Printed on February eleventh, 2025 by Bob Ciura

All different issues being equal, the upper the dividend yield, the higher.

It’s true – in isolation, there’s no such factor as “too excessive” of a dividend yield. The larger the dividend yield, the more cash you might be paid to your funding. Getting the next yield in your funding {dollars} is an effective factor.

With this in thoughts, we compiled an inventory of excessive dividend shares with dividend yields above 5%. You possibly can obtain your free copy of the excessive dividend shares listing by clicking on the hyperlink beneath:

The issue is, nonetheless, that “all different issues being equal” by no means appears to pan out in actual life.

In the true world, a really excessive dividend yield generally is a signal of misery; a crimson flag that requires additional investigation. With this in thoughts, revenue buyers ought to attempt to keep away from dividend cuts or elimination as a lot as attainable.

The next listing represents the ten riskiest excessive dividend shares within the Positive Evaluation Analysis Database.

The ten dividend shares beneath have dangerously excessive yields above 10%, and lack the basic energy to help their payouts over the long term.

The shares all have Dividend Threat Scores of ‘D’ or ‘F’ (our lowest grades) within the Positive Evaluation Analysis Database, with payout ratios above 70%, and both maintain or promote scores from Positive Dividend.

The listing is sorted by present yield, from lowest to highest.

Desk of Contents

You possibly can immediately bounce to any particular part of the article by utilizing the hyperlinks beneath:

Overly Dangerous Excessive Dividend Inventory #10: PennantPark Floating Fee Capital (PFLT)

PennantPark Floating Fee Capital Ltd. is a enterprise growth firm that seeks to make secondary direct, debt, fairness, and mortgage investments.

The fund additionally goals to take a position via floating charge loans in non-public or thinly traded or small market-cap, public center market firms, fairness securities, most well-liked inventory, frequent inventory, warrants or choices obtained in reference to debt investments or via direct investments.

On November 26, 2024, PennantPark Floating Fee Capital reported robust outcomes for the fourth fiscal quarter of 2024, with core internet funding revenue of $0.32 per share. The portfolio grew 20% quarter-over-quarter, reaching $2 billion because the agency deployed $446 million throughout 10 new and 50 present firms.

Investments carried a median yield of 11%, reflecting the continued energy of the center market lending surroundings. After the quarter, PFLT remained lively, investing a further $330 million at a yield of 10.2%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven beneath):

Overly Dangerous Excessive Dividend Inventory #9: Xerox Company (XRX)

Xerox Company traces its lineage again to 1906 when The Haloid Photographic Firm started manufacturing photographic paper and tools. Via a sequence of mergers and spinoffs, the Xerox we all know at this time was shaped.

Xerox spun off its enterprise processing unit in 2017 (now known as Conduent) and now focuses on design, growth, and gross sales of doc administration techniques.

Xerox reported third quarter earnings on October twenty ninth, 2024, and outcomes had been terrible, sending the inventory spiraling decrease. Income fell 7.3% year-on-year to $1.53 billion, lacking estimates by $100 million. Adjusted earnings-per-share got here to 25 cents, lacking estimates by greater than 50%, which had been set at 51 cents.

Unadjusted earnings included a non-cash after-tax goodwill impairment cost of $1 billion, or $8.16 per share, in addition to an additional $161 million, or $1.29 per share, that was associated to the institution of a valuation allowance.

Click on right here to obtain our most up-to-date Positive Evaluation report on XRX (preview of web page 1 of three proven beneath):

Overly Dangerous Excessive Dividend Inventory #8: Arbor Realty Belief (ABR)

Arbor Realty Belief is a nationwide mortgage actual property funding belief (REIT) that acts as a direct lender and operates in two reporting segments: Company Enterprise and Structured Enterprise. The belief supplies mortgage origination and servicing for multifamily, seniors housing, healthcare, and different numerous business actual property belongings.

Arbor Realty’s particular focus is government-sponsored enterprise merchandise, though its platform additionally consists of business mortgage backed securities (CMBS), bridge and mezzanine loans, and most well-liked fairness issuances.

Arbor Realty Belief, Inc. (ABR) reported third-quarter 2024 outcomes with internet revenue of $0.31 per diluted frequent share, matching expectations, and distributable earnings of $0.43 per share. Income reached $88.81 million, a 17.23% year-over-year lower however nonetheless beating estimates by $3.10 million.

The corporate declared a money dividend of $0.43 per share and introduced company mortgage originations totaling $1.1 billion, supporting a $33.01 billion servicing portfolio, which grew 10% year-over-year. Structured mortgage originations reached $258.5 million, contributing to a $11.57 billion portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABR (preview of web page 1 of three proven beneath):

Overly Dangerous Excessive Dividend Inventory #7: Prospect Capital (PSEC)

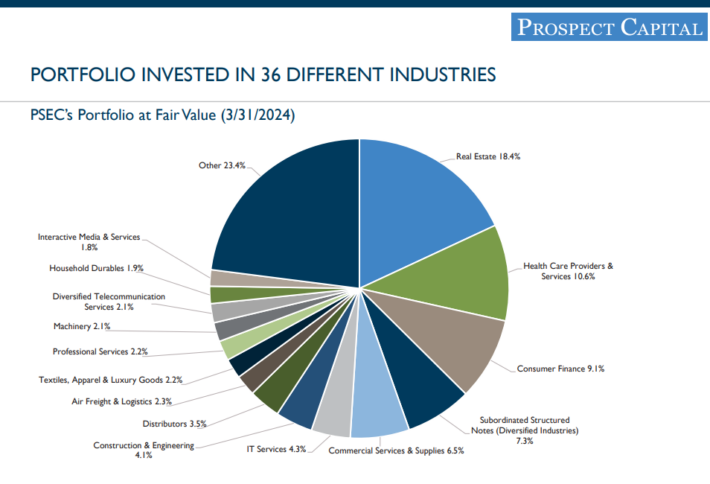

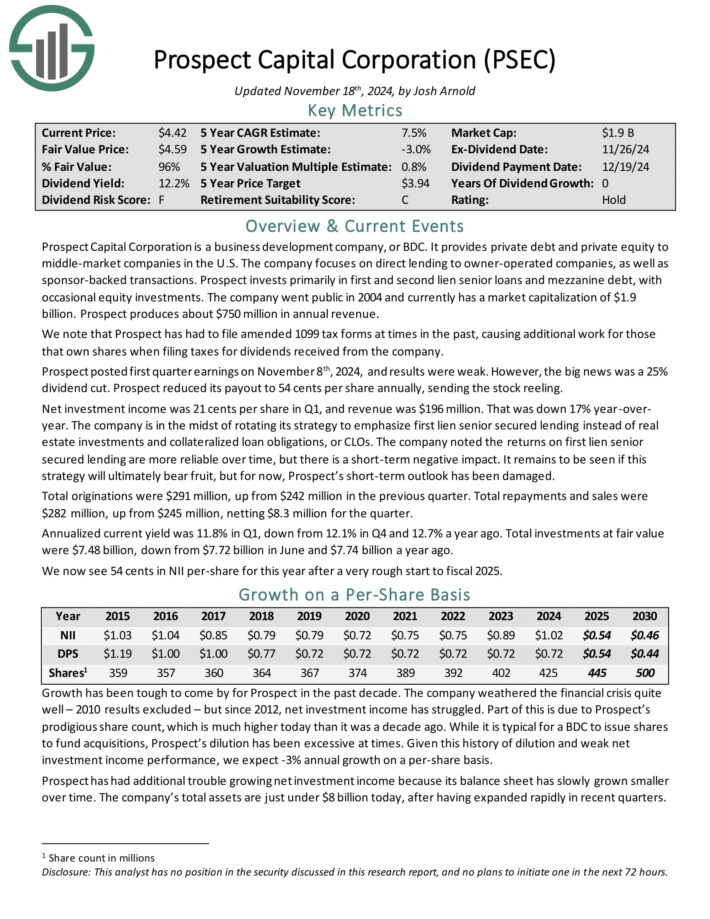

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives non-public debt and personal fairness to center–market firms within the U.S.

The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect posted first quarter earnings on November eighth, 2024, and outcomes had been weak. Nonetheless, the large information was a 25% dividend reduce. Prospect decreased its payout to 54 cents per share yearly, sending the inventory reeling.

Internet funding revenue was 21 cents per share in Q1, and income was $196 million. That was down 17% year-over-year.

The corporate is within the midst of rotating its technique to emphasise first lien senior secured lending as an alternative of actual property investments and collateralized mortgage obligations, or CLOs.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven beneath):

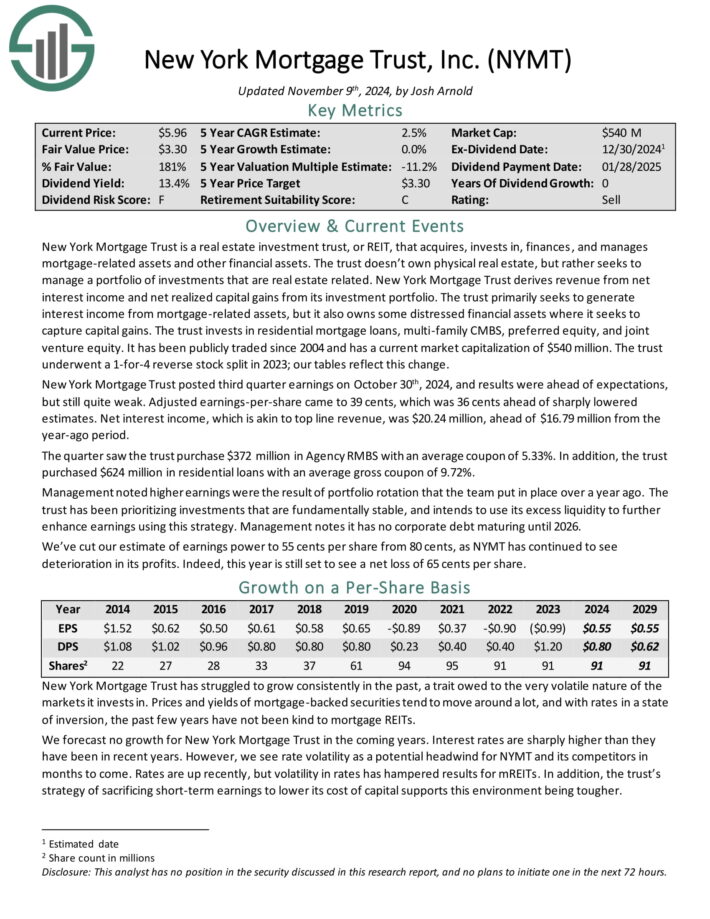

Overly Dangerous Excessive Dividend Inventory #6: New York Mortgage Belief (NYMT)

New York Mortgage Belief acquires, invests in, funds, and manages mortgage-related belongings and different monetary belongings. The belief doesn’t personal bodily actual property, however moderately seeks to handle a portfolio of investments which might be actual property associated.

The belief invests in residential mortgage loans, multi household CMBS, most well-liked fairness, and three way partnership fairness.

New York Mortgage Belief posted third quarter earnings on October thirtieth, 2024, and outcomes had been forward of expectations, however nonetheless fairly weak.

Adjusted earnings-per-share got here to 39 cents, which was 36 cents forward of sharply lowered estimates. Internet curiosity revenue, which is akin to prime line income, was $20.24 million, forward of $16.79 million from the year-ago interval.

The quarter noticed the belief buy $372 million in Company RMBS with a median coupon of 5.33%. As well as, the belief bought $624 million in residential loans with a median gross coupon of 9.72%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NYMT (preview of web page 1 of three proven beneath):

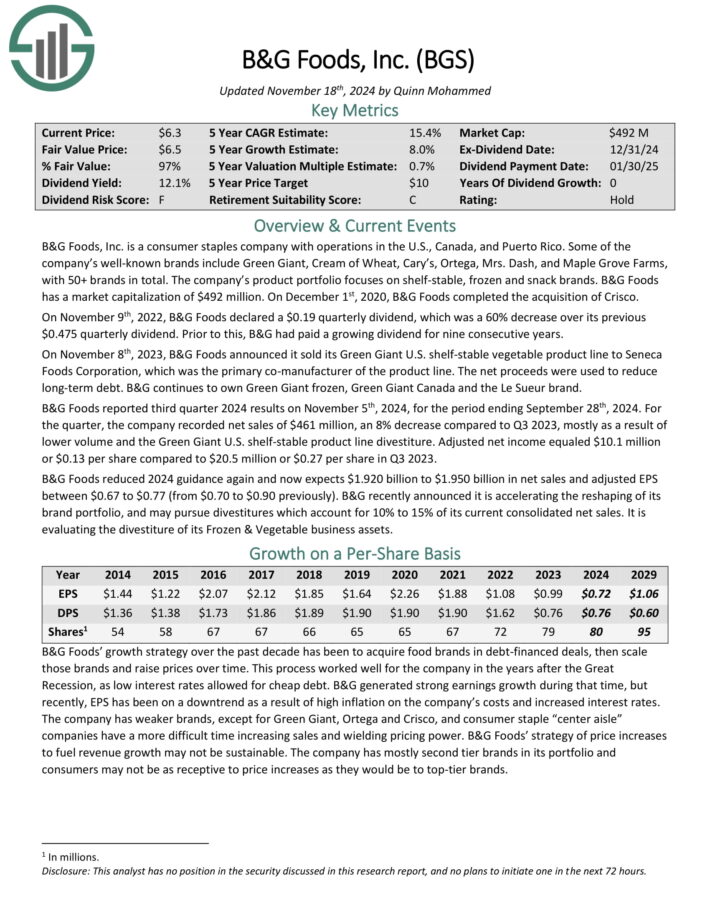

Overly Dangerous Excessive Dividend Inventory #5: B&G Meals, Inc. (BGS)

B&G Meals, Inc. is a shopper staples firm with operations within the U.S., Canada, and Puerto Rico. A few of the firm’s well-known manufacturers embody Inexperienced Big, Cream of Wheat, Cary’s, Ortega, Mrs. Sprint, and Maple Grove Farms, with 50+ manufacturers in complete.

It product portfolio focuses on shelf-stable, frozen and snack manufacturers. On December 1st, 2020, B&G Meals accomplished the acquisition of Crisco.

B&G Meals reported third quarter 2024 outcomes on November fifth, 2024, for the interval ending September twenty eighth, 2024.

For the quarter, the corporate recorded internet gross sales of $461 million, an 8% lower in comparison with Q3 2023, principally on account of decrease quantity and the Inexperienced Big U.S. shelf-stable product line divestiture. Adjusted internet revenue equaled $10.1 million or $0.13 per share in comparison with $20.5 million or $0.27 per share in Q3 2023.

B&G Meals decreased 2024 steerage once more and now expects $1.920 billion to $1.950 billion in internet gross sales and adjusted EPS between $0.67 to $0.77 (from $0.70 to $0.90 beforehand).

Click on right here to obtain our most up-to-date Positive Evaluation report on BGS (preview of web page 1 of three proven beneath):

Overly Dangerous Excessive Dividend Inventory #4: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) reminiscent of Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different sorts of investments.

Supply: Investor presentation

On October 23, 2024, ARMOUR Residential REIT introduced its unaudited third-quarter 2024 monetary outcomes, reporting a GAAP internet revenue accessible to frequent stockholders of $62.9 million, or $1.21 per frequent share. The corporate generated a internet curiosity revenue of $1.8 million and distributable earnings of $52.0 million, equal to $1.00 per frequent share.

ARMOUR achieved a median curiosity revenue of 4.89% on interest-earning belongings and an curiosity value of 5.51% on common interest-bearing liabilities. The financial internet curiosity unfold stood at 2.00%, calculated from an financial curiosity revenue of 4.44% minus an financial curiosity expense of two.44%.

Through the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of frequent inventory via an at-the-market providing program and paid frequent inventory dividends of $0.72 per share for Q3.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

Overly Dangerous Excessive Dividend Inventory #3: Kohl’s Company (KSS)

Kohl’s traces its roots again to a single retailer: Kohl’s Division Retailer in 1962. Since then, it has grown into a frontrunner within the area – providing ladies’s, males’s and kids’s attire, housewares, equipment, and footwear in additional than 1,100 shops in 49 states. The corporate ought to generate roughly $16 billion in gross sales this 12 months.

From 2007 via 2018, Kohl’s was in a position to develop earnings-per-share by about 4.7% yearly. Nonetheless, it must be famous that this was pushed by the corporate’s intensive share repurchase program. Over that interval the share rely was practically halved, a discount charge of -5.6% per 12 months.

With the share repurchase program having been paused, we don’t see that as a tailwind in the meanwhile. Fears of struggling margins have confirmed to be proper, because the previous few years have seen declining profitability. We word that 2021’s earnings has the potential to be the highest for a while.

We forecast earnings-per-share at $1.85 this 12 months as the corporate is seeing weakened demand come to fruition, and vital margin headwinds, together with a lot weaker gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on KSS (preview of web page 1 of three proven beneath):

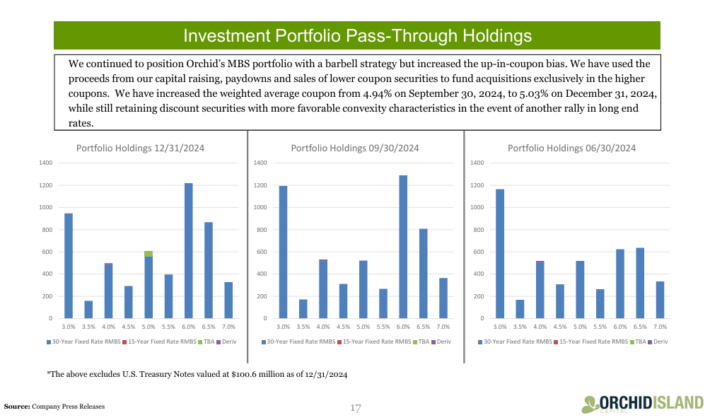

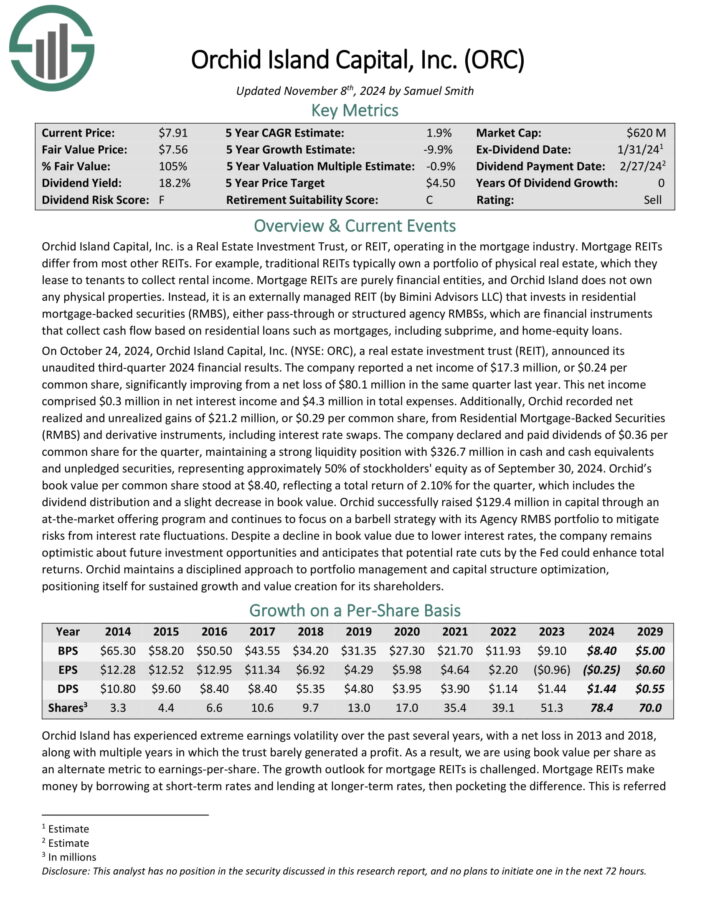

Overly Dangerous Excessive Dividend Inventory #2: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money stream based mostly on residential loans reminiscent of mortgages, subprime, and home-equity loans.

Supply: Investor Presentation

The corporate reported a internet revenue of $17.3 million, or $0.24 per frequent share, considerably enhancing from a internet lack of $80.1 million in the identical quarter final 12 months. This internet revenue comprised $0.3 million in internet curiosity revenue and $4.3 million in complete bills.

Moreover, Orchid recorded internet realized and unrealized good points of $21.2 million, or $0.29 per frequent share, from Residential Mortgage-Backed Securities (RMBS) and spinoff devices, together with rate of interest swaps.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

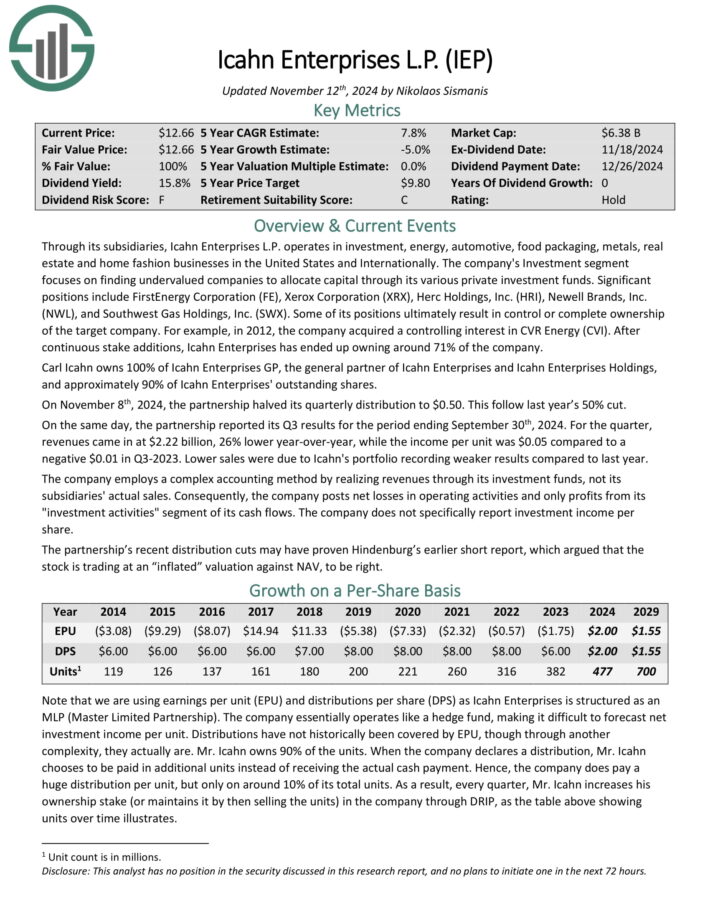

Overly Dangerous Excessive Dividend Inventory #1: Icahn Enterprises LP (IEP)

Via its subsidiaries, Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property and residential vogue companies in america and Internationally.

The corporate’s Funding section focuses on discovering undervalued firms to allocate capital via its numerous non-public funding funds.

Important positions embody FirstEnergy Company (FE), Xerox Company (XRX), Herc Holdings, Inc. (HRI), Newell Manufacturers, Inc. (NWL), and Southwest Fuel Holdings, Inc. (SWX).

On November eighth, 2024, the partnership halved its quarterly distribution to $0.50. This observe final 12 months’s 50% reduce. On the identical day, the partnership reported its Q3 outcomes for the interval ending September thirtieth, 2024.

For the quarter, revenues got here in at $2.22 billion, 26% decrease year-over-year, whereas the revenue per unit was $0.05 in comparison with a unfavorable $0.01 in Q3-2023. Decrease gross sales had been as a consequence of Icahn’s portfolio recording weaker outcomes in comparison with final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on IEP (preview of web page 1 of three proven beneath):

Closing Ideas & Further Studying

Excessive dividend shares are naturally interesting on the floor, as a consequence of their excessive dividend yields.

However revenue buyers want to ensure they don’t fall right into a dividend ‘lure’, which means buying a inventory solely as a consequence of its excessive yield, solely to see the corporate reduce or eradicate the dividend payout.

Whereas there may be by no means a assure a inventory is not going to reduce its dividend, specializing in shares with robust underlying fundamentals and modest payout ratios can go a great distance.

If you’re fascinated about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].