hapabapa

We have coated quite a few income-generating and value-based shares currently. As such, we determined to alter to combine issues up by assessing a development inventory known as NerdWallet, Inc. (NASDAQ:NASDAQ:NRDS).

NRDS Inventory Efficiency (In search of Alpha)

NerdWallet’s inventory has surged by extra than 40% year-over-year, suggesting it has gained recognition amongst traders. Nonetheless, as proven within the article, the inventory stays under its IPO worth. Thus, the query turns into: Will NerdWallet breach its IPO worth of $18 per share, keep at its present degree of round $14 per share, or retrace again to its all-time lows?

Let’s handle the central query by assessing our findings on the inventory.

What Is NerdWallet?

One of the simplest ways to explain NerdWallet is to think about a high-quality, high-volume monetary weblog that writes about numerous monetary subjects and consequently hyperlinks readers to their desired merchandise.

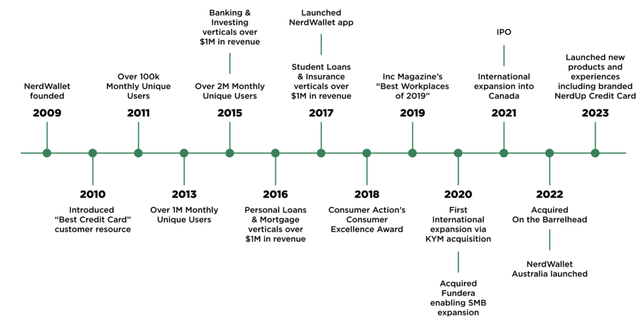

The corporate began in 2009 and managed to draw sufficient customers to monetize its idea. Within the following years, NerdWallet launched into an exterior development journey, creating an internet online affiliate marketing platform. Furthermore, NerdWallet generated sufficient income to amass like-minded firms and improve its footprint.

As issues stand, NerdWallet has an built-in platform that streams clients by way of instructional content material, converts its traction into income by linking its customers to related product varieties, and retains its person base by way of its in-house administration utility choices.

Firm Timeline (NerdWallet)

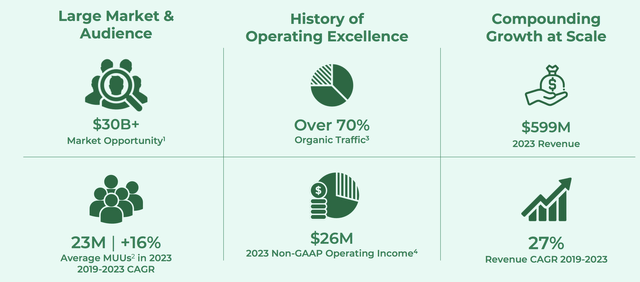

Changing the aforementioned elements into numbers exhibits that NerdWallet achieved almost $600 million in income final 12 months, concurrently consolidating a five-year annualized development price of 27%. The corporate has but to realize sustained profitability. Nonetheless, it looks like scale is the principle focus for now; due to this fact, its flimsy backside line ought to be put into perspective.

By The Numbers (NerdWallet)

Key Worth Drivers

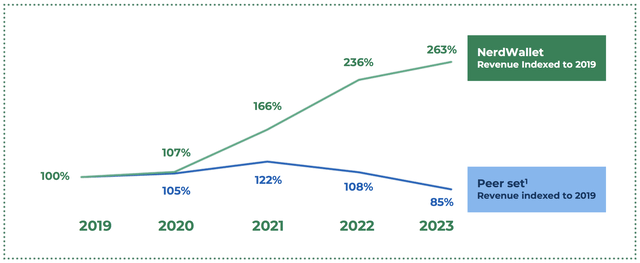

In line with its in-house knowledge, NerdWallet’s income is scaling quicker than that of its peer group. We do not know the way it chosen its friends. However, an remoted view suggests the corporate has achieved telling outcomes previously 5 years.

NerdWallet

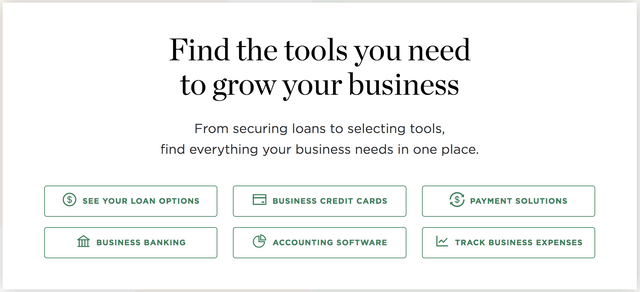

We predict a lot of NerdWallet’s scalability has derived from two components: Fundera, a diversified mortgage product comparability firm it acquired in 2020, and BarrelHead, a associated firm it acquired shortly after.

Rated at 4.6 stars by Belief Pilot, Fundera is a completely built-in instrument that permits shoppers and companies to match financial institution accounts, credit score options, accounting software program, and extra. The platform has delivered key synergies as NerdWallet’s instructional advertising and marketing method and Fundera’s concise comparability strategies have coalesced to generate stellar development. In reality, NerdWallet claims that Fundera’s acquisition has immediately contributed to a 3x scale think about small-business income (because the acquisition).

Touchdown Web page (Fundera)

Barrelhead is an analogous product to Fundera. Nonetheless, private mortgage linkage has been the principle contributing issue since its acquisition. NerdWallet claims the acquisition has doubled its match price as a result of technological enhancement and data-driven shopper experiences.

We anticipate NerdWallet will resume its holistic development all through the subsequent few years as we predict monetary literacy will probably be taken extra critically than ever. Furthermore, we imagine enhanced SME participation will ship alternatives to firms comparable to NerdWallet.

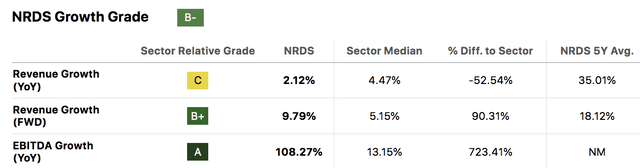

Key Development Metrics (In search of Alpha)

Current Elementary Efficiency

NerdWallet launched its first-quarter monetary leads to April, beating its income estimate by $4.6 million and delivering an earnings-per-share of $0.01, which was according to expectations.

Though NerdWallet delivered a commendable report, it has suffered a sequence of earnings-per-share misses. We flag this as a danger issue as a result of earnings momentum’s function in inventory efficiency.

NRDS Previous Earnings (In search of Alpha)

Regardless of caring by NerdWallet’s occasional bottom-line miss, we just like the make-up of its Q1 outcomes.

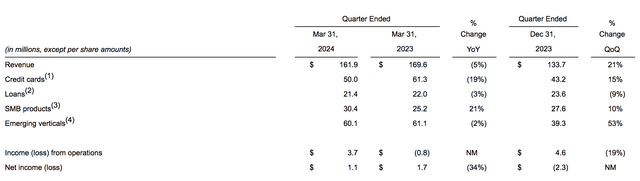

NerdWallet’s SMB merchandise have resumed sturdy development, which we anticipate to proceed, contemplating the aforementioned segmental development multiplier.

Positive, NerdWallet’s mortgage and bank card income slumped year-over-year. Nonetheless, we predict peak rates of interest are the possible trigger. We anticipate that debt inquiries and originations will speed up as soon as rates of interest begin decreasing. Though we will not ensure when rates of interest will drop, we predict the U.S. yield curve’s newest habits suggests they’ve topped out.

Q1 Segmental Outcomes (NerdWallet)

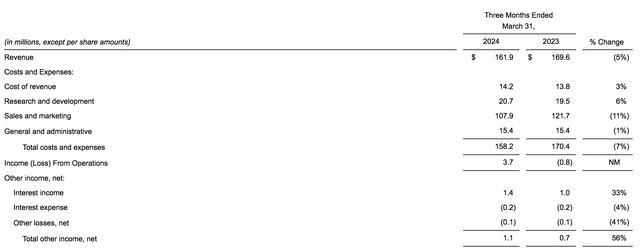

A view of NerdWallet’s complete earnings assertion raises a number of attention-grabbing factors.

The corporate’s working earnings margin is on a knife’s edge. Nonetheless, we do not suppose NerdWallet’s lean working earnings is a matter, as many of the agency’s bills have been associated to R&D and advertising and marketing. We imagine NerdWallet’s beforehand talked about development multiples and early-stage nature excuse the excessive R&D and advertising and marketing bills. In reality, we desire seeing excessive numbers in these line objects, because it indicators the corporate’s intent to enhance market share.

Q1 Detailed Earnings Assertion (NerdWallet)

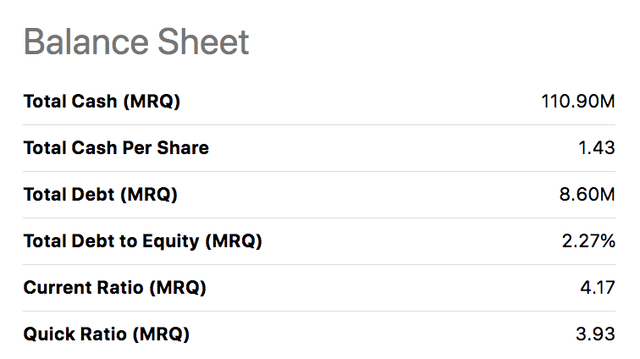

Lastly, NerdWallet’s key stability sheet liquidity metrics appear secure. We predict the agency’s present and fast ratios are sturdy, which means its skill to reinvest with out voiding its solvency is probably going intact. Furthermore, the agency has a robust money place of almost $111 million, defending it towards sudden macroeconomic declines.

Steadiness Sheet Ratios (In search of Alpha)

In abstract, we predict NerdWallet’s Q1 outcomes are favorable, putting the corporate on a very good trajectory for the mid-to-late levels of its present reporting 12 months.

Valuation

Peer Evaluation

It is difficult to seek out friends for NerdWallet as a result of its novel enterprise mannequin and the truth that few of its rivals commerce publicly. Nonetheless, I compiled a number of with the assistance of In search of Alpha’s database. A detailed peer we not too long ago analyzed is MoneyLion (ML), which operates beneath comparable key worth drivers.

Friends (In search of Alpha)

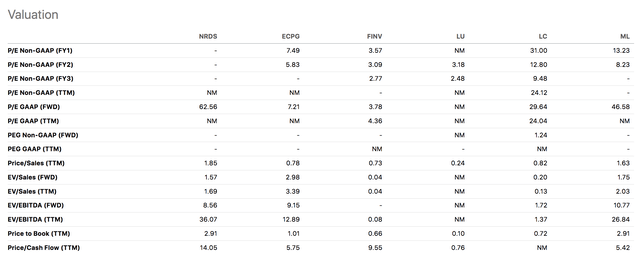

The next diagram illustrates NerdWallet’s peer-based valuation multiples; a dialogue follows.

Peer Valuation Fashions (In search of Alpha)

We determined to emphasise NerdWallet’s price-to-sales and EV/EBITDA ratios. In our view, the prior supplies a very good approximation of a development inventory’s worth, whereas the latter supplies a price-to-earnings proxy for unprofitable corporations. Furthermore, we desire EBITDA for tech firms as amortization figures will be subjective.

In isolation, we like NerdWallet’s price-to-sales ratio of 1.85x as we deem it low for a development inventory. Nonetheless, NerdWallet’s P/S ratio ranks weaker than these of its friends, suggesting little relative worth is in retailer. In essence, there is a tradeoff.

As with its P/S ratio, we predict the corporate’s ahead EV/EBITDA ratio of 8.56x is stable for a development agency. And, not like its P/S ratio, NerdWallet’s ahead EV/EBITDA ratio ranks higher than most of its friends.

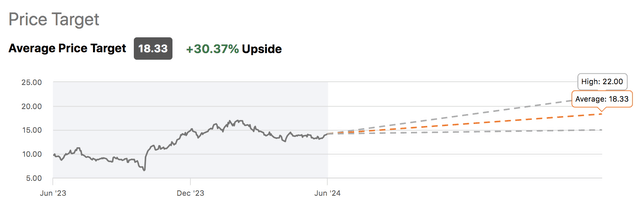

Wall Road Value Targets

Wall Road worth targets do not assure an consequence. However, they supply stable guideposts.

In search of Alpha’s database exhibits that NerdWallet has acquired seven scores within the final 90 days, together with 4 Buys, two Sells, and one Maintain. The common analysts’ worth goal is $18.33, which indicators potential upside of roughly 30%.

In search of Alpha

We predict the beforehand mentioned fundamentals, Wall Road’s scores, and our worth a number of judgment place NerdWallet’s inventory in undervalued territory. Nonetheless, the inventory has a number of danger elements value contemplating; let’s focus on a number of of them.

Dangers

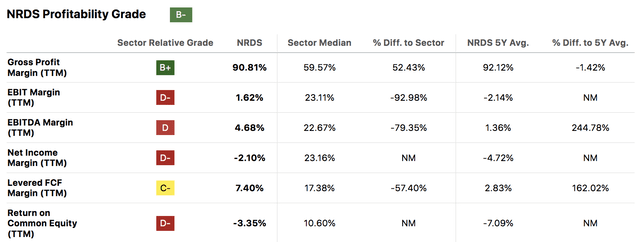

As talked about earlier, NerdWallet has struggled to maintain a constructive internet earnings margin. Though we argued that the character of its bills is not dangerous, we worry that sustained losses would possibly dampen the corporate’s liquidity, inflicting a share issuance and concurrently diminishing shareholders’ worth.

In search of Alpha

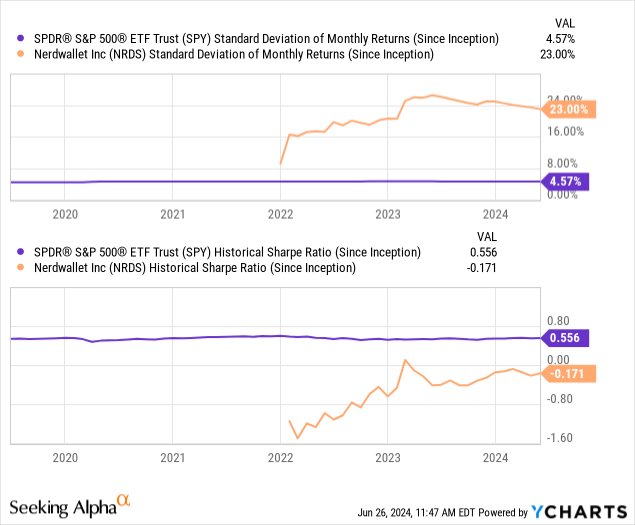

Moreover, NerdWallet’s month-to-month returns have a excessive normal deviation, suggesting it’s vulnerable to tail danger. The inventory additionally has a unfavourable Sharpe Ratio, implying its returns do not justify its elevated normal deviation.

Though merely quantitative measures, the Sharpe Ratio and Commonplace Deviation present a parsimonious indicator of a inventory’s risk-return profile.

Closing Verdict

We predict NerdWallet presents a wonderful development alternative. Regardless of working on lean revenue margins, the corporate is rising at scale. Furthermore, most of its bills are geared towards R&D and advertising and marketing, which means further development is probably going.

NerdWallet’s natural development has proliferated in recent times after its Fundera and Barrelhead acquisitions, bolstering its development multiplier. We count on this development to renew as a result of systematic help and a sturdy money place, permitting it to have interaction in further acquisitions and embark on product improvement journeys.

Lastly, we predict NerdWallet’s inventory is undervalued on the premise of its salient worth multiples, that are supported by Wall Road’s outlook.

Consensus: Purchase/Chubby Holding