An rising variety of states now require monetary literacy coursework as a commencement prerequisite for highschool college students. This recognition underscores the significance of imparting core life expertise associated to budgeting, financial savings, investing, and debt administration. Whereas colleges attempt to include this coursework, monetary establishments are equally keen about enhancing monetary proficiency amongst their shoppers’ households. Goalsetter is a B2B monetary literacy platform for monetary establishments, wealth managers, and credit score unions that permits Ok-12 college students and their households to be taught extra about private finance in an attractive and age-appropriate approach. The platform’s award-winning curriculum combines parts of gaming, GIFs, and popular culture references to foster significant engagement. Goalsetter has cast strategic partnerships with main monetary service suppliers to supply their shoppers a white-label turnkey youth banking resolution. The corporate presently gives financial savings account and spend administration instruments with plans to combine extra dwell banking capabilities into the platform, leveraging its robust relationships with monetary establishments and credit score unions.AlleyWatch caught up with Goalsetter Founder and CEO Tanya Van Courtroom to be taught extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete funding raised to $39.7M, and far, way more…

Who had been your traders and the way a lot did you elevate?

This latest spherical for Goalsetter was a Sequence A extension and was led by an affiliate of Edward Jones and MassMutual by way of its MM Catalyst Fund. Sequence A traders Fiserv, Webster Financial institution, Seae Ventures, Astia Fund, and Partnership Fund for New York Metropolis additionally participated within the spherical together with new traders Reseda Group and InTouchCU.Inform us in regards to the services or products that Goalsetter gives.

Goalsetter gives monetary establishments, credit score unions, and wealth administration suppliers with an award-winning, education-first household finance and expertise platform that’s centered round enjoyable and interesting monetary literacy instruments that empower Ok-12 college students and their households. In 2022, Goalsetter was acknowledged by Quick Firm as one of many “Manufacturers That Matter,” underscoring its cultural and social impression and the revolutionary worth it brings to the monetary schooling house.

What impressed the beginning of Goalsetter?

I used to be impressed to begin the corporate after my 8-year-old daughter requested for an funding account and a motorbike for her ninth birthday. I noticed the potential impression of equipping each baby in America with the instruments to avoid wasting and make investments, thus altering their roles from customers to savers and traders.

How is Goalsetter completely different?

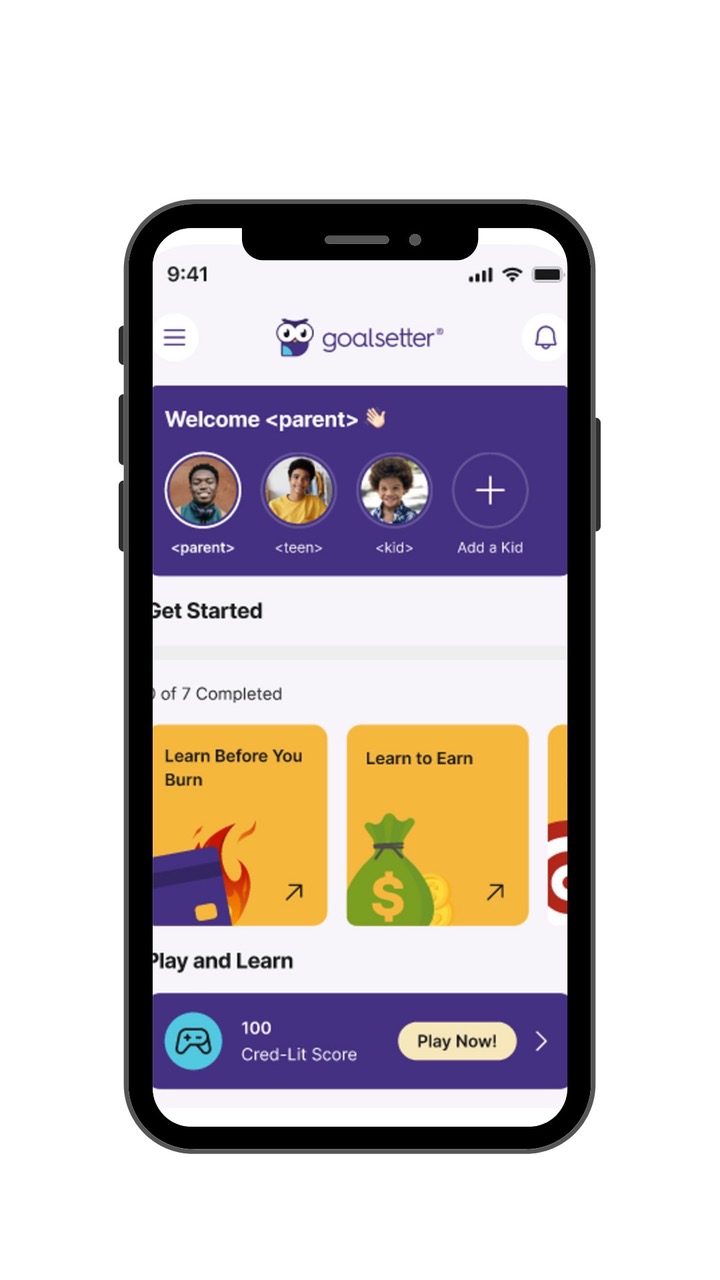

Goalsetter is completely different in that it focuses on educational-first monetary options, aiming to show children and teenagers the language of cash in a relatable and interesting approach by way of video games, GIFs, and popular culture references. It gives a full suite of monetary instruments together with FDIC-Insured Financial savings Accounts, funding platforms, and parental management options like “Study to Earn,” which permits children to earn cash by answering monetary quiz questions, and “Study Earlier than You Burn,” which freezes their debit playing cards in the event that they don’t take weekly quizzes. This method targets constructing generational data and wealth from kindergarten to commencement and past.

What market does Goalsetter goal and the way massive is it?

Goalsetter primarily seeks to work with monetary establishments, credit score unions and wealth administration firms to have interaction the Ok-12 youth market and their households. This demographic is digitally native, extremely various, and is estimated to be about 68 million robust within the U.S., representing 25% of the inhabitants and holding $140B in spending energy. It’s a big market with a considerable affect on present and future monetary traits.

What’s your small business mannequin?

Goalsetter’s enterprise mannequin consists of partnering with monetary establishments, credit score unions, wealth administration firms, and college techniques to white-label its platform. These partnerships and the B2B mannequin enable Goalsetter to distribute its academic instruments and monetary providers extra broadly, remodeling entry to monetary schooling in America.

How are you making ready for a possible financial slowdown?

Diversifying income streams, managing burn alongside progress alternatives, doubling down on efforts to attain profitability and rising as income is available in.

What was the funding course of like?

We have now a strong enterprise mannequin, robust traction, and a powerful pipeline, and that’s what funders wish to see. Funders respect pivots when the financial system modifications, however are cautious of purported pivots with out robust plans. Goalsetter has been a B2B-focused fintech since we secured our preliminary Sequence A spherical 2 years in the past, and have executed on that technique to serve credit score unions, banks, wealth administration companies, and college techniques with a platform that helps them each safe and financially put together the following era of their prospects. Our traders noticed the worth prop we carry to the desk for our enterprise prospects and had been excited to hitch the journey with us. This resulted in a reasonably simple elevate course of, since we’ve a confirmed B2B enterprise mannequin and sought capital from strategic companions who acknowledge the necessity for Goalsetter’s resolution within the ecosystem.

What are the most important challenges that you simply confronted whereas elevating capital?

The most important problem we confronted was individuals complicated Goalsetter with the B2C teen banking platforms out there. As soon as they understood each how completely different our product is and the way differentiated our enterprise mannequin is, issues fell into place. We’re a market chief in B2B monetary providers choices, and are 100% aligned with monetary establishments and their wants. We’re not a B2C fintech play that’s attempting to disrupt the ecosystem – we are literally bolstering the monetary providers ecosystem. Which means our mannequin, our prospects, our companions, and our future market alternatives are considerably completely different than the teenager challenger banks.

What components about your small business led your traders to jot down the examine?

Goalsetter’s traders acknowledged that we’re a market chief in B2B monetary providers choices, and are 100% aligned with monetary establishments and their wants. We’re not a B2C fintech play that’s attempting to disrupt the ecosystem – we are literally bolstering the monetary providers ecosystem. The profitable execution of our enterprise go-to market technique that reaches credit score unions, banks, wealth administration companies, and college techniques tells the story for us.

What are the milestones you intend to attain within the subsequent six months?

Within the subsequent six months, we’ll proceed to reinforce our product suite, and signal and launch new companions. We are going to use our further capital to develop our human sources and our expertise sources at a measured tempo, making certain that we’re rising the place our companions want us most and the place the best alternatives for extension and growth are within the monetary providers and academic ecosystems.

What recommendation are you able to supply firms in New York that should not have a contemporary injection of capital within the financial institution?

The recommendation that we give to these firms is that in lean occasions, it’s a must to sit down and do a technique session centered on the three P’s: Pivot, Revenue, and Partnerships. Are you able to pivot to make your small business stronger within the current financial system – is there one thing completely different you are able to do to place your self for fulfillment? Are you able to obtain profitability by diversifying your income stream or making the most of short-term alternatives that may assist you to to climate the storm and put together your self for long-term progress? Partnerships: What companions do you will have in your staff or in your ecosystem who’re important and may gasoline your progress? How will you ship outsized worth to them, enabling them to additionally ship outsized worth to you?

The place do you see the corporate going now over the close to time period?

Goalsetter has already paved the best way for what household finance ought to appear like, and we’re powering an increasing number of monetary establishments that understand that the way forward for finance is household finance. We’re going to proceed to assist credit score unions, neighborhood banks and wealth administration companies to be related to the following era, and our product will enable them to maneuver as rapidly as the following era strikes with respect to their ever-changing expertise tastes and pursuits.Our nation has seen total industries upended by expertise disruptors who goal the following era of consumers and peel them away when they’re 16 and 17, and the monetary providers trade is not any completely different. They’re at risk of disruption, and our fixed evolution helps them to stay with a viable suite of choices because the nation’s monetary panorama – and monetary providers customers – evolve.

What’s your favourite restaurant within the metropolis?

Tatiana in Brooklyn. The crispy okra is incredible, and my 8-year previous tells me there isn’t a shrimp fairly like Mother Dukes shrimp.