Printed on July 1st, 2024 by Josh Arnold

Excessive-yield shares pay out dividends which are considerably greater than market common dividends. For instance, the S&P 500’s present yield is just ~1.3%, a product of report highs in inventory indices up to now in 2024.

Excessive-yield shares might be very useful to shore up revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

We now have created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You may obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our checklist of excessive dividend shares to evaluation is Horizon Bancorp, Inc. (HBNC).

Horizon has an eight-year dividend improve streak, which definitely isn’t the longest streak, however the financial institution has been in a position to put in some very robust dividend will increase in these eight years.

Enterprise Overview

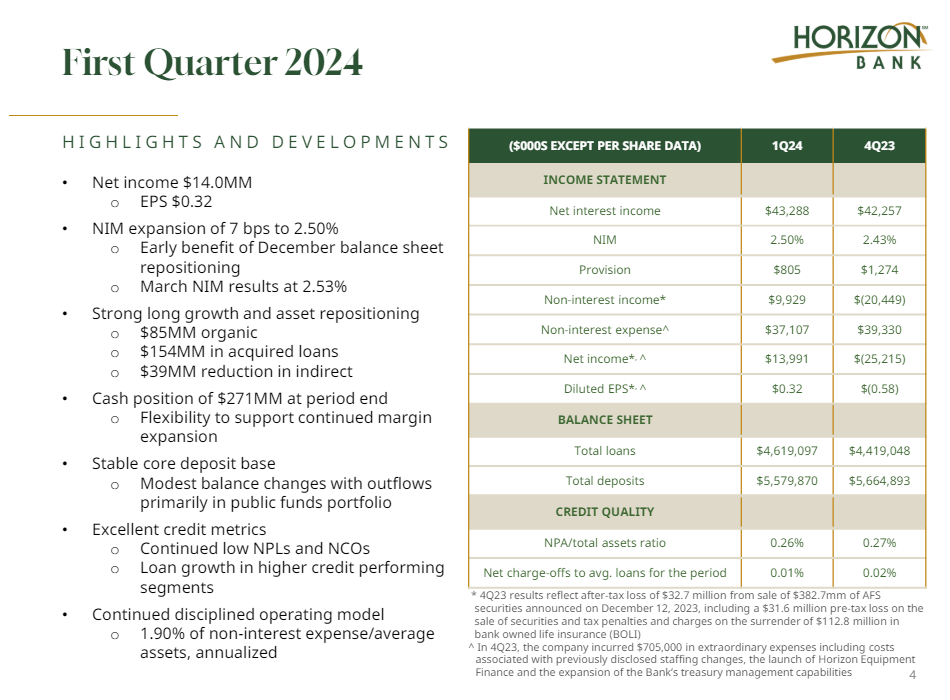

Horizon is a financial institution holding firm for Horizon Financial institution, which engages within the typical combine of business and retail banking providers and merchandise.

It presents checking, saving, cash market, certificates of deposit, retirement accounts, varied varieties of shopper and business loans, insurance coverage, and extra.

Horizon operates in Indiana and Michigan, and was based in 1873.

Supply: Investor presentation

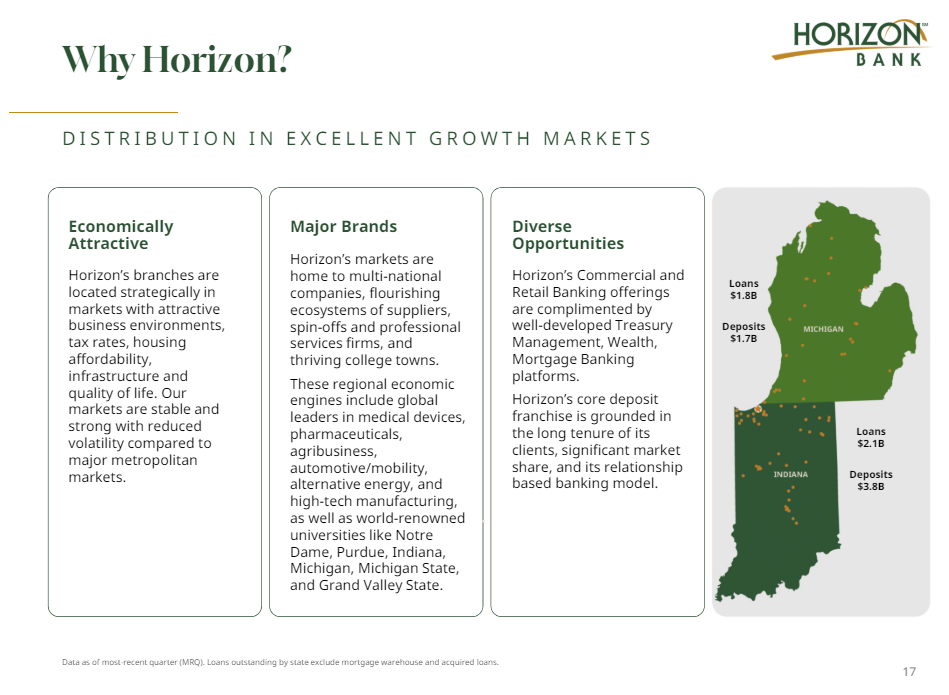

The financial institution reported first quarter earnings on April twenty fourth, 2024, and outcomes have been tremendously improved from the prior quarter.

Supply: Investor presentation

Horizon noticed 32 cents in earnings-per-share, up from a lack of 58 cents within the fourth quarter of 2023. Credit score high quality stays glorious with simply 0.01% internet charge-offs for the interval, and non-performing property totaled simply 26 foundation factors of whole property.

Web curiosity margin was up seven foundation factors, boosting profitability, however we notice that’s a really low NIM determine in comparison with the remainder of our protection universe within the banking sector.

After Q1 outcomes, we estimate $1.32 in earnings-per-share for this 12 months.

Development Prospects

Horizon’s earnings development has been uneven to say the least. The financial institution has managed to spice up earnings over time, however previously decade, there have been three years of declining earnings, together with final 12 months.

We anticipate to see 8% development from this 12 months’s base of $1.32, however we imagine this can be a reversion to the imply given the low base.

In different phrases, we don’t imagine Horizon’s natural development over the long-term is especially robust, however we’re in search of a return to imply ranges nearer to $2 in earnings-per-share we’ve seen lately.

Supply: Investor presentation

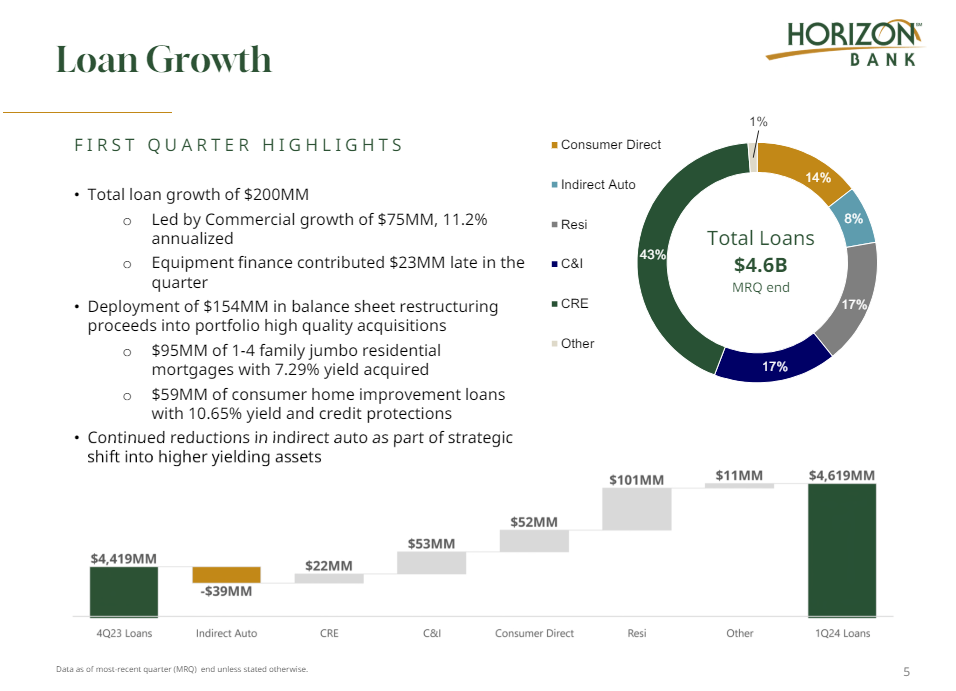

If that is going to occur, Horizon is prone to depend on mortgage development, which its been concentrating on in current quarters.

In Q1, the financial institution grew loans by $200 million, led by business mortgage development, in addition to high-yield shopper loans. Whereas these are riskier, the nearly-11% yield is kind of engaging, significantly for a financial institution with very low NIM like Horizon.

Aggressive Benefits & Recession Efficiency

Like different banks, Horizon actually doesn’t have any aggressive benefits. We notice that each one banks typically provide the identical set of services, so small banks like Horizon depend on model loyalty and workplace location comfort for buyer retention. Nevertheless, we notice that these are free benefits at finest, like different banks.

Additionally like different banks, Horizon is prone to recessionary intervals, and we notice that Horizon’s earnings are prone to undergo through the subsequent interval of financial weak spot.

To its credit score, the corporate carried out comparatively strongly through the earlier main financial downturn, the Nice Recession of 2008-2009:

2008 earnings-per-share: $0.54

2009 earnings-per-share: $0.47

2010 earnings-per-share: $0.54

Horizon’s glorious credit score high quality will serve it properly through the subsequent recession, however the reality stays that no financial institution has management over mortgage demand throughout recessions, or certainly debtors which are unable to pay.

With Horizon struggling lately to develop earnings throughout what has been a really robust interval of financial development, we’re cautious for the financial institution through the subsequent recession.

Dividend Evaluation

Horizon has managed to spice up its dividend by a median of just about 11% yearly previously decade, which is extraordinarily robust by the requirements of the banking group.

Horizon’s dividend payout ratio was fairly low a decade in the past at a couple of quarter of earnings, however is double that now.

The present dividend of 64 cents per share yearly is true at half of earnings, so we imagine it’s protected for the foreseeable future. We do suppose that the power for Horizon to lift the dividend is considerably restricted, but additionally imagine small will increase are within the playing cards within the coming years.

The yield could be very robust at 5.2%, the product of that robust dividend development, but additionally a comparatively stagnant share value. General, we just like the yield and the relative security of the payout, however see the probability for giant will increase to be muted.

Last Ideas

We see Horizon as a powerful revenue inventory, and one with a comparatively protected dividend and house for small will increase going ahead. We notice the dearth of aggressive benefits and recession susceptibility, however the latter isn’t a difficulty for the second.

We encourage traders to look at internet curiosity margin, as that’s a weak level for Horizon in the mean time by way of earnings, which clearly has a direct impression on its means to lift the dividend.

In case you are eager about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].