Joe Raedle/Getty Photos Information

Introduction

This month, the federal government launched new jobless claims numbers from the Bureau of Labor Statistics that shocked many individuals. The unemployment fee has gone above 4% for the primary time since January 2022, a soar that might sign future rate of interest cuts from the Fed.

For the final yr, the jobless fee has had a constant pattern. It is unclear precisely what’s inflicting this modification, because the fee had stayed pretty low by means of the speed hike cycle. Maybe that is quantitative tightening attrition.

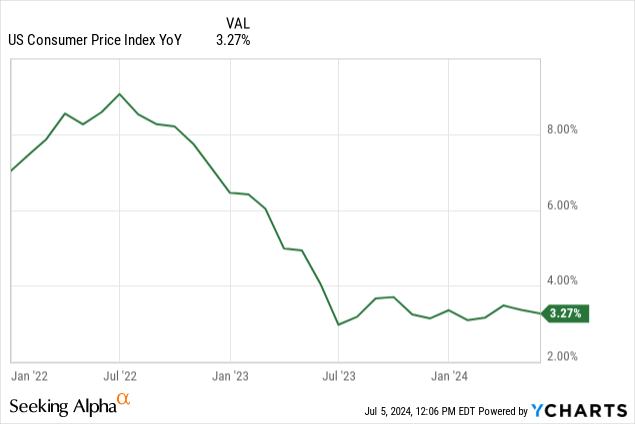

That attrition is what the Fed has wished with their fee hikes, which had been designed to curb inflation. Right here is CPI over the identical timeframe because the chart above.

Discover how they’ve moved pretty reverse of one another since final yr, with inflation staying subdued and unemployment ticking again up. That is what I imply by “attrition.” Over time, companies coping with larger charges will trigger them to put individuals off and downsize their operations because the leverage they used to broaden or deliberate to make use of has gotten considerably costlier.

That is the price of larger charges.

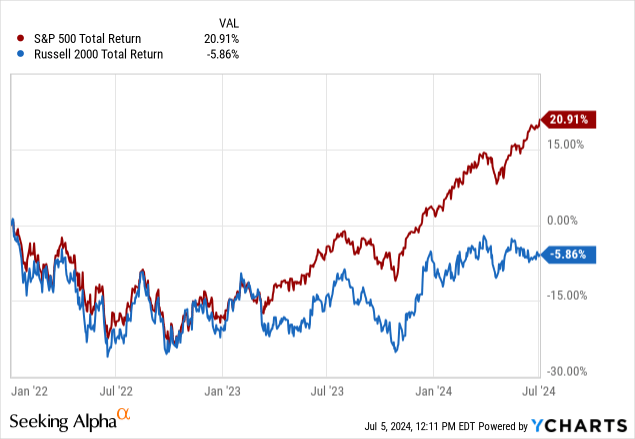

One of many methods we have seen that’s within the divergence of the S&P 500 with the Russell 2000. Each observe US shares, however they observe very completely different ends of the spectrum.

The S&P 500 consists of the five hundred largest public firms The Russell 2000 consists of the 2000 smallest public firms

The Russell is usually mentioned to signify the “actual financial system” as a result of the companies within the index are extra immediately affected by macroeconomic modifications reminiscent of rates of interest and recessions, whereas bigger firms like these within the S&P 500 have a bigger, international attain and are much less affected by the US financial system.

Jobs & Employment

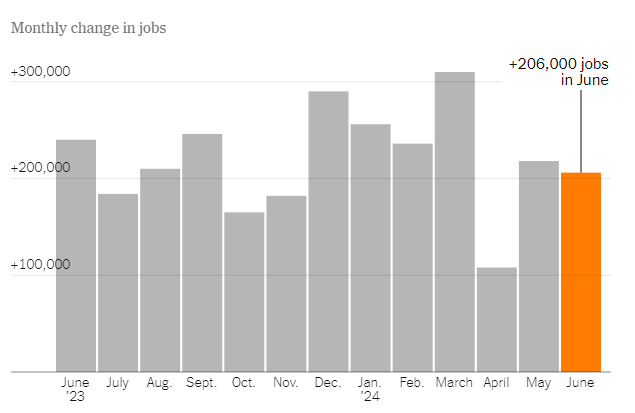

The large information is that on Friday, job development and jobless numbers had been launched, as talked about earlier. Whereas the unemployment fee ticked up above 4%, we’re nonetheless seeing job development. In truth, we’re in our forty second consecutive month of job development. Be aware that these final three months have been the worst quarter for job development because the Biden administration got here to energy in 2021.

Determine 1 (Ella Koeze by way of NYT)

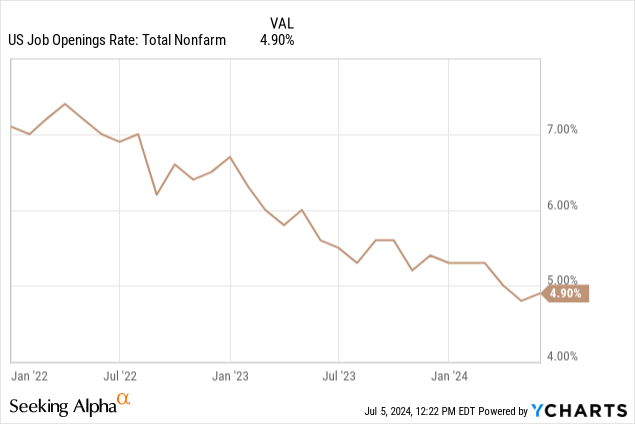

That being mentioned, the job opening fee has been trending down within the final two years.

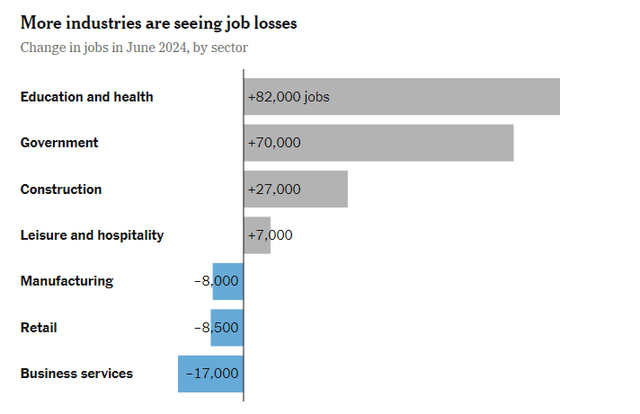

Largely, we have seen uneven job creation and loss charges. Whereas now we have had a web optimistic job fee for the final whereas (42 months sturdy as of this month), it isn’t web optimistic throughout all sectors. Right here is that this month’s main modifications.

Determine 2 (Ella Koeze by way of NYT)

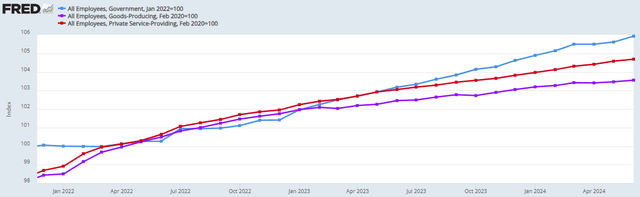

Between the completely different sorts of employers, we have seen modifications as effectively. There was a slowing of employment in good-producing jobs and an uptick within the fee of employment within the public sector. That is partially to be anticipated with the elevated authorities spending post-pandemic and following the Inflation Discount Act’s improve funding to public sector jobs associated to infrastructure.

Determine 3 (FRED)

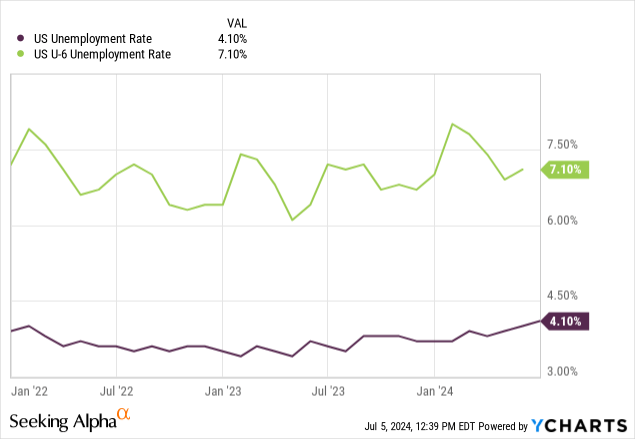

Unemployment

I harp on this in each macroeconomic article I write, as a result of I really feel just like the headline unemployment determine is deceptive. It counts people who would not have any type of employment (which incorporates unpaid internships and enrollment in coaching or faculty applications) and are actively in search of work. Which means the determine excludes two main teams that dramatically have an effect on the information: discouraged employees and under-employed employees (i.e. working half time, however looking for full time). That determine known as “U-6” and is represented by the lime line under.

It has additionally been experiencing a tick up, that means that the ache within the job market is widespread. It is not simply that it is more durable to land a job than earlier than for frictionally unemployed individuals (frequent job changers/hoppers), however for individuals throughout the board.

Why Did Unemployment Go Up?

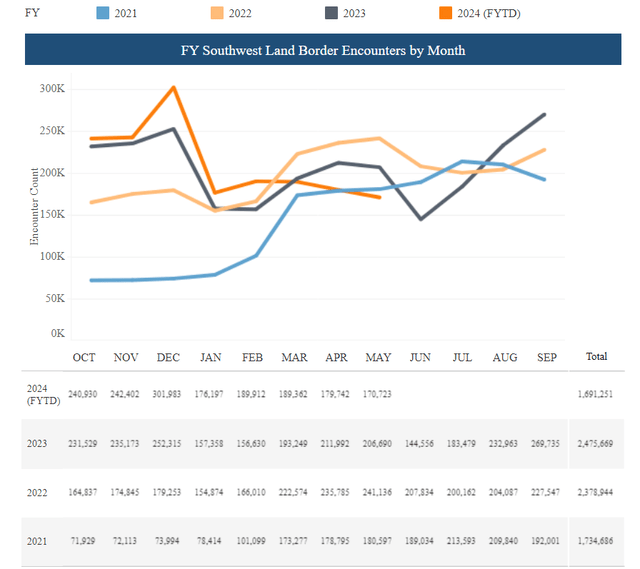

So far as I can inform from the information now we have, as a result of the reply to this query is at all times imprecise, extra persons are beginning to enter the labor pressure. With rising immigration figures within the US, immigrants added 80,000 individuals per thirty days to the US job pool final yr, and are estimated so as to add one other 50,000 per thirty days this yr, even with the elevated restrictions on asylum claims positioned by the Biden admin final month.

Be aware: of the 1.2M immigrants the US gave everlasting resident standing to final yr, a complete of 38% had been from different North American nations, and a complete of 15% of immigrants got here from Mexico in 2023.

These figures are accounting for the lower in land border encounters that we have seen in comparison with the previous few years, with Might’s encounter numbers falling under these we noticed in ’23, ’22, or ’21.

Determine 4 (US Clients and Border Safety)

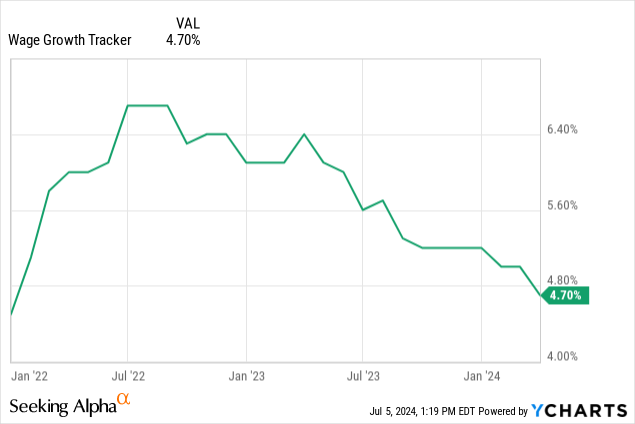

Wage Progress Was an Difficulty

One of many issues now we have seen that’s regarding relating to jobs is the decline of wages. Whereas there are extra jobs, and extra individuals wanting jobs, we’re seeing a slowing within the wages these jobs are paying.

This checks out from an economics standpoint. A rise within the provide of labor with out a corresponding improve within the demand for labor will trigger the value of labor to fall, or on this case, rise much less.

What Now?

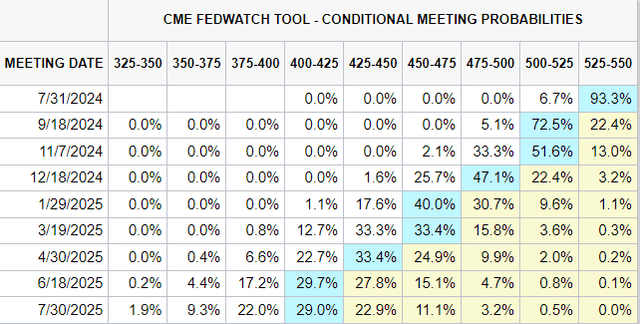

For now, we anticipate the Fed to reply. Beforehand, the Fed has used unemployment figures as a measure of when they should cease their tightening. They’re unlikely to relent till after the August assembly, with most analysts predicting that the primary fee minimize will come on the September assembly, earlier than the election on stress from the Biden admin to chop not less than as soon as earlier than then.

The market is consistent with this, with many contributors believing that there could also be three fee cuts by the top of the yr and one earlier than the election (11/5/24).

Determine 5 (CME)

The Fed could also be prompted by this month’s information to behave within the September assembly, with the information more likely to be tabled for this month’s assembly. In his final press convention after an FOMC assembly, which I lined right here, Powell mentioned:

Payroll job positive aspects averaged 218 thousand jobs per thirty days in April and Might, a tempo that’s nonetheless sturdy however a bit under that seen within the first quarter. The unemployment fee ticked up however stays low at 4 %. Sturdy job creation over the previous couple of years has been accompanied by a rise within the provide of employees, reflecting will increase in participation amongst people aged 25 to 54 years and a continued sturdy tempo of immigration… General, a broad set of indicators means that situations within the labor market have returned to about the place they stood on the eve of the pandemic-relatively tight however not overheated. FOMC contributors count on labor market power to proceed

A disruption on this narrative, weaker job and wage development, and a better unemployment fee might immediate the Fed to behave sooner somewhat than later. This information will not be a pink flag, however undoubtedly an orange one that ought to have the Fed pausing. A continued motion up within the unemployment, towards 4.5%, might set off the Fed to look extra dovish to mood markets.

The Trades

In my article on Powell’s press convention final month, and in a number of articles I’ve written since I started publishing on Looking for Alpha in October final yr, I recommended a number of commerce concepts which can be designed to make the most of the Fed’s pivot towards fee cuts.

The Lengthy Period Play

– 20+yr bond funds like TLT are the best way to go to make the most of falling charges, as their costs rise probably the most when charges fall.

– Traders might also be serious about Simplify’s tackle the length commerce, TUA & TYA, which I wrote about briefly right here. It is a leveraged ETF, traders beware!

The Mounted Charge Play

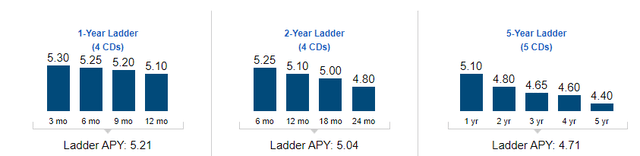

– We all know that charges will change within the subsequent 9 months, and certain decrease. Which means now’s the proper time to lock in charges on CDs or different cash-like devices that supply fastened charges for lengthy intervals of time.

– Newly-issued mortgages are providing unbelievable charges. Simplify’s MTBA invests solely in these excessive yielding mortgages, that are usually fixed-rates. This removes the decrease yielding “fluff” within the index.

– It’s time to slowly transfer out of T-Payments over the subsequent 9 months, shifting over to longer timelines.

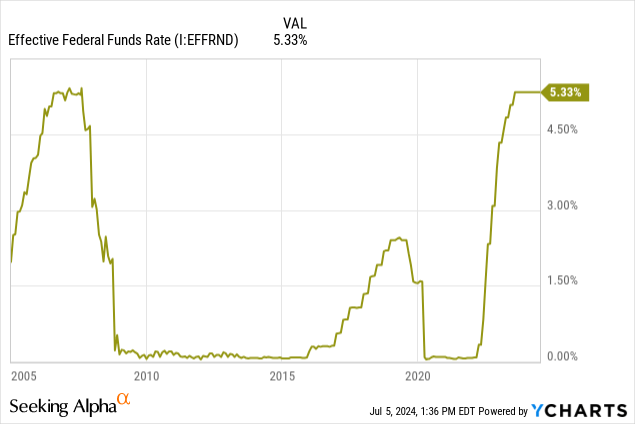

The bit I need to concentrate on right here is the fastened fee play. CDs are at the moment at, what I imagine can be for a reasonably very long time, a fee peak. There may be little room for the Fed to maneuver charges up from 5.25-5.5%, and traditionally because the GFC, charges have by no means exceeded this.

Presently, CD ladders may be constructed with a reasonably enticing combination yield.

Determine 6 (Constancy Investments)

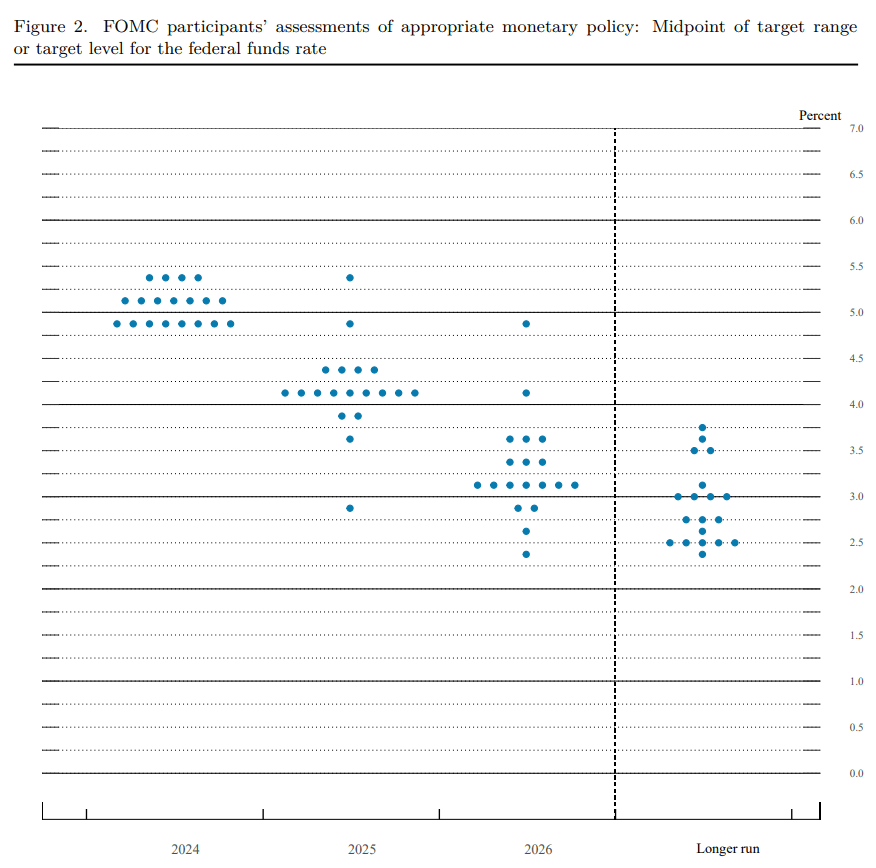

Now’s the time to be locking in charges whereas we will, and discovering fastened charges to park your money that will exceed the efficient charges shifting ahead. The FOMC, the Fed committee that determines the Fed Funds Charge in addition to how a lot the Fed will buy or run-off into the open market, believes that charges can be at or round 3% in 2026.

Determine 7 (FOMC)

That implies that a two-year ladder of CDs that pays out 5.04% (like within the instance above), you’ll web out larger than in the event you had been in variable-rate bond devices that extra intently comply with the reside Fed Funds Charge reminiscent of ETFs just like the iShares 0-3 Month Treasury Bond ETF (SGOV).

Be aware: Make certain when trying by means of CDs, you make sure that to keep away from callable ones that can seemingly be known as as soon as their fee exceeds the efficient Fed Funds Charge.

Conclusion

Current information means that the Fed’s struggle on inflation is cooling off and now the labor market could also be feeling a little bit of stress. This could give traders wanting fee cuts some hope, as this stress will drive the Fed towards these fee cuts sooner somewhat than later. For now, the best choice traders have, for my part, is to make the most of at the moment excessive charges earlier than they depart by locking in charges with devices like CDs.

Thanks for studying.