On this article

As I start gathering my ideas about what would possibly occur subsequent yr, I wish to look again at my predictions for the earlier yr to see how I did. It’s helpful to take a look at what I received proper and be taught from what I received mistaken to develop into a greater investor.

I’m not knowledgeable forecaster and don’t keep my very own financial fashions. However as an analyst and an investor, I do research tons of information to type a thesis about what’s prone to occur within the coming months and years. The purpose is to not get all of it proper—that’s unimaginable. Information is backward-looking, and we will by no means say for sure what’s going to come subsequent. The purpose is to grasp the almost definitely situations and to type a thesis in regards to the economic system that allows assured decision-making.

I create plenty of content material and replace my thesis frequently when new information emerges, so I don’t have one concrete “prediction” from final yr, however let’s take a look at among the themes that made up my 2022 thesis.

A Story of Two Halves

In January 2022, I wrote, “I don’t suppose the dynamics of the housing market will change an excessive amount of within the coming months. Demand continues to be sturdy, provide continues to be extremely low, and costs will seemingly hold going up…Finally, what occurs within the second half of 2022 is extra of a query mark for me. My estimate proper now’s that cooling will drop year-over-year appreciation to 2% to 7% appreciation charges by year-end.”

A significant a part of my thesis final yr was my sturdy perception that 2022 can be “a story of two halves” for the nationwide housing market. We knew the Fed wasn’t going to start out elevating charges till March, and I felt that given the seasonality of the housing market, worth appreciation would peak in Q2, after which the second half of 2022 would see cooling.

Total, I believe I nailed the timing of the market shift. It regarded like dwelling costs in lots of markets peaked in June (whereas others are nonetheless rising), and at the moment are seeing month-over-month declines (which is completely different from year-over-year, which is how I made my prediction). The shift occurred proper on the midway level! The newest weekly information from Redfin exhibits year-over-year appreciation at round 6%, which is correct in vary, however we’ll simply should see if I used to be proper about 2-7% by the tip.

The Fed Playbook

In November of 2021, I wrote, “If charges rise shortly, it may trigger a shock to the system, and housing costs may slide backwards. However, the Fed isn’t seemingly to try this. They are going to seemingly attempt to increase charges as slowly as doable to permit financial growth and wage progress to counteract the impacts of rising charges. That is what occurred post-Nice Recession, which was one of many strongest durations of property worth progress in American historical past—regardless of rising charges. That mentioned, if inflation stays excessive for too lengthy, and even begins to speed up, the Fed may very well be compelled to lift rates of interest quicker than they need to, which may harm housing costs.“

I believe I received the logic right here proper, however with a caveat (extra about that beneath). I consider the Fed’s intention across the finish of 2021 was to comply with their outdated playbook from post-Nice Recession and lift charges slowly. I believed that as a result of they mentioned that’s what they’d do!

This wasn’t precisely a scorching take. However, I did acknowledge the very actual likelihood the Fed may very well be mistaken about inflation, and so they may very well be compelled to interrupt from its post-Nice Recession playbook and lift charges quickly. And as all of us now know, that’s precisely what occurred.

Mortgage Charges

Though I acknowledged the Fed is likely to be compelled to lift charges shortly, I’ll be trustworthy, I didn’t suppose rates of interest would rise as shortly as they did, as a lot as they did. I assumed supply-side enhancements would assist average inflation someday in Q1 or Q2 of 2022 (although elevated financial provide and powerful demand would hold inflation comparatively excessive), after which the almost definitely course for the Fed was to comply with their 2009 playbook and lift charges steadily.

However that’s not what occurred. As a substitute, lockdowns throughout the globe endured, and the Russian invasion of Ukraine brought on much more supply-side points. These occasions, coupled with the elevated financial provide and powerful demand, despatched the CPI larger than I believed it could go. It stays stubbornly excessive at present, and mortgage charges are hovering round 6.25% as of this writing.

About these mortgage charges, that’s the place issues went off the rails for me. On November 21, 2021, I posted this on Instagram (I’m @thedatadeli in the event you don’t comply with me):

Wow. It burns my eyes simply that. Once I can’t go to sleep at evening, it’s this submit that haunts me.

To be honest to myself, this was posted earlier than the Fed introduced three fee hikes in 2022, and we had been flying blind, however I figured I’d offer you all a very good chuckle at my expense. And, at the least I used to be very barely much less mistaken than Realtor.com, CoreLogic, and Redfin.

However to be trustworthy, even as soon as the Fed introduced three fee hikes in 2022, I nonetheless didn’t suppose we’d have charges as excessive as we do at present. I figured we’d nonetheless finish 2022 someplace round 5%. On condition that charges are round 6.25% as of this writing, I believe it’s secure to say I missed badly on this one. I knew charges had been going as much as a extra ‘regular’ stage, however I simply didn’t suppose the Fed can be as aggressive as they’ve been. I anticipated inflation to come back down sooner, not due to Fed motion, however as a result of the provision chain would open up. That didn’t occur, and the Fed goes full throttle on fee hikes with restricted success in containing inflation up to now.

Given this, I see extra draw back danger within the nationwide housing market than I did in the beginning of 2022. The decline in affordability accompanying this speedy rise in charges will weaken demand and put downward stress on costs. It’s onerous to say what’s going to occur from right here, however I nonetheless consider {that a} “crash” (20% decline or extra) isn’t the almost definitely situation on a nationwide stage, however some markets may see crash-level declines.

The Stock X Issue

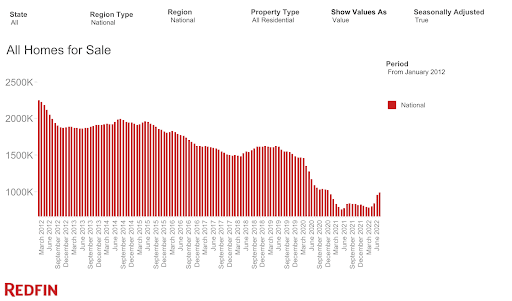

Once we entered 2022, stock (the variety of properties in the marketplace at any given time) was traditionally low. When stock is tremendous low, it alerts a vendor’s market that’s prone to see worth appreciation. And certain sufficient, that’s what we noticed within the first half of 2022.

I knew that as charges rose, affordability and demand would fall, usually sending stock upward. However stock isn’t just about demand. It’s additionally about what number of properties are listed on the market. There’s plenty of vendor psychology to account for. Most individuals don’t need to promote their properties for a loss, so in a correcting market, many sellers decide to attend out the correction. I wrote about this concept in Might if you wish to perceive extra.

I truthfully wasn’t certain what would occur within the second half of 2022, which is why I thought of it the X issue that might finally decide if the nationwide housing market remained barely optimistic or skewed unfavourable by the tip of the yr. I landed on the facet of “slight modest YoY appreciation” as a result of I used to be skeptical we’d see stock hit pre-pandemic ranges, which seems to be right. Whether or not my worth prediction is right stays to be seen.

However the simplicity of this national-level chart betrays what’s actually happening out there—the housing market is splitting. Completely different metros are seeing very completely different stock dynamics.

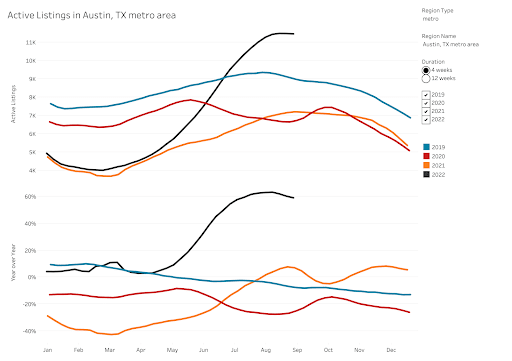

Simply take a look at the distinction in Lively Listings between Austin and Boston.

In Austin, Lively Listings are up 60% YoY, which signifies a speedy shift from a vendor’s market to a purchaser’s market. Fairly simple to see costs coming down in Austin.

Then again, we’ve Boston, the place energetic listings have been declining! Nonetheless a vendor’s market right here. Costs may nonetheless average, however on a a lot smaller scale than in Austin.

So stock actually is changing into a significant X issue! We’ll nonetheless should see this all play out, nevertheless it’s positively the primary factor I’m watching lately.

Conclusion

Given the complexity of the financial local weather in 2022, I believe my thesis has held up fairly nicely up to now. In fact, I want I wasn’t up to now off on mortgage charges, however as I mentioned above, the purpose of creating an investing thesis is to not be proper about every part. It’s about formulating an informed understanding of the market that helps you make knowledgeable investing choices. In that respect, I’m happy with my 2022 thesis as a result of my general understanding of the market was good and allowed me to make stable investing choices.

I locked in low-rate financing on long-term fixed-rate loans, dove extra into giant multifamily investments to reap the benefits of long-term provide constraints, and underwrote offers with little to no market appreciation within the subsequent few years, simply to be conservative.

As we strategy one other yr of unsure financial situations, I encourage you all to start out excited about your investing thesis for 2023. Take the time now to take inventory of the financial local weather and the shifting market dynamics. Take into consideration what would possibly occur in your market within the coming yr and how one can make sturdy investing selections given the realities on the bottom. What’s going to excessive charges do to stock in your space? What asset lessons will provide good returns? How do you shield your self from a possible rise in unemployment charges?

You shouldn’t be scared of those situations simply as long as you’re ready for them. There are at all times offers available. You simply have to regulate your thesis to suit the market. To be taught extra about analyzing offers, be sure you try my new ebook Actual Property by the Numbers right here!

Run Your Numbers Like a Professional!

Deal evaluation is among the first and most crucial steps of actual property investing. Maximize your confidence in every take care of this first-ever final information to deal evaluation. Actual Property by the Numbers makes actual property math simple, and makes actual property success inevitable.

I’ll share my 2023 thesis with you all quickly.

Within the meantime, I’d love for you all to affix me on this train within the feedback. What did you get proper about 2022? What did you get mistaken? Let’s all share and be taught collectively.

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.