DarrelCamden-Smith

It has been a tough 12 months up to now for the Gold Juniors Index (GDXJ). Whereas the softness within the producers is sensible given the destructive revisions to value steerage, the royalty/streamers have additionally been pummeled, down over 20% year-to-date on stability. The truth that names which are inflation-resistant are additionally taking a beating means that this bear market within the sector is now on the level the place corporations are buying and selling devoid of fundamentals and easily being bought to halt the proverbial bleeding.

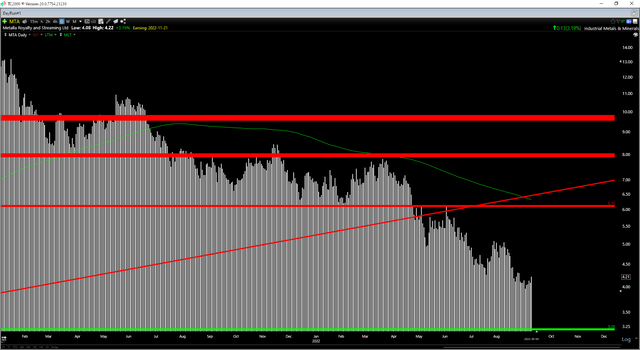

One title that is been bought off sharply on this bear market is Metalla Royalty & Streaming (NYSE:MTA), a junior royalty/streaming firm with six producing belongings and a stable pipeline of improvement belongings. Whereas the inventory got here into the 12 months costly at $7.00 per share, MTA is turning into rather more attention-grabbing close to $4.00 per share particularly given the latest constructive developments. So, with sturdy natural progress, I consider we are able to overlook its missing liquidity to capitalize on the present atmosphere, and I’d count on pullbacks beneath US$3.70 to current shopping for alternatives.

Metalla Royalty & Streaming (Firm Presentation)

Q2 Outcomes

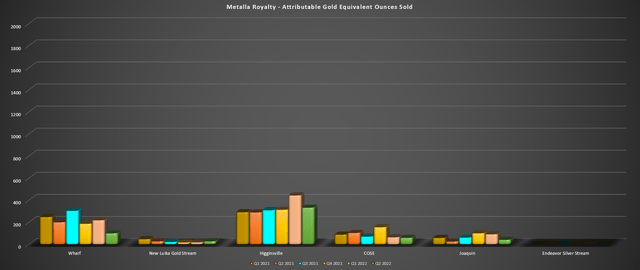

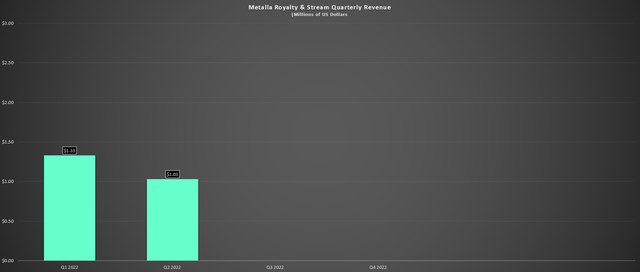

Metalla launched its Q2 outcomes final month, reporting an attributable quantity of 560 gold-equivalent ounces [GEOs], a 22% decline on a sequential foundation. This was associated to decrease attributable GEOs at almost all of its belongings (beneath chart), aside from the New Luika Gold Stream, its smallest contributor. On a year-over-year foundation, quantity was additionally decrease, with decrease quantity at almost each asset besides Higginsville and Joaquin. Given this decline in attributable GEO quantity and a comparatively flat gold worth, Metalla’s income fell sequentially to $1.03 million (Q1 2022: $1.33 million).

Metalla – Quarterly GEO Quantity by Mine (Firm Filings, Creator’s Chart)

Whereas these headline numbers is likely to be disappointing when some corporations like Franco-Nevada (FNV) and Osisko Gold Royalties (OR) simply got here off file quarters, it is necessary to notice that Metalla’s portfolio is nearing an inflection level, and issues can change in a short time for junior corporations. Therefore, somewhat than trying solely at quarterly gross sales, a superficial endeavor that gives little to no worth, I believe it is sensible to take a look at the portfolio as a complete and the place it is going sooner or later. On this sense, Metalla’s future has by no means regarded brighter, which we’ll dig into beneath:

Metalla – Quarterly Income/Funds (Firm Filings, Creator’s Chart)

Latest Developments

Earlier than entering into the constructive developments, it’s price mentioning the one destructive improvement, which was the information that Monarch (OTCQX:GBARF) has seen a slower-than-expected ramp-up at its Beacon Mill. This was anticipated to be a key contributor for Metalla (1.0% NSR royalty), even when small, however for now, milling is constant at a decrease fee of 500 tonnes per day with the processing of stockpiles, with the purpose being to optimize its mining technique and get manufacturing as much as the purpose of 750 tonnes per day. Given the slower ramp-up, I’d be shocked to see greater than 20,000 gold ounces produced subsequent 12 months, suggesting lower than $0.50 million in income attributable to Metalla.

On the constructive entrance, there are too many developments to rely, so I’ll checklist them in bullet kind, besides Wasamac, the place Metalla holds a 1.5% NSR, topic to a 0.50% buyback for ~$6.0 million.

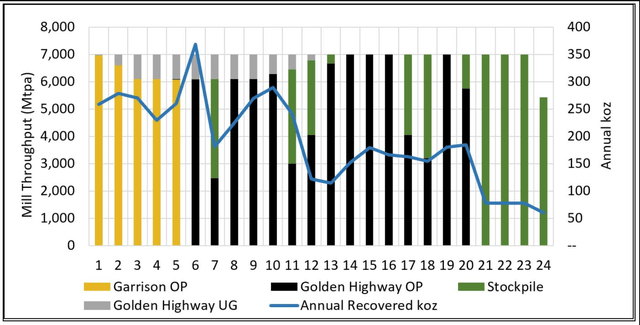

G Mining Ventures (OTC:GMINF) Financing: This has positioned the undertaking on a path to the primary gold pour by H2 2024, with the asset anticipated to be a ~175,000-ounce producer, producing vital income based mostly on Metalla’s 0.75% GVR. Akasaba West to Feed Goldex Mill: Agnico (AEM) has introduced the undertaking will contribute 1,500 tonnes per day to the mill, with building to start out in 2024, doubtlessly contributing as much as $1.0 million in attributable income for Metalla. Tower Gold Mission PEA Completion: Whereas Moneta’s (OTCQX:MEAUD) market cap to capex ratio is comparatively excessive at 0.50 to 1.0, and it could be robust to fund the undertaking within the present atmosphere, the PEA has outlined a strong undertaking able to producing ~197,000 ounces in its first 5 years from Garrison, the place Metalla holds a 2.0% NSR. See the chart beneath, with Garrison contribution in gold.

Tower Gold PEA + Garrison Contribution (Moneta Gold Web site)

4. Agnico advancing Amalgamated Kirkland: Agnico Eagle continues to advance Amalgamated Kirkland, an orphaned deposit that lies east of the South Mine Advanced, however nearer to the floor, however was too small to develop. Following the KL/AEM merger, the asset might be in manufacturing by late 2024, benefiting Metalla, which holds a 0.45% NSR.

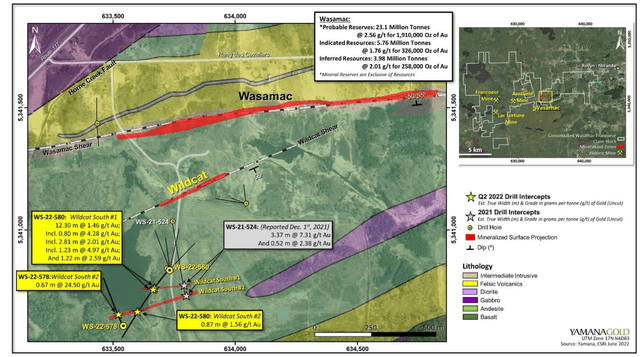

Wasamac Drilling (Yamana Presentation)

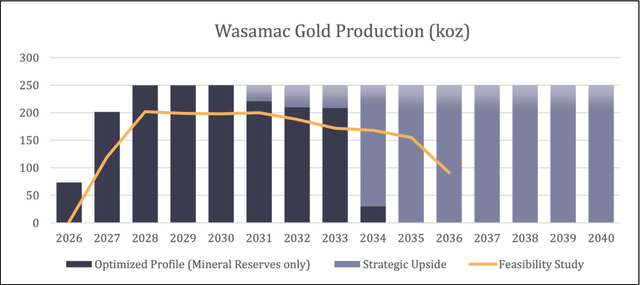

Whereas these are all constructive developments, the key one was Wasamac, the place the operator continues to launch phenomenal exploration outcomes, with infill outcomes confirming and or exceeding anticipated grades and widths. Nonetheless, the large information is that parallel constructions akin to Wildcat and South Wildcat appear to be pointing to this being a a lot bigger deposit, main Yamana (AUY) to consider this might be a 200,000 to 250,000 ounce each year operation with a mine lifetime of 15 years. For these unfamiliar, it is a main step up from ten years at 169,000 ounces beforehand.

Wasamac Manufacturing Profile Upside (Yamana Presentation)

Assuming that is the case, with Yamana assured it may incrementally improve throughput (7,000 to 9,000 tonnes per day) and increase recoveries, this could be very constructive for Metalla. The reason being that even when Yamana chooses to purchase again its 0.5% NSR for ~$6 million (representing a pleasant money cost), the 1.0% NSR would nonetheless signify ~2,200 GEOs each year from 2027-2030 attributable to Metalla, or ~$4.0 million in income at a $1,800/oz gold worth. This could be an identical income determine from this asset alone vs. all its paying belongings mixed at the moment, and the upper manufacturing would offset any discount within the royalty.

To summarize, I consider the positives for Metalla inside its portfolio simply outweigh any negatives, and the positives have are available in droves year-to-date.

Valuation

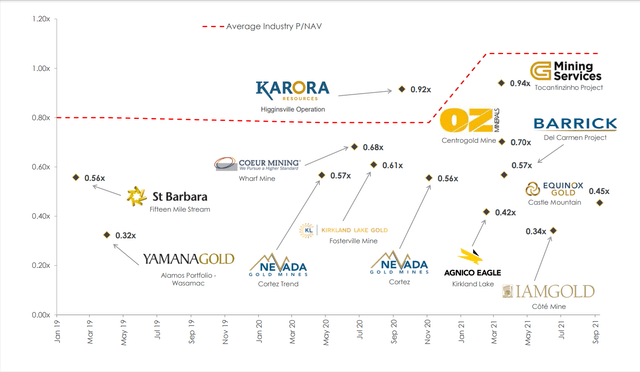

Based mostly on ~48 million totally diluted shares and a share worth of US$4.20, Metalla has a market cap of $202 million. This interprets to the inventory buying and selling at 0.73x P/NAV based mostly on my estimates of ~$275 million in internet asset worth. On condition that Metalla has a various portfolio of belongings held by among the greatest operators globally, that is turning into a way more cheap valuation. That stated, the one destructive price mentioning is that it is transitioned to a harsh winter for the junior/developer area, and even some producers are in tough form. Whereas the mid-tier royalty/streaming corporations are cashed as much as take benefit, Metalla isn’t. As of quarter-end, the corporate had lower than $20 million in out there liquidity.

One purpose that the corporate has much less flexibility is that it has been very busy doing offers over the previous few years, finishing 28 offers since Q3 2016 vs. the peer common of lower than 20. Usually, I’d be crucial of the numerous deal circulate in a vendor’s market, however the firm has achieved a stable job selecting up belongings on the proper worth. That stated, this seems to be the time to essentially strike, and whereas names like Osisko Gold Royalties with ~$650 million in liquidity may gain advantage significantly in the event that they bulk up the portfolio with fairness markets much less favorable, Metalla will not be capable to profit. The exception is that if it bought shares on its ATM, which might not be accretive at present costs.

Clearly, the shortage of liquidity is a destructive improvement as a result of Metalla isn’t producing constant money circulate to funnel into future offers. Nonetheless, the corporate did much better than its junior friends, given Metalla’s measurement and deal circulate over the previous two years. The reason being that it did not expend its capability doing common offers with mediocre operators and overpaying. To summarize, even when we low cost Metalla barely for its incapacity to finish significant transactions in a market ripe for deal circulate, I nonetheless see the inventory as undervalued, and whereas there are royalty/streaming corporations that may be criticized for his or her acquisitions and rush to burn by means of their out there capability to develop, Metalla isn’t one in all them.

Metalla – Latest Offers (Firm Presentation)

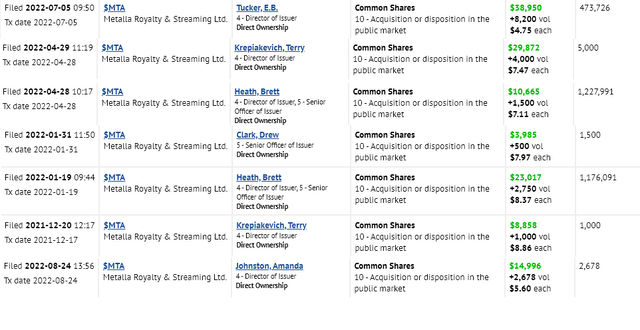

Metalla – Insider Shopping for (SEDI Insider Filings)

Trying on the chart above, the Wasamac transaction at lower than 0.40x P/NAV stands out as an outstanding deal, and one that might possible value twice as a lot or extra within the present market atmosphere, particularly if Yamana merges and the asset is held by a top-5 gold firm. Additionally of be aware is that insiders appear to agree with the worth proposition, with some smaller insider buys just lately filed.

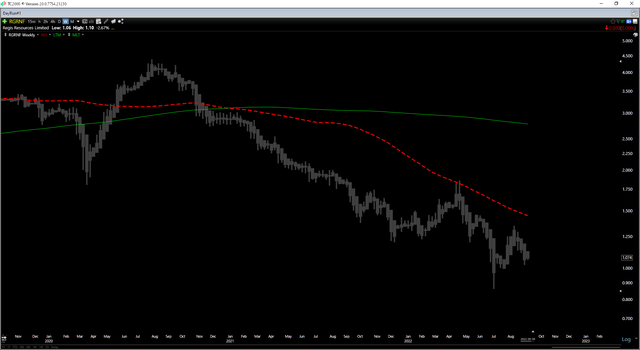

Technical Image & Dangers

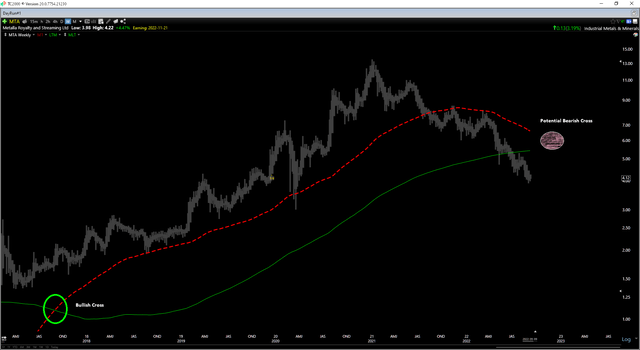

Whereas Metalla’s valuation has improved significantly, we’ve got seen a destructive improvement from a technical perspective, and the turbulent market atmosphere has led to further danger. Starting with the technical image, the inventory broke a key assist degree at US$5.200, and it is now trying like we may see a bearish cross later this 12 months if the inventory cannot rebound sharply. This typically results in underperformance for miners after prolonged uptrends, and we noticed this in Regis Sources (OTCPK:RGRNF), which noticed a bearish cross in Q1 2021 (down 70% since), and Equinox Gold (EQX) which noticed a bearish cross in Q2 2022 (down 40% since). Clearly, historical past would not should repeat itself for MTA, however a destructive cross-over could be an unfavorable improvement.

MTA Weekly Chart (TC2000.com)

RGRNF Weekly Chart (TC2000.com)

In the meantime, with the US$5.20 assist being eliminated, the following sturdy assist degree for the inventory would not are available in till US$3.20, which is greater than 20% beneath present ranges. So, whereas there’s appreciable upside to the following sturdy resistance degree at US$6.10, the reward/danger ratio has deteriorated barely with $1.00 in potential draw back to assist and $1.90 in potential upside to resistance. This interprets to a reward/danger ratio of 1.90 to 1.0, beneath the 6.0 to 1.0 reward/danger ratio that I favor for micro-cap shares. For Metalla to enter a low-risk purchase zone with a ~6.0 to 1.0 reward/danger ratio, it could want to say no to US$3.70.

MTA Each day Chart (TC2000.com)

Lastly, though Metalla has turn into rather more engaging from a valuation standpoint at simply over 0.70x P/NAV, the market atmosphere for micro-cap shares has turn into riskier. It is because the S&P 500 (SPY) is at the moment in a cyclical bear market, beneath its 30-week and 40-week shifting averages. Sometimes, this atmosphere favors holding extra liquid shares with increased market caps which are producing constant money circulate on condition that they have an inclination to have institutional assist and ideally defensive shares generally which are recession-resistant.

Whereas Metalla could also be recession-resistant (no demand destruction for gold) and inflation-resistant, I usually favor holding larger-cap valuable metals names when markets get ugly, on condition that they’re much less prone to violent sell-offs in a liquidity crunch than their micro-cap friends. So, whereas Metalla presents a really engaging progress profile, my choice within the sector within the royalty/streaming area at the moment is Osisko Gold Royalties, which trades at an identical P/NAV ratio (~0.88x) however is able to put appreciable cash to work on this downturn, has ~10x the market cap, and is producing constant money circulate with a internet money place.

Abstract

Metalla has declined greater than 65% from its highs since I famous to take income above US$12.75, and the severity of this decline mixed with constructive developments at some royalty belongings has put the chances again within the bulls’ favor from a valuation standpoint. This makes for a riskier atmosphere for holding micro-cap shares, and whereas Metalla is medium-term oversold, the low-risk purchase zone is available in 15% decrease beneath US$3.65. This does not imply that MTA should decline right here, however in a turbulent market atmosphere, I favor to solely make investments at the absolute best worth when shopping for micro-caps. Therefore, whereas Metalla stays excessive on my watchlist as a possible Purchase, I stay on the sidelines for now.