Investing.com– Most Asian currencies rose barely on Friday, capitalizing on a drop within the greenback as markets hunkered down earlier than key U.S. payrolls information that’s more likely to issue into rates of interest.

The greenback was additionally pressured by a rebound within the Japanese yen, which pulled additional away from 34-year lows amid what gave the impression to be authorities intervention in foreign money markets.

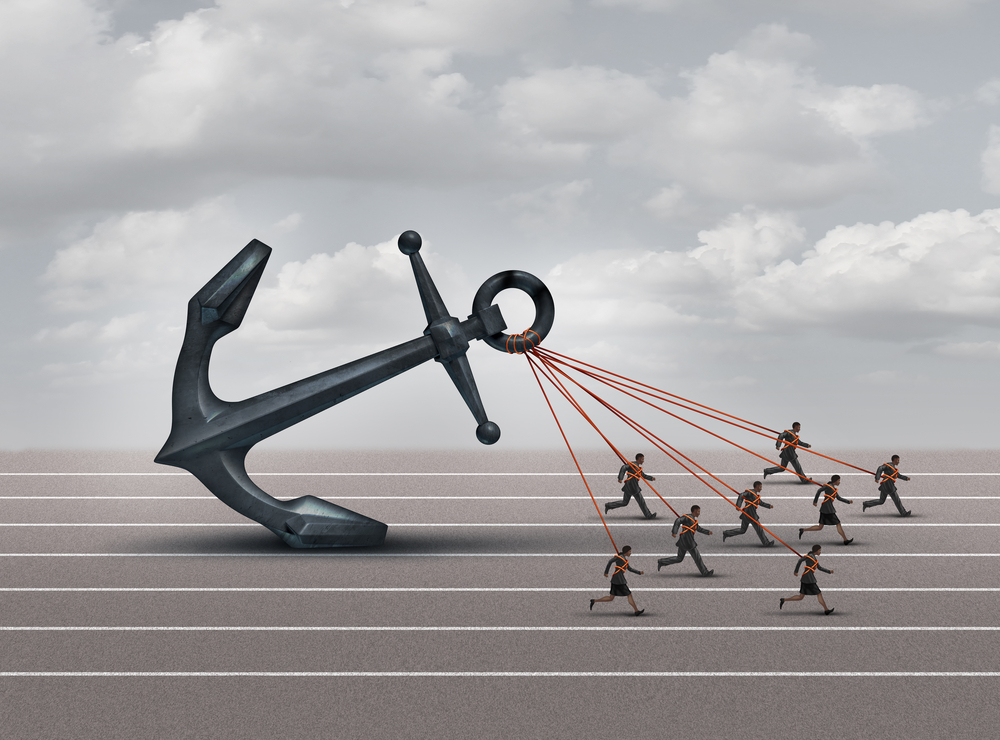

Weak point within the greenback provided some respiration room to regional currencies, though they have been nonetheless nursing steep losses on the prospect of U.S. rates of interest remaining excessive for longer.

Japanese yen corporations amid probably intervention, USDJPY at 3-week low

The Japanese yen noticed prolonged beneficial properties on Friday, with the pair- which strikes inversely to energy within the yen- falling 0.4% to 153.02. The pair briefly hit a three-week low of 152.9.

The USDJPY pair was set to lose about 3.4% this week because it tumbled from 34-year highs. Merchants and analysts attributed the drop largely to foreign money market intervention by the Japanese authorities.

The USDJPY pair had surged to 160 earlier this week. Merchants mentioned this stage was the brand new line within the sand for foreign money market intervention.

Home Japanese markets have been closed on Friday. However the decrease volumes additionally aided the yen.

Nonetheless, the components that had spurred current yen weak spot remained in play, mainly the prospect of high-for-longer U.S. rates of interest.

Broader Asian currencies rose barely, capitalizing on an in a single day drop within the greenback. The Australian greenback’s pair rose 0.2%, as markets positioned for doubtlessly hawkish indicators from the subsequent week. Hotter-than-expected Australian inflation readings noticed markets largely worth out expectations of any price cuts by the RBA in 2024, providing the Aussie some energy.

take away advertisements

.

Buying and selling volumes in Asia remained muted on account of market holidays in Japan and China.

The South Korean received’s pair fell 0.3%, whereas the Singapore greenback’s pair fell 0.1%.

The Indian rupee’s pair fell barely, and was buying and selling properly under document highs hit in April.

Greenback steadies from in a single day losses, nonfarm payrolls awaited

The and steadied in Asian commerce after tumbling in in a single day commerce, as stress from the yen and expectations of no extra rate of interest hikes by the Federal Reserve dented the buck.

Focus was now squarely on information for April, which is due later within the day. The studying has persistently crushed estimates for the previous 5 months, with any indicators of persistent labor market energy giving the Fed extra headroom to maintain charges excessive for longer.

The Fed signaled earlier this week that it had no plans to chop charges within the near-term, particularly within the face of sticky inflation.