littleclie

By Peter Vanden Houte

No Olympic medal for trade

After an OK-ish second quarter, the place GDP progress got here in at 0.3% quarter-on-quarter, information for the third is blended at greatest. Judging by sentiment indicators, the Olympic Video games had a small optimistic impact in France in August. This, along with a robust tourism season in Spain and Italy, lifted companies sentiment in the entire of the eurozone.

Nevertheless, it could be untimely to label this as the beginning of a progress tempo acceleration. The manufacturing sector stays within the doldrums, with the stock correction continuing at a snail’s tempo, and the order books evaluation stays at a depressed degree. The German Ifo indicator declined for the third month in a row in August. The truth that even Volkswagen is now contemplating closing factories in Germany is testimony to the persevering with trade rout.

Winter weak spot appears probably

We’re sceptical that the eurozone financial system will speed up within the second half. We’re forecasting a deceleration in US progress, and home demand in China stays below stress, so European exports are unlikely to be a robust progress driver. Low capability utilisation in trade and weak credit score demand should not heralding a robust pick-up in enterprise funding both.

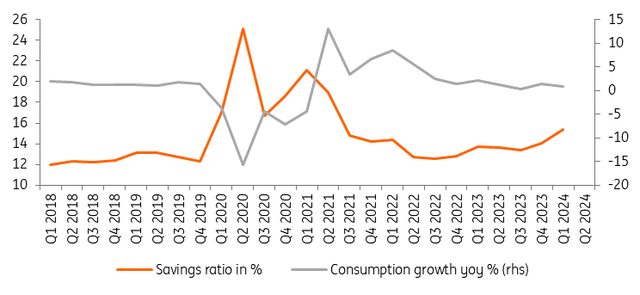

Whereas households are actually having fun with actual wage progress, labour market expectations within the shopper survey have been softening since April. This would possibly lead to the next financial savings ratio than an acceleration of consumption expenditure. All of this leads us to imagine that the eurozone financial system will proceed to develop, however at a slower tempo. That doesn’t take away the hopes for an acceleration from the second half of 2025 onwards. However on the again of weak winter quarters, it appears sensible to downgrade subsequent 12 months’s GDP progress to 0.9%, after 0.7% this 12 months.

A rising financial savings fee is constraining consumption progress

Supply: LSEG Datastream

Core inflation is coming down

HICP inflation fell to 2.2% in August, with core inflation declining to 2.8%. That mentioned, companies worth inflation reaccelerated to 4.2%. That is prone to be a brief impact, additionally as a result of Olympics. Certainly, trying on the promoting worth expectations within the companies sector, which has been a dependable main indicator, companies worth inflation is prone to fall under 3.5% by the primary quarter of subsequent 12 months.

Whereas wage progress stays fairly excessive, particularly in Germany, the European Central Financial institution thinks that is non permanent due to one-off funds. Wage progress is predicted to fall again to 2.5% in the middle of 2025. The underside line is that inflationary pressures are softening, although headline inflation would possibly nonetheless present some volatility over the approaching quarters.

ECB stepping up easing tempo in subsequent 12 months

On the one hand, the ECB appears to have gained confidence in its forecasts of gradual disinflation. However on the opposite, there may be nonetheless the concern that easing financial coverage too quickly would possibly push inflation expectations up once more. As Isabel Schnabel just lately said: “Central banks should not abandon disinflationary insurance policies too early”. So, we nonetheless count on the ECB to tread cautiously within the brief run.

We preserve our forecasts of 25bp fee cuts each in September and December. On the again of the weaker progress outlook, we now imagine that the ECB will step up the tempo of easing thereafter, slicing charges by 50bp in each the primary and the second quarters of 2025. As soon as the “impartial” degree of two.25% has been reached, the deposit fee is predicted to stay at that degree for fairly a while.

Content material Disclaimer

This publication has been ready by ING solely for info functions regardless of a selected consumer’s means, monetary scenario or funding aims. The knowledge doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Publish