ricochet64/iStock Editorial by way of Getty Photos

Shares of UPS (NYSE:UPS) have been performing poorly because the burst of the post-COVID eCommerce bubble, and the agency has been shedding market share to Amazon (AMZN) at an accelerating tempo in current instances. These conditions may be tough to time, however UPS nonetheless has a strong aggressive place and is uncovered to ongoing tailwinds of development in eCommerce, which seems to have principally normalized following the previous couple of years of volatility. I share why I believe the general image could also be bettering.

ECommerce Tailwind Is Nonetheless There

Retail eCommerce gross sales are anticipated to compound at practically ~10% per yr between 2024 and 2028. Within the US, the CAGR is predicted to achieve practically 12%. Some extra optimistic forecasts have the 2024-29 CAGR at ~16%. I imagine this stays a key driver for the business, each by way of rising deliveries and rising parcel returns.

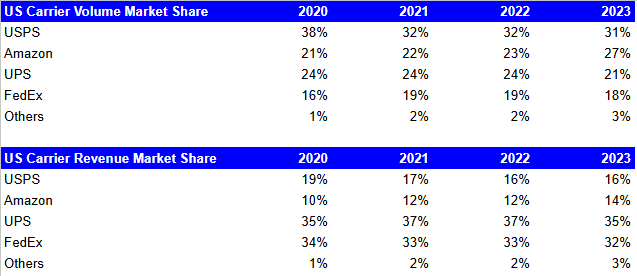

UPS, like FedEx and USPS, has been shedding market share to Amazon, and it’ll in all probability hold shedding some. Nevertheless, I believe it’s extremely unlikely that the world’s largest package deal supply firm will be unable to learn in some way from such optimistic structural development in eCommerce. That is an underlying tailwind that may doubtlessly final a decade or extra, and it doesn’t have an effect on solely Amazon. Amazon’s share of US eCommerce, for instance, may be stabilizing between 37 and 38%. That is the sector that Amazon has disrupted and which it dominates.

An analogous market share in logistics, in my opinion, tougher to achieve. Established gamers akin to UPS have robust relationships with companies that may not need Amazon to dominate logistics along with eCommerce. UPS and different extra established friends additionally cater to a wider vary of supply wants, together with high-value gadgets.

Amazon already boasts an enormous 27% market share in logistics now by way of variety of parcels delivered, making it the second largest offered after USPS (31%), whereas saying extra expansions of the community. Amazon can definitely hold gaining market share by leveraging its dominant place in eCommerce and world community, however its market share positive aspects do not imply UPS cannot develop and prosper at a decrease fee that might nonetheless make the present valuation a discount.

Pitney Bowes, Creator

As Amazon can also be the primary competitor for many retailers who would use it as a supplier of logistics providers, it’s affordable to imagine that many retailers will likely be reluctant to totally depend on it.

For UPS particularly, there are a lot of massive retailers relying not less than partially on its logistics providers (apart from Amazon), together with Dwelling Depot, Sephora, Lowes, Goal, eBay, to call a number of. Large tech giants akin to Apple additionally rely rather a lot on UPS for delivery.

I imagine that for many retailers, Amazon’s dominance out there the place the agency would have huge contractual energy just isn’t fascinating, and a market share equilibrium between giant logistics corporations might be the fascinating final result. If Amazon’s market share development slows down, the bull case for the core enterprise turns into comparatively easy. A ten-14% CAGR is, in my opinion, sufficient to permit the highest gamers to prosper and develop with out the necessity for a winner-takes-all state of affairs.

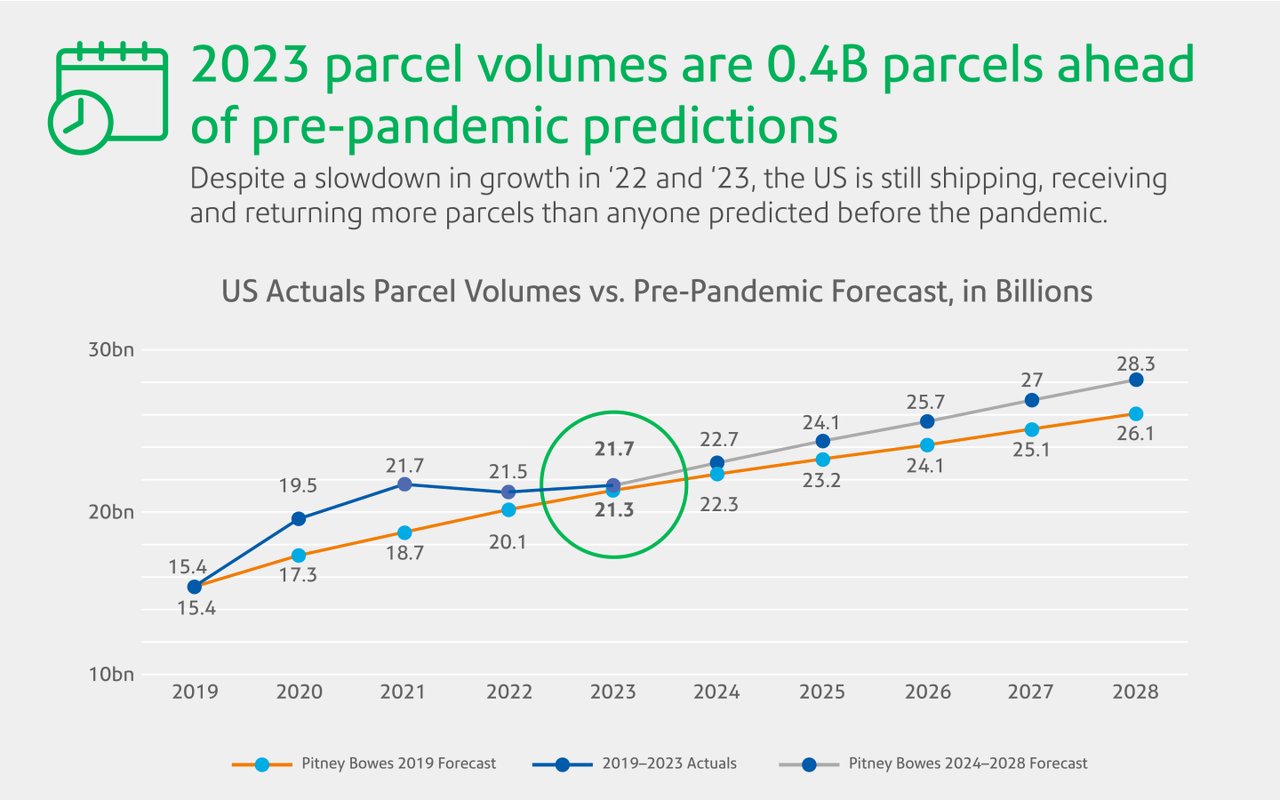

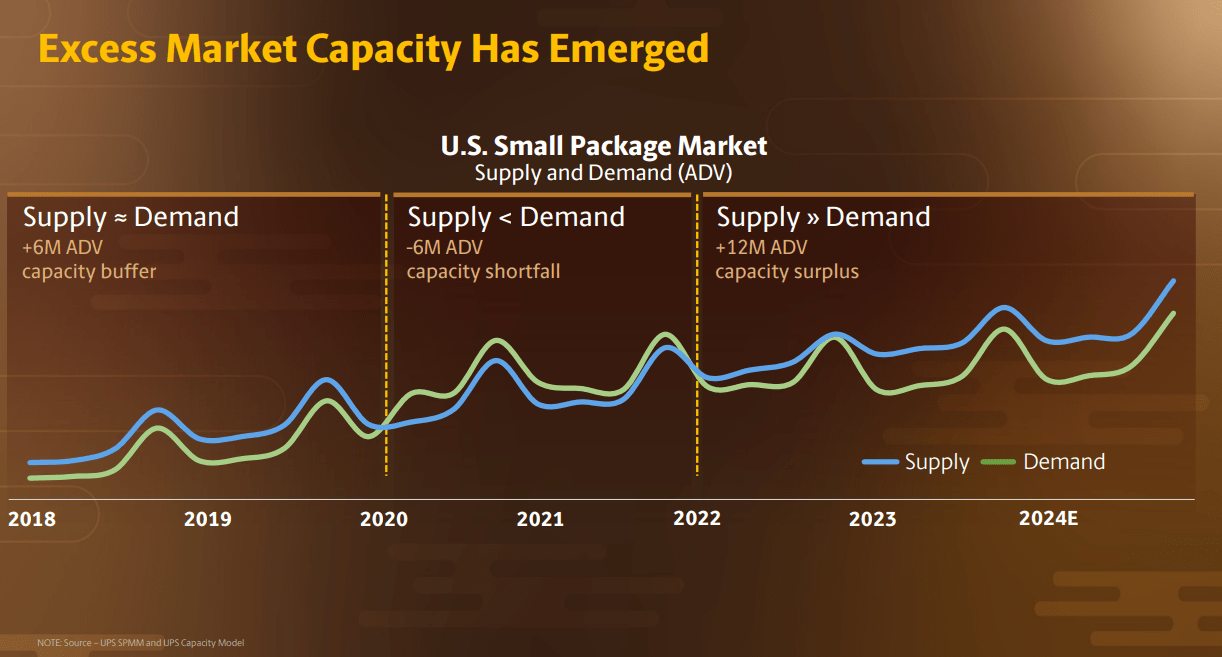

Overcapacity Drawback Is Bettering

UPS recognized an issue of overcapacity, estimated at 12m every day volumes within the US small parcel market. This can be a results of lock-down-induced eCommerce development that ended up falling again post-reopening. The ten-14% CAGR the eCommerce business is experiencing is the structural driver that makes me optimistic that these overcapacity points ought to step by step enhance now that the demand pattern seems to have normalized. I say the market seems to have normalized as a result of in accordance with information from Pitney Bowes, US precise parcel volumes are actually what we’d have anticipated had Covid not occurred, which suggests the business is now able to resume its structural development pattern.

Pitney Bowes

With the US present small parcel market between 84m and 88m every day parcels, and assuming ~70% is from eCommerce, it might take lower than one and a half years of 14% development and roughly two years ~10% development for eCommerce development to handle the capability surplus (assuming no additional will increase or very restricted will increase in capability).

And a discount to full equilibrium will not be wanted. Even a discount to a 6m surplus would lead the market again to an equilibrium just like the 2018-19 interval.

UPS Investor Day

Again then, the enterprise was capable of ship a ~10% working margin, consistent with the 2023 ranges. 2023 margins have been comparatively good regardless of declining income and price pressures, suggesting the enterprise remains to be capable of get pleasure from wholesome profitability in a tough yr. Wage will increase kicking in in 2024 and may not be a persistent stress if inflation stays at acceptable ranges. Due to this fact, some margin enlargement on a declining provide/demand hole ought to assist the enterprise obtain the ~12% working margin goal for 2026.

Traits Are Anticipated to Enhance

2023 and Q1’24 have been powerful years on all fronts. Income steering on the investor day implied a tough H1, with income down 1-2% and working revenue down 20-30%, however indicated a strong rebound in H2, with income up 4 -8% and working revenue up 20-30%.

Administration shared a goal of $114bn income at a 13%+ working margin by 2026, which suggests $14.9bn in adjusted working earnings, with a conservative ~$220m of funding and different earnings, ~$700m curiosity expense and a tax fee of 21% imply $11.4bn of internet earnings. On the present market cap and assuming a flat variety of shares excellent, this may correspond to a P/E ratio of lower than 11x. If the enterprise executes within the subsequent three years, I contemplate this a beautiful valuation, as UPS remains to be a strong, worthwhile and cash-flow generative enterprise with a strong place out there and uncovered to structural tailwinds regardless of the market share loss.

If Issues Don’t Go Properly

I principally talked in regards to the conventional core enterprise uncovered to eCommerce. I believe we might see issues enhance as Amazon’s market share will get stretched in the direction of a pure equilibrium and eCommerce development goes again to turning into a structural driver. There are nonetheless elementary dangers, and nothing ensures that Amazon won’t get much more aggressive.

Nevertheless, even with persistent pressures from Amazon within the subsequent few years, there are potential mitigating elements. UPS’ healthcare logistics is round $10bn in income now (~11% of complete income, and over 1 / 4 of SCS income), however administration’s aim is to double it by 2026. This can be a larger margin enterprise with much less aggressive pressures by Amazon (though not absent). As half of income development is predicted to return from larger income per piece, I’d count on margins to increase additional if administration’s targets are met.

Except for what’s taking place within the eCommerce-exposed small package deal market, from a combination perspective, it helps to have 10% of upper margin income doubtlessly double in three years with margins increasing additional.

Valuation Is A lot Extra De-risked, Probably Oversold

Even in a adverse yr akin to 2023, UPS managed to print over $5bn of FCF. At its high circumstances in 2022, the agency’s FCF was practically $10bn. A return to these ranges would make it appear to be a possible discount at 12x FCF, though it’s not anticipated to happen within the subsequent few years as a consequence of ~$6bn of yearly capex.

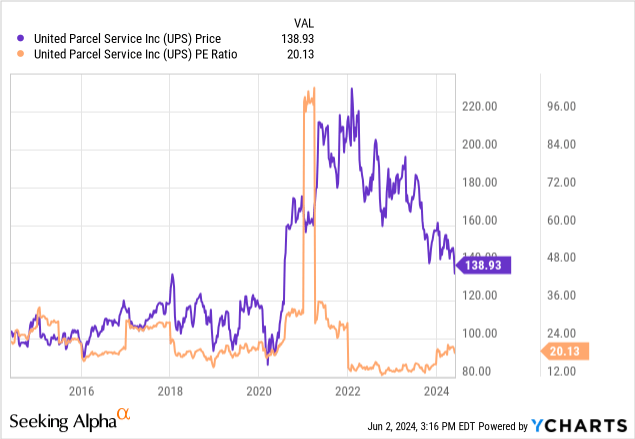

If we take a look at easy PE ratios, at present at ~20x, the present valuation suggests a doubtlessly enticing entry level. Previously ten years, a PE ratio of 20x or under characterised good entry factors in 2016 and within the 2019-20 interval.

The midterm steering shared on the investor day was additionally quite bullish. $111bn income (per midpoint of the steering vary) by 2026 at a 13% working margin means $14.4bn of working earnings. With a conservative ~$220m of funding and different earnings, ~$700m curiosity expense and a tax fee of 21% it offers practically $11bn of internet earnings. On the present market cap and assuming a flat variety of shares excellent, this may correspond to a P/E ratio of lower than 11x. If the enterprise executes within the subsequent three years, I contemplate this a possible discount, as UPS remains to be a strong, worthwhile and cash-flow generative enterprise with a powerful place out there and uncovered to structural tailwinds.

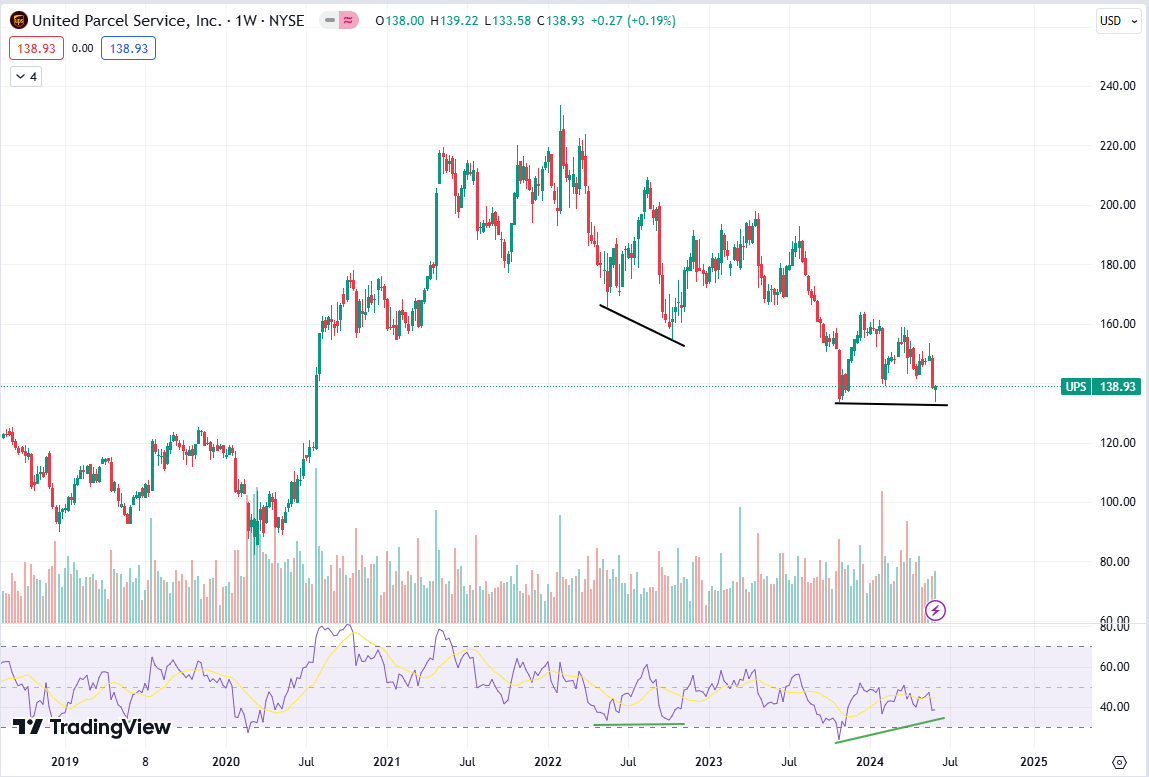

Potential Double Backside?

The inventory has been weak and technicals are approaching oversold territory once more. Though not tremendous clear, there’s a potential double backside forming on the weekly chart with a optimistic divergence on the RSI (14-week within the chart). This kind of sample has labored on UPS inventory earlier than (e.g. Could-October 2022) and may provide one other angle to counsel a constructive short-term image.

TradingView

Conclusion

UPS enterprise remains to be uncovered to the specter of Amazon’s rising market share, however I see a extra optimistic image doubtlessly rising. Valuation is reaching enticing ranges, whereas the eCommerce market normalisation could lead on the small parcel market to increase once more. The optimistic combine impact of rising, high-margin healthcare income helps, and valuation doesn’t seem demanding, particularly if met with execution on the 2026 targets.

Bettering monetary traits for the remainder of the yr and a doubtlessly constructive technical image counsel the risk-reward has improved. I see UPS shares as a cautious purchase right here.