Lya_Cattel/E+ by way of Getty Photos

Synopsis

Amcor plc (NYSE:AMCR) is a world chief within the manufacturing and creating of accountable packaging merchandise. They’ve a powerful dedication in the direction of sustainability. In 2018, they grew to become the primary packaging agency to pledge that each one of their packaging could be recyclable, compostable, and reusable by 2025. Via the primary half of the 12 months, they’ve been experiencing weaker quantity arising from destocking and weaker market demand. Moreover, the EU’s advancing laws on plastics might doubtlessly pose a major problem to the packaging trade, as they impose stringent laws and standards for product packaging. Given the blended outlook, I’m recommending a maintain ranking for AMCR.

Historic Monetary Evaluation

Creator’s Chart Creator’s Chart

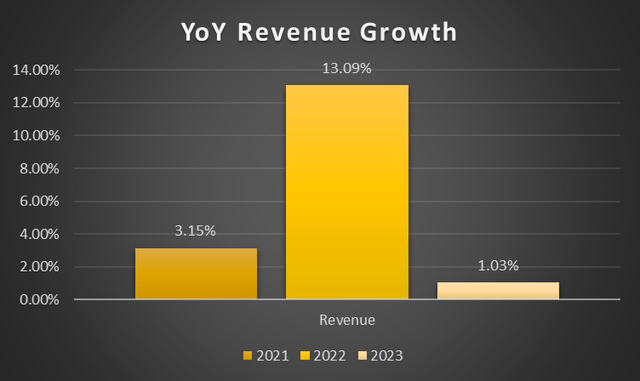

AMCR’s year-over-year income progress has fluctuated over the previous few years, with the strongest progress of 13.09% in FY2022. In FY2022, internet gross sales have elevated by $1.683 billion, or 13.09%. This contains the worth improve of ~$1.530 billion, passing down increased uncooked materials prices. For FY2023, internet gross sales have been barely up by 1% because of unfavourable foreign money impression and a worth improve of ~$775 million. Quantity has fallen 3% decrease as in comparison with FY2022. In North America, volumes have been higher in healthcare, pet care, house, and private care classes. It’s offset by decrease volumes in packaging for condiments, meat, and prepared meals. Europe has additionally seen low single digit progress, offset by weaker volumes in espresso, house, and private care segments. Stronger volumes within the pet care and pharmaceutical segments partially offset this.

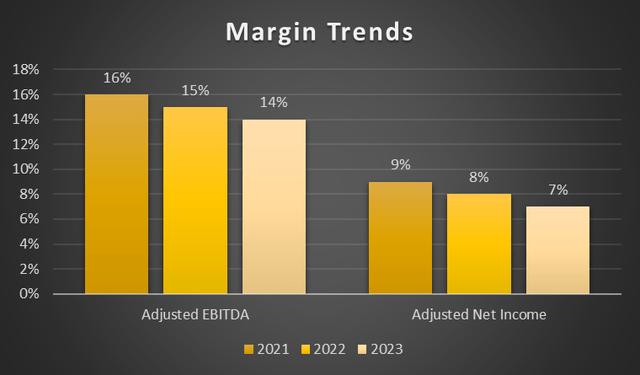

Shifting onto its profitability margins, they’ve been declining however modestly. FY2023’s adjusted EBITDA margin is down barely to 14% from 15% in FY2022, whereas its adjusted internet earnings margin is all the way down to 7% from 8% in FY2022. GAAP’s internet earnings would come with a $215 million acquire from promoting its enterprise in Russia. The explanation behind the margin contraction in FY2023 was as a result of inflation and growing uncooked materials prices.

Third Quarter 2024 Earnings Evaluation

In 3Q24, quantity and internet gross sales have fallen. Web gross sales fell 7% 12 months over 12 months, with a 6.8% decline in versatile packaging and a 7.6% decline in inflexible packaging. On a comparable fixed foreign money base, internet gross sales are 6% decrease year-over-year. Destocking within the healthcare section and the North American beverage section are the explanations for the weak point in quantity. Administration has identified that weaker efficiency is because of destocking and weak client demand.

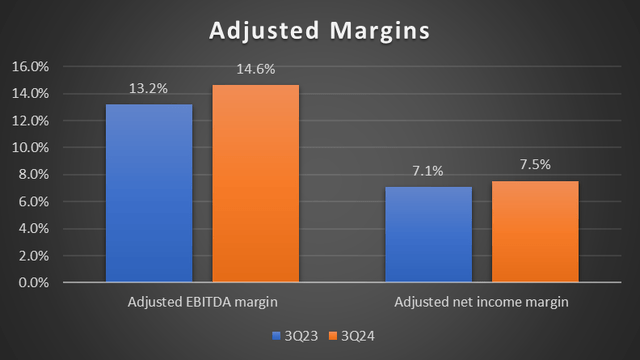

Shifting onto adjusted margins, each its adjusted EBITDA margin and adjusted internet earnings margin expanded year-over-year. AMCR’s adjusted EBITDA margin expanded from 13.2% to 14.6% whereas its adjusted internet earnings margin elevated from 7.1% to 7.5%. The explanation behind the enlargement was attributed to restructuring initiatives’ advantages and value efficiency, which improved AMCR’s working leverage.

Alternatively, internet earnings is up by 5.6% 12 months over 12 months. Administration has reaffirmed their steerage vary for adjusted free money movement of $850 million to $950 million for FY2024. They’ve additionally raised their adjusted EPS steerage from $0.67 – $0.71 to $0.685 – $0.71, anticipating additional momentum for the upcoming quarter.

Creator’s Chart

Enterprise Overview

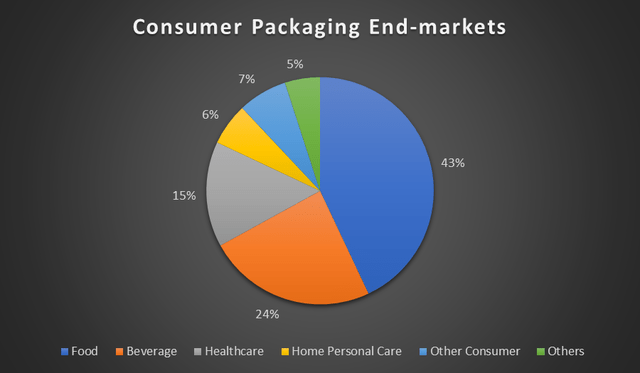

AMCR is a world chief within the packaging trade for meals, drinks, healthcare, private care, and lots of others. With two reportable segments underneath Flexibles and Inflexible Packaging segments. Flexibles accounts for ~76% of FY2023 internet income, whereas Inflexible Packaging section accounts for the remaining ~24%. AMCR is significantly one of many largest producers of plastics, aluminium and fibre-based versatile packaging. With a number of client packaging end-markets starting from meals and drinks to healthcare and residential private care, AMCR’s gross sales are considerably numerous.

Creator’s Chart

Destocking Eases however Continues to Linger in Healthcare Trade

In AMCR’s versatile section, it might have been optimistic this quarter if not for its healthcare product efficiency. The important thing motive for its weak point lies primarily in destocking within the healthcare end-market, which has been lingering from 2Q24 to 3Q24. Just like its earlier quarter, general healthcare volumes have been down double-digits. The destocking persists in North America and Europe, leading to weaker demand for healthcare merchandise. Administration is anticipating this non permanent headwind to increase into 1Q25 earlier than its healthcare section quantity begins stabilising.

Packaging Regulation within the EU

With the European Parliament advancing on the Packaging and Packaging Waste Regulation [PPWR], AMCR has proven help of such modifications to the regulation. The regulatory framework goals to lower the quantity of packaging and restrict particular varieties. Suppliers would wish to adjust to strict necessities in order that packaging is minimised and recyclable. This might pose a major problem for AMCR, as new laws typically necessitate strict disclosures and practices, doubtlessly resulting in increased prices and affecting the European packaging trade. Varied packaging could be required to satisfy sure standards, akin to recyclability, use of recycled content material, and others.

Nevertheless, the administration seems to be welcoming these necessities, as they’ve ongoing initiatives in place to make sure the sustainability of packaging. They’ve reiterated their dedication to make 100% of its product portfolio recyclable, reusable, or compostable by 2025. By 2030, they’ve deliberate to attain 30% use of recycled content material. It is a chance for AMCR to bolster and lead the trade on sustainability.

Relative Valuation Mannequin

Creator’s Relative Valuation

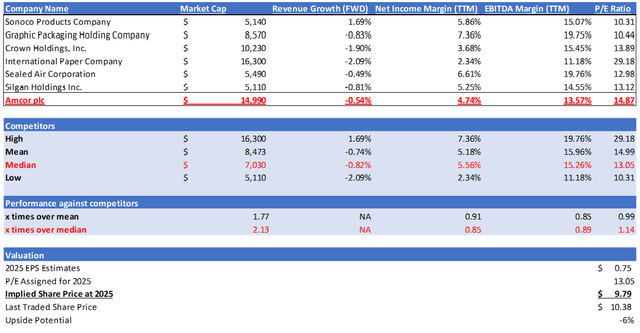

In my relative valuation mannequin, I might be evaluating AMCR with an inventory of friends within the extremely aggressive packaging trade, as proven above, when it comes to its progress outlook and profitability margins. Beginning with progress outlook, AMCR has a ahead income progress charge of -0.54%, which outperforms its friends’ median of -0.82%. General, the packaging trade’s outlook seems to be weak, with most of its friends indicating a destructive ahead income progress charge. For context, AMCR is experiencing weaker client demand and chronic destocking.

AMCR’s profitability margin barely underperformed its friends’ median when it comes to internet earnings margin TTM and EBITDA margin TTM. AMCR reported a internet earnings margin TTM of 4.74% and an EBITDA margin TTM of 13.57%, that are 0.85x and 0.89x of the friends’ median, respectively.

AMCR’s ahead non-GAAP P/E ratio is at present buying and selling at 14.87x, which is increased than the friends’ median of 13.05x. For context, it’s buying and selling beneath its 5-year common of 17.49x. Given its blended efficiency in opposition to its friends, I argue it is truthful for AMCR to be buying and selling at its friends’ median of 13.05x relatively than increased.

For 2024, the market income estimate for AMCR is $13.75 billion, whereas EPS is $0.70. For 2025, the income estimate is $14.31 billion, whereas EPS is $0.75. Given the administration steerage for FY2024 in addition to my forward-looking evaluation as mentioned, they help the market’s estimate. Subsequently, by making use of my 2025 goal P/E for AMCR to its 2025 EPS estimate, my 2025 goal share worth is $9.79.

Dangers & Conclusions

I’d give AMCR a maintain ranking in the intervening time, as they’ve underperformed barely in opposition to their friends. Weaker quantity because of destocking and weaker client demand could be a short lived headwind for now. AMCR has reaffirmed their dedication to sustainability and ESG practices by actively taking part in varied initiatives to make sure sustainability in packaging. With elevated scrutiny and laws on the packaging trade, AMCR could be well-prepared and have the potential to be the trade chief on sustainability in the long term.