Baloncici

Pricey readers,

The problems for Telenor (OTCPK:TELNY) aren’t precisely new. Each time a conservative, incumbent telecommunications firm hinges its development on rising markets, even regardless of its dwelling markets being rock-solid, the share can encounter valuation difficulties when challenges in these rising markets come up.

Let me present you the the reason why Telenor is down fairly a bit – but additionally why I am not anxious within the least and have taken the possibility to essentially broaden my place to its 5% restrict, with a really enticing price foundation.

Telenor – Updating as a result of sub-110 NOK value

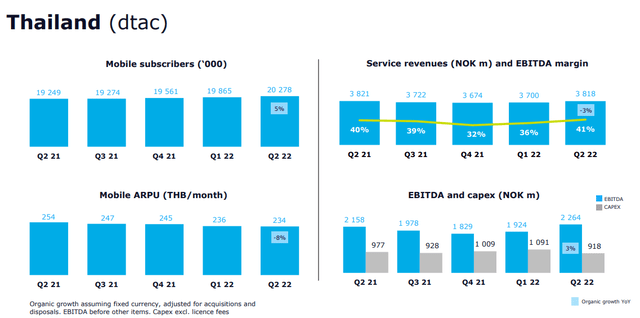

The previous few quarters for Telenor have proven a reasonably clear image of the general ebb and circulate of the corporate’s enterprise. Whereas total cellular efficiency was very strong, and the corporate’s investments are paying off, the corporate is seeing elevated competitors in rising markets – that means above all Thailand.

That is actually the core of the difficulty we’re seeing, and what different analysts are pointing to as a threat.

As a result of cellular service development and ARPU had been actually strong – in each dwelling nation (Scandinavia). The corporate can actually do little or no “higher” in these geographies. Regardless of the maturities of those markets, the corporate is basically seeing good outcomes right here, with round 0.5% natural development.

The corporate additionally noticed some readability in rising markets, within the type of a regulatory clearance for a merger in Malaysia.

Telenor IR (Telenor IR)

Copper networks are declining on the house entrance – however to weigh this up, the corporate is seeing basically replacements within the type of cellular development.

Inflation is a matter. The corporate is rising its vitality effectivity to offset among the prices right here, together with organizational modernization. However value mentioning right here, above all, is I imagine the execution on M&A’s in Asia. These are transferring ahead, and we are able to count on extra updates on the 3Q22 in about 4-5 weeks.

Telenor IR (Telenor IR)

Stability is, in any other case, the secret right here. Service income development is nice, with EBITDA steady regardless of a number of one-offs that drag issues down for the quarter. Internet earnings is impaired by a big place in Pakistan, however we nonetheless have practically a billion NOK value of free money circulate and CapEx beneath the 4Q21 stage of practically 6B. Leverage stays one of many lowest in your complete business, near 2x web debt/EBITDA.

The corporate’s outlook for 2022 stays strong and steady, anticipating low single-digit development with a CapEx of round 16-17% of gross sales. That is above the extent of Orange (ORAN), which I wrote about lately, however Orange is in a special place.

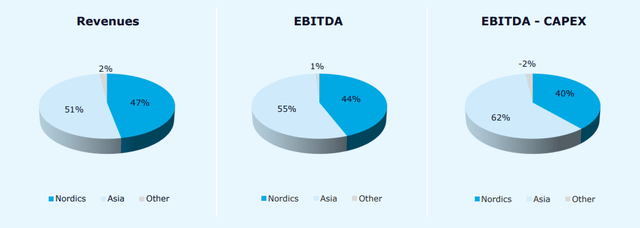

Even when the corporate has a “dwelling market”, the corporate’s development, revenues, and EBITDA tilt closely in the direction of its development areas.

Telenor IR (Telenor IR)

The house markets function a type of “security” for the corporate’s dividend and its primary enterprise, and as soon as these rising markets see among the anticipated pivot and efficiencies, now we have an organization that might develop considerably.

It is not as if rising market outcomes are unhealthy. Have a look.

Telenor IR (Telenor IR)

Even Malaysia and Bangladesh are exhibiting subscriber, ARPU, and income development. On a bunch stage, service income is up 3%, and EBITDA is up 1.2%. Regardless of this, we see the corporate declining to ranges not seen in just a few years. The corporate has no vital debt maturities in 2022 or 2023 and has low debt regardless. CapEx and different results, together with IFRS 16, have resulted in some ROCE reductions – from round 16% to round 12-13 – however there’s potential for enchancment right here.

The market is lacking a number of issues with the corporate, as I see it. Telenor is likely one of the best-rated Telcos in your complete market. Why? It is at an A-rating, and there are not any indicators that that is altering. Evaluate this to any of its telco friends within the EU and what they have been doing, and the corporate has saved steadily paying dividends. That is additionally why, even after this drop, I am considerably within the inexperienced on my funding.

This isn’t me saying the corporate doesn’t have dangers. It does – however these dangers are inherent to round 40% of its working income and EBITDA, associated to the geopolitical instability of its markets. The corporate needed to go away Myanmar, which resulted in a major loss beneath round $600 when accounting for the gross sales value. These geopolitical instabilities and uncertainties are a part of what drives the corporate’s valuation “story” right here – with FX as a result of FX losses can actually drive issues down as nicely.

Ultimately, my view is that this. I do not see the identical geopolitical dangers in Thailand, Bangladesh, Pakistan, and Malaysia that I see in Myanmar. In comparison with Myanmar, the opposite geographies are “extra steady” (I hesitate to make use of “steady” as a result of that is a bit far).

Nonetheless, traders want to contemplate this as a threat.

Nonetheless, in the long run, we’re a valuation for an A-rated European telco incumbent with enticing dwelling markets – even when there are dangers.

Let me present this to you.

Telenor Valuation

Regardless of the drop in valuation from round 120-125 NOK to a present of round 107 NOK, the corporate continues to offer a really enticing dividend and valuation case. There’s additionally a distinction now from after we take a look at the corporate in comparison with earlier than.

An organization like Telenor offers me with an excellent yield, throwing off hundreds of {dollars} yearly, and still have given me excellent capital appreciation. Tele2 (OTCPK:TLTZF) alone is up greater than 50% since I invested in it just a few years again. Telenor remains to be up – however not as a lot. I’ve, nevertheless, been investing extra and increasing my place.

I do not personal corporations like Tele2 and Telenor for supposed earnings or large quantities of income “development”. Nonetheless, on the present valuation, Telenor’s upside from 107 NOK is, based mostly on each development and reversal. Assuming even a below-GDP development of 1% in EBITDA and solely a 2% terminal development price per yr, in addition to a 1.2% CapEx development, the corporate, is available in at an implied EV of nicely over 250 NOK/share. This may increasingly sound ridiculous, as it might suggest an over 100% upside, but it surely’s as a result of firm’s massively low WACC as a consequence of a really low price of debt (low leverage), and its interesting dwelling areas, which basically throw off money like a bond proxy.

The corporate could be extra risky than your typical telco due to its Asian tasks, however the elementary substance of the corporate is past steady.

Most bigger Scandinavian banks, akin to DNB (OTCPK:DNBHF), have the corporate with PTs of at the least 145-150 NOK/Share for the native.

Telenor is A-rated however has used its money to drive for accretive M&As over the previous few years. A lot of what the corporate may ship over the following 5 years remains to be percolating, and traders ought to view an funding into Telenor as a mid-term funding on the very least – if not very long-term.

The yield is now over 8% – and it is well-covered. That places it on par with Orange, which is superb to me. The common for these friends across the EU is round 11-12X P/E with a 5.5X EBITDA and a 1.12X guide a number of, up to date for decrease valuations. Nonetheless, its large yield and now below-average P/E signifies that on a comp foundation, Telenor is a really buyable enterprise. As a result of firm’s dwelling geographies and strong histories, in addition to its credit standing, I proceed to assign a 5% premium to the general public comparisons for Telenor right here.

The corporate’s increased upside is primarily growth-driven, in addition to being one of many lower-traded telcos in a set of low-valued Telcos on the European market.

The seek for development in Asia continues – and matched with the house market power, I proceed to view the corporate with a really favorable eye when it comes to threat and development. I am snug assuming an annual income development pattern of at the least 1-2% per yr – that is what kinds the idea for my assumptions about Telenor – and is totally in keeping with present tendencies.

Telenor ASA has a valuation goal vary from S&P World of between 114 NOK and 175 NOK on the excessive finish. Neither of those valuation assumptions takes into consideration a full success of development in Asia, which might push the premium up above 230-250 NOK. The 114 NOK is basically assuming an entire failure in something however the dwelling market (and the corporate is at present buying and selling beneath this stage), whereas the 175 is a balanced method between development and legacy. Present averages are 145 NOK per share – and that is additionally the place most present analysts land.

Just one analyst lands even near the present firm share value, and even they are saying 110 NOK/share. The implied upside to present averages is round 33.1%. My price foundation is improved to beneath 120 NOK/share right now.

Asia is making most analysts extra cautious than I imagine they need to be given a budget value you are paying for a assured yield in a yield-starved, inflation-driven world, whereas on the similar time getting the potential for development from Asia.

I am recognizing the upper quantity of threat and reducing my PT by 5 NOK. That places me at 150 NOK/share.

Even assuming solely a post-pandemic reversal adopted by single-digit EPS will increase for the corporate, this could be based mostly on normalized 5-year P/E averages leading to an annual RoR of nicely over 15% till 2024. Sure, Asia and one-offs flip the corporate’s web earnings ranges/EPS into a reasonably lumpy affair, however as soon as this inventory grows, it has the potential to hit that 180 NOK mark, which might ship development of nicely above 25%. This a part of the thesis nonetheless holds loads of water, and that is why my thesis for the corporate nonetheless stands.

Thesis

My thesis for Telenor is as follows:

I view Telenor as one of many most secure telcos in all of Europe, based mostly on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Maybe Deutsche Telekom (OTCQX:DTEGY) could be as protected, however lower than half the present yield. Based mostly on this security and this yield in addition to this upside, I am marking this firm as a “BUY” and take into account it with a PT of 150 NOK/share. I imagine the fitting option to put money into the enterprise is native shares solely, not ADR’s. The native share trades on the Oslo Share alternate below image TEL.

Keep in mind, I am all about :1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is basically protected/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low cost. This firm has a sensible upside based mostly on earnings development or a number of growth/reversion.

Thanks for studying.