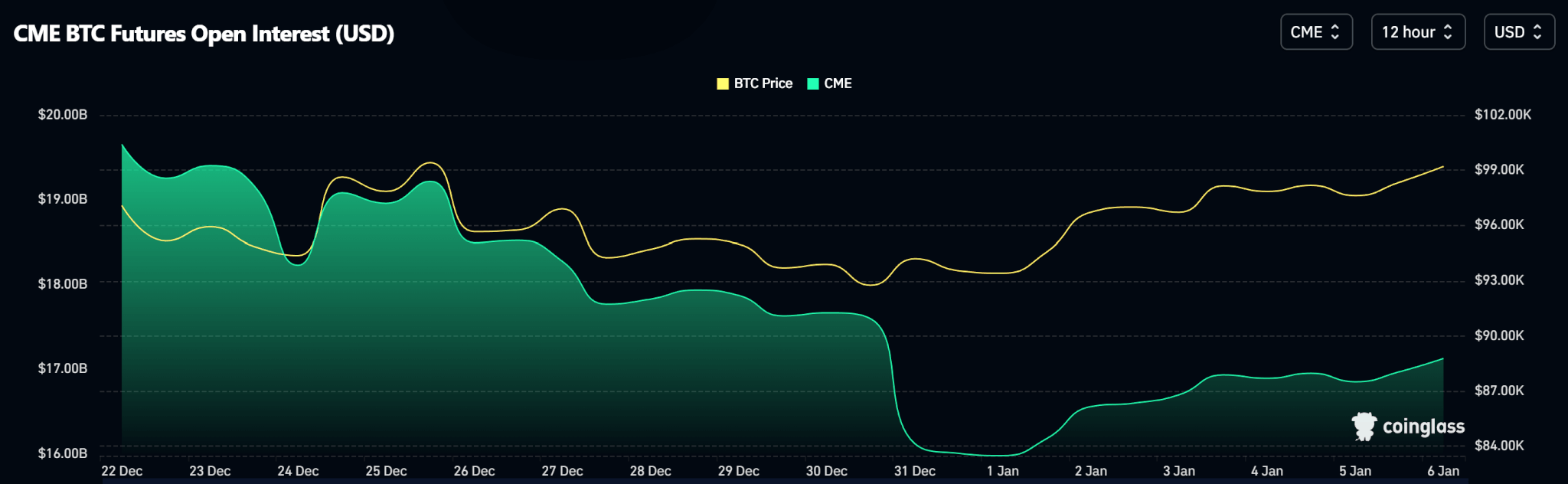

Costs rose over the primary week of the yr as open curiosity within the CME improved.

Altcoins outperformed Bitcoin as the most important crypto remained rangebound.

In the meantime, ETF flows remained web adverse.

Bitcoin

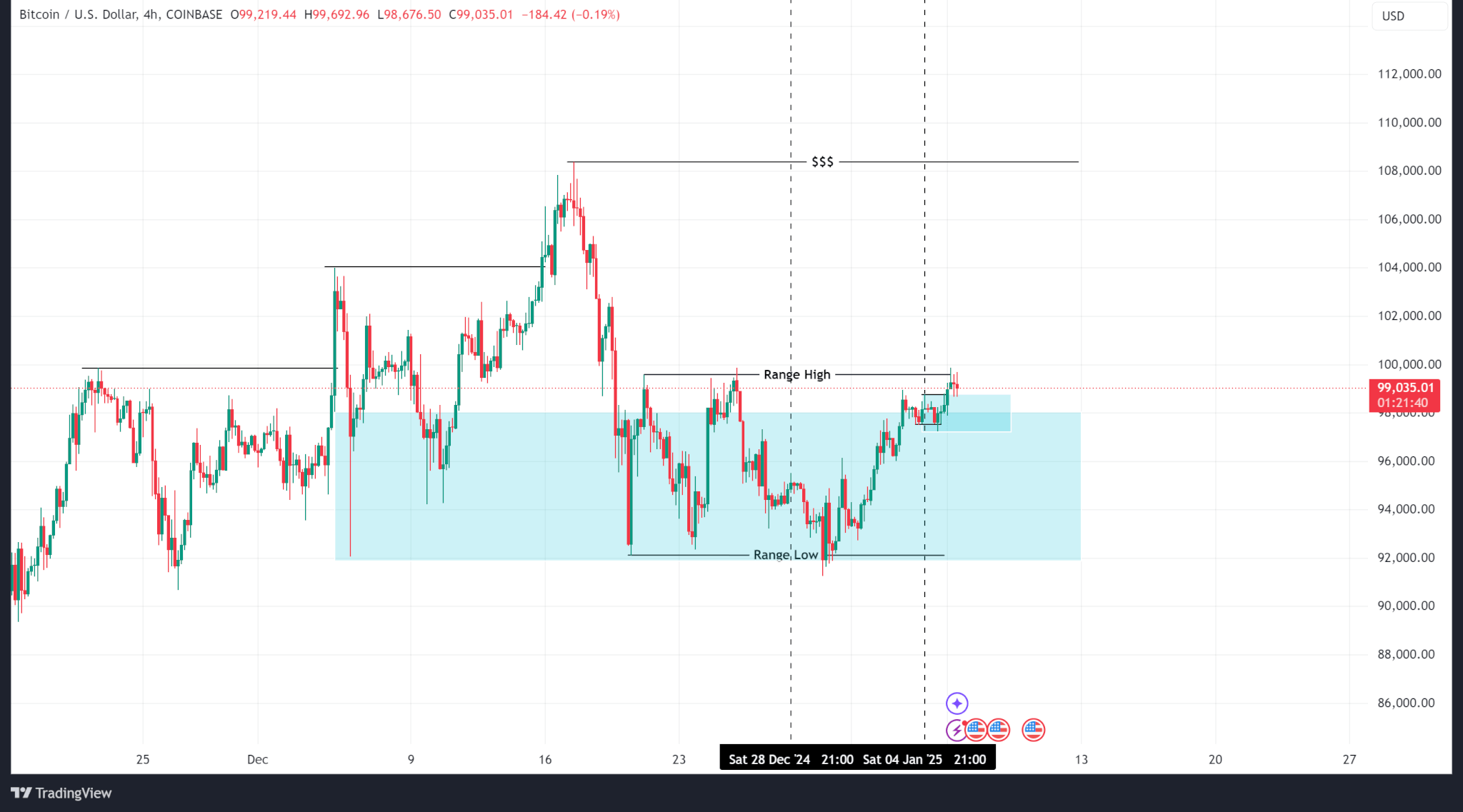

Bitcoin’s worth improved final week however remained throughout the vary established in earlier buying and selling periods. BTC logged a weekly low of 91,271.19 and a excessive of $98,972.29. Bitcoin closed final week at $98,198.52.

Open curiosity within the CME improved over the past week as extra contracts have been added. Evaluating that with worth motion means that extra lengthy contracts have been opened.

In the meantime, BTC ETF flows have been web adverse subsequent week as outflows totalled $652.10Mn.

Outlook

BTC discovered help throughout the demand zone on the H4 timeframe and has begun an increase (supported by new futures longs). BTC might want to first break above the vary excessive at $99,596.57.

BTC trades at $101,978.76 as of publishing.

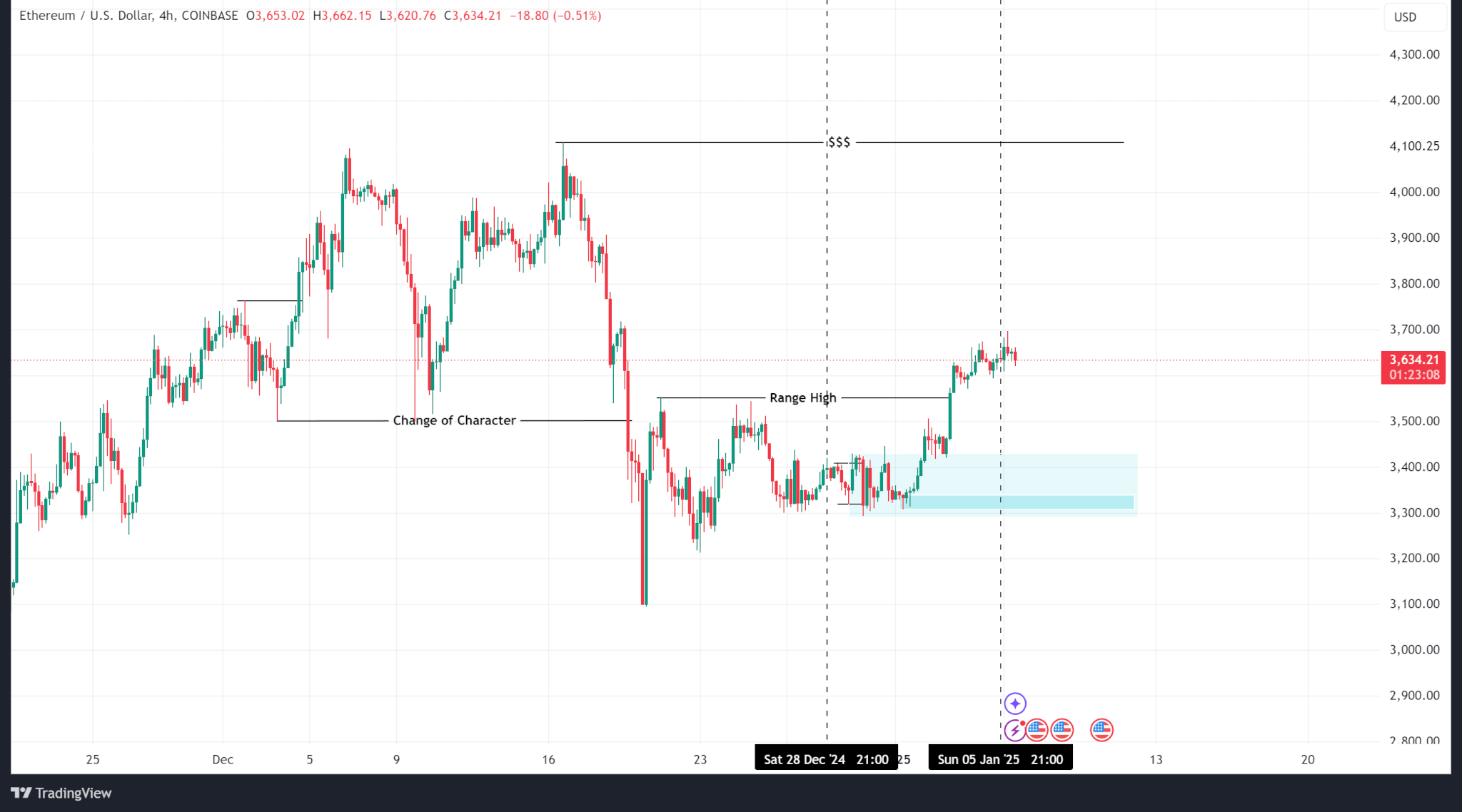

Ethereum

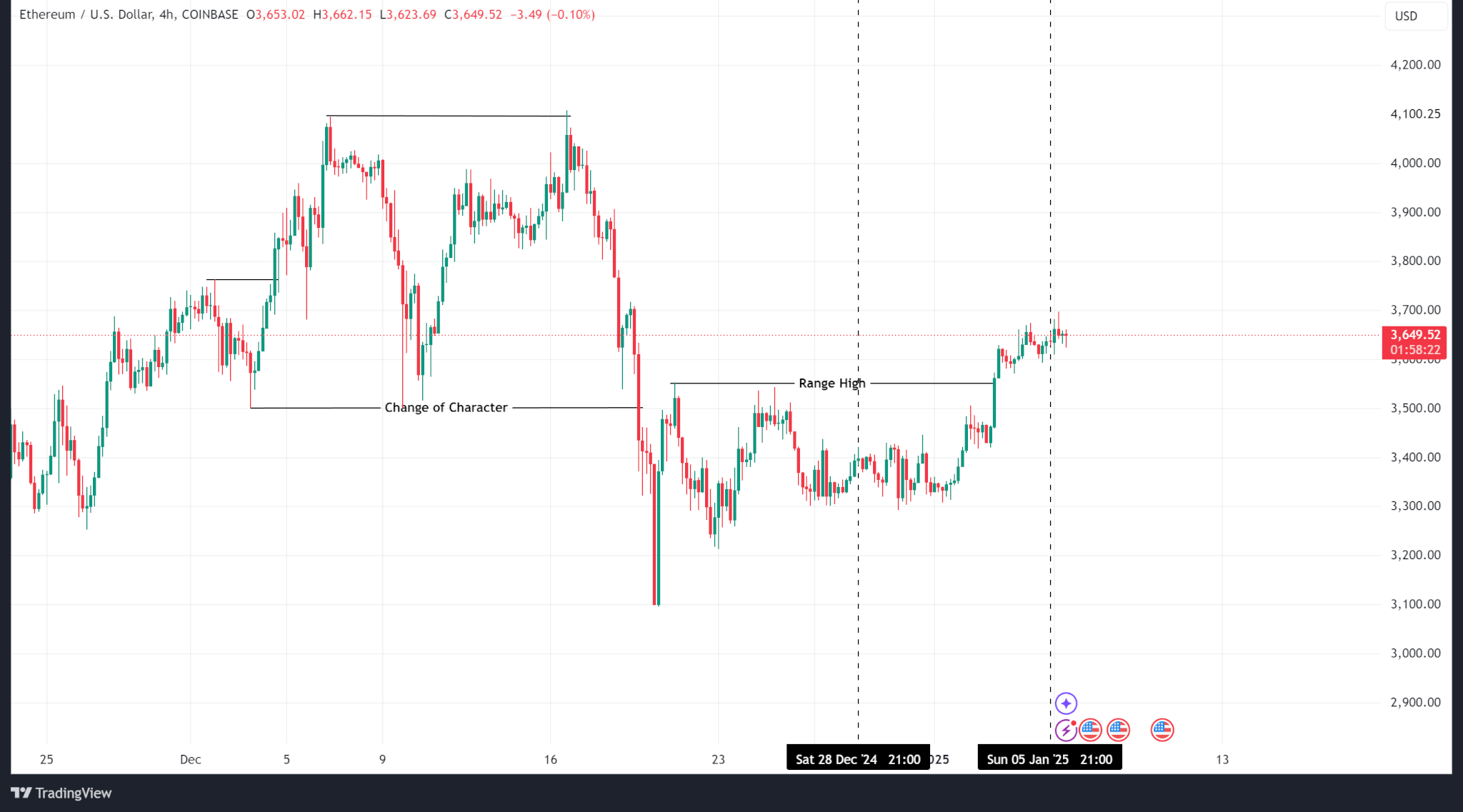

Ethereum’s worth motion was extra bullish because it broke above the vary fashioned within the earlier week’s buying and selling session. The weekly high and low have been $3,293.19 and $3,675.77, respectively. ETH closed final week at $3,637.39.

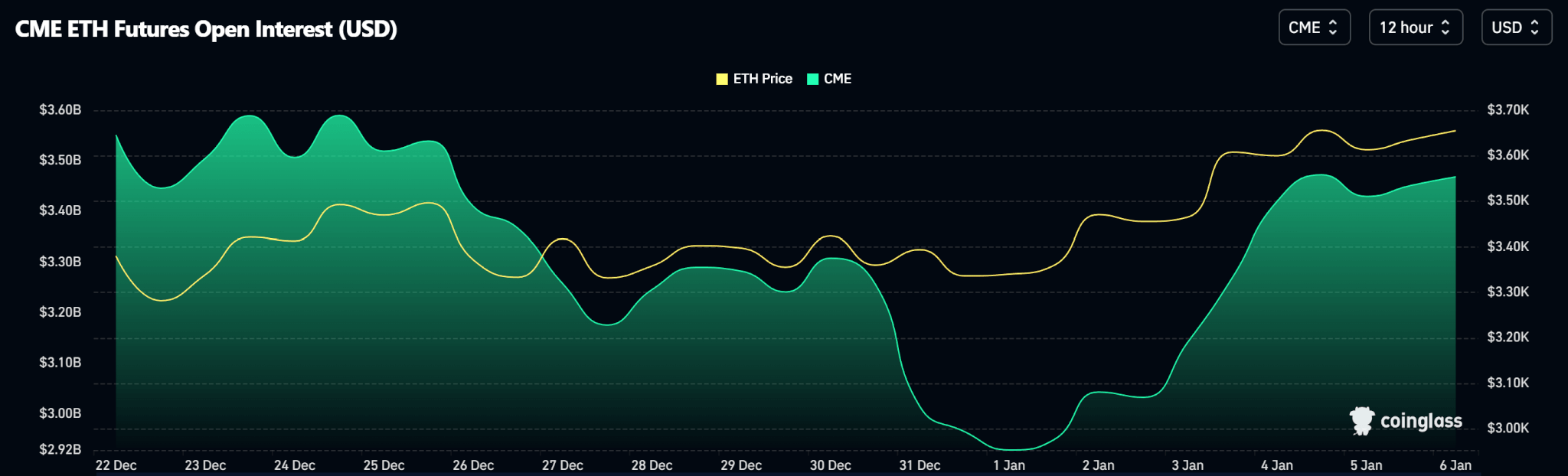

Just like Bitcoin’s open curiosity charts, Ethereum OI reached a weekly low on Jan. 1 and has been rising since as new longs enter the derivatives market.

In the meantime, spot ETH ETF inflows logged a adverse week as $97.00Mn flowed out of ETFs within the US.

Outlook

Whereas the worth has damaged by means of the final vary excessive, it should clear the current excessive, which is on the $4,096.44 stage, to renew a bullish pattern. Within the interim, a requirement stage on the $3,500.00 stage may function liquidity for an upward.

ETH trades at $3,679.36 as of publishing.

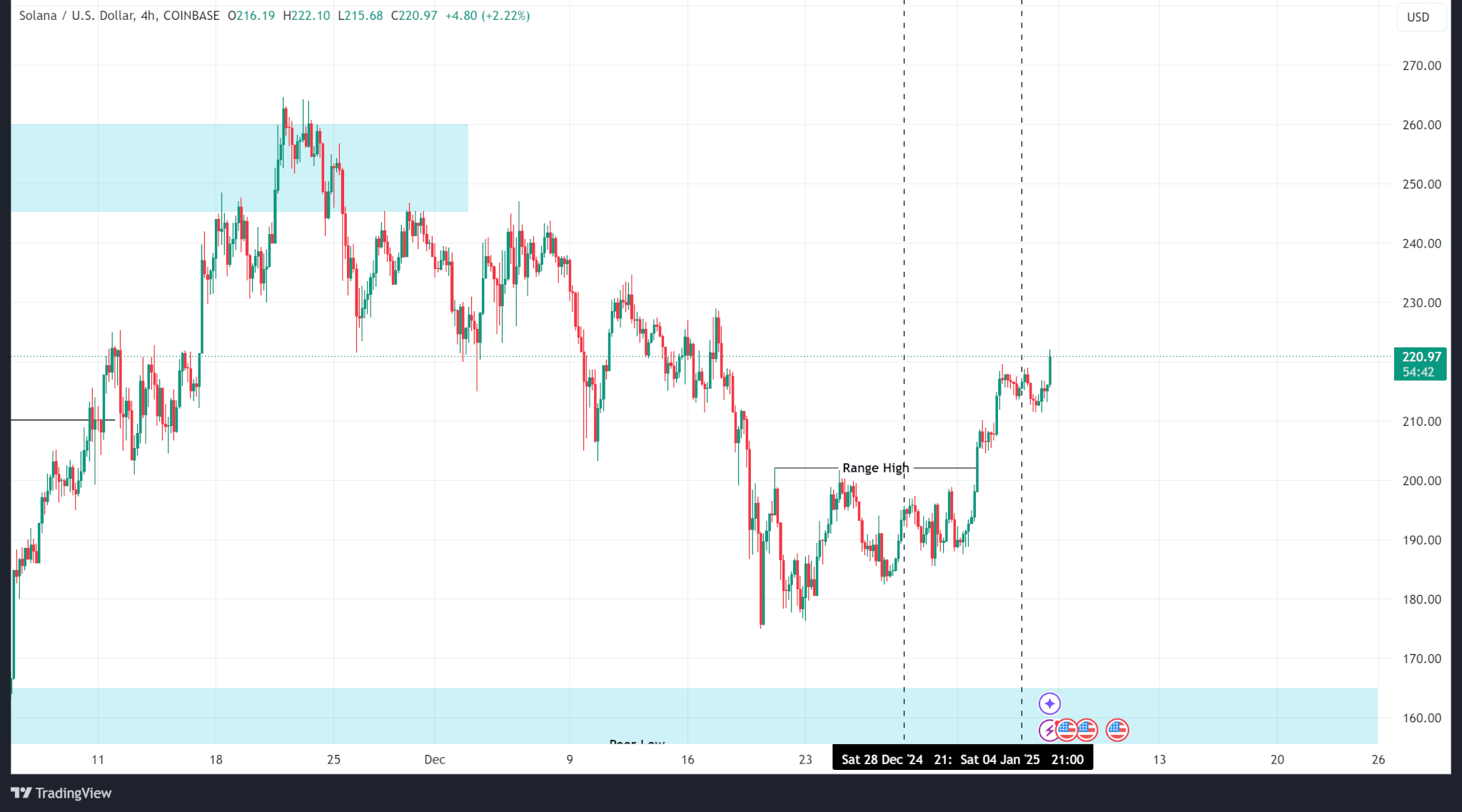

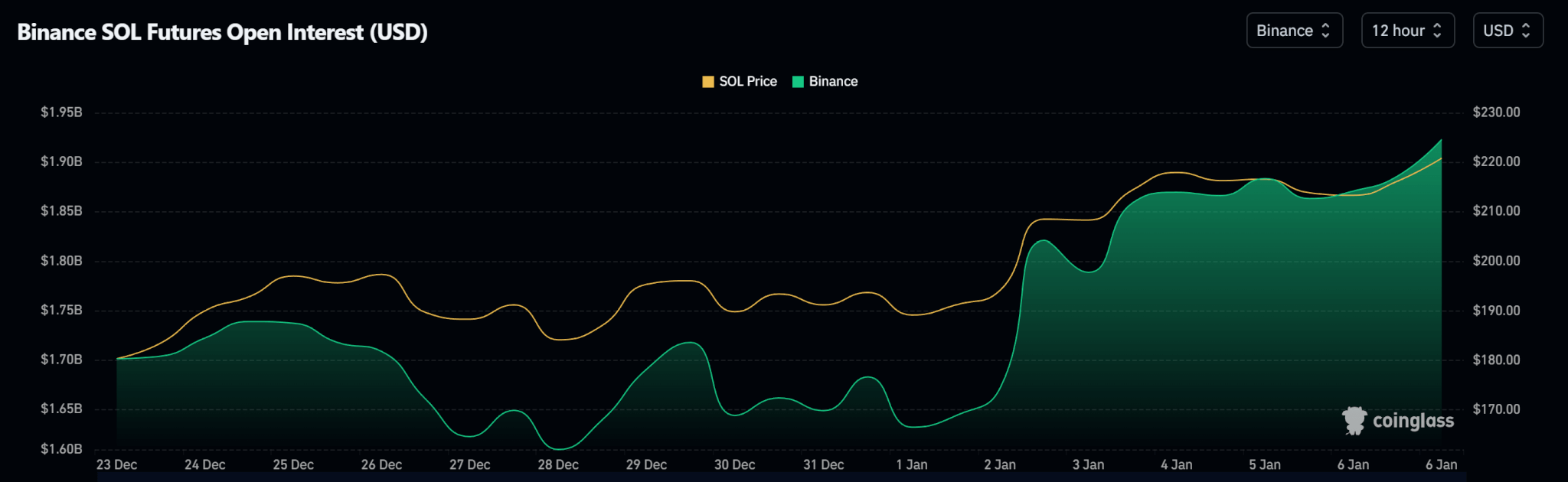

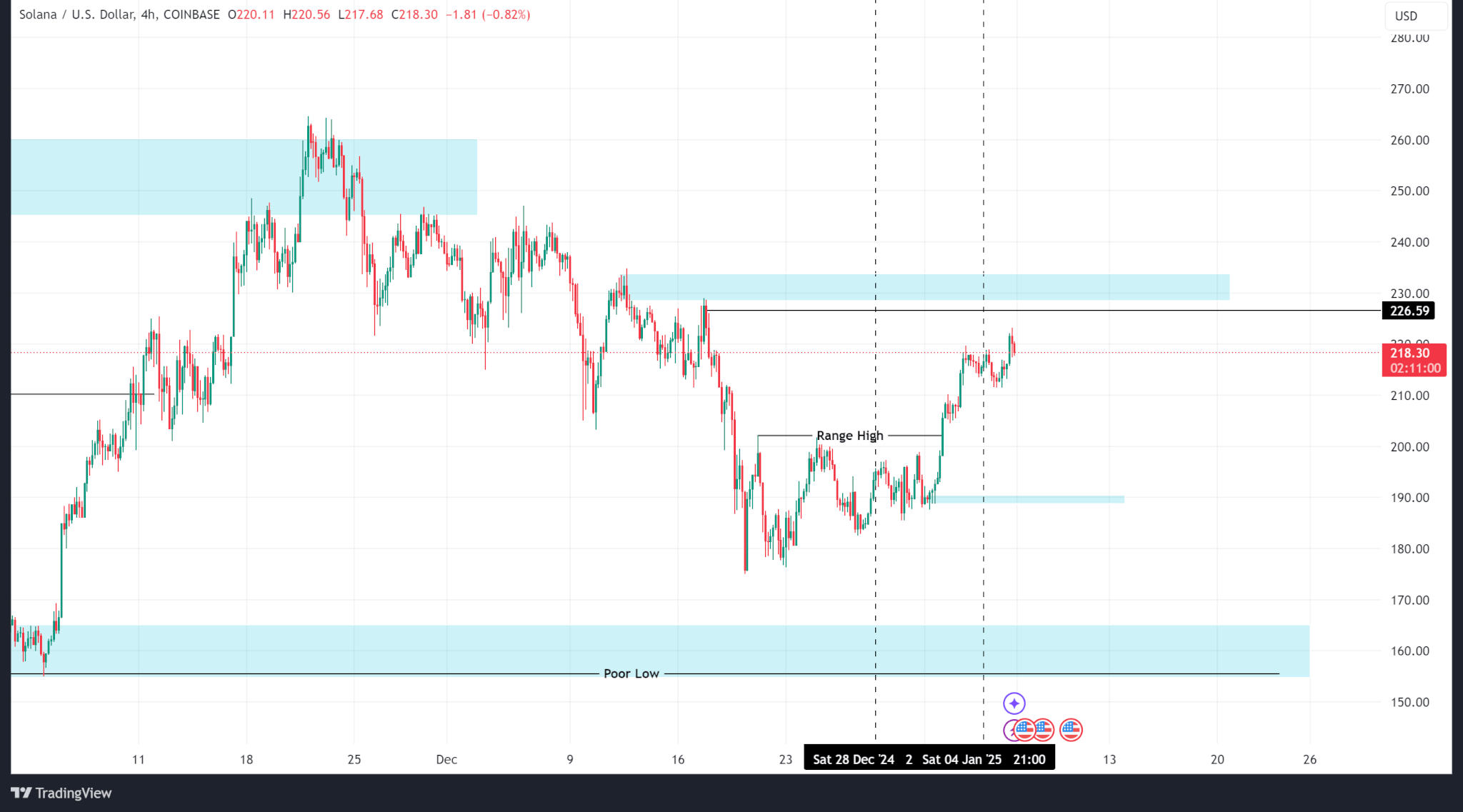

Solana

Solana’s worth motion was bullish final week because it broke above the native vary excessive from the earlier week’s buying and selling session. Weekly high and low fashioned have been $185.55 and $219.67.

Open curiosity in Solana adopted the same sample as that of Bitcoin and Ethereum, selecting up from Jan. 1.

Outlook

Regardless of failing to interrupt its all-time excessive, Solana’s pattern is bullish. Nevertheless, the worth has logged consecutive decrease lows on the H4 timeframe and should break the $230 stage after which the $260 stage to proceed its bullish pattern.

SOL trades at $218.28 as of publishing.

Ripple

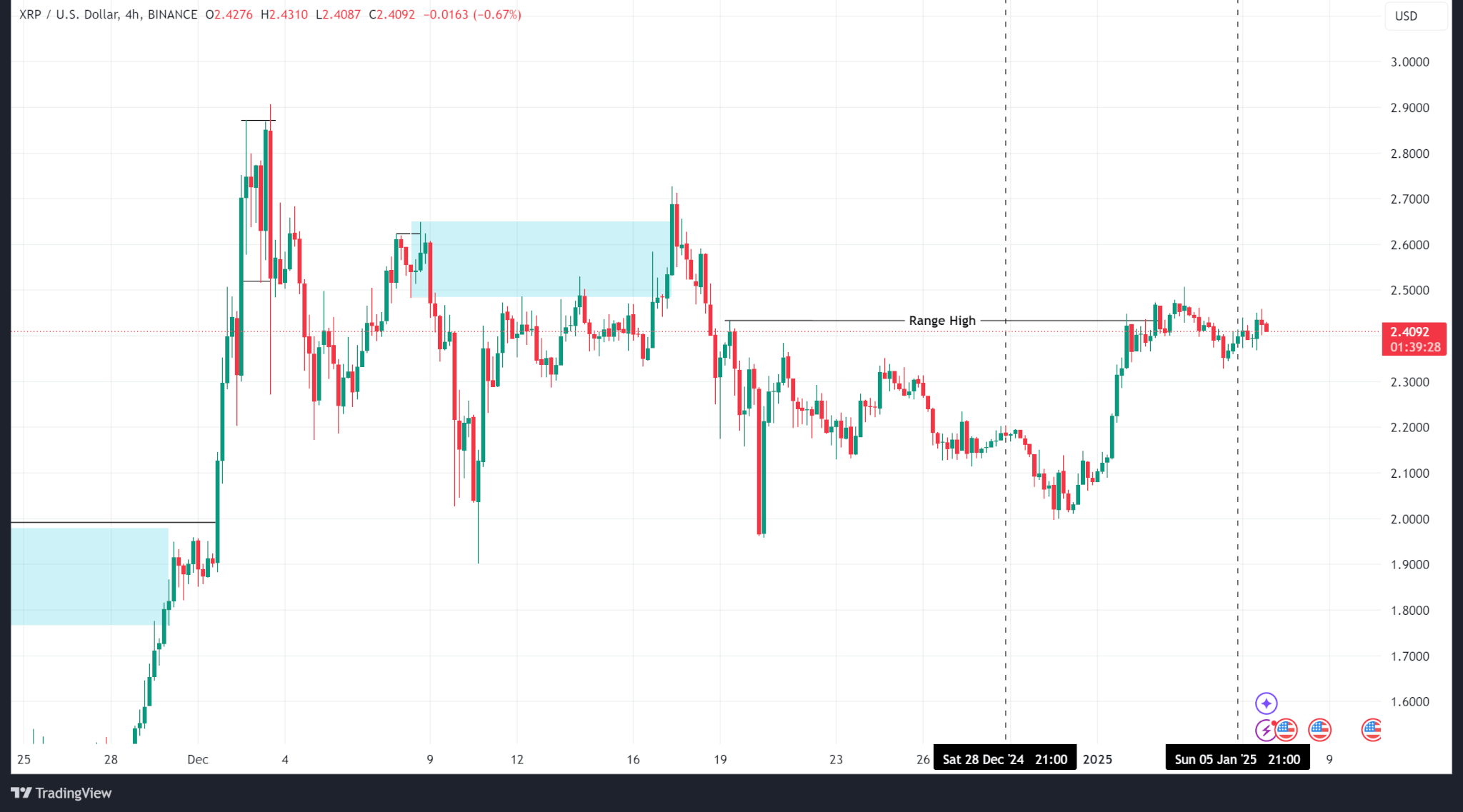

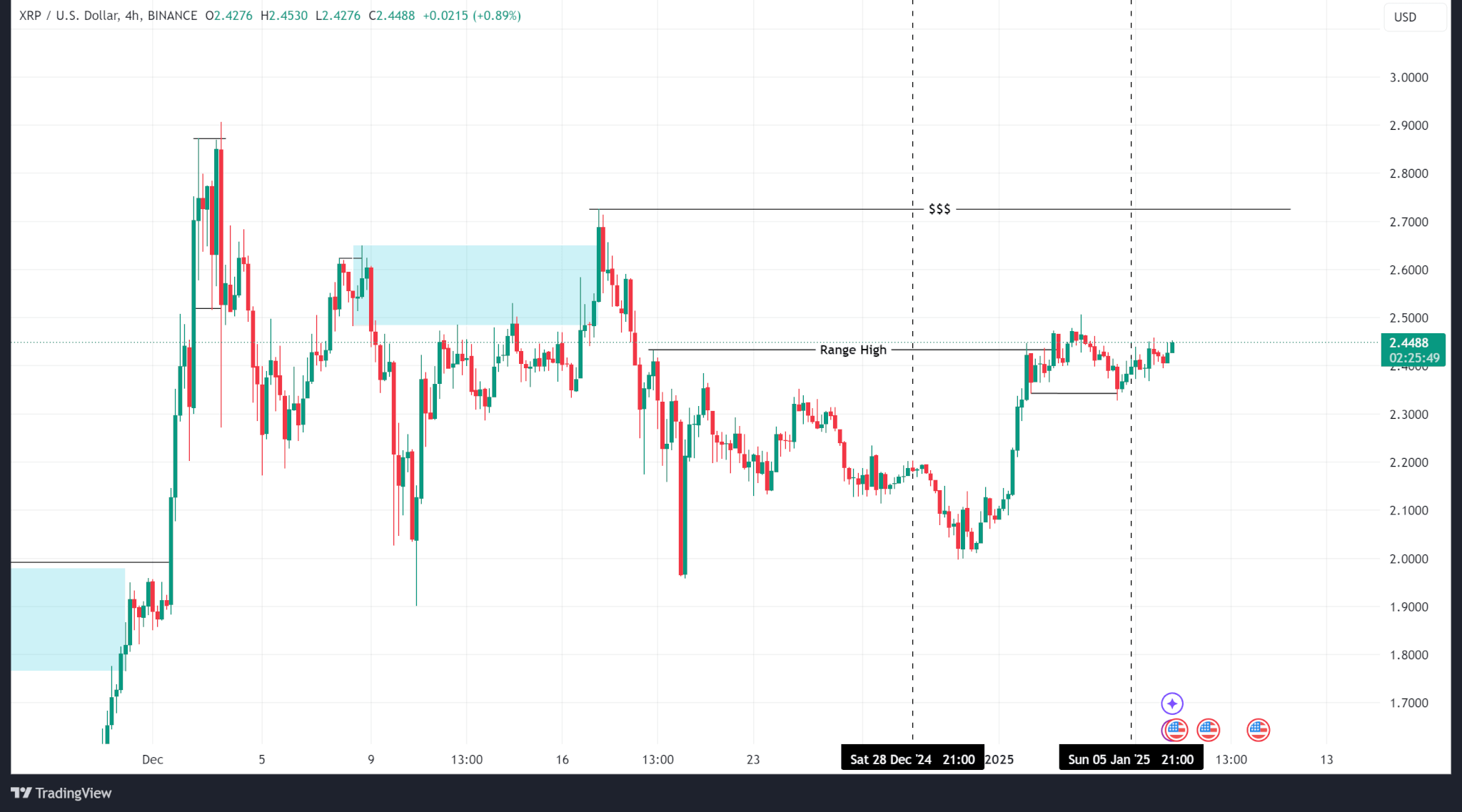

Ripple’s worth motion improved final week after logging a low of $1.99 and a excessive of $2.50.

Nevertheless, worth was incongruent with open curiosity as a rise in lengthy contracts didn’t buoy the worth.

Outlook

Since breaking above the vary excessive and pulling again for liquidity on the final increased low at $2.34, XRP’s worth has logged increased highs and lows, climbing in direction of the following provide zone round $2.72.

XRP trades at $2.44 as of publishing.