onurdongel

DCP Midstream, LP (NYSE:DCP) is without doubt one of the largest and most well-known midstream partnerships in the US. Sadly, it’s also one of the vital controversial ones as the corporate earned the ire of many traders following its distribution reduce in 2020. Whereas this ire is probably not totally undeserved, the corporate has made some very good choices with the cash that its distribution lower freed up. The truth is, there may be quite a bit to love right here as DCP Midstream boasts a rock-solid stability sheet and a few near-term progress potential. The corporate additionally posted very strong outcomes for the second quarter, which has had a really constructive impact on the unit value. Certainly, DCP Midstream’s widespread models are up 39.77% over the previous yr. Whereas that is actually a really spectacular return relative to many different firms within the sector, it has additionally had the impact of suppressing the yield as DCP Midstream solely yields 4.20% on the present value. There might nonetheless be an argument to be made in favor of shopping for the corporate’s widespread models nonetheless so allow us to examine and see if DCP Midstream might deserve a spot in your portfolio.

About DCP Midstream

As said within the introduction, DCP Midstream is without doubt one of the largest and most well-known midstream partnerships in the US. The corporate boasts a considerable portfolio of property stretching throughout a lot of the Southcentral a part of the nation:

DCP Midstream

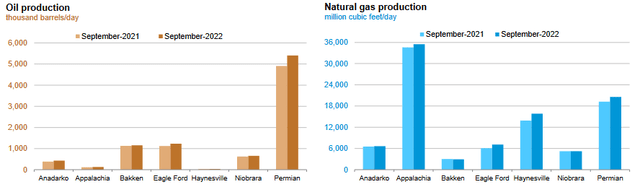

In complete, DCP Midstream owns 55,000 miles of pipelines, 35 pure gasoline processing vegetation able to dealing with roughly 5.4 billion cubic ft of pure gasoline per day, and twelve billion cubic ft of pure gasoline storage capability. One factor that we discover right here is that DCP Midstream’s property are extremely centered across the Permian Basin, so it’s not practically as diversified as a few of its bigger friends like Kinder Morgan (KMI) or Power Switch (ET). The one basin focus just isn’t essentially a nasty factor, although. The Permian Basin is by far probably the most mineral-rich hydrocarbon basin in the US and it has been the point of interest of the American vitality growth over the previous decade. The truth is, even right now the Permian Basin is seeing sturdy manufacturing progress. As we will see right here, the manufacturing of each crude oil and pure gasoline is up year-over-year:

U.S. Power Data Administration

This has created some progress alternatives for DCP Midstream’s gathering and processing property. This enterprise unit operates a community of gathering pipelines, which seize assets from the wellhead the place they’re extracted from the bottom and carry them to a processing plant or bigger long-haul pipeline. As is the case with all midstream firms, DCP Midstream’s gathering pipelines earn their cash primarily based on the amount of assets that they deal with. Thus, when volumes improve, DCP Midstream’s money flows additionally improve. We actually noticed that mirrored within the firm’s second-quarter 2022 earnings outcomes as the corporate reported file adjusted EBITDA and distributable money circulation.

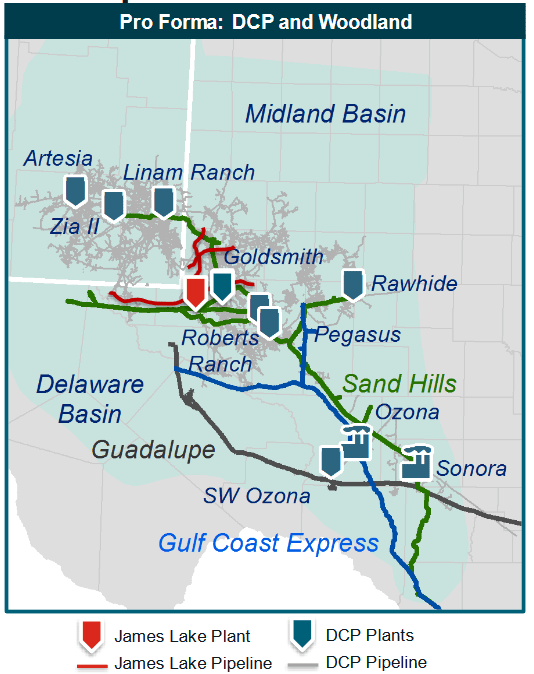

The rise in volumes just isn’t the one factor driving DCP Midstream’s progress. One other methodology that the corporate is utilizing to generate progress is acquisitions. The corporate is presently doing that as it’s within the technique of buying a gathering and processing system within the Permian Basin:

DCP Midstream

Woodland Midstream, which is the corporate that DCP Midstream is buying, owns and operates a 230-mile gathering pipeline system and a pure gasoline processing plant that’s able to dealing with 120 million cubic ft of pure gasoline per day. As we will clearly see, this technique ought to complement DCP Midstream’s present operations within the Permian Basin. This acquisition can even broaden DCP Midstream’s already substantial presence within the pure gasoline midstream house. That is one thing that may be very good to see given the extremely sturdy fundamentals for pure gasoline that exist right now, which we’ll focus on later on this article. The great factor about this acquisition is that Woodland Midstream’s infrastructure is absolutely contracted and money circulation constructive. Thus, we may be fairly sure that this acquisition will probably be accretive to DCP Midstream’s personal money flows. In mild of this, DCP Midstream seems to be getting an excellent value for Woodland Midstream. DCP Midstream is paying $160 million for this firm, so it ought to pay for itself in 5.5 years. It is a very spectacular return for any type of midstream progress spending and it’s actually higher than the 6x EBITDA a number of that The Williams Firms (WMB) is getting from the tasks that it’s establishing itself. The corporate’s traders ought to thus be fairly happy as soon as this transaction closes, which is predicted to be someday within the third quarter of 2022.

As talked about within the introduction, DCP Midstream earned the ire of many traders when it lower its distribution in response to the uncertainty that was plaguing the vitality business. The corporate was compelled to cancel or defer lots of the progress tasks that it was engaged on on the time and lower its distribution with the intention to release money to pay down debt. It has really loved nice success at shoring up its stability sheet since that point, which we will see by wanting on the firm’s leverage ratio. The leverage ratio, which is often known as the web debt-to-adjusted EBITDA ratio, basically tells us how lengthy it will take the corporate to utterly repay its debt if it had been to dedicate all of its pre-tax money circulation to that process. As of June 30, 2022, this ratio stood at 2.9x, which is without doubt one of the lowest ratios within the midstream business. That is very good to see as analysts often take into account something below 5.0x to be cheap. Nonetheless, following the occasions of 2020, most midstream firms have been working to get their ratios down below 4.0x with the intention to enhance their means to climate crises and I’ll admit that I prefer to see this ratio below 4.0x for a similar purpose. As we will clearly see, DCP Midstream simply meets this extra restrictive requirement. Thus, traders ought to respect this.

On August 18, 2022, one other occasion occurred that might have a big impression on our funding in DCP Midstream. In brief, Phillips 66 (PSX), which already has a big possession stake in DCP Midstream, supplied to buy the entire excellent widespread models of DCP Midstream for $34.75 per unit. As of the time of writing, DCP Midstream’s widespread models are buying and selling for $38.13 per unit, so shopping for the models right now might not make sense except Phillips 66 will increase its provide. Nonetheless, the present provide seems to require Phillips 66 to buy the entire models available in the market versus traders being compelled to promote on the providing value. That is additionally a preliminary provide and there are numerous analysts anticipating that Phillips 66 will improve its provide by 10%. As such, it’s troublesome to say whether or not or not traders needs to be keen to purchase the widespread models at a value above $34.75 per unit however it positively is sensible to purchase at a cheaper price.

Fundamentals Of Pure Gasoline Midstream

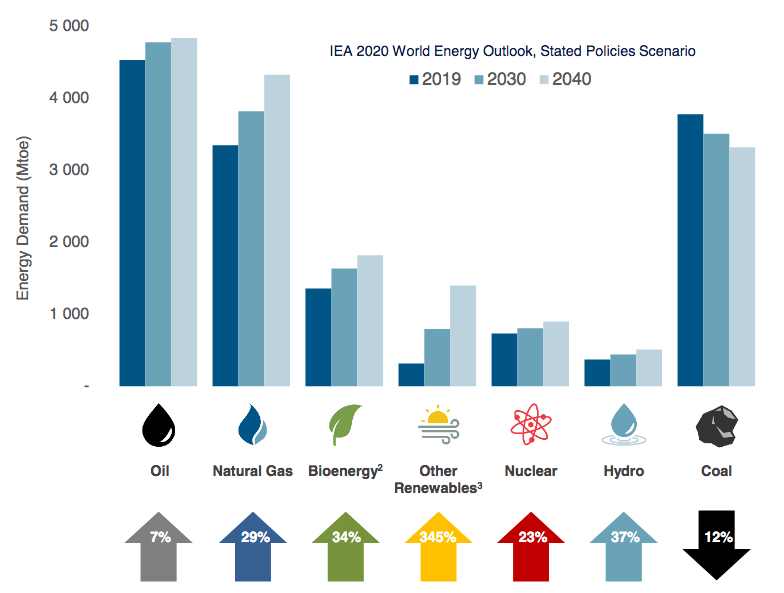

As we mentioned earlier on this article, DCP Midstream has been aggressively increasing its presence within the pure gasoline house. That is fairly good to see because the fundamentals of pure gasoline are fairly constructive. The basics for crude oil are additionally sturdy, albeit not as sturdy as pure gasoline. That is one thing that could be stunning to many readers contemplating the demonization that conventional fossil fuels have been receiving from environmental activists, the media, and politicians. Nonetheless, the Worldwide Power Company tasks that the demand for pure gasoline will improve by 29% and the worldwide demand for crude oil will improve by 7% over the subsequent twenty years:

Pembina Pipeline/Knowledge from IEA 2021 World Power Outlook

Maybe surprisingly, the demand for pure gasoline is being pushed by issues about local weather change. As everybody studying that is little question properly conscious, these issues have led governments everywhere in the world to impose a wide range of incentives and mandates which might be supposed to scale back the carbon emissions of their respective nations. The most typical methodology that’s getting used to perform that is to encourage utilities to retire previous coal-fired energy vegetation and exchange them with renewables. Sadly, renewables have one main drawback and that’s that they’re unreliable. In spite of everything, wind energy doesn’t work if the air remains to be and solar energy doesn’t work if the solar just isn’t shining. The widespread answer for that is to complement the renewable technology with pure gasoline generators as a result of pure gasoline burns cleaner than some other fossil gasoline and has the reliability to maintain the grid purposeful when renewables can not. This is the reason pure gasoline is commonly referred to as a “transitional gasoline,” because it gives a technique to cut back carbon emissions and maintain the grid purposeful till renewable know-how advances sufficiently to carry out this process.

The case for crude oil demand progress could also be considerably more durable to know. In spite of everything, we’re seeing a robust push by the governments of most developed nations to scale back the consumption of crude oil inside their borders. Nonetheless, it’s a very completely different story if we take a look at the varied rising markets world wide. These nations are anticipated to see large financial progress over the projection interval. This may naturally have the impact of lifting the residents of those nations out of poverty and placing them securely into the center class. These newly middle-class folks will start to need a life-style that’s nearer to their counterparts within the developed nations than what they’ve now. This may lead to a rising consumption of vitality, together with vitality derived from crude oil. Because the populations of those nations are greater than the populations of the developed nations, the rising demand for crude oil from the rising world will greater than offset the stagnant-to-declining demand within the developed nations.

DCP Midstream is positioned to learn from this regardless of the corporate not really producing any crude oil or pure gasoline itself. It’s because the US is without doubt one of the solely nations on the planet that may improve its manufacturing sufficiently to fulfill this demand progress because of the mineral wealth of areas just like the Permian Basin. Nonetheless, the producers on this space might want to get their assets to the market the place they are often offered. That is precisely the enterprise that DCP Midstream is in. Thus, we will see a situation the place the corporate’s volumes develop over time and since DCP Midstream’s money flows are straight correlated with volumes, the corporate ought to see rising money flows as this story performs out.

Distribution Evaluation

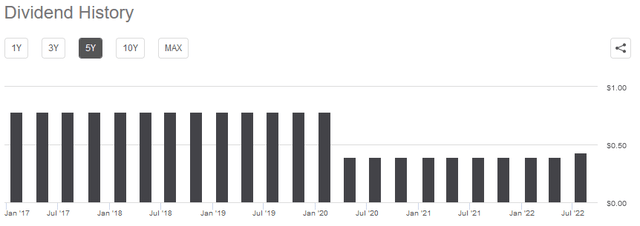

One of many largest the reason why traders buy the widespread models of midstream partnerships is due to the extremely excessive yields that many of those firms possess. That is additionally why DCP Midstream earned the ire of many traders because it lower its distribution drastically again in 2020 with the intention to shore up its stability sheet and has nonetheless not returned it to the earlier degree:

Looking for Alpha

The corporate presently yields 4.20%, which is far decrease than lots of its sector friends. Nonetheless, it’s nonetheless higher than the 1.48% yield of the S&P 500 index (SPY). As is at all times the case, it’s important that we decide how properly DCP Midstream can afford the distribution that it pays out. In spite of everything, we don’t need to discover ourselves the victims of one other distribution lower that each reduces our incomes and virtually actually causes the inventory value to say no.

The same old means that we analyze an organization’s means to pay its distribution is by taking a look at its distributable money circulation. It is a non-GAAP determine that theoretically tells us the amount of money that was generated by the corporate’s abnormal operations and is out there to be distributed to the restricted companions. Within the second quarter of 2022, DCP Midstream reported a distributable money circulation of $369 million, which represents a reasonably substantial enchancment over the $225 million that the corporate had within the year-ago quarter. This was sufficient to cowl the corporate’s distribution 4.5 occasions over, which is a really spectacular ratio for a grasp restricted partnership. Analysts typically take into account something over 1.20x to be cheap and sustainable. Nonetheless, I’m far more conservative and prefer to see this ratio above 1.30x with the intention to add a margin of security to the distribution. As we will clearly see, DCP Midstream is considerably above that determine. We are able to due to this fact conclude that the corporate’s distribution is nearly actually fairly protected.

Conclusion

In conclusion, DCP Midstream might not have one of the best fame amongst traders proper now however there are actually some causes to think about investing in it right now. The most important of those causes is that the corporate boasts a really sturdy stability sheet and a few actual progress prospects. The yield is admittedly a bit low however it’s extremely properly coated and the corporate does have room to extend it fairly a bit if it needs to. The most important wildcard right here is the proposed acquisition by Phillips 66 as we have no idea precisely what the value will probably be for that deal nor can we even know for positive that it’s going to even undergo. Thus, it may be price taking an opportunity and investing within the firm since Phillips 66 will virtually actually have to extend its providing value with the intention to get anybody shopping for right now to comply with the deal. The present unit value is above the provide value although so there’s a danger of taking a loss. Total, it may be price contemplating in case you are keen to guess on both the deal falling by or Phillips 66 being compelled to extend its provide.