RiverNorthPhotography

Thesis

As traders proceed to navigate this AI-driven market the place fundamentals appear to take a backseat, many high-quality compounders stay underappreciated and missed. Not often does a possibility come up to buy dividend aristocrats buying and selling at 60-cent greenback invoice valuations. For value-oriented traders, there is no higher state of affairs than nearly all of market contributors turning a blind eye to the “boring” compounders whereas they quietly place themselves for long-term progress.

This distinctive, generational dynamic has allowed a best-of-breed firm like Sysco (NYSE:SYY) to slide below the radar. With three consecutive quarters of top-line misses, underwhelming investor day steering, and fears of a client slowdown creeping in, traders have written Sysco off for lifeless. Nonetheless, whereas traders proceed to view Sysco via the lens of a “present me story,” they proceed to develop their aggressive benefits and are poised to capitalize on a number of secular tendencies. For these in a position to see the forest via the bushes, Sysco seems to be a golden alternative.

Aggressive Benefits

As beforehand talked about, I take into account Sysco as a best-of-breed firm within the meals distribution sector. The pure follow-up query is, why? To start out, Sysco is the world’s international meals service chief, offering a variety of meals and non-food merchandise to eating places, healthcare and training amenities, and authorities organizations. The meals distribution {industry}, although not flashy, is an plain necessity and can stay in excessive demand so long as folks proceed to eat. This elementary and irreplaceable nature is a key attribute that I search for in new funding alternatives.

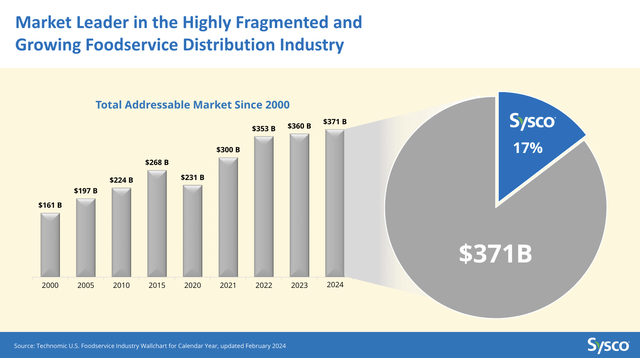

Along with benefiting from an irreplaceable product, Sysco additionally leverages its in depth economies of scale to widen the moat additional. The meals service distribution {industry}, valued at $371 billion, is very fragmented and is one the place measurement and scale are important.

Sysco Investor Relations

The sector is dominated by the “Massive 3” —Sysco, US Meals (NYSE:USFD), and Efficiency Meals Group (NYSE:PFGC)—holding roughly 40% of the market, with smaller regional distributors controlling the remaining 60%. Sysco instructions a whopping 17% market share, dwarfing its opponents as they’re double the dimensions of US Meals and 25% bigger than Efficiency Meals Group.

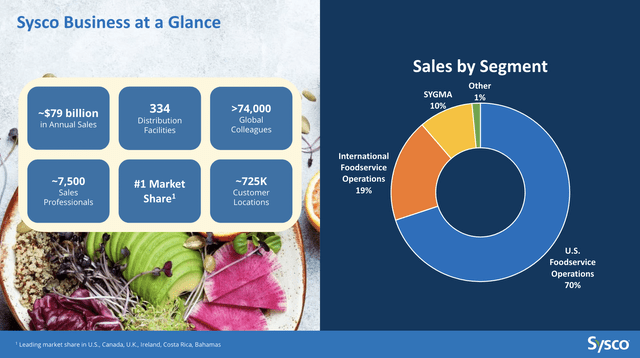

Because the Q3 earnings name highlighted, all three {industry} giants proceed to outpace broader market progress. It was no coincidence that every “Massive 3” member attributed this outperformance to benefits achieved via measurement and scale. Sysco is the largest beneficiary of those scale-related benefits, working a worldwide community of 334 distribution amenities and boasting a workforce of over 74,000.

Sysco Investor Relations

Compared, Efficiency operates 78 amenities and US Meals operates 70 amenities, figures not even within the ballpark vary of Sysco. This extremely environment friendly, scaled community of amenities offers Sysco a big edge because it ensures shut proximity to the large buyer base of 725,000. This proximity results in sooner, cheaper supply occasions; a bonus opponents wrestle to copy and a key driver of incremental market share good points.

These scale benefits lengthen far past distribution and logistics, inflicting a big ripple impact on buying energy and different scale-enabled price benefits. By buying meals merchandise from hundreds of suppliers and in volumes that no current firm matches, Sysco advantages from having the bottom procurement prices within the {industry}.

This benefit was lately highlighted through the Q3 earnings name, significantly concerning commodity merchandise. Whereas opponents grapple with immediately’s extremely aggressive, price-sensitive market, Sysco has turned the atmosphere to its benefit. By having the most cost effective commodity procurement prices, Sysco has strategically priced its merchandise on the best charges. This strategy has enabled Sysco to realize incremental market share whereas sustaining industry-leading gross margins of 18.6%, in comparison with Efficiency’s 11.3% and U.S. Meals’s 16.7%.

The M&A Revival

The realm the place I really feel Sysco’s potential is most missed lies in its key monetary benefits amidst a possible resurgence in mergers and acquisitions (M&A) throughout the {industry}. All through its historical past, Sysco has leveraged M&A because the cornerstone of its progress technique, evidenced by the 200 strategic offers since its inception. Administration has persistently demonstrated distinctive capital allocation expertise, pushed by having 33% of their compensation linked to the three-year common Return on Invested Capital (ROIC). This compensation plan ensures administration’s incentives are correctly aligned with maximizing shareholder worth, contributing to Sysco’s industry-leading 16.4% ROIC.

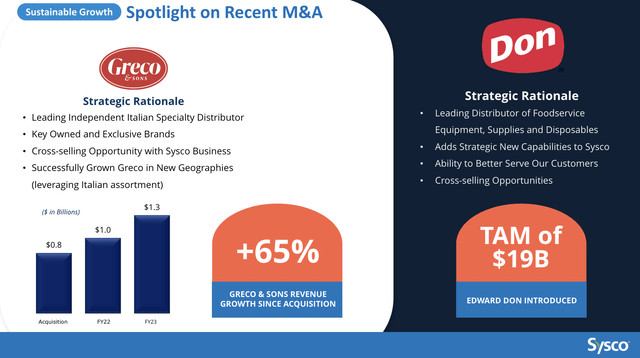

Sysco’s observe report in M&A is kind of spectacular, highlighted by profitable offers equivalent to Greco & Sons and Edward Don. Since buying Greco & Sons in 2021, revenues have surged over 65% from $800 million to $1.3 billion.

Sysco Investor Relations

This growth into the upper margin, speciality Italian market has allowed Sysco to capitalize on cross promoting alternatives and develop into new geographical markets. The 2023 acquisition of Edward Don, the main meals service tools distributor with $1.3 billion in annual gross sales, has considerably expanded Sysco’s Whole Addressable Market (TAM) by over $19 billion. This acquisition considerably elevated Sysco’s footprint in tools and provides, opening the door for cross-selling potential amongst massive Edward Don prospects who at the moment don’t use Sysco’s meals distribution providers.

I imagine we’re on the cusp of a resurgence in M&A exercise, particularly throughout the meals distribution sector. As beforehand famous, smaller distributors, who at the moment account for 60% of the whole market share, proceed to grapple with rising labor prices and decreased restaurant visitors. With out the good thing about scale benefits, these regional distributors change into extremely susceptible and ripe acquisition targets. Sysco, as the only investment-grade participant within the {industry}, stands uniquely positioned to capitalize on this consolidation development.

Whereas I don’t foresee large-scale mergers such because the $3.5 billion bid for US Meals in 2013, which the FTC halted, I anticipate Sysco pursuing quite a few small to medium-sized bolt-on acquisitions. This difficult macro atmosphere has created a “lion within the winter” alternative for Sysco, with a strong pipeline of potential offers. Whereas smaller opponents are compelled to play protection, Sysco stays on the offensive. This dynamic is a testomony to Warren Buffett’s timeless recommendation to “be grasping when others are fearful.”

Regardless of cautious steering of a modest 50 foundation level impression from M&A (down from earlier expectations of fifty to 100 foundation factors), the market continues to underappreciate Sysco’s M&A possible. This conservative steering has set the stage for beats and raises over time, all whereas Mr. Market continues to miss this hidden gem.

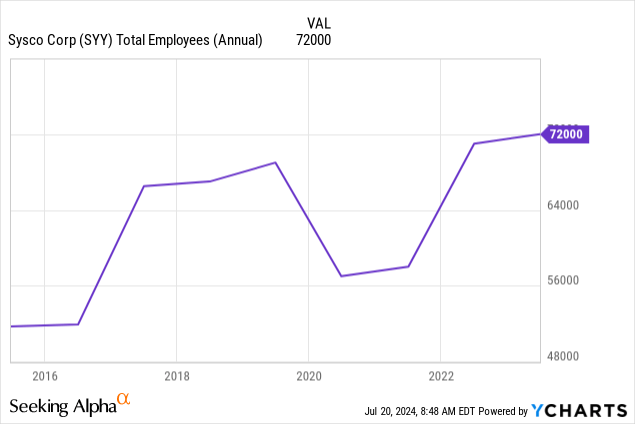

Gross sales Drive Investments

Through the years, Sysco has made important investments in a number of key areas, with a main give attention to increasing its gross sales drive. Earlier than the COVID-19 pandemic, Sysco employed a workforce of roughly 69,000. Nonetheless, resulting from decreased restaurant exercise and shutdowns, this quantity dropped to a low of 57,000 in 2021. Whereas the worldwide workforce has since rebounded to 74,000, Sysco’s restoration post-Covid has been sluggish, contemplating the substantial progress since 2019.

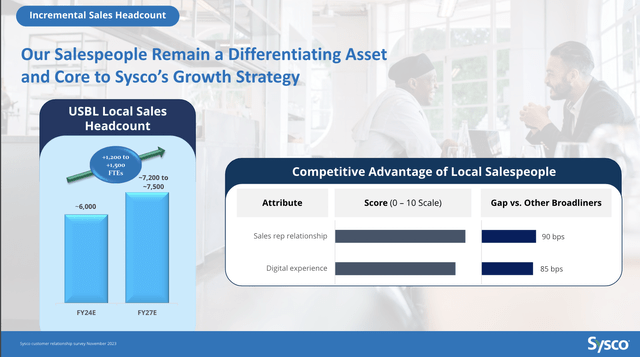

In response, Sysco is doubling down on its investments within the gross sales drive now and for the foreseeable future. In FY2024, Sysco plans to recruit an extra 400 broadline gross sales representatives and is on observe to realize this goal as of Q3 earnings. Whereas FY2024 will heart on coaching and integrating new hires into their roles, Sysco expects substantial progress advantages in FY2025 and past.

Sysco Investor Relations

Wanting additional forward, Sysco has guided to develop its native gross sales group by 1,200 to 1,500 positions by FY2027. Attaining this goal would convey the whole variety of US broadline gross sales reps to 7,200 to 7,500, marking a 20% improve from the present headcount and representing the most important growth in firm historical past.

On the floor degree, traders’ pure intuition and takeaway could also be that working bills will improve and stay below stress till FY2027. Whereas this assumption could also be right, the rationale behind Sysco’s emphasis on its gross sales drive might be defined via two easy knowledge factors. As highlighted within the latest investor day presentation, sustaining face-to-face buyer visits as soon as per week yields an extra 240 foundation factors in top-line progress. Furthermore, every gross sales guide makes between 8 to 10 potential calls per week with a closure price of roughly 20%. Assuming the decrease finish of the hiring projection via FY2027, including 1200 new positions would translate into 12,000 extra weekly calls and a pair of,400 new prospects. Merely put, sustaining a robust gross sales drive is important within the {industry}, and Sysco is effectively conscious of the fruits of its labor.

Financials

As talked about earlier, one among Sysco’s main aggressive benefits lies in its sturdy monetary place. Sysco leads the {industry} for its capacity to generate free money circulation, totaling $2 billion in free money circulation over the past twelve months alone. This starkly contrasts US Meals’ trailing twelve-month free money circulation of $791.4 million and Efficiency Meals Group’s $812.4 million, each figures lower than 50% of Sysco’s FCF era. Whereas free money circulation is my favourite metric when trying to find new funding alternatives, it is important to grasp that not all free money circulation is created equal. Producing free money circulation is one factor; successfully deploying it in a shareholder-friendly method is one other. On this regard, Sysco’s administration has rightfully earned a repute for exemplary capital allocation and has set a top-tier instance throughout the {industry}.

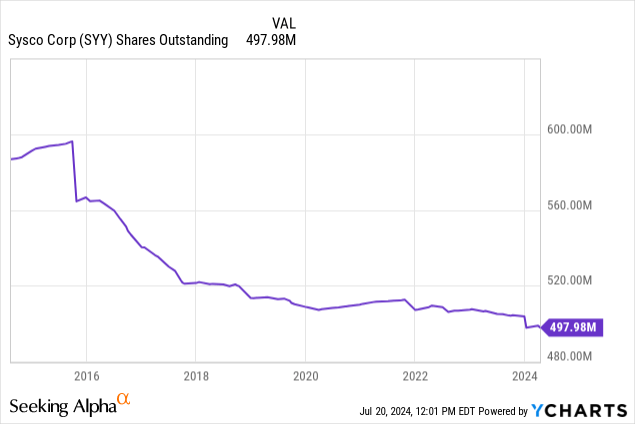

Beginning with share repurchases, administration has decreased the share rely by 16% over the previous decade. With $3.3 billion remaining below the present share repurchase settlement, administration has conservatively guided for $1 billion in annual buybacks via FY2027. Given the present depressed market worth and below-average historic a number of, I anticipate administration to meaningfully speed up these buybacks and capitalize on cut price costs.

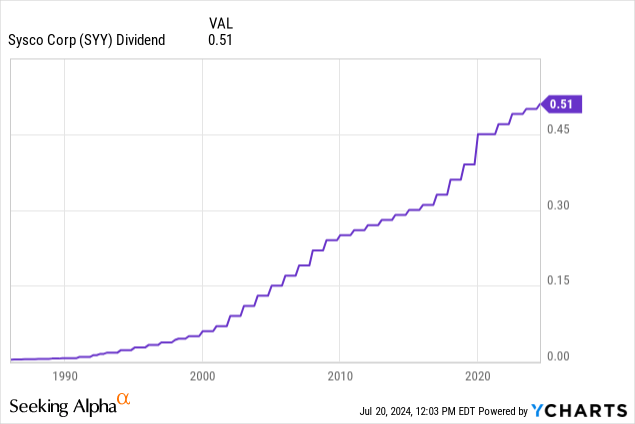

Sysco additionally holds the extremely esteemed title “dividend aristocrat,” having elevated its dividend for 54 consecutive years. With a present yield of two.77% and a wholesome payout ratio of 46.95%, I take into account this dividend unquestionably protected and a pleasant “cherry on prime” reward for affected person traders whereas awaiting a worth restoration. Furthermore, I anticipate dividend shares, particularly aristocrats, to get a bid as we see the primary rate of interest cuts. With decrease yields on treasuries, dividend shares ought to change into extremely engaging and stay in demand for the foreseeable future.

Combining this 2.77% dividend yield with the assumed annual discount of two.5% of shares excellent via the $1 billion in repurchases (based mostly on a mean repurchase of $75 per share) ends in a complete shareholder yield of 5.27%. Traders primarily obtain a yield corresponding to a Treasury invoice alongside the sturdy potential for important share worth appreciation.

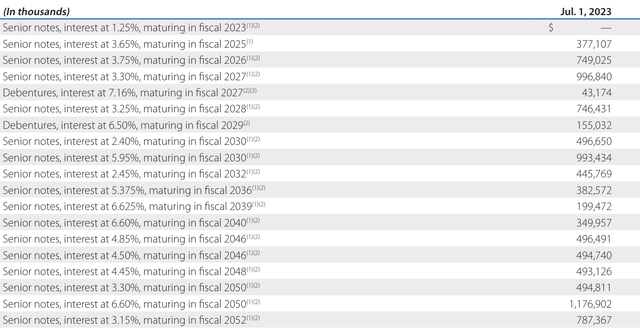

Sysco 2023 Annual Report

The final facet of Sysco’s steadiness sheet I wish to spotlight is its long-term debt. Sysco has $12.2 billion in long-term debt, 96% of which is secured at engaging fastened charges. Given Sysco’s sturdy annual free money circulation era of $2 billion or extra and $598 million money readily available, I’m assured in Sysco’s capacity to handle debt obligations. The upcoming maturities in FY2026 and FY2027, totaling $749 million and $996 million, shouldn’t current any points. Sysco stays dedicated to sustaining a stable investment-grade steadiness sheet, and I don’t anticipate this altering within the foreseeable future.

Valuation

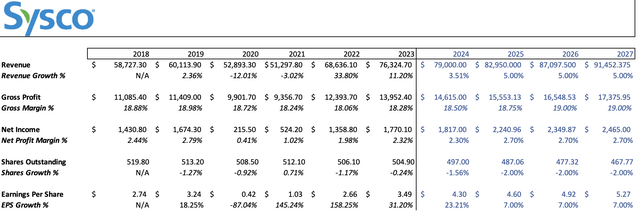

Sysco Earnings and Writer’s Calculations

Beginning with Sysco’s FY2024 top-line gross sales, I elected to make use of administration’s beforehand issued steering of $79 billion, contemplating that is the fiscal 12 months’s ultimate quarter. I then opted for a 5% income progress price via FY2027, the midpoint of administration’s investor day steering. Whereas I imagine that this investor day steering was intentionally conservative and constructed to rebuild credibility, it’s best to be modest with projections. This 5% income progress goal can also be effectively under Sysco’s five-year common of 6.45%, once more highlighting the conservative strategy.

Shifting to gross margins, I projected a modest growth from 18.5% in FY2024 to 19% by FY2027. This growth is based upon inflation stabilization and elevated gross sales of higher-margin specialty merchandise, a core focus for Sysco.

Subsequent, I projected web margins of two.3% for FY2024, then an growth to 2.7% via FY2027. This growth shall be pushed by continued good points from specialty merchandise and the belief of additional price financial savings that administration has guided for. I forecasted a discount in shares excellent to 467.77 million shares, reflecting a 2% annual lower via FY2027. Given the $3.3 billion remaining below the present share repurchase settlement and the $1 billion in annual buyback steering, this forecast is probably going conservative. Lastly, I utilized the midpoint of administration’s EPS progress steering of 6% to eight% via FY2027. This leaves us with an FY2027 EPS of $5.27. By assigning a 20x P/E a number of, effectively under Sysco’s five-year common of 24.65x, I arrived at a share worth of $105.40. This worth goal implies a forty five% upside potential from the present share worth. Over three years, this boils all the way down to a 13.02% compounded annual progress price (CAGR) earlier than contemplating any quarterly dividend funds.

Backside Line

Given the present market atmosphere, I imagine now is a superb second for traders to get defensive and add publicity to client staples. Sysco stands out as a main alternative for affected person traders and is poised for a rebound. I like to recommend SYY as a robust purchase with a goal worth of $105.40.