Shutthiphong Chandaeng

Schwab Excessive Yield Bond ETF (NYSEARCA:SCYB) has been an ETF I’ve had my eye on for some time. SCYB has been round for somewhat below a yr and has an AUM of about $187M. SCYB tracks the ICE BofA US Money Pay Excessive Yield Constrained Index. This index has some particular standards that make SCYB’s holdings engaging. I’ve not been a fan of high-yield bonds previously yr; in truth, I’ve 2 high-yield ETFs with Robust Sells. Nevertheless, since June of final yr, I have been bullish on HYBB, an ETF that holds solely BB bonds. In case you care to learn my articles on HYBB, you will discover them right here and right here. As the info continues to return in on the Goldilocks vary, I am keen to start out incorporating some barely lower-rated high-yield bonds into my portfolio, and SCYB is my ETF to try this.

Holdings

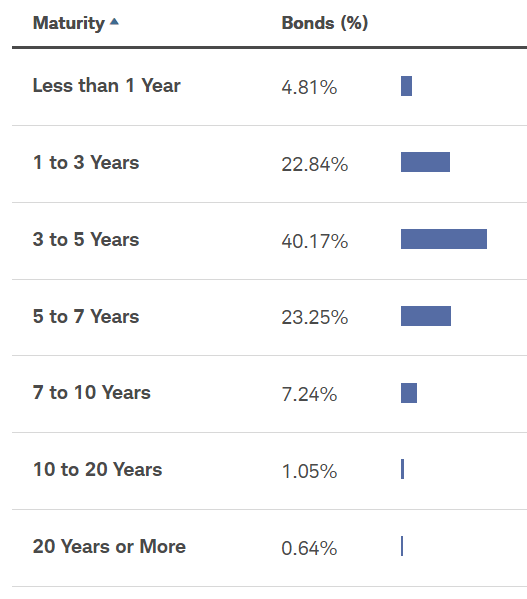

SCYB holds 1,562 high-yield bonds. The index ensures that nobody issuer is liable for greater than 2% of the index’s holdings, which makes SCYB a well-diversified ETF. SCYB has an efficient period of three.3 years, which is on the decrease finish. Whereas SCYB is certainly not a low-risk ETF, its decrease period does restrict some rate of interest volatility. Its common maturity is 4.4 years, with over 40% of its holdings falling into the 3-5 yr vary.

SCYB’s holdings by maturity (Schwab.com)

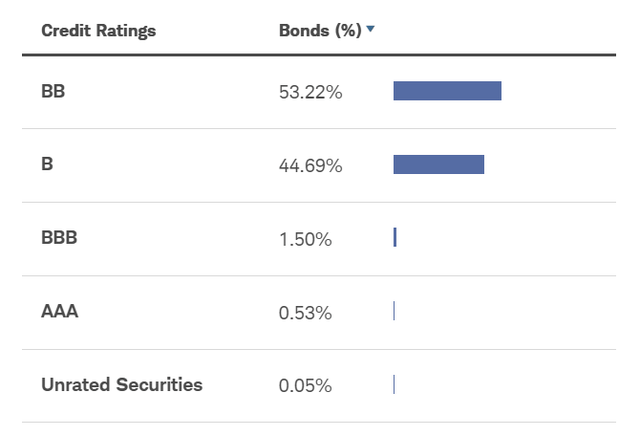

As a consequence of index standards, SCYB solely holds bonds rated B or higher. Roughly 53% of the ETF is in BB-rated bonds, and 45% in B-rated bonds.

SCYB’s holdings by credit standing (Schwab.com)

This make-up of higher-rated high-yield bonds is what makes SCYB engaging.

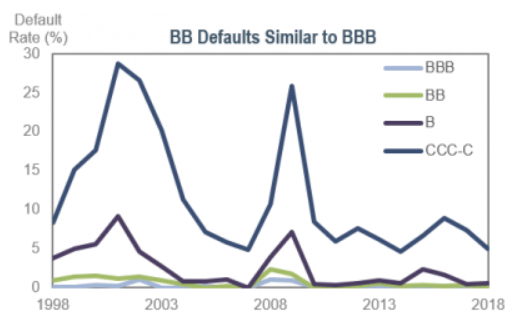

BB and B bonds are dangerous, however primarily based on the present financial atmosphere, I do not see any cause to count on an increase in default charges. Many different high-yield ETFs personal giant quantities of CCC and below-rated bonds. These are the junk bonds I am actually anxious about. Not solely have CCC bonds had far larger default charges than B and BB bonds, however there are additionally present technical elements that make me much more bearish about CCC bonds.

Defaults

It isn’t a shock that CCC bonds have extra defaults than B bonds, nevertheless it may be shocking to some how large of a distinction one notch could make. From 1994 to 2015, B-rated bonds averaged a default charge of two.8%. Throughout that very same time interval, CCC bond default charges had been over 11%, virtually 4 occasions larger than that of B’s! The next chart is from considered one of my previous articles, the place I argued BB bonds had been “in a league of their very own”. Whereas I nonetheless imagine that lower-risk traders can use BB bonds so as to add yield for less than somewhat extra danger in comparison with BBB bonds, for extra risk-tolerant traders, B-rated bonds look good too.

Default charges of bonds by credit standing (www.incomeresearch.com)

The one factor that appears terrible is CCC bonds. And I believe issues are getting even worse for them.

CCC bonds

CCC issuance has been down dramatically. In 2023 CCC rated bonds accounted for lower than 1% of high-yield issuance. Earlier than 2023, the earlier low was 3.7% in 2009. The low issuance is because of a wide range of causes. First, CCC firms must situation new debt at charges far larger than they’re used to. With the risk-free SOFR charge at 5.33%, these firms have so as to add fairly a little bit of yield to entice traders. CCC-rated firms try to attend out the excessive charges to allow them to situation after charge cuts in an effort to have decrease curiosity bills. Another excuse is that CCC-rated firms are turning to personal credit score to get decrease charges. The final cause is that curiosity expense is just too excessive for firms to situation debt to take part in M&As. Whereas this situation impacts the entire bond market, it hits the already struggling CCC bond market tougher.

All these elements that trigger decrease provide additionally artificially increase costs and trigger spreads to be tight. Spreads throughout your complete fixed-income sector are tight, however due to the technical elements I mentioned, CCCs valuation is hit even tougher.

B and BB bonds

Now that I’ve mentioned why CCC bonds should not be in your portfolio, let’s tackle why I am keen so as to add some dangerous B and BB bonds. SCYB’s 30-day SEC yield is 7.7%. The chart under reveals SCYB’s yield in comparison with HYBB and BND.

ETF 30-Day SEC Yield SCYB Yield Unfold to ETF SCYB 7.7% — BND 4.69% +301 bps HYBB 6.47% +123 bps Click on to enlarge

The yield is excessive due to the danger of its holdings. However primarily based on the current financial information, I believe defaults will keep to a minimal. Inflation is coming down, giving hope of a charge reduce within the not-too-distant future. Whereas curiosity expense is way larger than it has been, company earnings have additionally been rising. Payrolls grew by 206,000 in June and whereas unemployment did rise a bit, it wasn’t sufficient to trigger fear that client spending will lower inflicting decrease company earnings.

As inflation retains falling and unemployment slowly rises, the Fed will reduce charges and relieve some stress on these lower-rated firms. For the report, I count on one or zero charge cuts in 2024. 2025 is after I forecast the actual decline in charges to start out. I additionally imagine that the impartial rate of interest goes to be larger within the coming decade than it has been previously, so I do not count on SCYB’s yield to fall all that a lot sooner or later.

Proper now is an efficient time to lock in these yields after which expertise the capital appreciation that is to return from falling charges.

Takeaways

SCYB gives publicity to higher-rated high-yield bonds. Whereas this ETF is dangerous, it limits what I imagine to be the insupportable danger that presently comes with CCC bonds. CCC bonds should not solely traditionally far riskier, however technical elements are driving costs up and spreads tighter. For many who can tolerate the danger, SCYB is a good way to realize publicity to the high-yield bond market. I charge SCYB a purchase.