Justin Horrocks/E+ by way of Getty Photographs

Comcast (NASDAQ:CMCSA) supplied Q1 earnings this week. Regardless of beating on the highest and backside line, the share value fell 6% in at some point, ensuing within the lowest shut since April 26, 2023.

The inventory is now down over 10% this month and has fallen almost 14% in 2024.

Bears have lengthy pointed to the speedy decline within the cable and media companies as an inexorable headwind that can derail the corporate. Moreover, some level to developments highlighted on this quarter’s outcomes as proof that administration’s progress initiatives are failing to mitigate the loss in cable subscribers.

Nevertheless, I contend that there are a number of positives to be discovered on this earnings season, in addition to in total tendencies.

Q1 Earnings

Comcast reported Q1 2024 outcomes on the twenty fifth of April.

Non-GAAP EPS of $1.04 beat analysts’ estimates by $0.05 and was up from the comparable quarter by $0.12.

Income of $30.1 billion beat consensus by $300 million and elevated by $400 million from Q1 of 2023.

Free money movement for the quarter was up almost 20%, to $4.5 billion.

Common income per consumer (ARPU) for broadband elevated by over 4%, leading to mid-single digit progress in residential broadband income to over $6.5 billion.

Residential connectivity income elevated by 7%, with 4% progress in home broadband, 13% progress in home wi-fi and 19% progress in worldwide connectivity.

Enterprise companies connectivity income grew 5%.

Nevertheless, income for complete connectivity in platforms was flat at $20.3 billion.

The variety of wi-fi subscribers elevated by 21%, to six.9 million prospects, and wi-fi income was up 13%.

The corporate reported strong progress from Peacock, with income surging by 54% to $1.1 billion 12 months over 12 months and subscribers hitting 34 million, a 55% improve.

Why The Inventory Plummeted

Sure, Comcast beat on the highest and backside line; nevertheless, income solely elevated by roughly 1% 12 months over 12 months, and web revenue grew by lower than 1%.

Plus, the corporate reported an adjusted EBITDA lack of $639 million for Peacock. Add to {that a} 65,000 loss in home broadband prospects and 487,000 home video prospects for the quarter.

Whereas a big drop in video subs was anticipated, that doesn’t diminish the headwind it creates. And administration has lengthy pointed to home broadband as a progress engine that may counter the cable losses.

What Many Bears Are Lacking

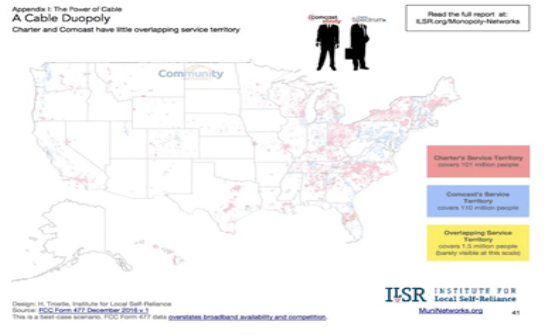

Comcast and Constitution (CHTR) are a duopoly that serve 200 million individuals within the US, with lower than 1% of these getting access to the companies of each corporations.

Comcast can be the one broadband supplier to thirty million prospects in america.

ILSR

In response to the Institute For Native Self-Reliance, this duopoly leads to Comcast and Constitution having “an absolute monopoly” over 47 million individuals. Moreover, until they go for a a lot slower and fewer dependable supplier, 33 million individuals within the US haven’t any possibility in addition to Comcast or Constitution.

A report launched by Ookla early this 12 months rated Comcast’s Xfinity because the quickest broadband service. Latest exams of web speeds additionally confirmed downloads are greater than two-and-a-half occasions sooner for broadband versus wi-fi, and broadband add speeds versus wi-fi are even better.

That is of explicit significance for video players who’ve a robust desire for the quickest service supplier.

Over 85% of Comcast’s prospects obtain 100 megabits/second service. In distinction, the three main telecom suppliers’ speeds hardly ever high 20 megabits/second.

In an effort to compete towards Comcast, AT&T (T), T-Cellular (TMUS), and Verizon (VZ) must make investments huge capex to improve their programs. Contemplating that every of these corporations have heavy debt masses, I might argue that that’s an unlikely state of affairs.

Moreover, Comcast is at present investing in DOCSIS 4.0. to improve its broadband choices. DOCSIS 4.0 supplies downstream capability of 10 Gbps however boosts upstream capability to six Gbps. That represents a significant enchancment over DOCSIS 3.1, which supplies a most downstream capability of 10 Gbps and a most upstream capability of 1-2 Gbps.

Comcast expects DOCSIS 4.0 to be obtainable to 50 million prospects by the top of 2025. DOCSIS 4.0 ought to serve to not solely hold opponents at bay whereas additionally driving ARPU progress.

Debt, Dividend, And Valuation

Comcast’s credit score is rated A- with a steady outlook. The weighted common value of the corporate’s debt is 3.6%, and the typical lifetime of Comcast’s debt is 16 years.

CMCSA has a yield of three.08%, a payout ratio a bit above 29%, and a 5-year dividend progress charge of 8.63%, indicating the dividend is protected and prone to develop for the foreseeable future.

The inventory trades for $37.92 a share. Analysts’ common one 12 months value goal is$49.94. CMCSA is rated as a robust purchase by 12 analysts, 4 charge the inventory as a purchase, and the rest have a maintain ranking.

CMCSA has a ahead P/E of 10.23x, nicely beneath the inventory’s common P/E over the past 5 years of 14.23x.

The present 5-year PEG of 0.66x can be nicely beneath the 5-year common PEG of 1.24x for CMCSA.

The corporate repurchased $13 billion of its inventory in 2022, $11 billion in 2023, and $2.4 billion this quarter. Share buybacks decreased Comcast’s share depend by almost 6% in FY 2024 and by over 15% since 2021.

Is CMCSA A Purchase, Promote, Or Maintain?

I’ll readily admit that the lack of cable subs is a significant headwind. Moreover, whereas the Peacock streaming service might (might) present an extra income stream, that’s removed from a foregone conclusion. Within the meantime, Peacock is a cash consuming machine.

I’ll add that I can’t see broadband offering a lot progress. That being stated, I imagine Comcasts has a really strong moat in that enviornment, one that’s prone to prevail for the foreseeable future.

Now let me present the explanation why I’m including to my place in CMCSA.

Since 2018, Comcast’s adjusted EPS is up over 50% whereas free money movement per share has elevated by almost 25%.

Comcast reported $4.5 billion in free money movement this quarter, up from $3.8 billion a 12 months in the past. The corporate’s strong FCF has been put to good use: since 2021, inventory buybacks have lowered the share depend by over 15%.

Administration has emphasised that Hulu proceeds will likely be used to speed up the share repurchase program.

With web debt at 2.3 occasions EBITDA, Comcast has a agency monetary basis.

In FY 2023, Comcast posted a record-breaking 12 months in theme parks, with $3.3 billion in adjusted EBITDA, up 25%, and a 19% surge in income.

Comcast’s new park, Common Epic Universe, is scheduled to open in Orlando in 2025..

Comcast had the #1 studio by worldwide field workplace in 2023, with The Tremendous Mario Brothers, Quick X, and Oppenheimer amongst three of the top-five films for the 12 months.

As famous above, CMCSA is the #1 broadband supplier within the U.S., in addition to the #2 broadband supplier within the U.Okay.

SKY, which supplies broadband and wi-fi companies within the U.Okay. and broadband service in Italy, reported a 23% improve in income in 2023.

Final however removed from least, I view the inventory as buying and selling at a valuation that gives a big margin of security.

Weighing all of those components, I charge CMCSA as a BUY.

I’ve a average sized place within the inventory which I added to following the earnings report.