(Reuters) – Insurance coverage dealer TWFG, backed by U.S. reinsurer RenaissanceRe (NYSE:), stated on Wednesday it priced its preliminary public providing (IPO) above its indicated vary, in search of to lift as much as $187 million.

TWFG priced its 11 million shares at $17 apiece, and had marketed them at a variety of $14 to $16.

The share providing comes at a time when the U.S. IPO market is at its strongest since 2021 as buyers proceed to heat as much as new listings.

Texas-based TWFG, which works with greater than 300 insurance coverage carriers, has a presence in 41 states and the District of Columbia. Its enterprise, nonetheless, is principally concentrated in Texas, California and Louisiana.

Rising premiums lately have benefited brokers, who usually pocket a share of insurance coverage premiums as fee.

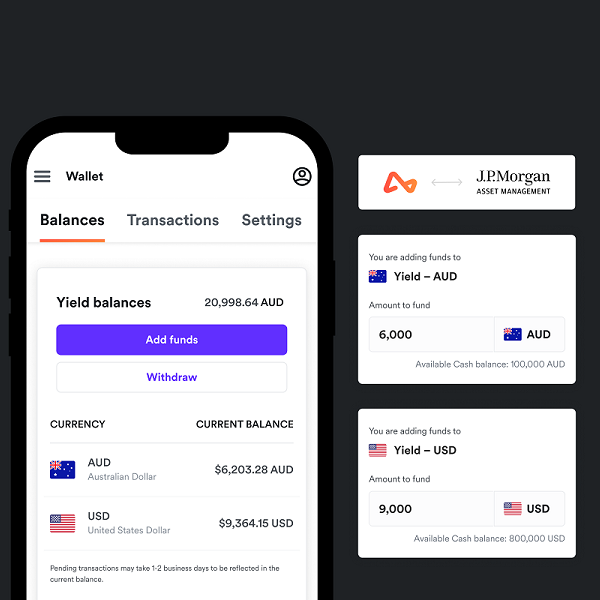

The providing is being underwritten by a syndicate of 9 Wall Avenue banks led by J.P. Morgan Securities, Morgan Stanley, BMO Capital Markets and Piper Sandler.

The corporate will checklist on the Nasdaq World Choose Market beneath the image “TWFG” on Thursday.