syahrir maulana

Funding Thesis

On this cycle of quantitative tightening by the Federal Reserve, a “increased for longer” notion has been exerting operational strain on the small-cap corporations of the U.S. financial system, making them extremely leveraged. Evident from the S&P 500’s six-month-long rally since late October 2023, the higher finish of the markets or large-cap equities have already priced in potential price cuts late in 2024, however an analogous impact is just not evident in small-cap shares. When the Fed pronounces price cuts, small caps will profit probably the most.

This evaluation explores the potential of Defiance R2000 Enhanced Choices Earnings ETF (NYSEARCA:IWMY) as a compelling income-generating automobile to capitalize on the anticipated uptrend in small caps. Exploring the effectiveness of put-writing methods inside the ETF’s framework, using a possible bull run to reinforce revenue technology and handle volatility.

About IWMY

IWMY is an actively managed ETF began on December 23, 2023, with a present expense ratio of 0.99%. The fund has an upside related to the expansion within the Russell 2000 index, the benchmark index for small-cap shares within the U.S. fairness markets. The first intention of the ETF is to generate present revenue for the traders.

The fund blends choices methods with U.S. Treasuries to offer traders with month-to-month revenue. The fund’s major objective is to make use of put choices on the Russell 2000 index to revenue from adjustments within the small-cap inventory market whereas decreasing threat by way of collateralizing U.S. Treasuries. The fund seeks to revenue from time decay and premium revenue by promoting put choices with expirations starting from near-term to quick length. Within the meantime, the underlying U.S. Treasuries supply stability and liquidity. With this twin strategy, traders can protect themselves from market volatility whereas nonetheless having some profit-making alternatives.

The Technique: Brief Places and U.S. Treasuries

The fund’s technique has two legs, as described under:

First Leg: Promoting Places

Particularly, the fund intends to promote put choices with expirations within the close to time period, starting from 0% to five% “in-the-money,” that means the strike worth exceeds the present worth of the index by 0% to five%. By promoting these places, the fund will generate premium revenue. This strategy additionally presents a chance for the fund to revenue from time decay and, for in-the-money places, to realize a restricted quantity of upside potential as much as the strike worth of the places plus their intrinsic worth. The expiration dates of the places offered by the fund will differ from in the future to at least one week on the time of buy.

Second Leg: Holding U.S. Treasuries

Managers of IWMY intention to carry U.S. Treasury securities as collateral for brief places inside a portfolio. These securities are extremely liquid and creditworthy property, successfully minimizing counterparty threat.

When an investor sells a put choice, committing to buying the underlying asset on the strike worth upon train, having U.S. Treasury securities as collateral assures the counterparty relating to the investor’s monetary functionality to satisfy their obligation. This reassurance diminishes the perceived threat for the counterparty.

The principle goal of this ETF is to generate revenue for its traders each month within the type of money distributions with an oblique publicity to the worth of the index. The first supply of that is the choices premium, obtained from the sale of short-term (most one week) places on the small-cap index. With an increase within the worth of the small-cap index, the fund goals to generate further revenue from its choices investments.

Capitalizing on the Choices Holdings

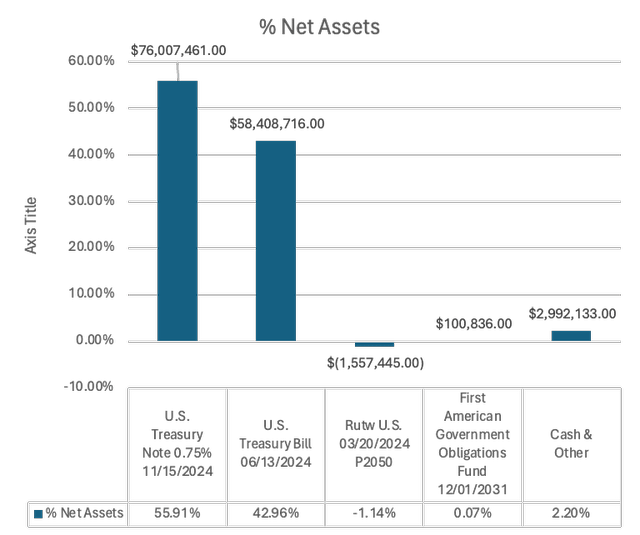

As of March 20, 2024, out of the $135.95 million whole property invested in IWMY, 98.87% consists of short-term U.S. Treasury securities, amounting to $134.41 million. $58.14 million is invested in Treasury payments that mature on June 13, 2024, and $78.25 million is invested in a 0.75% bond with a maturity date of November 15, 2024. The share of put holdings is -1.15% (the ‘-‘ image denoting a brief place).

Asset Allocation of IWMY (Detrimental-option % signifies a brief place) (Defiance ETFs Web site)

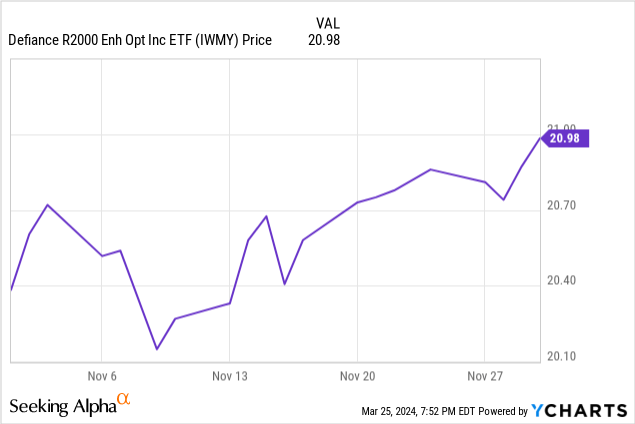

Though IWMY’s put holdings % could seem minuscule initially, historic proof signifies that when there’s market turbulence or strain on small-cap corporations to say no, the premium revenue from promoting put choices can act as a buffer in opposition to losses and enhance whole returns. As per the fund’s schedule of investments, this dynamic was noticeable throughout November 2023, when the efficiency of the ETF was considerably impacted by even a tiny allocation to quick places of -0.7%, i.e., premiums of $97,927. The chart under depicts worth appreciation for November.

IWMY at present has -1.14% of its choices holdings (the ‘-‘ image signifies a brief place), which is 62% greater than it did within the earlier case. The above case confirmed that even when the proportion allocation to choices is comparatively small in comparison with its different holdings, the strategy aligns with the prospectus to generate revenue from choices premiums.

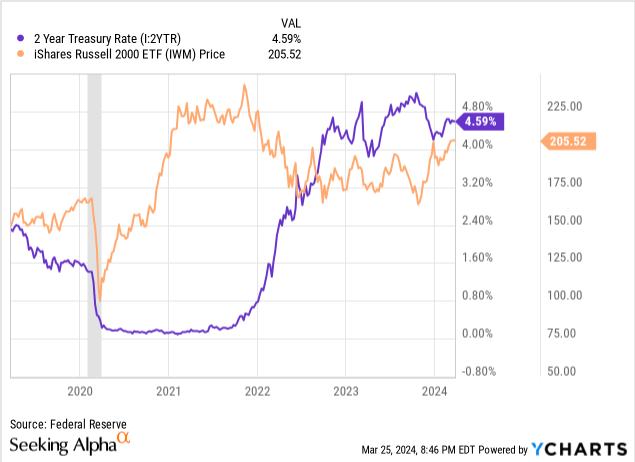

Lowering Charges and Rising Development of Small Caps

Rate of interest reductions normally encourage funding and borrowing, which helps small-cap companies that rely upon credit score for enlargement. Decrease rates of interest can present a constructive surroundings for U.S. small-cap equities markets by growing shopper spending, enhancing liquidity, and reducing borrowing prices. This impact of reducing rates of interest is clear from the chart under that includes the U.S. 2-year treasury price (Ticker on Looking for Alpha: US2Y) and IWM, a Russell 2000-based ETF.

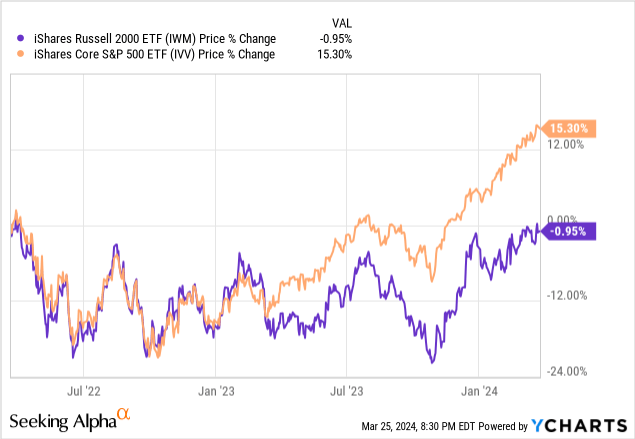

This yr, the financial system is predicted to expertise a quarter-point price lower in rates of interest, leading to a median price of 4.6%, down from the current excessive of 5.5%. The graph under with IWM (Russell 2000-based ETF) and IVV (S&P 500 based mostly ETF), which shows a timeline from the day the Federal Reserve introduced its first price hike in March of 2022, clarifies {that a} broader vary of the S&P500 already factored in when it started its rally in late October 2023. When giants like Microsoft (MSFT) and Nvidia (NVDA) started to point out progress on their steadiness sheets, earnings progress grew to become the gasoline for the S&P 500’s six-month run.

Regardless of this, the small cap remains to be working in a leveraged method pertaining to increased charges, as seen within the chart under. This chart makes it abundantly evident how the small-cap index is behind the S&P 500 relating to progress. Consequently, there could also be an opportunity to revenue from this potential Russell 2000 rise by investing in IWMY.

Potential Downsides: Combined Financial Indicators and the Threats to Charge Cuts

Whereas the ETF presents a tempting approach to revenue from predicted actions in small-cap shares and generate revenue, traders ought to pay attention to financial elements and rate of interest sensitivity. A change in rates of interest might have an effect on the efficiency of the ETF since it’s uncovered to U.S. Treasury securities and is determined by the Federal Reserve for rate of interest selections. The worth of the Treasury property might lower within the occasion of an surprising enhance in rates of interest, which would cut back revenue technology and probably reduce the effectiveness of the choices technique.

The financial system is displaying combined alerts when measured by the variety of jobs and the private consumption expenditures index (PCE deflator), that are, for my part, two of probably the most essential markers to find out how sturdy an financial system is.

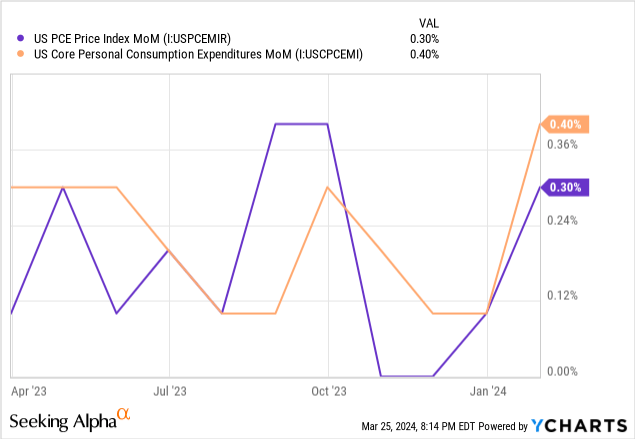

The core PCE, which excludes risky costs of meals and vitality, rose in January 2024 by 0.4% MoM (month on month) and by 2.8% YoY (yr on yr). Whereas some market members might have anticipated these figures, the PCE exceeded the earlier file in January 2024 because the CPI got here in scorching at 0.3% in January 2024 as a substitute of 0.2% in December 2023. Nevertheless, they’re too excessive for a data-dependent Federal Reserve to think about reducing charges till extra indicators of declining inflation are proven.

The financial system added 275,000 jobs in February 2024, as proven within the chart under from CNBC. February’s rise exceeded January’s when the primary reported 353,000 was sharply revised to 229,000. The variety of employments added in December was additionally decreased from 333,000 to 290,000, leading to 167,000 fewer jobs over the 2 months than initially reported.

The common hourly wage, often monitored as a gauge of inflation, elevated by lower than anticipated this month and decreased from the earlier yr. Wages elevated 4.3% from a yr in the past, down from the 4.5% progress in January and considerably under the 4.4% projection. Nevertheless, they solely elevated by 0.1% within the month, a tenth of a share level lower than the estimate.

On the core of IWMY’s potential progress is a problem over rate of interest cuts that the Federal Reserve faces on account of combined financial indications. Robust shopper spending is indicated by strong Private Consumption Expenditure (PCE), however declining month-to-month job counts and slower hourly earnings progress level to deteriorating labor market situations. Policymakers should steadiness these contradictory alerts to determine which plan of action is greatest for sustaining financial stability, which makes it more difficult to decide on to lower rates of interest.

Conclusion

The upcoming rate-cut cycle will set off a possible rally within the small caps of the U.S. fairness markets. The ETF’s present asset allocation is closely weighted in favor of U.S. Treasury bonds to retain its collateral for short-put investments. Nonetheless, its comparatively small choices place can considerably improve NAV (web asset worth). This ETF is a purchase for the long run because the Russell 2000 would look to make up for its misplaced worth when the steadiness sheets of small corporations develop with decrease borrowing prices for his or her operations, opening room for enterprise expansions.