panida wijitpanya

The bull market is in full power on the tailcoats of blowout earnings numbers from the poster little one for synthetic intelligence — Nvidia. This firm makes the processors that energy the event of AI. Its inventory and people which are linked to the AI business have risen to dizzying heights, elevating issues about one other bubble of types within the inventory market. If valuations proceed to rise greater than income, I think a bubble is a risk, however it could be an remoted one, because the broad market within reason valued, and the underlying financial fundamentals stay sturdy. Nonetheless, this bifurcated market presents challenges to buyers, which is what I wish to deal with on this week’s replace. Can we chase this yr’s largest winners or search the marketplace for tomorrows which have but to take part?

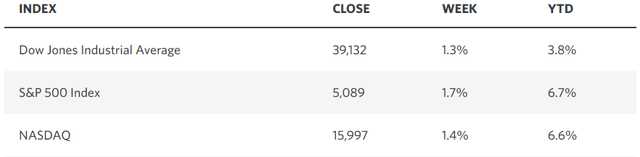

Edward Jones

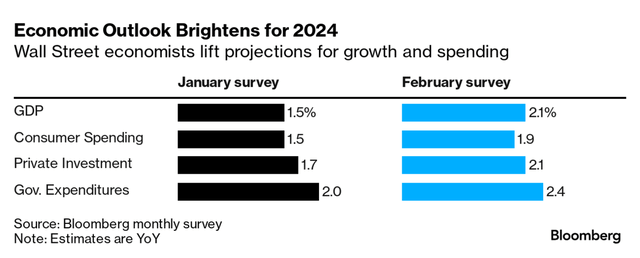

I’m a robust proponent of following the charges of change on the subject of financial and market evaluation. This may be tough in a smooth touchdown surroundings as a result of the speed of financial development should gradual, which is a headwind, to understand decrease charges of inflation, which is a tailwind. The important thing variable is the Fed’s benchmark rate of interest, which should start returning to impartial in an easing course of inside a window of time that forestalls the speed of financial development from slowing an excessive amount of. That’s the reason Fed coverage has been the focus for buyers over the previous yr, and the uncertainty of the timing of this easing cycle has saved most shares in verify because the starting of this yr. It doesn’t really feel that manner due to the surge in AI-related inventory costs, that are seen as impervious to rates of interest that will stay increased for longer. Whatever the timing, the consensus is satisfied that the following transfer in coverage is a fee minimize, which is a constructive fee of change. On the similar time, economists are elevating expectations for crucial financial variables, that are additionally constructive charges of change. That is all coming in an ongoing disinflationary course of, which is resoundingly bullish.

Bloomberg

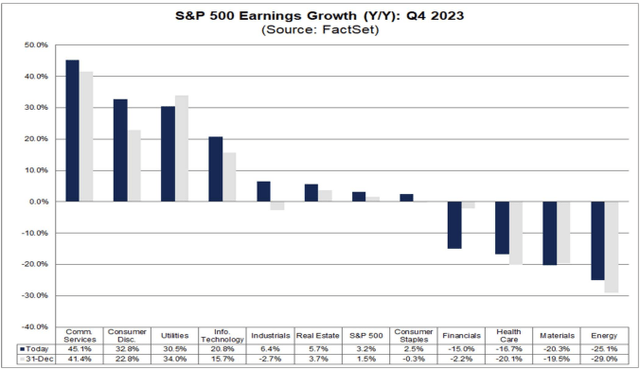

We’re on the tail finish of the earnings season for the fourth quarter of final yr, and the year-over-year development fee is on monitor to be 3.2%, which is above expectations for 1.5%. Once more, one other constructive fee of change.

FactSet

This yr we might want to see a regularly rising development fee to assist the lofty valuation of the general index at greater than 20x this yr’s anticipated earnings. Bears might level to a declining fee of expectation for the present quarter, however that’s the norm. Analysts all the time decrease the bar for the present quarter because it involves an finish to make it a bit simpler for the businesses they cowl to beat expectations. In the meantime, expectations for the quarters additional out sometimes rise. If we see expectations come down for the quarters additional out, that shall be a purple flag. In different phrases, a destructive fee of change.

FactSet

At 20.4x anticipated earnings for the approaching yr, the S&P 500 isn’t low-cost. In truth, it’s on the higher finish of its historic vary when it comes to valuation, which is an affordable level of rivalry. But we all know the rationale for that is the valuation extremes we see for the highest ten firms within the index (2%), which account for roughly 30% of its worth. There are an innumerable variety of names that commerce at 16x or much less, which is what I view as a extra cheap worth for the general index, given the speed of financial development and inflation right now. That stated, buyers are hypnotized by the stellar returns of those mega-cap know-how names.

Subsequently, if you’re a bullish investor who desires to place for capital appreciation shifting ahead, I feel the prudent method is to not chase the greed driving the highest ten names within the S&P 500 to nosebleed valuations. Granted, these are phenomenal firms, however deploying new capital at right now’s ranges possible presents better draw back than it does upside over the rest of this yr. If the holding interval is 3-5 years or extra, then maybe right now’s valuations don’t matter, however my crystal ball for funding technique solely operates on a rolling 12-month interval. I feel there shall be higher entry factors throughout that timeframe.

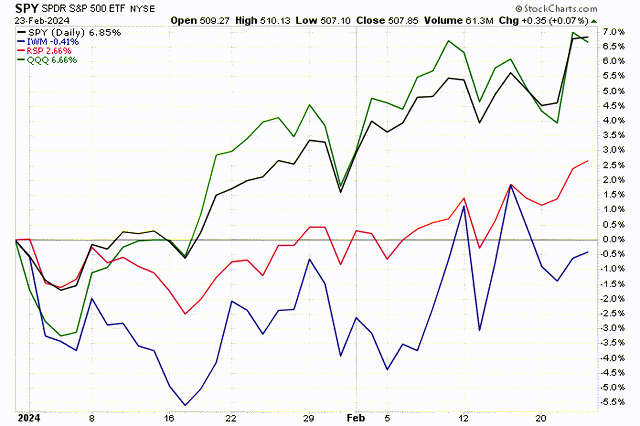

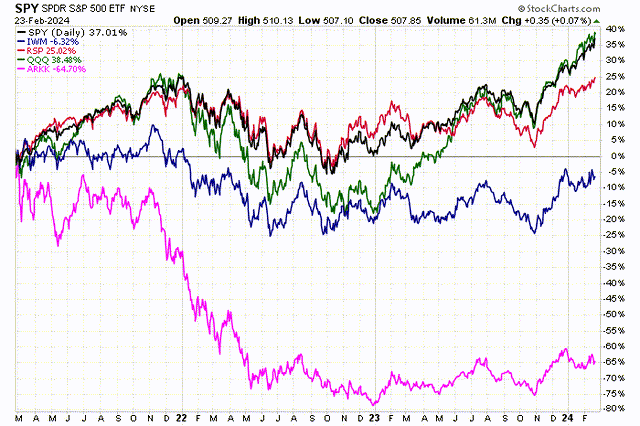

I might a lot choose to personal the equally weighted S&P 500 (RSP) at this stage of the bull market than the one dominated by the ten largest firms. I additionally see a whole lot of worth within the worthwhile firms that occupy the Russell 2000 small-cap index (IWM). I feel the efficiency hole you see beneath will proceed to shut, as the common inventory presents a significantly better danger reward right now.

StockCharts

This method requires the self-discipline of not falling sufferer to the concern of lacking out (FOMO). It is extremely simple to purchase extraordinarily sturdy momentum, which is what the consensus is doing now. The final time I noticed such a fury for an funding theme was Cathie Wooden’s ARK Innovation Fund (ARKK), which peaked in reputation and efficiency three years in the past. The returns since aren’t fascinating, as will be seen beneath. Granted, AI is an rising business and never a portfolio supervisor investing in “disruptive innovation,” however the level is that sentiment drives valuations to extremes, which inevitably reverts to a imply. The problem is that we don’t know what the set off shall be for imply reversion.

StockCharts

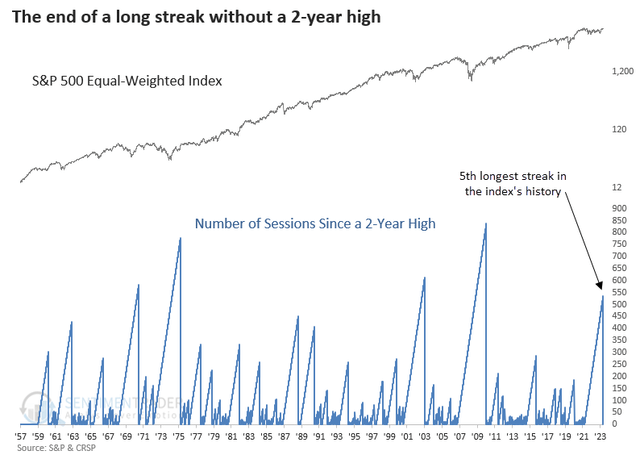

I feel one of the vital developments for this bull market final week was not Nvidia’s blowout earnings report, however the breakout for the equally weighted S&P 500 index. It has been two years since this index stood finally week’s stage, and the implications for such a breakout after two years or extra are extraordinarily bullish. As famous by SentimenTrader, the equal-weighted index has outperformed the cap-weighted index after most of those occurrences. Moreover, this index has closed increased 12 months later 100% of the time. That may be a steep mountain to climb for the bears.

SentimenTrader