thitivong

I clearly keep in mind the quantity of pleasure across the long-awaited rally in Japanese equities originally of the 12 months. Nevertheless, just some extra months have proven that the Japanese inventory market is dealing with rising challenges.

Overseas traders have a tendency to depart the Japanese equities attributable to considerations across the Japanese financial system and forex. With the yen hitting new lows relative to the US greenback, currency-hedged exchange-traded funds just like the WisdomTree Japan Hedged Fairness Fund ETF (NYSEARCA:DXJ) have develop into an particularly related choice.

Although the DXJ ETF helps to mitigate the chance of the additional weakening of the Japanese yen, it’s nonetheless uncovered to structural points within the Japanese financial system. I give the DXJ ETF a “Maintain” score and would suggest traders in Japanese equities train warning.

DXJ ETF Overview

In line with the prospectus, the WisdomTree Japan Hedged Fairness Fund ETF is a passively managed ETF that seeks to trace the efficiency of the WisdomTree Japan Hedged Fairness Index. The DXJ ETF seeks to offer Japanese fairness returns whereas mitigating or “hedging” in opposition to fluctuations between the worth of the Japanese yen and the U.S. greenback. For reference, forex hedging is a technique designed to handle forex threat by way of ahead contracts or FX choices.

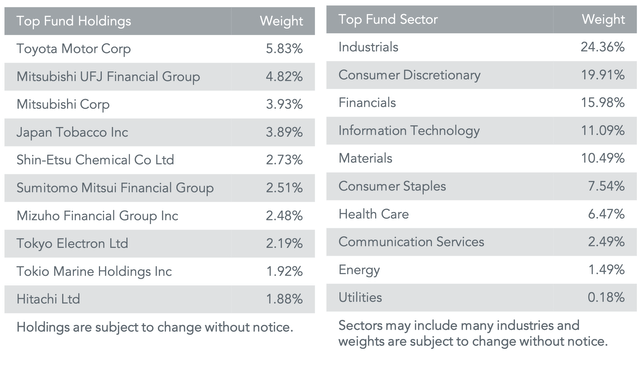

The DXJ ETF holdings construction consists of Japanese dividend-paying firms, primarily exporters. The sector composition is relatively diversified, with a main give attention to firms from the economic, shopper discretionary, and monetary sectors.

WidsomTree

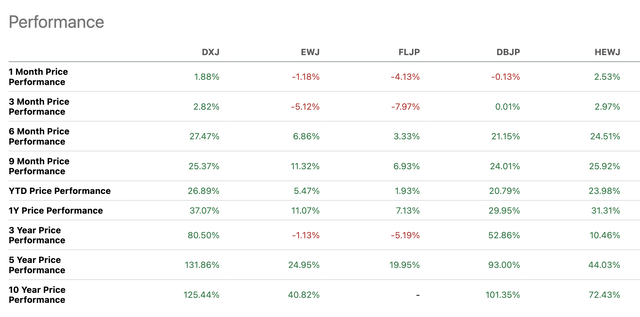

In comparison with peer Japan ETFs, the DXJ is an absolute winner if we’re speaking a few time horizon longer than 3-6 months. There is a clear development that non-hedged ETFs just like the iShares MSCI Japan ETF (EWJ) show radically inferior returns.

Looking for Alpha

The long-term efficiency of the DXJ ETF, amid a repeatedly declining Japanese yen relative to the US greenback, emphasizes how helpful currency-hedged ETFs could be for traders.

What’s The Bull Case For Japanese Equities?

The overview of the Japanese inventory market made by abrdn funding firm might be one of the concise and informative items on the subject. Let me summarize the important thing bullish factors associated to Japanese equities:

Japanese inventory market is massive however nonetheless massively underanalyzed, providing the potential for hidden worth;

Loads of Japanese firms have sturdy fundamentals, stability sheets, and money flows;

Japan’s nonetheless average inflation positions Japanese companies properly in comparison with different main economies;

Lengthy-term structural themes like robotics, vitality transition, and digitization might assist the expansion of Japanese equities sooner or later;

All of those factors sound fairly good, a minimum of so long as we do not dive too deep into macroeconomics surrounding the Japanese equities. Macro is the place the place issues get actually difficult for Japan.

Financial institution of Japan Is Locked In A Difficult Macro Panorama

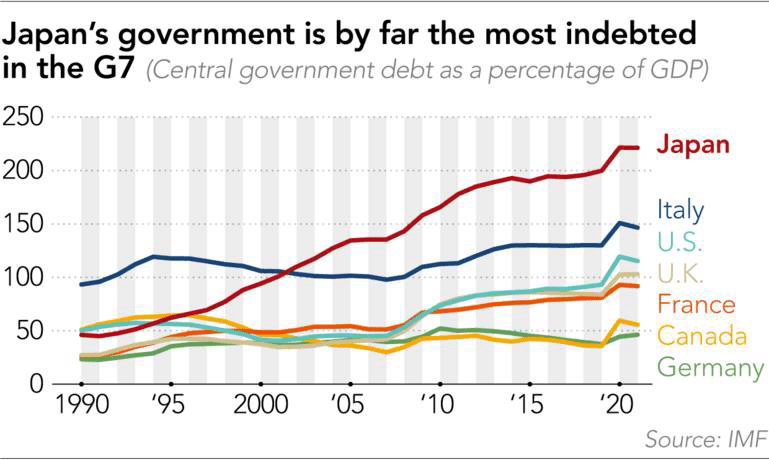

During the last a number of many years of financial stagnation, Japan has amassed loads of debt. Within the G7, Japan is essentially the most indebted nation of the group, with the proportion of presidency debt to GDP exceeding 260%, by some estimates.

Nikkei Asia

Japan’s financial system is closely depending on rising debt that helps the federal government to briefly masks the structural points (just like the growing old inhabitants) and the dearth of long-term financial drivers.

The debt “elephant within the room” cannot be ignored due to the a number of causes:

As a result of extraordinarily excessive authorities debt load, the Financial institution of Japan (BoJ) may be very restricted in its potential to lift rates of interest. The present rate of interest in Japan is 0-0.1%, which is nowhere close to the US Fed Funds price of 5.25-5.50%. Such an enormous distinction between charges places the BoJ in a weak place when it comes to financial flexibility. If the BoJ raises charges, the federal government’s finances will face a dramatic enhance in curiosity funds to keep up debt, and Japan shall be vulnerable to slipping right into a deflation spiral once more. On the identical time, the lack to lift rates of interest is particularly essential amid the steadily weakening Japanese yen and the BoJ has few financial instruments to cease the extreme decline of the yen. When the yen weakens an excessive amount of, the BoJ has to resort to direct FX interventions that show diminishing effectivity over time.

For me, such a macroeconomic setup may be very removed from being a sustainable one over the long run. Some might argue that america themselves are on the identical debt trajectory. Nonetheless, the US, in addition to the EU nations, are noticeably removed from the identical stage of debt Japan at present has.

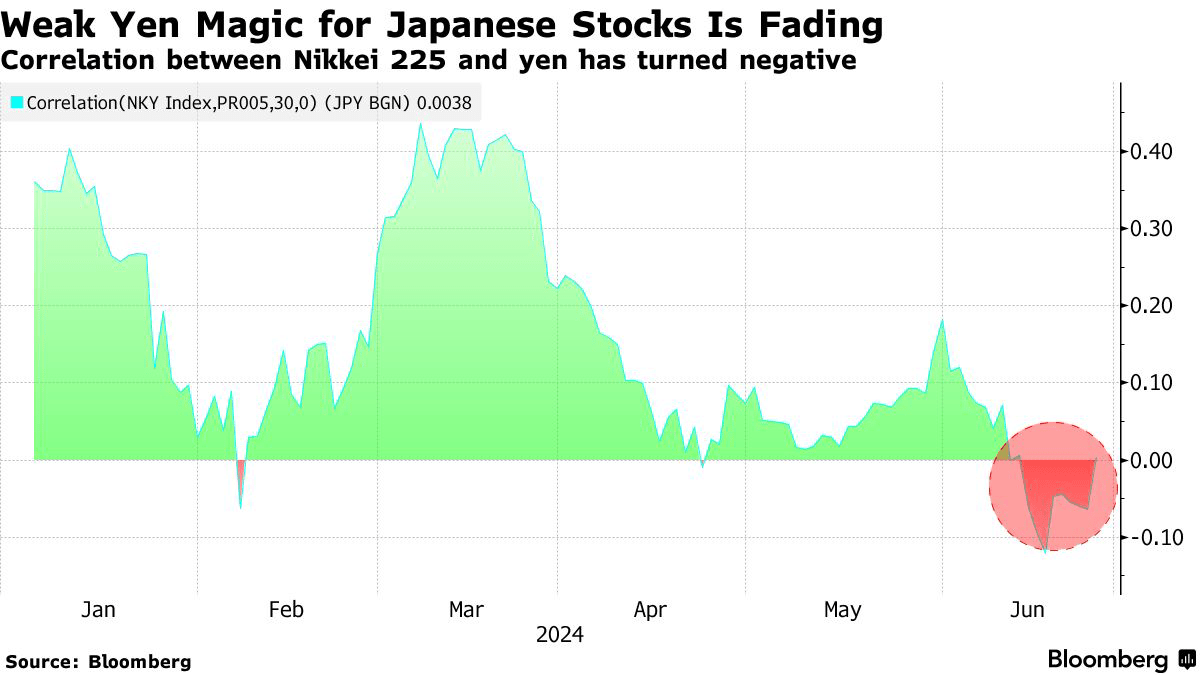

Up till just lately, the weak yen has been a boon for Nikkei 225, the primary Japanese inventory index. Nevertheless, in June, the correlation between Japanese equities and the yen turned unfavourable.

Bloomberg

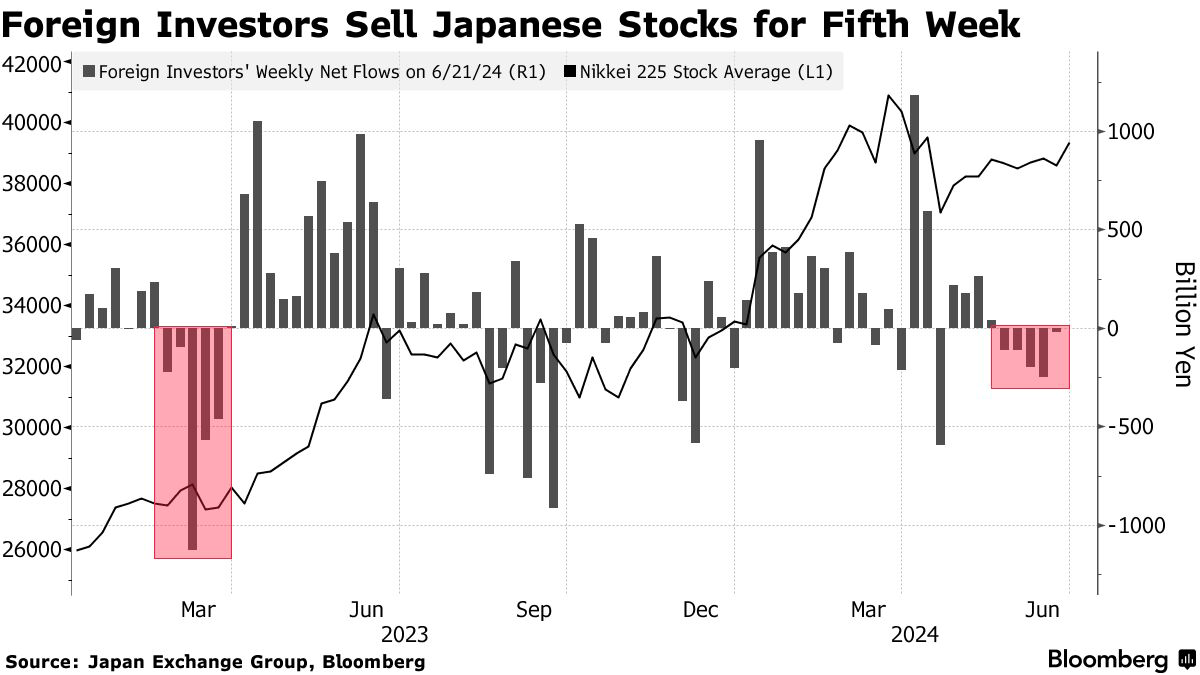

Weekly internet flows present a steady outflow for the fifth straight week, although the magnitude of outflows is way smaller than it was, for instance, in March 2023.

Bloomberg

The factor is, the yen change price climbed again above 160 per the US greenback, which is an indication of the uncomfortable weak point of the Japanese forex. The FX market fully absorbed the $62 billion intervention from the Financial institution of Japan simply in a few months, when the USD/JPY price was briefly introduced down from 160 to 152.

Earlier interventions of comparable quantity had been efficient for round a 12 months, and the Powell’s “pivot” ultimately of 2023 actually helped the Japanese forex. Now, on condition that the Fed sticks to the “increased for longer” method, the yen lacks tailwinds that would assist it to remain afloat with out falling an excessive amount of.

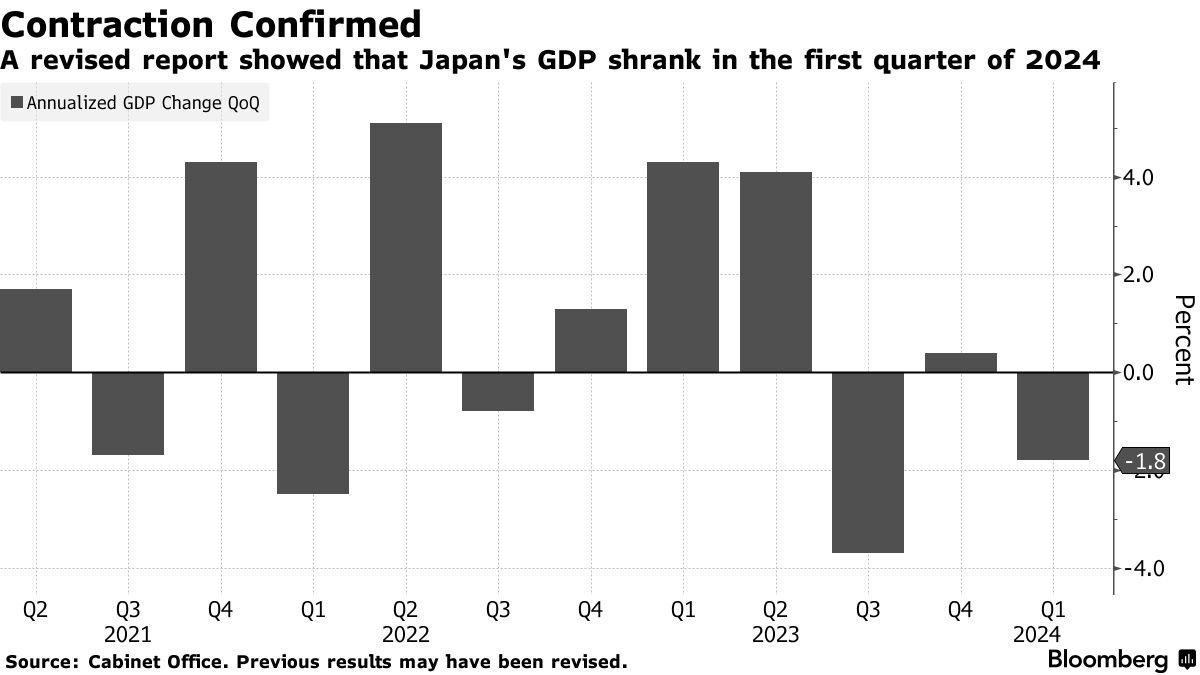

Even worse, revised information confirmed that Japan’s GDP declined by 1.8% in Q1 2024, with weak consumption as a key supply of concern.

Bloomberg

To be fully honest, Bloomberg specifies that the Q1 GDP was affected by one-off elements: a New Yr’s Day earthquake northwest of Tokyo and an auto manufacturing halt attributable to a certification scandal. The Q2 GDP numbers are anticipated to be significantly better and shall be revealed in August, which can be an area turning level for Japanese equities.

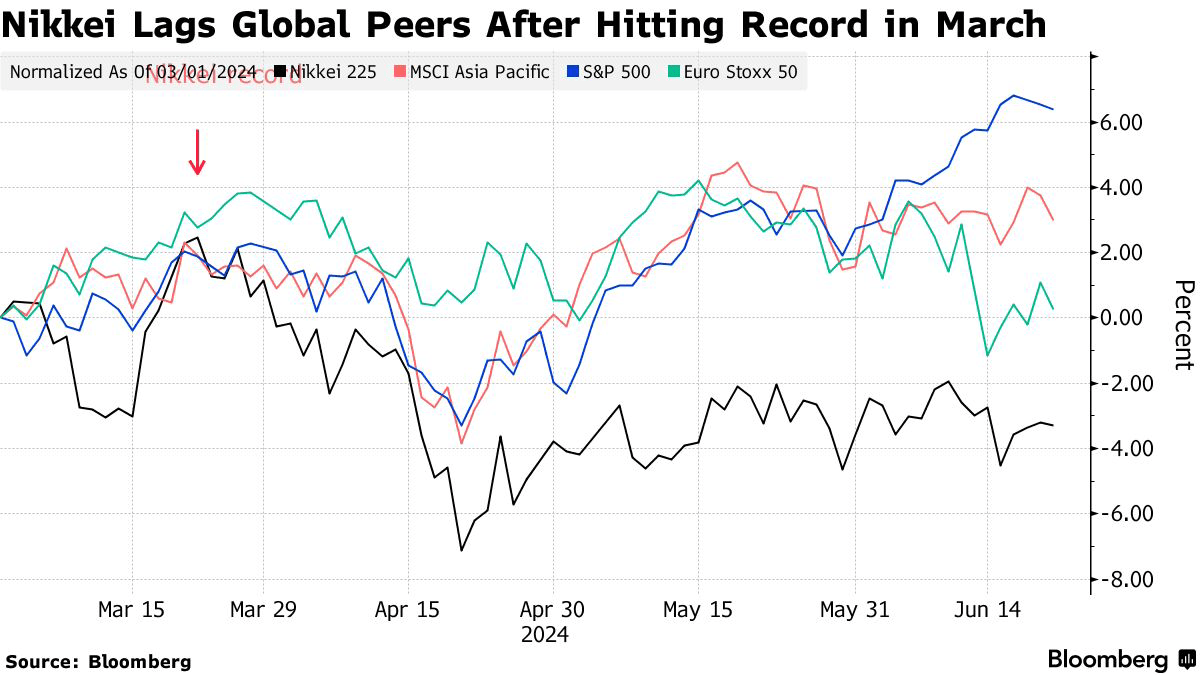

Within the following weeks, I count on the Nikkei to proceed lagging behind its peer inventory indexes due to the weakening of the yen and sluggish financial progress.

Bloomberg

To sum up, the present BoJ’s method to financial coverage could be described as “spray with liquidity and pray the Fed turns dovish quickly sufficient to keep away from price hikes”. Provided that we could also be in all probability on the point of the second inflation wave within the mid-2020s, any price cuts from the Fed within the foreseeable future might not keep for lengthy. Due to this fact, the longer-term macroeconomic panorama for Japan appears unfavorable, with the Financial institution of Japan mainly being on the mercy of the US Federal Reserve.

The Backside Line

I choose to carry a constructive and unbiased view of Japanese equities. If the Fed one way or the other manages to efficiently execute a broadly anticipated “comfortable touchdown” of the US financial system, then price cuts within the US can result in one other wave of progress in Japanese equities, for my part.

The DXJ ETF does a spectacular job of insulating traders from currency-related dangers, successfully benefiting from the collapsing yen. Nevertheless, the excessively weak yen mixed with weak financial information should crush on traders’ sentiment. Thus, I might personally keep away from investing in Japanese shares, a minimum of till the financial outlook improves.