Up to date on July thirty first, 2024 by Bob Ciura

Excessive dividend shares means extra revenue for each greenback invested. All different issues equal, the upper the dividend yield, the higher.

On this analysis report, we analyze 20 shares buying and selling under $10.00 per share and providing excessive dividend yields of 5.0% and higher. These shares are ranked based mostly on their dividend yield, from highest to lowest.

On this article, we’ll talk about the prospects of 20 shares which are buying and selling under $10 and are providing a dividend yield above 5.0%. We’ve ranked these shares based mostly on their dividend yield, from highest to lowest.

Moreover, the free excessive dividend shares record spreadsheet under has our full record of particular person securities (shares, REITs, MLPs, and many others.) with with 5%+ dividend yields.

Hold studying to see evaluation on these 20 high-yielding securities buying and selling under $10.00 per share.

Desk of Contents

Low-Priced Excessive Dividend Inventory #1: TriplePoint Enterprise BDC (TPVG) – Dividend Yield of 17.9%

TriplePoint Enterprise Development BDC Corp focuses on offering capital and guiding corporations throughout their personal progress stage, earlier than they finally IPO to the general public markets.

Supply: Investor Presentation

On Could 1st, 2024, the corporate posted its Q1 outcomes. For the quarter, complete funding revenue of $29.3 million in comparison with $33.6 million in Q1-2023.

The lower in complete funding was primarily on account of a decrease weighted common principal quantity excellent on the BDC’s income-bearing debt funding portfolio. The variety of portfolio corporations fell from 59 final yr to 49.

The corporate’s weighted common annualized portfolio yield got here in at 15.4% for the quarter, up from 14.7% within the prior-year interval.

Additionally throughout Q1, the corporate funded $13.5 million in debt investments to a few portfolio corporations with a 14.3% weighted common annualized yield at origination.

Click on right here to obtain our most up-to-date Positive Evaluation report on TPVG (preview of web page 1 of three proven under):

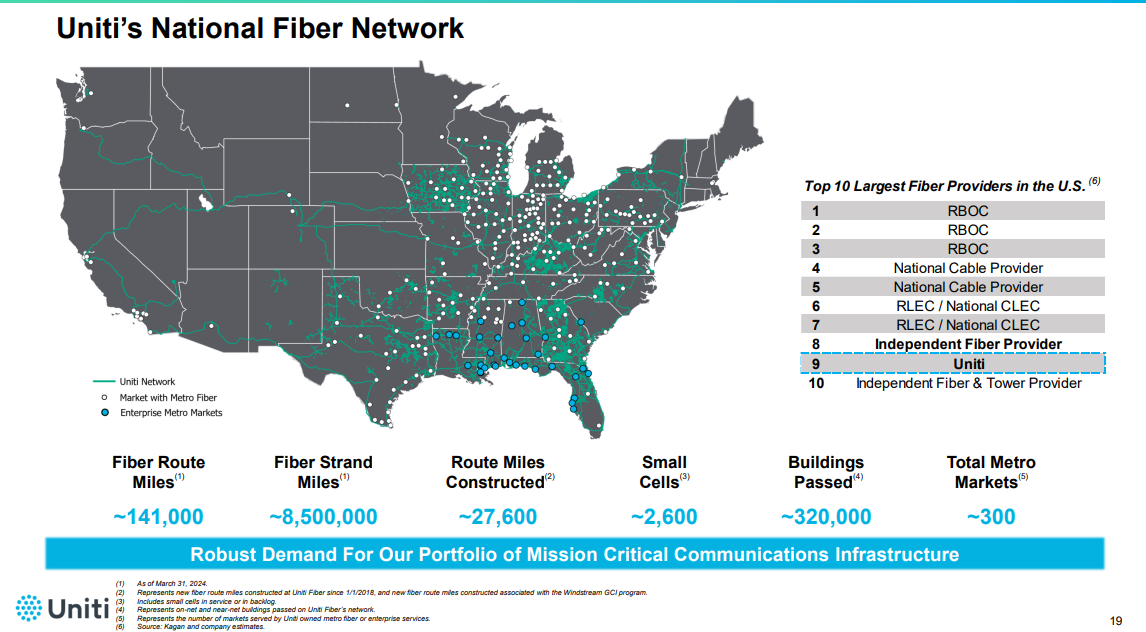

Low-Priced Excessive Dividend Inventory #2: Orchid Island Capital (ORC) – Dividend Yield of 17.6%

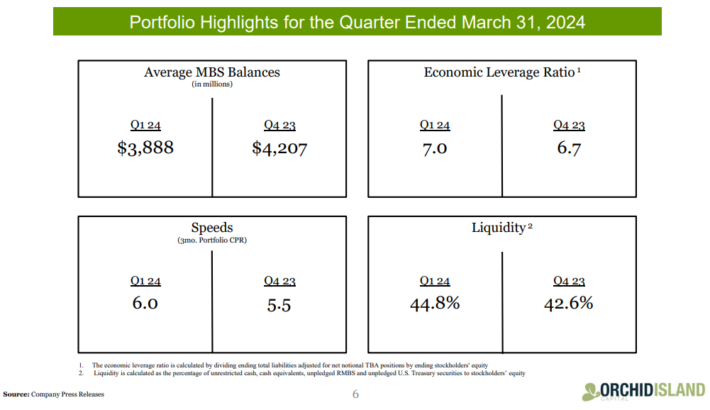

Orchid Island Capital, Inc. is a mortgage REIT that invests in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money move based mostly on residential loans corresponding to mortgages, subprime, and home-equity loans.

Supply: Investor Presentation

Orchid Island reported its first-quarter 2024 outcomes, revealing a web revenue of $19.8 million, equal to $0.38 per frequent share. This determine contains web curiosity expense of $2.5 million, or $0.05 per frequent share, and complete bills of $3.7 million, or $0.07 per frequent share.

The corporate recorded web realized and unrealized good points of $26.0 million, or $0.50 per frequent share, on RMBS and by-product devices, inclusive of web curiosity revenue on rate of interest swaps.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

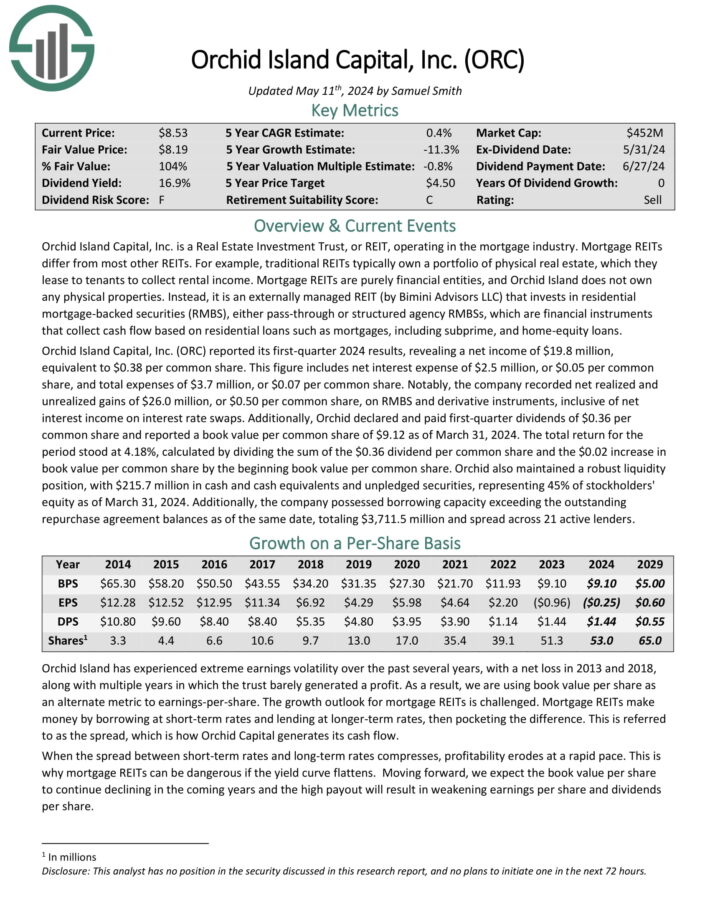

Low-Priced Excessive Dividend Inventory #3: Uniti Group (UNIT) – Dividend Yield of 16.2%

Uniti Group focuses on buying, setting up, and leasing out communications infrastructure in the US.

Particularly, it owns thousands and thousands of miles of fiber strand together with different communications actual property.

Supply: Investor Presentation

Uniti Group reported stable outcomes for the primary quarter of 2024, with consolidated revenues reaching $286.4 million. Web revenue stood at $41.3 million, and adjusted EBITDA amounted to $228.6 million, attaining adjusted EBITDA margins of roughly 80%. The core recurring strategic fiber enterprise grew by 4% in comparison with the identical interval in 2023.

Uniti Fiber contributed $68.8 million in revenues and $23.8 million in Adjusted EBITDA for the quarter, whereas Uniti Leasing contributed $217.6 million in revenues and $210.7 million in Adjusted EBITDA.

Click on right here to obtain our most up-to-date Positive Evaluation report on UNIT (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #4: Oxford Sq. Capital (OXSQ) – Dividend Yield of 14.0%

Oxford Sq. Capital Corp. is a BDC specializing in financing early and center–stage companies via loans and CLOs.

The firm holds an equally break up portfolio of First–Lien, Second–Lien, and CLO fairness assets unfold throughout a number of industries, with the best publicity in software program and enterprise companies.

Supply: Investor Presentation

On Could 2nd, 2024, Oxford Sq. reported its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, the corporate generated roughly $10.7 million of complete funding revenue, down from $12.3 million within the earlier quarter.

The weighted common money distribution yield of its money revenue producing CLO fairness investments at present additionally rose sequentially from 13.6% to 13.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #5: Ellington Credit score Co. (EARN) – Dividend Yield of 14.6%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On Could 14th, 2024, Ellington Residential reported its first quarter outcomes for the interval ending March thirty first, 2024. The corporate generated web revenue of $4.0 million, or $0.20 per share.

Ellington achieved adjusted distributable earnings of $5.3 million within the quarter, resulting in adjusted earnings of $0.27 per share, which lined the dividend paid within the interval. Ellington’s web curiosity margin was 3.03% general.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

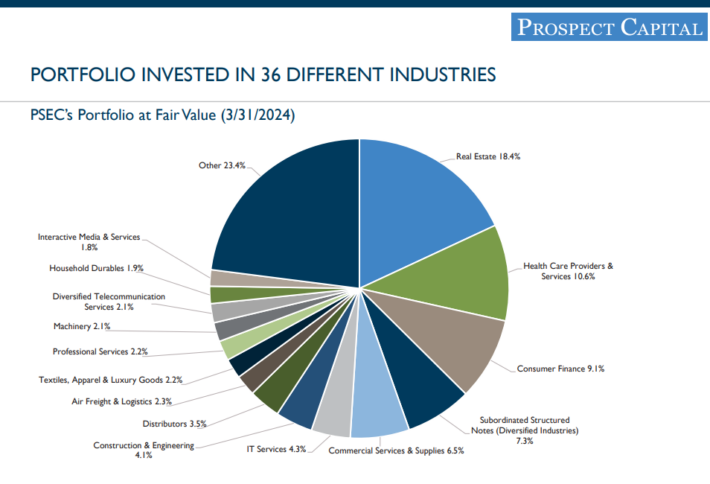

Low-Priced Excessive Dividend Inventory #6: Prospect Capital Company (PSEC) – Dividend Yield of 13.2%

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives personal debt and personal fairness to center–market corporations within the U.S.

The corporate focuses on direct lending to proprietor–operated corporations, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Supply: Investor Presentation

Prospect posted third quarter earnings on Could eighth, 2024. Web funding revenue got here to $94.4 million, off from just below $97 million within the December quarter, and down from $102.2 million a yr in the past.

As a proportion of complete web funding revenue, curiosity revenue was 91%, barely decrease than prior quarters.

On a per-share foundation, NII got here to 23 cents, down from 24 cents within the December quarter, and down from 26 cents within the March interval a yr in the past.

NAV declined from $9.48 within the March quarter final yr to $8.99, however up barely from $8.92 within the December quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

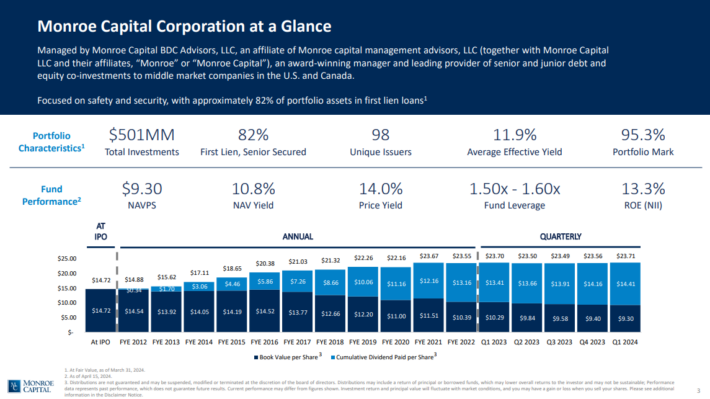

Low-Priced Excessive Dividend Inventory #7: Monroe Capital Corp. (MRCC) – Dividend Yield of 12.8%

Monroe Capital Company supplies financing options primarily to decrease middle-market corporations in the US and Canada.

The corporate primarily invests in senior and “unitranche” secured loans ranging between $2.0 million and $25.0 million every. It generates practically $57 million yearly in complete funding revenue.

Supply: Investor Presentation

On Could eighth, 2024, Monroe Capital Company reported its Q1 outcomes. Complete funding revenue for the quarter got here in at $15.2 million, in comparison with $15.5 million within the earlier quarter.

The weighted common portfolio yield fell through the quarter, from 12.1% to 11.9%, although it remained moderately excessive because of an elevated rates of interest atmosphere.

A barely larger variety of portfolio corporations, which grew from 96 to 98 additionally impacted complete funding revenue. Web funding revenue per share got here in at $0.25, secure from final quarter’s $0.25.

Click on right here to obtain our most up-to-date Positive Evaluation report on MRCC (preview of web page 1 of three proven under):

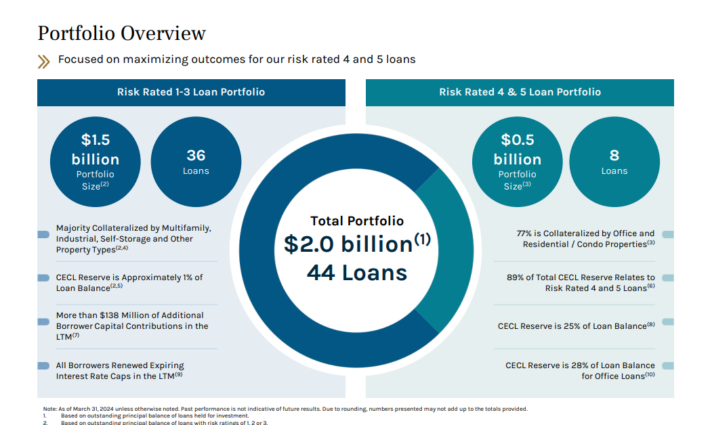

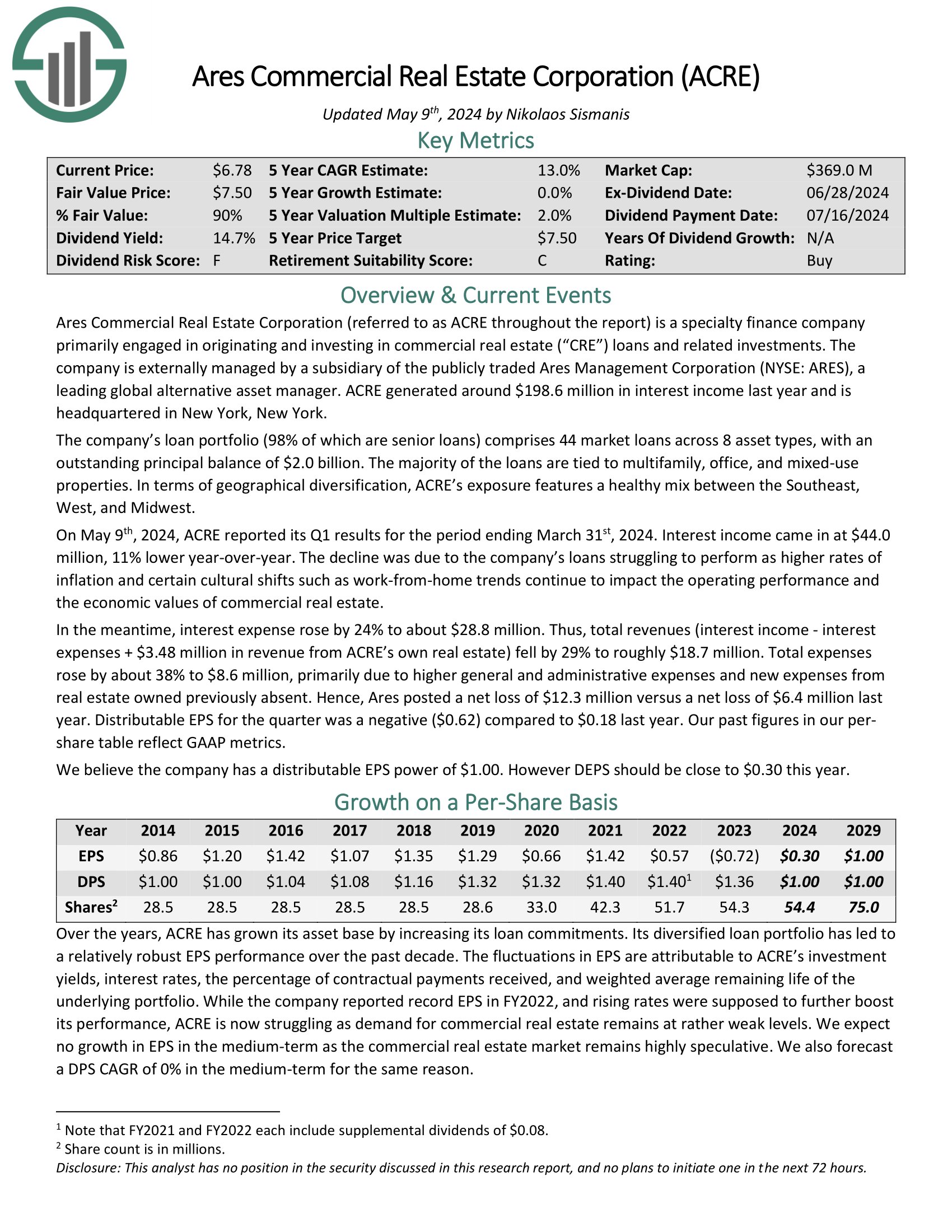

Low-Priced Excessive Dividend Inventory #8: Ares Industrial Actual Property Company (ACRE) – Dividend Yield of 12.8%

Ares Industrial Actual Property Company is a specialty finance firm primarily engaged in originating and investing in business actual property (“CRE”) loans and associated investments. ACRE generated round $198.6 million in curiosity revenue final yr.

The corporate’s mortgage portfolio (98% of that are senior loans) includes 44 market loans throughout 8 asset sorts, with an excellent principal steadiness of $2 billion. Nearly all of the loans are tied to multifamily, workplace, and mixed-use properties.

Supply: Investor Presentation

When it comes to geographical diversification, ACRE’s publicity encompasses a wholesome combine between the Southeast, West, and Midwest.

On Could ninth, 2024, ACRE reported its Q1 outcomes for the interval ending March thirty first, 2024. Curiosity revenue got here in at $44.0 million, 11% decrease year-over-year.

The decline was because of the firm’s loans struggling to carry out as larger charges of inflation and sure cultural shifts corresponding to work-from-home developments proceed to affect the working efficiency and the financial values of economic actual property.

Click on right here to obtain our most up-to-date Positive Evaluation report on ACRE (preview of web page 1 of three proven under):

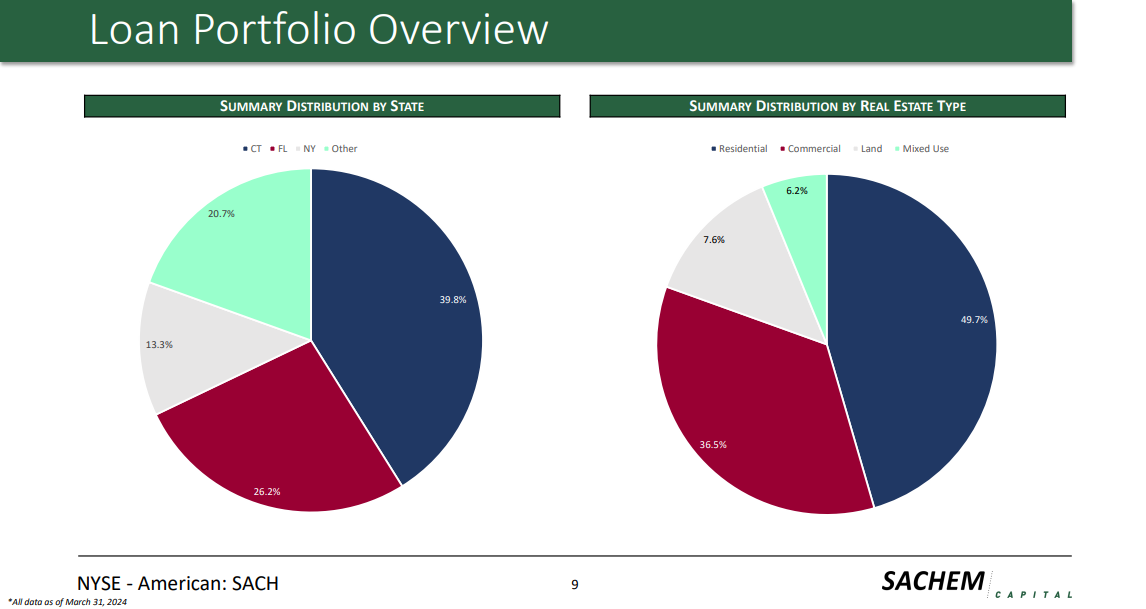

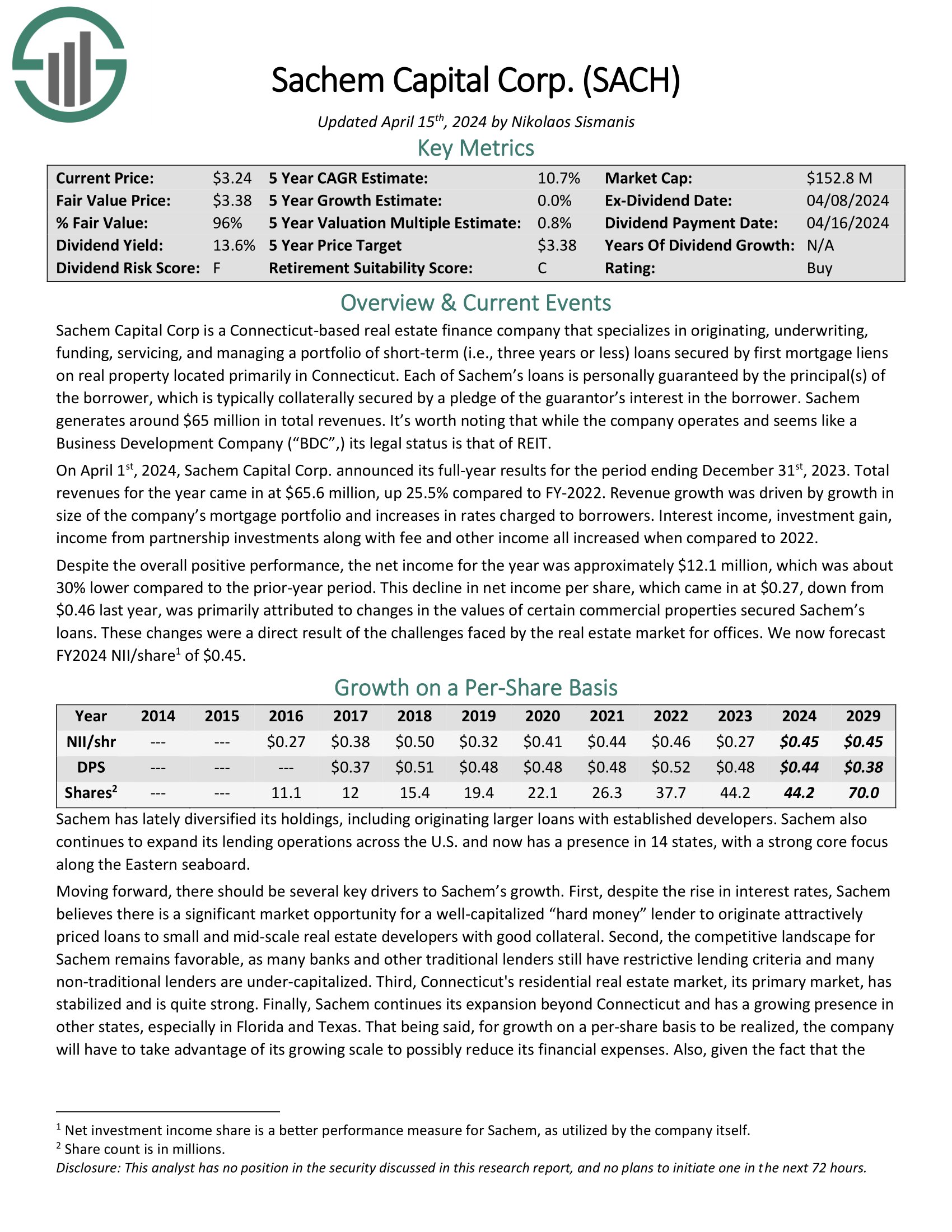

Low-Priced Excessive Dividend Inventory #9: Sachem Capital (SACH) – Dividend Yield of 12.5%

Sachem Capital Corp is a Connecticut-based actual property finance firm that makes a speciality of originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or much less) loans secured by first mortgage liens on actual property positioned primarily in Connecticut.

Every of Sachem’s loans is personally assured by the principal(s) of the borrower, which is often collaterally secured by a pledge of the guarantor’s curiosity within the borrower. Sachem generates round $65 million in complete revenues.

Supply: Investor Presentation

On April 1st, 2024, Sachem Capital Corp. introduced its full-year outcomes for the interval ending December thirty first, 2023. Complete revenues for the yr got here in at $65.6 million, up 25.5% in comparison with FY-2022.

Income progress was pushed by progress in dimension of the corporate’s mortgage portfolio and will increase in charges charged to debtors.

Click on right here to obtain our most up-to-date Positive Evaluation report on SACH (preview of web page 1 of three proven under):

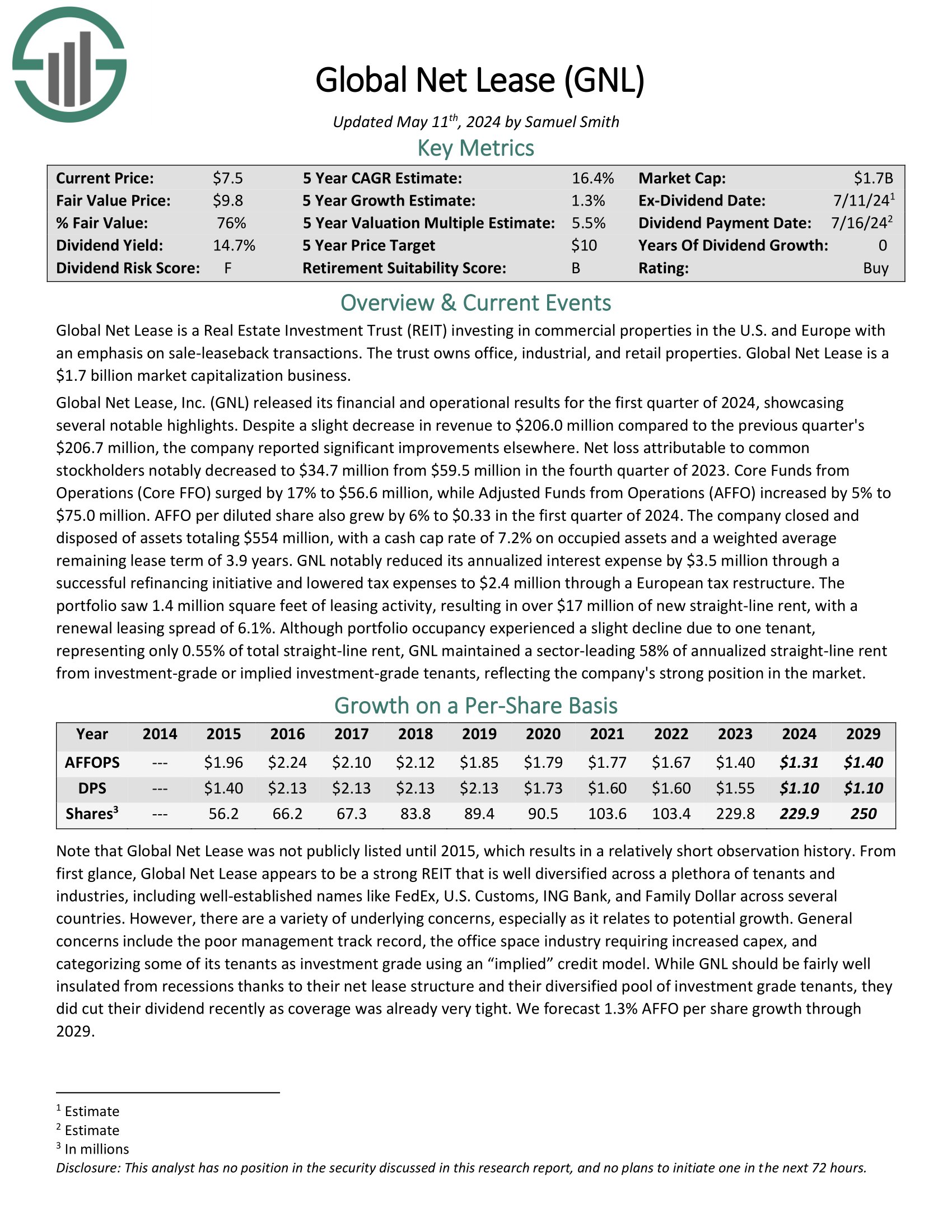

Low-Priced Excessive Dividend Inventory #10: World Web Lease (GNL) – Dividend Yield of 12.4%

World Web Lease invests in business properties within the U.S. and Europe with an emphasis on sale-leaseback transactions. GNL’s portfolio contains over 1300 properties, spanning practically 67 million sq. toes with a gross asset worth of $9.2 billion.

World Web Lease launched its monetary and operational outcomes for the primary quarter of 2024, showcasing a number of notable highlights. Regardless of a slight lower in income to $206.0 million in comparison with the earlier quarter’s $206.7 million, the corporate reported vital enhancements elsewhere.

Web loss attributable to frequent stockholders notably decreased to $34.7 million from $59.5 million within the fourth quarter of 2023.

Core Funds from Operations (Core FFO) surged by 17% to $56.6 million, whereas Adjusted Funds from Operations (AFFO) elevated by 5% to $75.0 million. AFFO per diluted share additionally grew by 6% to $0.33 within the first quarter of 2024.

The corporate closed and disposed of property totaling $554 million, with a money cap charge of seven.2% on occupied property and a weighted common remaining lease time period of three.9 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on World Web Lease (GNL) (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #11: New York Mortgage Belief (NYMT) – Dividend Yield of 12.1%

New York Mortgage Belief is a REIT that acquires, invests in, funds, and manages mortgage-related property and different monetary property. The belief doesn’t personal bodily actual property, however moderately seeks to handle a portfolio of investments which are actual property associated.

New York Mortgage Belief derives income from web curiosity revenue and web realized capital good points from its funding portfolio. The belief primarily seeks to generate curiosity revenue from mortgage-related property, but it surely additionally owns some distressed monetary property the place it seeks to seize capital good points.

The belief invests in residential mortgage loans, multi-family CMBS, most popular fairness, and three way partnership fairness.

New York Mortgage Belief posted first quarter earnings on Could 1st, 2024, and outcomes had been fairly weak. Earnings-per-share got here to a lack of 75 cents, which was a staggering 89 cents off from expectations. Income was basically flat at $17.9 million, however missed by nearly $5 million.

The belief’s common incomes property yield is now simply 6.38%, that means the belief is struggling to even cowl its value of capital, which is crimping its means to generate earnings. Certainly, web curiosity unfold was simply 1.31% within the first quarter given strikes in market rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on NYMT (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #12: Medical Properties Belief (MPW) – Dividend Yield of 12.0%

Medical Properties Belief is the one pure-play hospital REIT as we speak. It owns a portfolio of over 400 properties that are leased to over 30 totally different operators.

Nearly all of the property are common acute care hospitals, but in addition embody inpatient rehabilitation and long-term acute care.

The portfolio of property can also be diversified throughout totally different geographies with properties in 29 states, in addition to Germany, the UK, Italy, and Australia.

Supply: Investor Presentation

Medical Properties Belief, Inc. (MPW) introduced its monetary and operational outcomes for the primary quarter. The corporate executed complete liquidity transactions of $1.6 billion year-to-date, reaching 80% of its preliminary FY 2024 goal.

Regardless of recording a web lack of ($1.23) per share and Normalized Funds from Operations (NFFO) of $0.24 per share within the first quarter of 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPW (preview of web page 1 of three proven under):

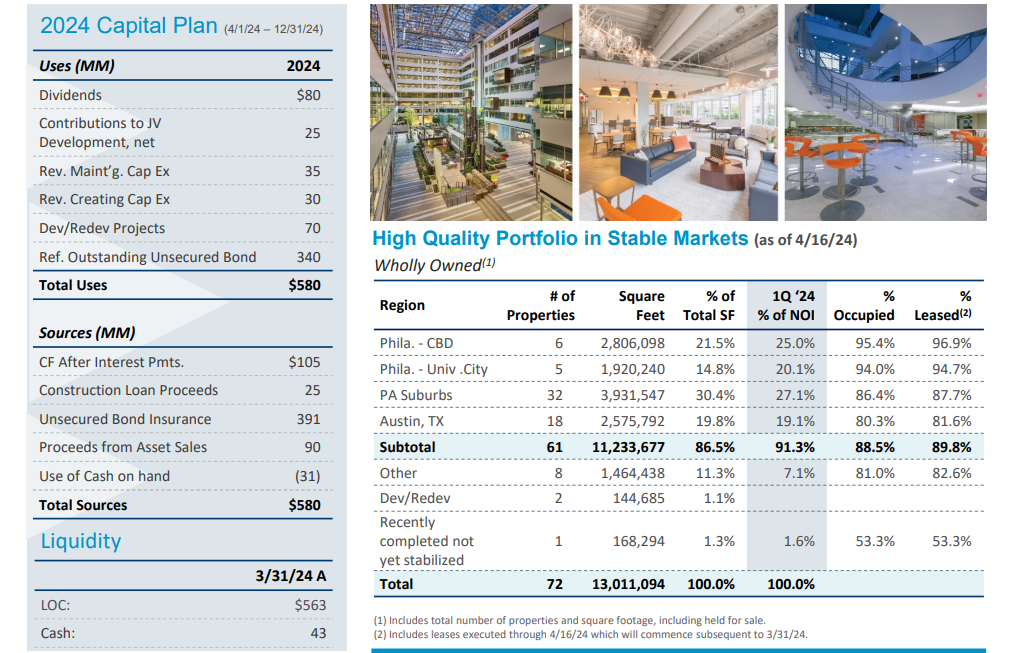

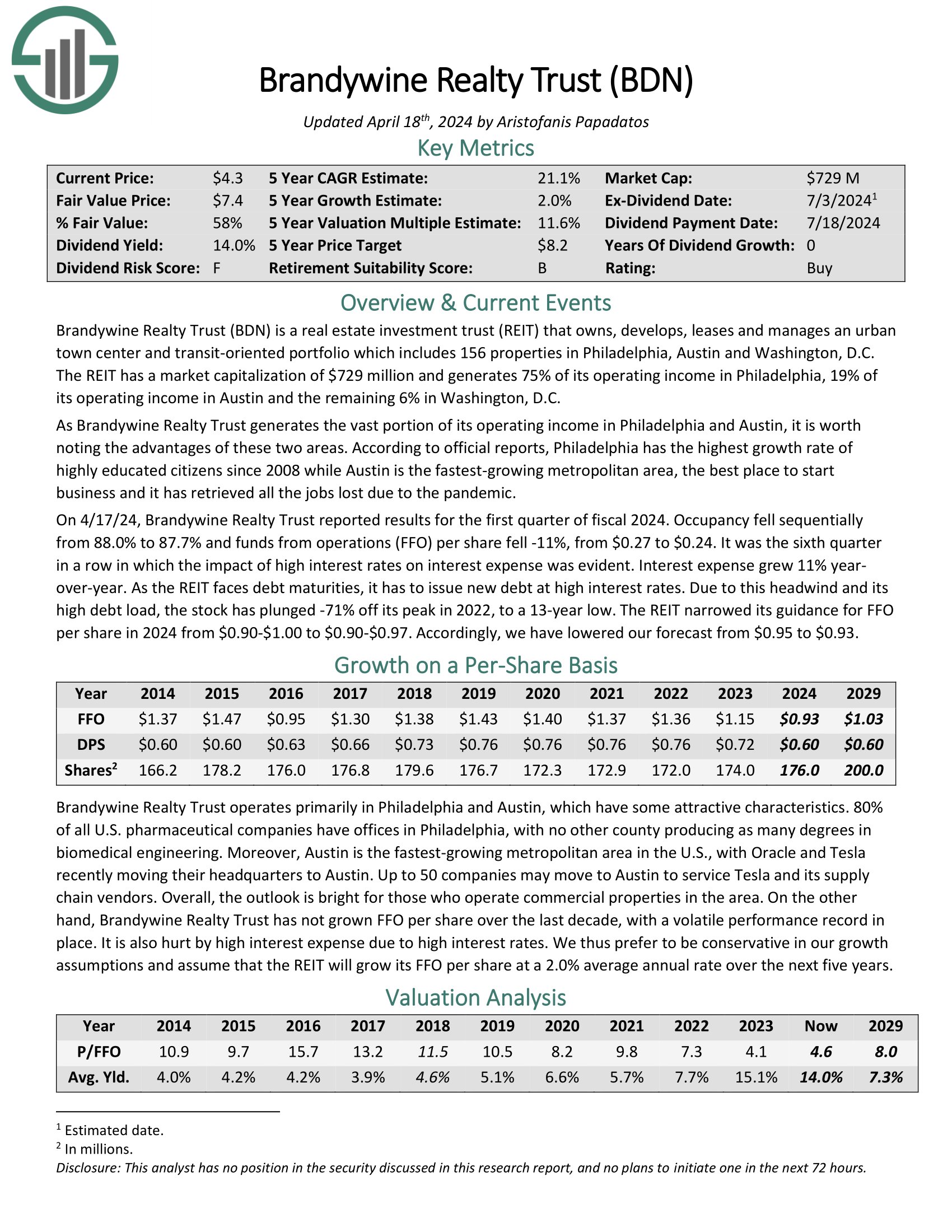

Low-Priced Excessive Dividend Inventory #13: Brandywine Realty Belief (BDN) – Dividend Yield of 11.8%

Brandywine Realty owns, develops, leases and manages an city city heart and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin, and different cities.

The REIT generates most of its working revenue in Pennsylvania, with the rest in Austin, TX and numerous different markets.

Supply: Investor Presentation

On 4/17/24, Brandywine Realty Belief reported outcomes for the primary quarter of fiscal 2024. Occupancy fell sequentially from 88.0% to 87.7% and funds from operations (FFO) per share fell -11%, from $0.27 to $0.24.

It was the sixth quarter in a row by which the affect of excessive rates of interest on curiosity expense was evident. Curiosity expense grew 11% year-over-year. Because the REIT faces debt maturities, it has to subject new debt at excessive rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on BDN (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #14: Vodafone Group plc (VOD) – Dividend Yield of 10.5%

Vodafone Group started operations in 1984 as an early supplier of cellular phone service within the UK. At the moment, the corporate is likely one of the world’s largest cellular communications suppliers, serving greater than 650 million prospects in 26 international locations.

Its immense scale and attain are evident in its ~$47 billion in annual income. Vodafone is listed in each London and New York; we’ll be referring to the New York-listed ADR on this report and all financials will likely be introduced in U.S. {dollars}.

Vodafone posted fourth quarter and full-year earnings on Could 14th, 2024, and outcomes had been considerably weak. The corporate posted adjusted earnings-per-share of eight cents for the fourth quarter, whereas full-year earnings got here to 81 cents per share. Income was off 2.5% year-over-year to $39.8 billion in This autumn.

Adjusted free money move fell 37.2% to $2.8 billion for the yr, which fell from $4.5 billion in fiscal 2023. Adjusted EBITDAaL, which is a professional forma revenue measure Vodafone tracks, was up 2.2% on an natural foundation nearly as good service income progress was partially offset by larger power prices.

Click on right here to obtain our most up-to-date Positive Evaluation report on Vodafone (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #15: Fortitude Gold Corp. (FTCO) – Dividend Yield of 10.5%

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions. The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or higher.

Its property portfolio at present consists of 100% possession in six high-grade gold properties. All six properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt.

Supply: Investor Presentation

On Could seventh, 2024, Fortitude Gold posted its Q1 outcomes. For the quarter, income got here in at $8.2 million, 62% decrease in comparison with final yr. The decline in income was pushed by a 65% drop in ounces of gold bought.

Nonetheless, a 19% improve in ounces of silver bought, mixed with 10% larger gold and a pair of% larger silver costs, barely offset this setback.

The corporate recorded a mine gross revenue of $4.2 million in comparison with $12.3 million final yr on account of decrease web gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven under):

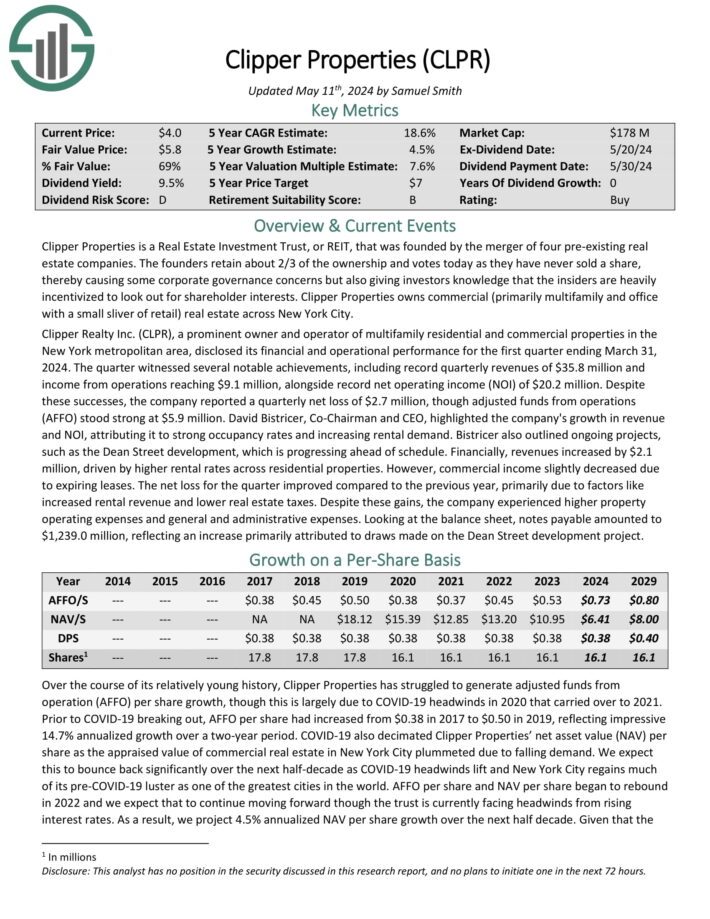

Low-Priced Excessive Dividend Inventory #16: Clipper Realty (CLPR) – Dividend Yield of 9.6%

Clipper Properties owns business (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

For the primary quarter ending March 31, 2024, CLPR reported report quarterly income of $35.8 million and revenue from operations reaching $9.1 million, alongside report web working revenue (NOI) of $20.2 million.

Regardless of this, the corporate reported a quarterly web lack of $2.7 million, although adjusted funds from operations (AFFO) stood robust at $5.9 million.

Income elevated by $2.1 million, pushed by larger rental charges throughout residential properties. Nonetheless, business revenue barely decreased on account of expiring leases.

The online loss for the quarter improved in comparison with the earlier yr, primarily on account of components like elevated rental income and decrease actual property taxes.

Click on right here to obtain our most up-to-date Positive Evaluation report on CLPR (preview of web page 1 of three proven under):

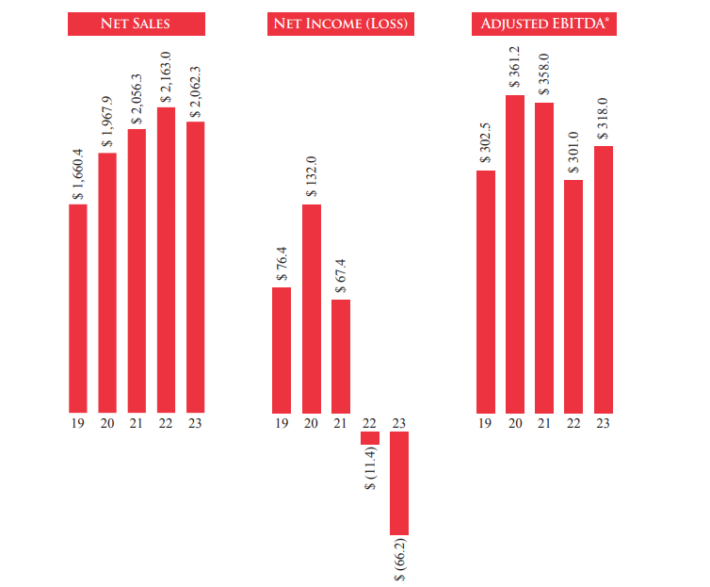

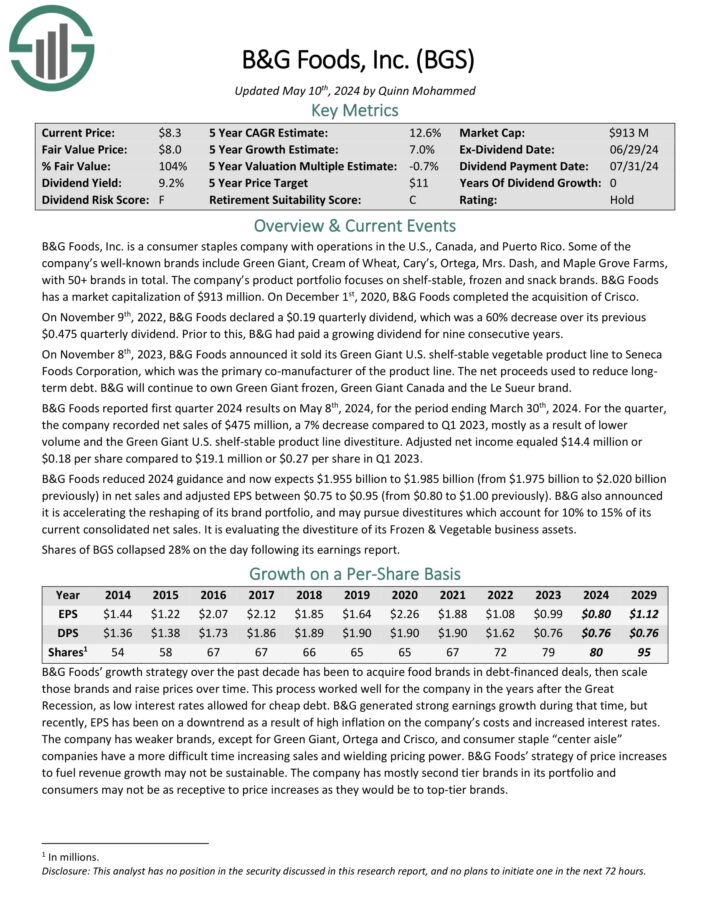

Low-Priced Excessive Dividend Inventory #17: B&G Meals (BGS) – Dividend Yield of 8.8%

B&G Meals was created within the late Nineties with the preliminary objective of buying Bloch & Guggenheimer, who bought pickles, relish, and condiments. Bloch was based in 1889. Final yr, the corporate had simply over $2 billion in gross sales.

A number of the firm’s well-known manufacturers embody Inexperienced Large, Ortega, Cream of Wheat, Mrs. Sprint, and Again to Nature, with over 50 manufacturers in complete. The product portfolio focuses on shelf-stable, frozen and snack manufacturers.

You’ll be able to see a picture of the corporate’s five-year monetary efficiency under:

Supply: 2023 Annual Report

B&G Meals reported first-quarter 2024 outcomes on Could eighth, 2024. Quarterly income of $475 million declined 7% year-over-year, due principally to decrease quantity and the divestiture of the Inexperienced Large U.S. shelf-stable product line.

Adjusted earnings-per-share declined 33% year-over-year, to $0.18 per share.

B&G Meals additionally decreased 2024 steering, and now expects web gross sales in a variety of $1.955 billion to $1.985 billion (from $1.975 billion to $2.020 billion beforehand), and adjusted EPS between $0.75 to $0.95 (from $0.80 to $1.00 beforehand).

Click on right here to obtain our most up-to-date Positive Evaluation report on BGS (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #18: World Medical REIT (GMRE) – Dividend Yield of 8.8%

World Medical REIT Inc. is a net-lease medical workplace REIT that acquires specialised healthcare services, which it leases to nationwide healthcare techniques and industry-leading doctor teams. Its portfolio consists of gross investments in actual property price round $1.4 billion.

They comprise 185 services with an mixture of 4.7 million leasable sq. toes (LSF) and an mixture of $114.9 million price of annualized base lease. Round 68% of the REIT’s LSF comprises Medical Workplace Buildings (MOB), 19% Inpatient Rehab Services (IRF), 4% surgical services, whereas the remaining 9% homes different specialised services.

On Could seventh, 2024, World Medical reported its Q1 outcomes for the interval ending March thirty first, 2024. Revenues got here in at practically $35.1 million, a 3.1% decline year-over-year.

The decline displays the corporate’s property tendencies accomplished through the first 9 months of 2023. AFFO fell by 3.1% to $16.5 million on account of decrease revenues regardless of decrease curiosity bills because of deleveraging. On a per-share foundation, AFFO got here in a single cent decrease, at $0.22.

Click on right here to obtain our most up-to-date Positive Evaluation report on World Medical REIT (GMRE) (preview of web page 1 of three proven under):

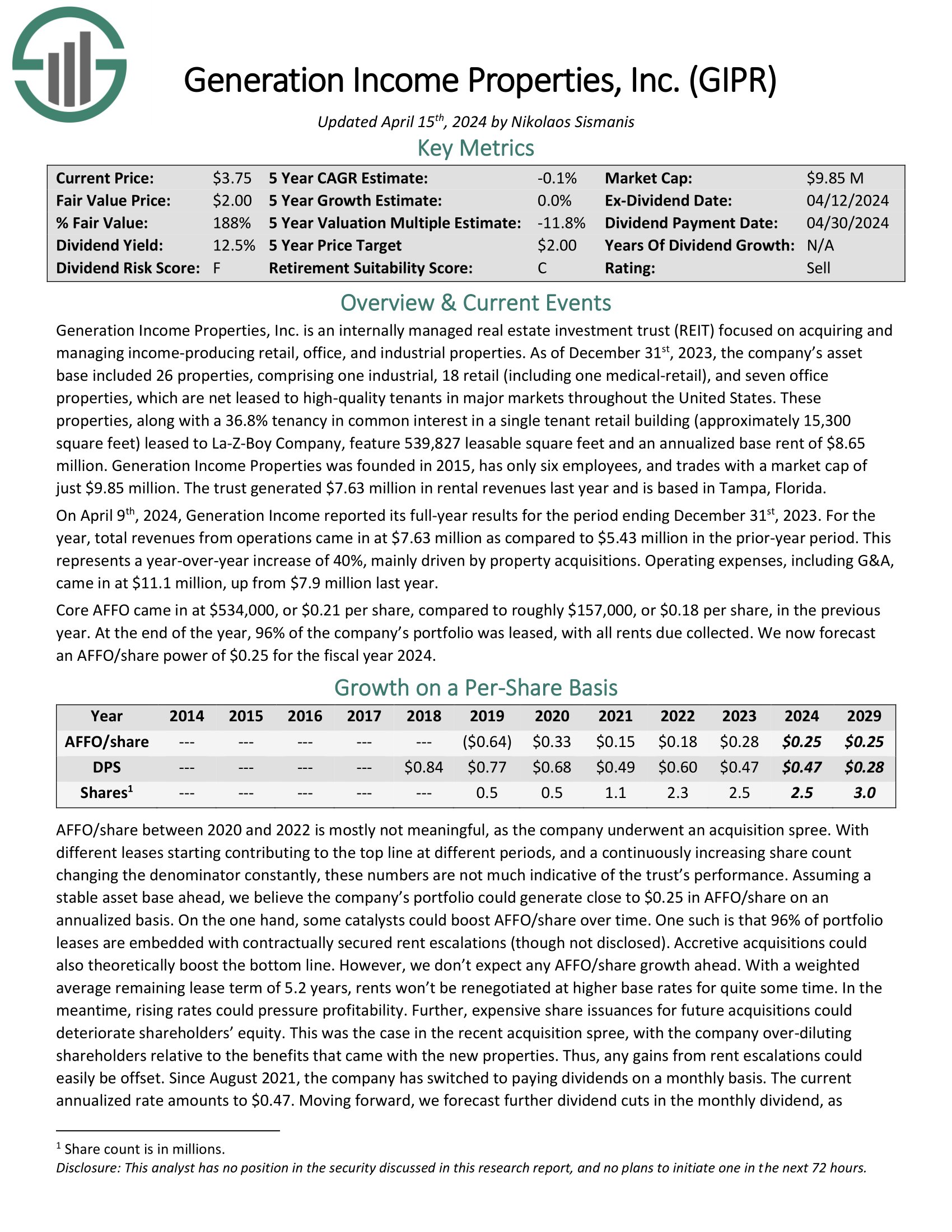

Low-Priced Excessive Dividend Inventory #19: Era Earnings Properties (GIPR) – Dividend Yield of 8.2%

Era Earnings Properties, Inc. is an internally managed REIT targeted on buying and managing income-producing retail, workplace, and industrial properties.

On the finish of the yr, 96% of the corporate’s portfolio was leased, with all rents due collected.

On April ninth, 2024, Era Earnings reported its full-year outcomes for the interval ending December thirty first, 2023. For the yr, complete revenues from operations got here in at $7.63 million as in comparison with $5.43 million within the prior-year interval.

This represents a year-over-year improve of 40%, primarily pushed by property acquisitions. Working bills, together with G&A, got here in at $11.1 million, up from $7.9 million final yr.

Core AFFO got here in at $534,000, or $0.21 per share, in comparison with roughly $157,000, or $0.18 per share, within the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIPR (preview of web page 1 of three proven under):

Low-Priced Excessive Dividend Inventory #20: Itau Unibanco (ITUB) – Dividend Yield of 8.2%

Itaú Unibanco Holding S.A. is a financial institution headquartered in Sao Paulo, Brazil. The financial institution has operations throughout South America and different locations like the US, Portugal, Switzerland, China, Japan, and many others.

On Could sixth, 2024, Itaú Unibanco reported first-quarter outcomes for 2023. The corporate showcased vital monetary progress, with a recurring managerial outcome totaling $1.9 billion, marking a notable 15.8% improve in comparison with the earlier yr. This surge was supported by an annualized recurring managerial return on common fairness of 21.9%.

Key drivers behind these spectacular outcomes included an augmented monetary margin with purchasers, attributed to a bigger mortgage portfolio and improved margins on liabilities, in addition to elevated commissions, charges, and earnings from insurance coverage operations.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven under):

Ultimate Ideas

When a inventory presents an exceptionally excessive dividend yield, it normally indicators that its dividend is on the danger of being lower. This rule actually applies to many of the above shares.

Nonetheless, among the above shares are extremely enticing now due to their low cost valuation and still-high yield even after a possible affordable dividend lower.

If you’re curious about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].