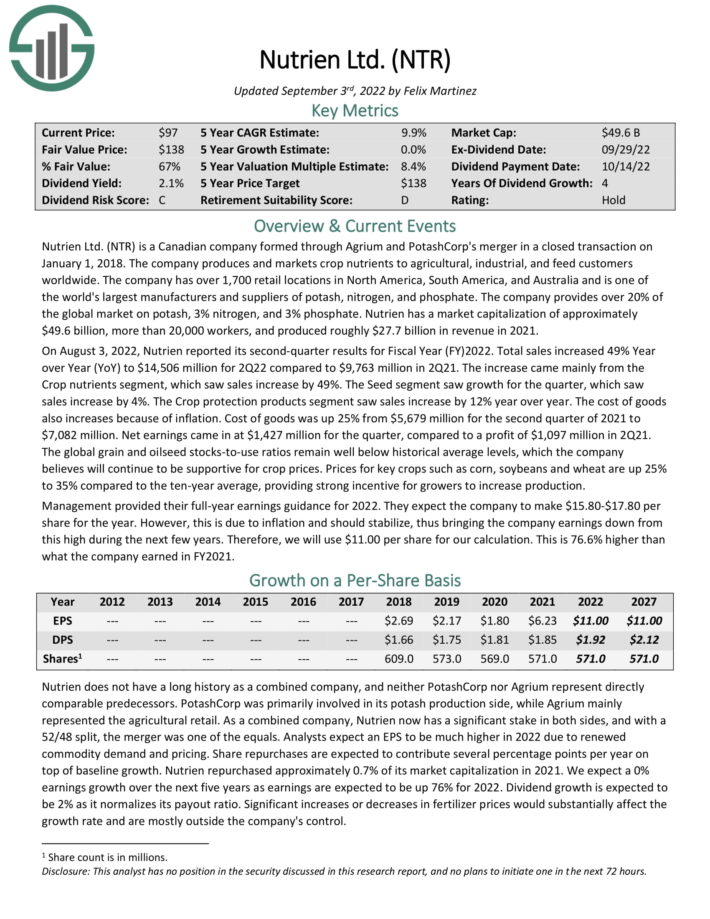

Agriculture Inventory #3: Nutrien Ltd. (NTR)

5-year anticipated annual returns: 11.3%

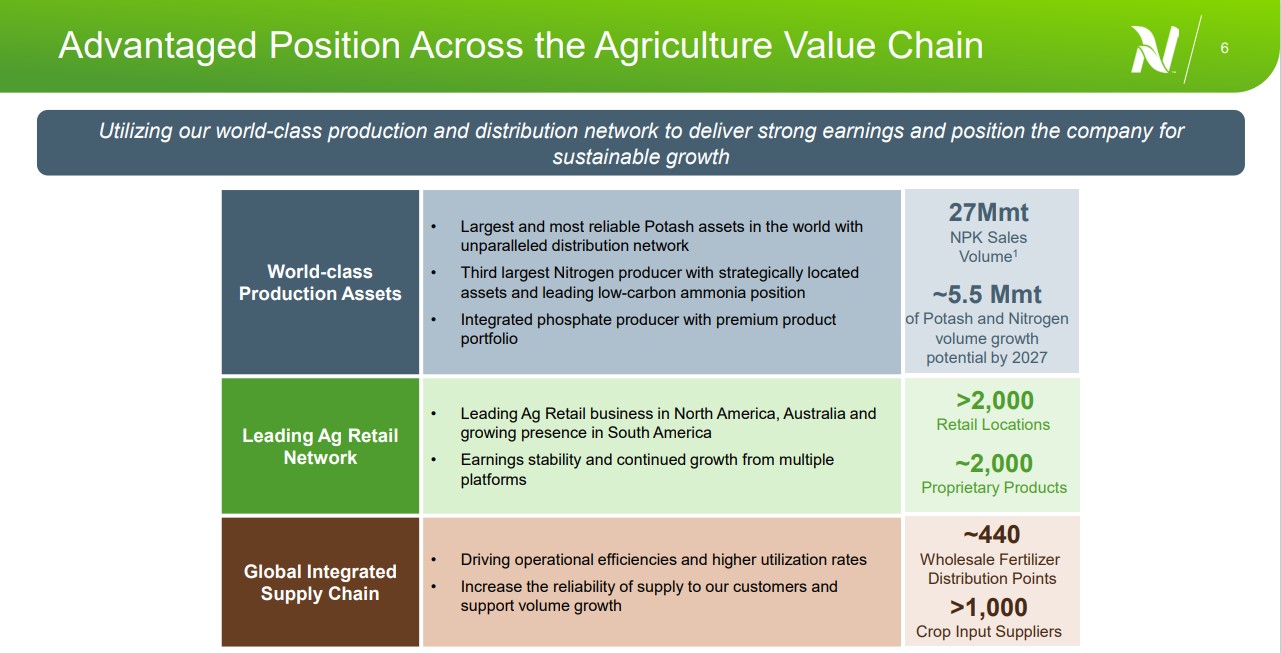

Nutrien Ltd. is a Canadian firm fashioned by way of Agrium and PotashCorp’s merger in a closed transaction on January 1, 2018. The corporate produces and markets crop vitamins to agricultural, industrial, and feed clients worldwide.

The corporate has over 1,700 retail areas in North America, South America, and Australia and is among the world’s largest producers and suppliers of potash, nitrogen, and phosphate.

Supply: Investor Presentation

The corporate supplies over 20% of the worldwide market on potash, 3% nitrogen, and three% phosphate. Nutrien produced roughly $27.7 billion in income in 2021.

On August 3, 2022, Nutrien reported its second-quarter outcomes for Fiscal Yr (FY)2022. Whole gross sales elevated 49% year-over-year. The rise got here primarily from the Crop vitamins phase, which noticed gross sales enhance by 49%. The Seed phase grew by 4%. The Crop safety merchandise phase noticed gross sales enhance by 12% yr over yr. Internet earnings got here in at $1,427 million for the quarter, in comparison with a revenue of $1,097 million in 2Q21.

The worldwide grain and oilseed stocks-to-use ratios stay properly beneath historic common ranges, which the corporate believes will proceed to be supportive for crop costs. Costs for key crops resembling corn, soybeans and wheat are up 25% to 35% in comparison with the ten-year common, offering robust incentive for growers to extend manufacturing. Administration expects the corporate to make $15.80-$17.80 per share for the yr.

Whole returns are estimated at 11.3% per yr. Whereas we anticipate no EPS progress, the two.2% dividend yield and ~9.1% annual returns from an increasing P/E a number of will gasoline future returns.

Click on right here to obtain our most up-to-date Positive Evaluation report on NTR (preview of web page 1 of three proven beneath):

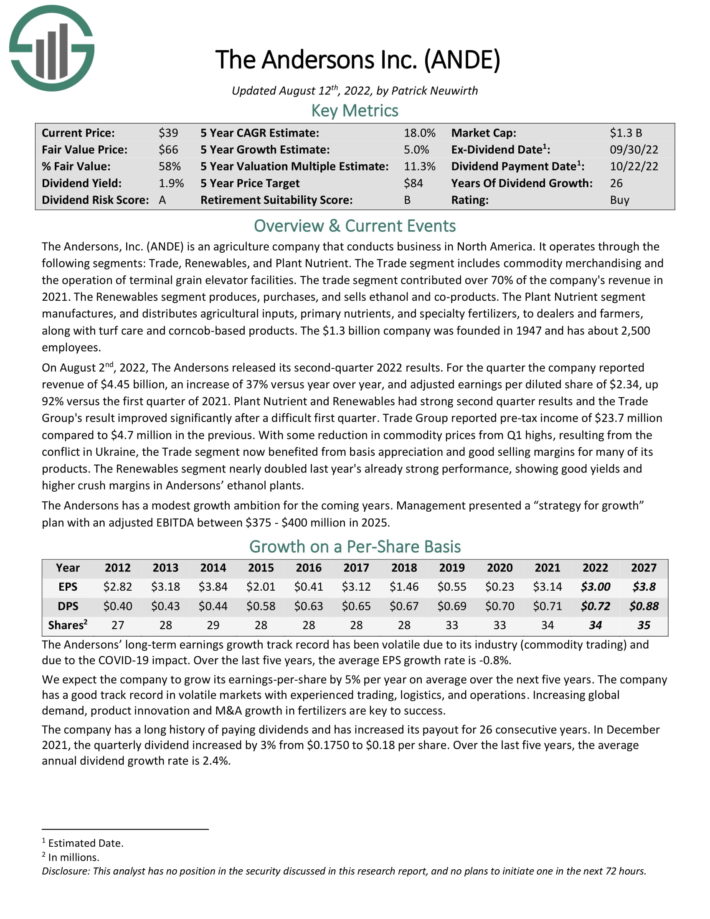

Agriculture Inventory #2: The Andersons Inc. (ANDE)

5-year anticipated annual returns: 20.6%

The Andersons, Inc. operates by way of the next segments: Commerce, Renewables, and Plant Nutrient. The Commerce phase consists of commodity merchandising and the operation of terminal grain elevator services. The commerce phase contributed over 70% of the corporate’s income in 2021.

On August 2nd, 2022, The Andersons launched its second-quarter 2022 outcomes. For the quarter the corporate reported income of $4.45 billion, a rise of 37% versus yr over yr, and adjusted earnings per diluted share of $2.34, up 92% versus the primary quarter of 2021. Plant Nutrient and Renewables had robust second quarter outcomes and the Commerce Group’s outcome improved considerably after a troublesome first quarter. Commerce Group reported pre-tax earnings of $23.7 million in comparison with $4.7 million within the earlier.

With some discount in commodity costs from Q1 highs, ensuing from the battle in Ukraine, the Commerce phase now benefited from foundation appreciation and good promoting margins for a lot of of its merchandise. The Renewables phase almost doubled final yr’s already robust efficiency, exhibiting good yields and better crush margins in Andersons’ ethanol vegetation.

The Andersons has a modest progress ambition for the approaching years. Administration offered a “technique for progress” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The corporate has a protracted historical past of paying dividends and has elevated its payout for 26 consecutive years. Shares at present yield 2.1%. We anticipate 5% annual EPS progress, whereas the inventory additionally seems to be considerably undervalued. Whole returns are estimated at 20.6% per yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on ANDE (preview of web page 1 of three proven beneath):

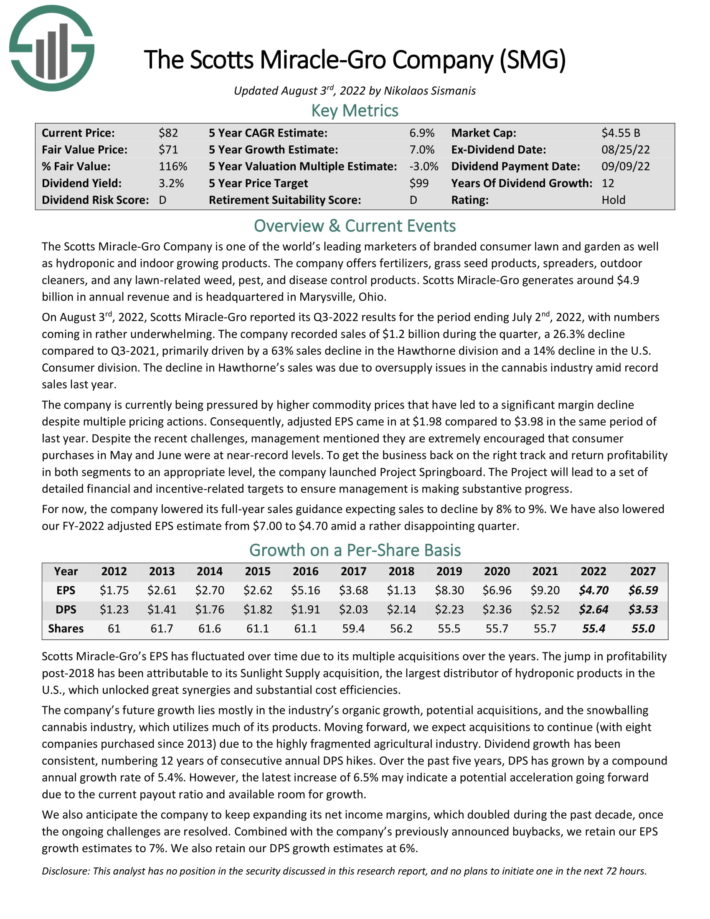

Agriculture Inventory #1: Scotts Miracle-Gro (SMG)

5-year anticipated annual returns: 22.2%

The Scotts Miracle-Gro Firm is among the world’s main entrepreneurs of branded shopper garden and backyard in addition to hydroponic and indoor rising merchandise. The corporate gives fertilizers, grass seed merchandise, spreaders, out of doors cleaners, and any lawn-related weed, pest, and illness management merchandise.

Supply: Investor Presentation

On August third, 2022, Scotts Miracle-Gro reported its Q3-2022 outcomes for the interval ending July 2nd, 2022, with numbers coming in fairly underwhelming. The corporate recorded gross sales of $1.2 billion throughout the quarter, a 26.3% decline in comparison with Q3-2021, primarily pushed by a 63% gross sales decline within the Hawthorne division and a 14% decline within the U.S. Client division.

The decline in Hawthorne’s gross sales was as a consequence of oversupply points within the hashish trade amid document gross sales final yr. The corporate is at present being pressured by larger commodity costs which have led to a major margin decline regardless of a number of pricing actions. Consequently, adjusted EPS got here in at $1.98 in comparison with $3.98 in the identical interval of final yr.

Regardless of the latest challenges, administration talked about they’re extraordinarily inspired that shopper purchases in Could and June had been at near-record ranges. To get the enterprise again heading in the right direction and return profitability in each segments to an acceptable degree, the corporate launched Mission Springboard.

The Mission will result in a set of detailed monetary and incentive-related targets to make sure administration is making substantive progress. The corporate lowered its full-year gross sales steerage anticipating gross sales to say no by 8% to 9%.

We anticipate annual returns of twenty-two.2% per yr, pushed by anticipated EPS progress of seven%, the 6.2% dividend yield and a ~9% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on Scotts Miracle-Gro (preview of web page 1 of three proven beneath):

Closing Ideas

Agriculture shares are a compelling place to search for long-term inventory investments. That’s as a result of the demand drivers of the trade make it extraordinarily prone to be round far into the longer term.

We consider the 7 agriculture shares examined on this article are the very best throughout the trade.

Of those, FMC, Scotts Miracle-Gro, and The Andersons stand above the remainder from a high quality perspective due to their robust enterprise fashions, engaging dividend yields, and long-term dividend progress potential.

At Positive Dividend, we regularly advocate for investing in firms with a excessive chance of accelerating their dividends each yr.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].