Picture Supply/DigitalVision by way of Getty Pictures

Major Thesis/Background

The aim of this text is to debate the border market backdrop with a selected concentrate on gold and the way it might proceed to do properly deeper into Q2. That is an asset class I’ve held for a very long time – nevertheless it has usually been a “boring” a part of my portfolio. Nevertheless, over the previous 12 months, gold has carried out strongly.

Readers are possible conscious that this efficiency has been accelerating in 2024. That is regardless of persistent inflation and an elevated rate of interest setting – two components that are inclined to restrict gold’s bull case. As a result of this problem of historic norms and continued geopolitical points going through the globe, I assumed now was a superb time to take one other take a look at this treasured steel to see if a purchase case remains to be warranted. I consider it’s, for a range of causes, certainly one of which is that central banks (who are usually worth agnostic) have been pumping up their allocations within the brief time period. I’ll focus on this issue and extra intimately beneath.

**I personal the iShares Gold ETF Belief (IAU). I’ve additionally advisable prior to now the Sprott Bodily Gold and Silver Belief (CEF) for individuals who need a one-stop store for each metals.

First – A Phrase Of Warning

I’ll clarify on this case that proudly owning gold – and even shopping for extra – at these ranges is one thing I assist. However I’m properly conscious of the truth that gold has had a giant run of late. For that reason, I’d warning my followers to be tactical in how they strategy this asset. If this can be a place you have already got plenty of, then maybe being affected person makes extra sense. Likewise, whether it is new to you, do not go “all in” at these ranges. Gold, like many different sectors in 2024, has been rising persistently and that’s all the time one thing that traders want to remember when constructing positions:

Returns (Varied Property) (Yahoo Finance)

What I get at right here is we’re in a bull market for all sorts of belongings, corresponding to shares, oil, metals – together with gold. Is that this excellent news for traders? Completely. This 12 months has seen an amazing acquire to my net-worth already. However does it sign an setting the place traders must be a bit extra cautious? I’d say so.

Happily, gold tends to be a extra defensive asset and may maintain up properly in instances of market stress. However, on the flip facet, gold does not usually see such sturdy runs together with fairness markets both. So historic norms are being examined and readers ought to fastidiously take into account their very own portfolio allocations earlier than deciding to purchase into gold (and by how a lot).

Central Banks Have Been Huge Patrons

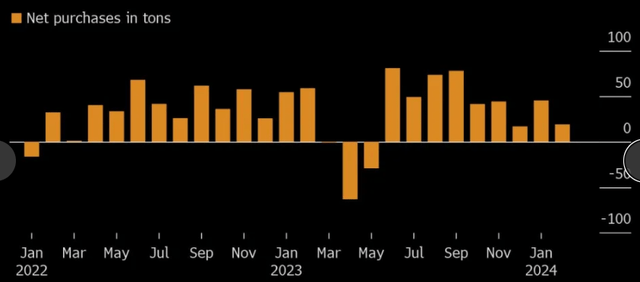

Now to a brighter be aware. As I began this evaluate off by saying, gold has a number of bullish components in its nook proper now. High of thoughts for me has been how central banks have been enjoying the steel. Particularly, they’ve been shopping for it up in droves on a worldwide degree:

Central Banks Web Gold Purchases (Tons) (Mixture) (World Financial institution)

I view this positively for a lot of causes. One, we should always all know the saying “do not combat the Fed” if now we have been investing during the last decade. I’m increasing that logic right here to “do not combat all of the central banks”. These are highly effective forces with plenty of capital to deploy, and betting towards them – whether or not it’s in relation to rates of interest (bonds) or metals corresponding to gold – appears a idiot’s errand to me. If central banks are shopping for (or promoting) than I wish to participate in that development.

Additional, central banks are usually price-agnostic as a result of they don’t seem to be essentially available in the market to show a revenue. They are often shopping for up belongings to stabilize markets or pursue another political purpose. This is not “good” or “dangerous”, only a reality of life. Perhaps it’s to hedge a neighborhood foreign money, shield the housing market, or calm volatility, amongst different components.

There are a plethora of the explanation why central banks may be shopping for gold at this second and the actual fact is that I wish to observe this herd. Being a contrarian towards the general public is one factor I’d assist. However being a contrarian towards central banks – particularly when they’re working in unison – shouldn’t be a play I’d make. This makes me a continued purchaser of gold right here.

Many “Actual” Property Are Gaining Favor

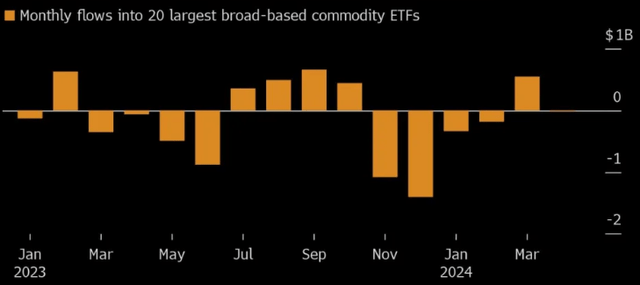

One other supporting issue I see for gold is related to what’s going on it different treasured metals/commodity markets. Merely put, gold’s run has not been a “fluke”, so to talk. Buyers are more and more searching for hedges towards political uncertainty, struggle, rate of interest volatility, and recessions, amongst others. This contains gold in probably the most conventional sense, however gold shouldn’t be alone on this regard. Whether or not it’s silver, oil, copper, or a number of different choices, traders appear to be turning to “actual” belongings to guard themselves.

For perspective, allow us to take a look at how retail traders have shifted course dramatically over the previous month to pump cash into a number of the greatest commodity ETFs. These are sometimes multi-themed merchandise, so traders aren’t simply banking on one or two commodities. It’s extra of a play throughout the spectrum:

ETF Inflows (By Month) (Yahoo Finance)

The conclusion I draw right here is this can be a development that’s simply starting. The world is seeking to commerce what’s going on in Gaza, jap Ukraine, China, and lots of different corners of the world by shopping for actual belongings to guard towards uncertainty and inflation. I believe this commerce has loads of room to run, and favor gold as a technique to capitalize on it.

Recession Worries? Gold An Choice

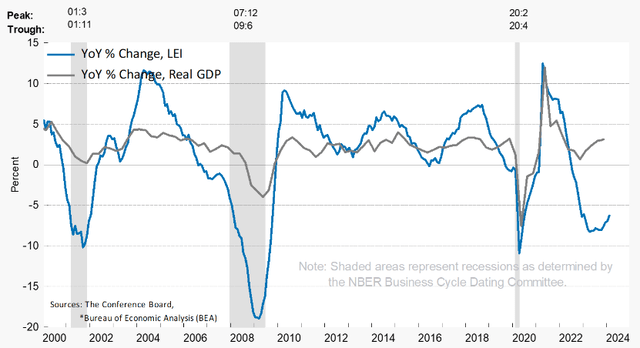

The following subject to think about is particularly related for these anxious about financial progress. For my functions I’m involved with home US financial efficiency, worldwide traders want to think about their very own distinctive circumstances. However for me, I see potential financial slowdowns within the US as a motive to personal gold. That is true now and virtually all the time, as gold tends to carry out properly in instances of financial stress. The underside-line is gold has a historical past of sturdy efficiency when equities fall – so it’s usually nearly as good a hedge as any.

In fact, this isn’t an computerized or assured inverse relationship. Gold can register destructive returns when equities fall and vice versa. I’m not right here suggesting the thesis is an ideal one. However historical past is usually a helpful information, and gold is without doubt one of the most steady and time-tested belongings on the market. This implies when financial worries mount (as they’re now) gold’s allocation in my portfolio is mostly going to extend. That is supported by the truth that the main financial indicators index is presently destructive – and has been for some time:

Financial Image (US) (The Convention Board)

The thesis right here is that if we do see the economic system falter a bit, will probably be a two-way win for gold. First, financial weak spot is mostly good for defensive belongings. And gold is such a defensive asset. Second, weaker financial alerts is simply what the Fed might want to see in an effort to transfer to a rate-cutting cycle. That once more must be bullish for gold and actual belongings. So whereas decline main financial indicators will not be “good” total, they are often good for gold.

Dangers? Of Course There Are

Shifting gears for a second, I’ll revert again to one thing I discussed on the onset of this evaluate. That’s that gold, like each different funding, comes with threat. I laid out some the explanation why I consider extra beneficial properties are forward, however an examination of some key headwinds is all the time warranted.

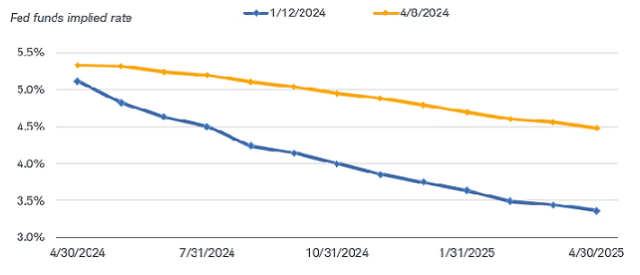

With respect to gold and different metals, rates of interest usually play a key position in future returns. This stems from gold particularly having an inverse relationship with charges. This relationship has been examined in 2024, as charges have stayed excessive and gold has rallied. So, once more, this isn’t an argument of a “positive factor”.

Nothing available in the market is “positive”. However we should always acknowledge that gold, as a non-income bearing asset, tends to do properly when rates of interest are on the decline. The prospect of decrease charges (particularly within the US) has little question fueled a number of the current beneficial properties. Nevertheless, this outlook must be tempered a bit based mostly on the truth that futures markets are beginning to worth in a much less dovish Fed within the second half of the 12 months:

Greater For Longer? (Charles Schwab)

The fact is that gold’s rally may very well be due for a breather if charges within the US keep “larger for longer” as many forecasters are beginning to counsel they’ll. If gold has welcomed beneficial properties because of the prospect of decrease charges, and people decrease charges do not materialize, then there’s a heightened probability the market will take a few of these beneficial properties again. This can be a paramount threat going through gold and different commodities going ahead. Readers ought to perceive this earlier than shopping for.

Backside-line: Tensions Are Good For Gold

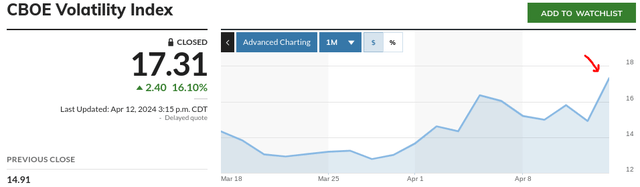

Regardless of the risk-on play successful handily in 2024, I really feel a basic sense of stress across the markets. Final week we began to see equities sell-off for a couple of causes and an elevated fee setting continues to stress bonds. Equally, volatility has moved off its current lows, suggesting a extra tumultuous setting forward:

VIX Index (Market Watch)

Because the finish of commerce Friday, now we have seen an Iranian strike towards Israel, one which Israeli Prime Minister Benjamin Netanyahu has vowed to answer. This tells me that tensions within the Center East – whereas already excessive – and possibly going to get larger. That is an setting the place volatility must also rise, suggesting benefit to a shift to a extra defensive posturing.

In the end, I see a number of the explanation why gold’s rally shouldn’t be over. Dangers are current that would derail this, however gold is a long-term play. I’ve held it for years with success, and intend to maintain doing the identical for years to come back.