JHVEPhoto

Funding thesis: Now that the much-awaited price cuts have been confirmed to be within the pipeline, the implications for the markets have gotten more and more apparent. A full buying and selling week and we’re into the second for the reason that Jackson Gap assembly the place Federal Reserve Chair Jerome Powell introduced his intention to start out slicing charges and the market is basically flat. It exposes that the speed cuts and some other optimistic catalysts, actual or assumed, are priced into the market. With seemingly little upside potential whereas draw back dangers are plentiful, the ProShares Quick QQQ ETF (NYSEARCA:PSQ) trades inversely to the Nasdaq composite and is an effective candidate for traders to wager in opposition to the market. The Nasdaq is at present buying and selling at a big P/E ratio premium relative to the remainder of the market which makes it a major candidate to see a big draw back, throughout the context of a broad inventory market selloff which may be on the horizon. At this level, I’m searching for the Nasdaq composite index to take a run on the all-time highs set in the summertime earlier than I buy shares within the inverse ETF.

Concerning the PSQ ETF

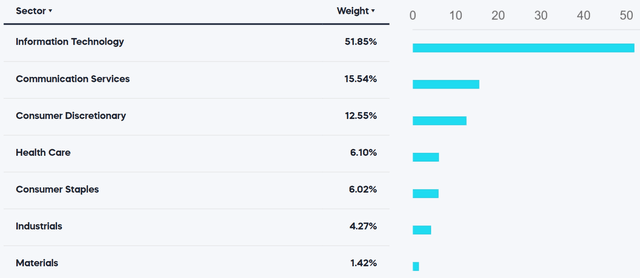

About half of the burden of the PSQ fund is comprised of knowledge tech firms. An additional 15% is made up of communication providers.

ProShares

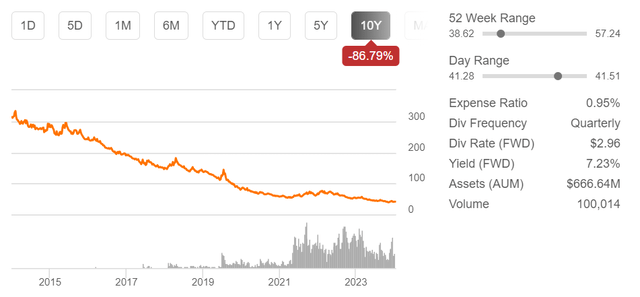

The fund’s expense ratio is 0.95%, making it pricier than the SPDN ETF (SPDN) I lately lined, which has an expense ratio of 0.58%. The PSQ ETF additionally pays an estimated ahead dividend of over 7%, which greater than covers the expense concerned, in addition to probably lowering the potential danger of loss, if the commerce doesn’t work out.

PSQ inventory worth and different metrics (Searching for Alpha)

Simply so one can get a way of what a long-term purchase & maintain place appears like on this ETF beneath regular market circumstances, I offered the 10-year share worth chart as a reference. Timing is essential to creating this a wager that pays. Because the chart reveals, there’s little room for error. If the funding thesis doesn’t work out in a matter of months, traders stand to lose cash, and the earlier one takes the loss the much less extreme the injury.

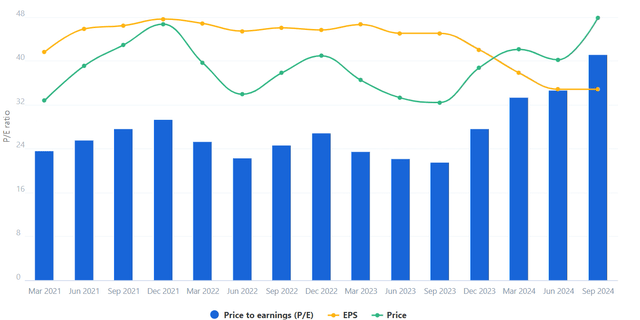

The ETF covers 102 firms, with a mean P/E ratio of about 35, which is barely decrease than the present P/E ratio of the NASDAQ composite. The ten-year common P/E ratio for the Nasdaq has been 29.

NASDAQ P/E ratio and different metrics (Full ratio)

The Nasdaq composite at present trades at a P/E ratio of about 41. The discrepancy within the P/E ratio of the ETF versus the Nasdaq index is a big element as a result of there’s a potential for the inverse ETF to not present a 100% proportional inverse consequence. Hypothetically, the PSQ ETF might present barely much less upside than the proportional downturn of the Nasdaq index, provided that the elements usually are not as overpriced on common as the general index.

Huge image elements related to the tech sector

The tech growth consequence situation is partially tied to AI progress expectations.

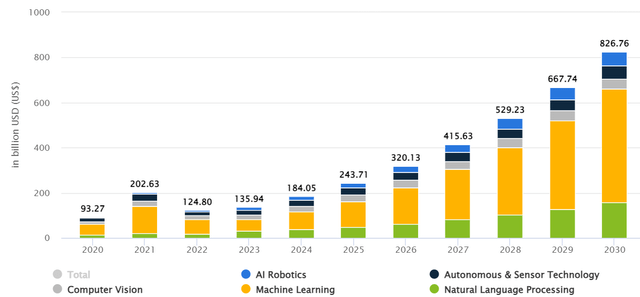

Except for ongoing expectations that the market has been patiently ready for, particularly for rates of interest to be lowered, one of many essential the explanation why the Nasdaq composite is buying and selling at such excessive valuation ranges is as a result of the AI pattern is seen as a big catalyst for tech progress.

AI market measurement (Statista)

The magnitude of the AI market’s potential progress might not seize its secondary impact as a broad driver of future tech gross sales progress for brand spanking new {hardware}, in addition to providers, generated or enhanced by AI. There isn’t a telling the way it will form the buyer & enterprise marketplace for know-how. There may be some pessimism about AI monetization, the place firms are investing in AI capacities, whilst there isn’t a clear path to monetizing these capacities.

My tackle the AI situation is that it’s a supply of nice uncertainty as a result of there isn’t a approach to predict the end result. There could also be many unexpected difficulties in monetizing it, subsequently sooner or later, it could result in a bubble bursting, much like the dot.com collapse at the start of the century. Or, it could result in progressive transformations in the way in which enterprise is performed, in ways in which we’re but to ascertain, which may result in a tech growth and in addition a brand new nice world financial growth.

Maybe one of many best impediments to the AI pattern turning into a transformational success story for the worldwide financial system is the chance that it turns into a instrument of affirmation bias, thus contributing little or no to innovation. As an illustration, Google’s AI experiment confirmed that the present perceptions of Google’s and society’s ideological tendencies ended up being mirrored again on the person, primarily based on the enter of the creators of the AI instrument. Past this apparent instance, there’s the chance that AI evaluation of any topic will find yourself being simply extra of the identical, together with efforts to provide AI-generated monetary evaluation, software program improvement, technical options, focused advertising, and different functions. Within the absence of the business with the ability to overcome this drawback, there’s the chance that AI use shall be very restricted when it comes to usefulness and never notably worthwhile to the end-consumer of the content material or service. If this seems to be the case, we may even see early indicators of funding in AI slowing down.

International tech cut up is perhaps a big danger issue.

On the flip of the century, the US & shut allies had a collective near-monopoly on high-tech. Tech manufacturing and providers migrated to locations like China & India. These rising financial powers had been nowhere close to the technological degree wanted to start out difficult the established tech ecosystem of the Western World. Many of the applied sciences they developed this century had been extremely depending on inputs sourced from Western firms. That each one modified with the China-2025 plan, meant to raise China out of its manufacturing function and convey it into the league of technological leaders. The initiative was launched a decade in the past and will be thought of the triggering occasion for the present tech warfare that threatens to separate the world into two or extra separate technological camps.

As issues stand, efforts to curb China’s technological rise appear to have principally failed. Huawei, the corporate that was most feared and sanctioned, is seemingly coming again stronger, with principally home Chinese language inputs driving its new merchandise that appear to be performant to the extent that they are often thought of to be enough alternate options to US & allied tech merchandise. Firms like Apple (AAPL) are already being negatively impacted with gross sales in China plunging attributable to Huawei’s competing merchandise coming into the market. It might be an early symptom of the unfavorable influence that this could have on most Western-based tech firms, the place they may more and more discover themselves outcompeted in markets around the globe.

A sluggish world financial system is bad for tech

Except for the urgent query that traders have to ask, whether or not an AI technological innovation has the potential to be transformative or not, there’s the problem of a slowing world financial system, which places into query whether or not technological progress will be supported by way of market adoption of recent applied sciences. The expansion/innovation correlation will be offered as a classical hen or egg dilemma. It’s thought that technological innovation can drive financial progress. The issue is that if there’s already a sluggish financial system, technological innovation might have a tough time being monetized and employed, particularly on the enterprise degree, the place a scarcity of financial progress can result in spending cutbacks, which are likely to impede the dissemination of recent applied sciences.

The worldwide financial system faces many challenges, starting from client demand points to financial, geopolitical, and arguably inner political frictions that may all play a detrimental function in financial progress. As I identified many instances in earlier articles, there’s additionally an opportunity that The upcoming price cuts mustn’t essentially be seen as an instantaneous financial booster. Firms & shoppers alike might select to make use of any rate of interest aid to shore up their funds after taking up vital debt fairly than increase spending. Some information factors, resembling job openings level to an already slowing financial system.

There are additionally different potential financial headwinds, resembling a potential shortfall in world oil provides that OPEC’s information & forecast appears to be pointing at. It believes that we had been already in a 1.5 mb/d shortfall state of affairs within the second quarter of the yr, and it sees strong demand progress in coming months. It must be famous that the IEA doesn’t share OPEC’s view. It sees plentiful provides and weak demand. The market at present acts in settlement with the IEA, however that might change if OPEC seems to be right. If OPEC seems to be right, we’re in all probability taking a look at an imminent recession, as quickly because the market catches on and an oil worth spike happens.

Funding implications:

As I identified in a current article, I lately began a place within the SPDN ETF (SPDN), which offers traders with an inverse share worth motion to the S&P 500. I’m holding off on PSQ as a result of I imagine there would possibly nonetheless be a big leg up for the tech-heavy Nasdaq index.

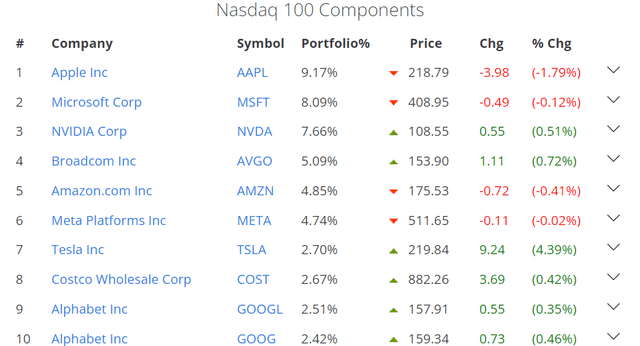

Slickcharts.com

The highest holdings of the index are usually on the must-own lists of most traders, so any pullbacks in these shares shall be adopted by consumers coming in, which may create upward momentum for some months to return.

Having mentioned that, there’s at all times a danger that the market won’t observe this sample and as an alternative, downward momentum will construct on itself, and an incredible re-balancing of the Index’s P/E again to extra cheap ranges will happen. In any case, the present P/E ratio within the 41 vary is considerably larger than it was throughout most years of the near-zero rate of interest interval post-2009. It’s troublesome subsequently to make a rational argument in favor of the index buying and selling at present valuation ranges. The markets are likely to stray from being rational infrequently after which collectively traders transfer again towards a extra rational place, which is often triggered by a actuality examine occasion. The danger to my present maintain place is that the market would possibly transfer again towards the rationality sooner than anticipated.

Dangers related to investing in leveraged ETFs.

As I already lined intimately, leveraged & inverse ETFs resembling this one are more than likely destined to steadily lose share worth as time goes on. The U.S. Securities & Change Fee offers an incredible rationalization for traders, detailing the dangers related to holding such ETF shares in a single’s portfolio for any timeframe longer than a day. I encourage everybody to take a minute and skim the paragraph that explains the chance. It ought to maybe assist as an instance why I’m not choosing an inverse & leveraged ETF concurrently. Constancy has a really detailed rationalization of the advantages/dangers related particularly with leveraged ETFs. The mixed options would make the crucial of getting the timing issue proper too distinguished for my liking.

Ready for a transfer again towards all-time highs.

Although there’s a potential danger of lacking out on betting in opposition to what’s arguably a closely overbought market, I intend to attend it out for the Nasdaq index to maneuver again towards its all-time excessive set in the summertime, about 1,200 factors above present ranges. I in all probability won’t anticipate the all-time excessive to be surpassed, however get inside a couple of share factors of it. At that time, I intend to construct a modest place within the PSQ ETF, maintaining in thoughts the chance/reward implications. A well-timed commerce would possibly deliver short-term returns within the 20%-30% vary, relying on how vital a selloff shall be. If the selloff doesn’t happen in a well timed method, time won’t be on the facet of the investor on this one. The earlier one cuts losses, the much less extreme the injury shall be to at least one’s funding. Timing is of the essence with this explicit inverse ETF, and the chance of lacking out doesn’t outweigh the chance of timing it mistaken, and subsequently I intend to attend it out just a bit longer.