Up to date on January nineteenth, 2024 by Bob Ciura

As a enterprise proprietor, promoting merchandise which have excessive revenue margins together with robust model consciousness and an exceptionally loyal buyer base is strongly fascinating. This permits for predictable income and excessive ranges of income over time.

The tobacco business matches this mannequin, regardless of declines over time within the variety of clients that use its merchandise. Tobacco shares are significantly enticing to earnings buyers due to their beneficiant dividends and defensive traits throughout financial downturns. Tobacco shares produce quite a lot of money, however have little or no capital expenditure wants, creating what may very well be thought-about excellent earnings shares.

You’ll be able to obtain a spreadsheet with all our tobacco shares (together with vital monetary metrics comparable to dividend yields and price-to-earnings ratios) utilizing the hyperlink beneath:

Tobacco shares are extensively prized by earnings buyers due to their excessive dividend yields, secure payouts and dividend enhance streaks. Nonetheless, declining buyer counts and utilization charges are weighing on the group.

This text will analyze the prospects of 6 of the biggest tobacco shares. Rankings are so as of projected complete returns from worst to finest.

Desk of Contents

You’ll be able to immediately bounce to any particular person inventory evaluation by clicking on the hyperlinks beneath:

However first, we’ll check out the tobacco business’s major concern, which is declining tobacco utilization.

Trade Overview: Declining Smoking Charges

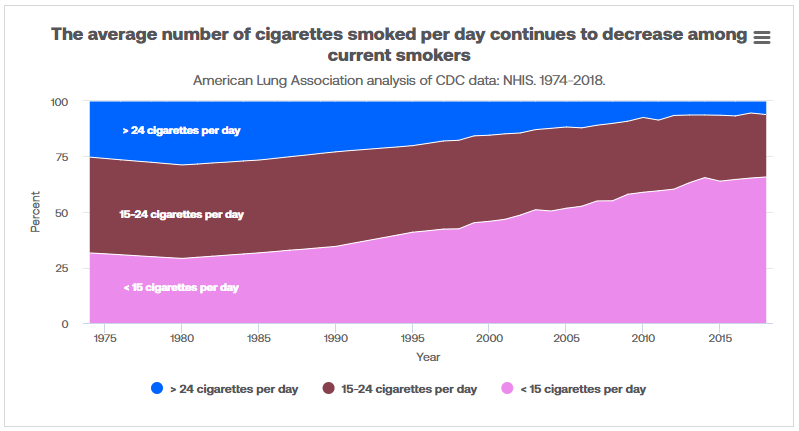

The p.c of the U.S. inhabitants that smokes is in a steady decline, and has been for many years.

Supply: American Lung Affiliation

The p.c of the U.S. smoking grownup inhabitants has steadily declined from 42% in 1965 to only 14% as of 2018. The declines among the many youth inhabitants have been even larger. Younger folks now have a smoking fee of about one in eleven. This kind of decline in an business’s buyer group typically spells hassle for the businesses that function inside it.

Different types of tobacco utilization have seen related charges of decline, together with smokeless tobacco. This has been the case with each demographic group, so it’s widespread amongst the entire corporations’ potential clients.

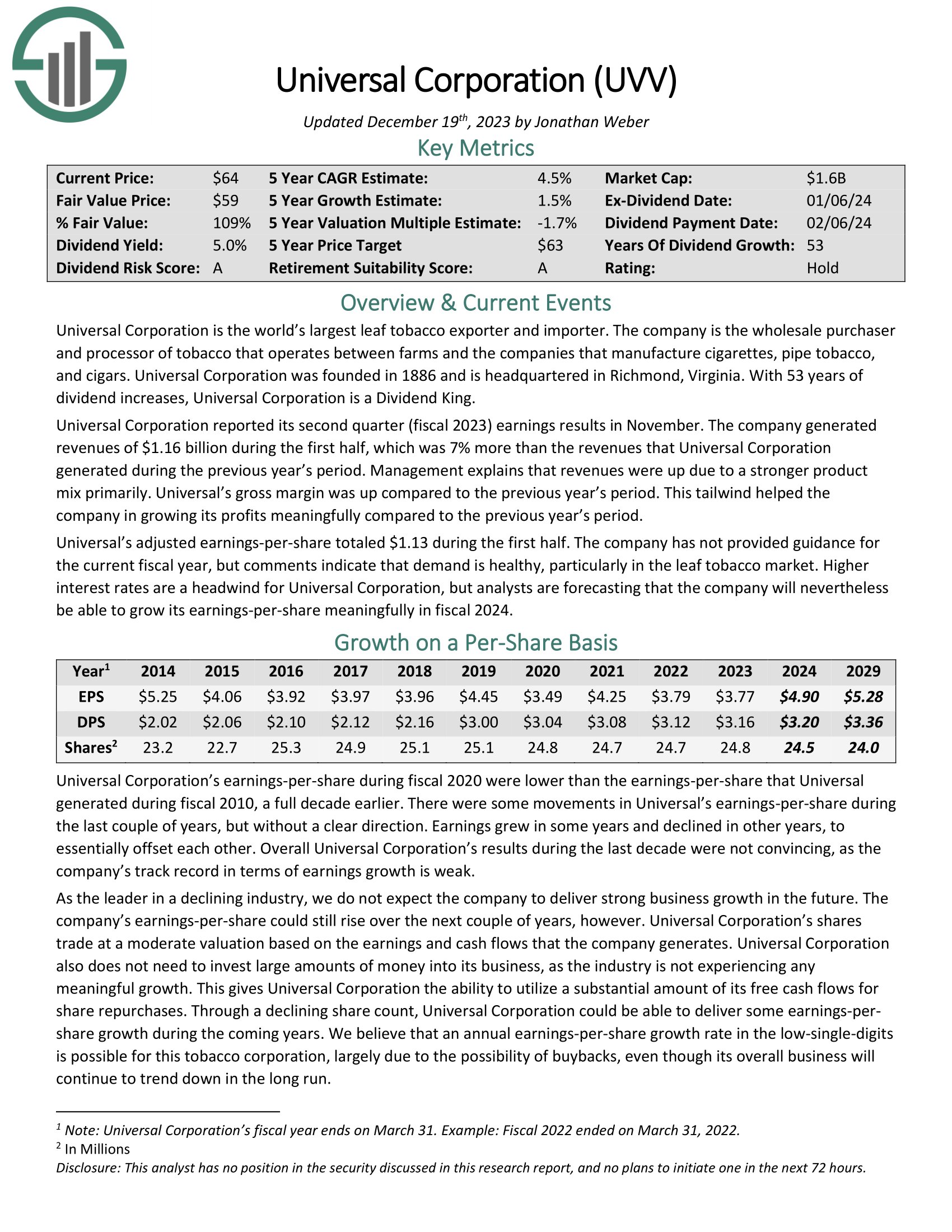

Not solely are fewer folks smoking, however the ones that do are smoking lower than they used to.

Supply: American Lung Affiliation

The variety of folks smoking no less than 15 cigarettes a day has plummeted prior to now few a long time. Immediately, the overwhelming majority of people who smoke use fewer than 15 cigarettes every day. In different phrases, there are fewer clients for the business. And, those that stay are utilizing fewer merchandise. This has negatively impacted demand from two instructions. This has led to a lot decrease volumes of complete cigarettes bought, producing a declining complete to be cut up up among the many varied corporations promoting cigarettes.

An growing variety of U.S. states have considerably raised the tax on cigarettes to scale back their price range deficits, and to scale back the potential attraction of smoking for customers. Given the propensity of localities to make use of tax will increase on cigarettes, the state of affairs will probably solely worsen for tobacco shares.

As well as, pricing will increase have the influence of decreasing utilization additional. Demand will nearly actually proceed to say no as taxes and costs rise. Certainly, well being organizations just like the American Lung Affiliation actively encourage localities to boost taxes on cigarettes and different tobacco merchandise to discourage utilization.

To make issues worse for tobacco corporations, a lot of the world’s smoking inhabitants fee appears to be like a lot the identical because the above chart. It has develop into abundantly clear that buyers world wide are eschewing tobacco merchandise for well being issues.

These destructive developments have stored many buyers away from tobacco shares. Nonetheless, tobacco shares can nonetheless generate strong complete returns on condition that they have a tendency to supply respectable dividend yields. The important thing behind an funding in tobacco shares is the inelastic demand for cigarettes relative to their value because of the addictive nature of those merchandise.

Tobacco corporations have been in a position to elevate their costs to assist offset declining smoking charges. In consequence, they’ve distinctive development information. As well as, inhabitants development partly offsets the impact of the declining p.c of people who smoke. Nonetheless, buyers should needless to say the entire volumes for the business are in pretty steep decline, and all indications are that that is irreversible.

Tobacco Inventory #6: Common Company (UVV)

5-year anticipated returns: 6.5%

Common Company is the world’s largest leaf tobacco exporter and importer. The corporate is the wholesale purchaser and processor of tobacco that operates as an middleman between tobacco farms and the businesses that manufacture cigarettes, pipe tobacco, and cigars. Common additionally has an components enterprise that’s separate from the core leaf section.

Common additionally doesn’t want to take a position massive quantities of cash into its enterprise, which supplies it the flexibility to make the most of a considerable quantity of its free money flows for share repurchases and dividends.

And, for its half Common is trying a transition to a producer of fruits, greens, and components which the corporate hopes will diversify its enterprise and supply renewed development. Common acquired FruitSmart, an impartial specialty fruit and vegetable ingredient processor. FruitSmart provides juices, concentrates, blends, purees, fibers, seed and seed powders, and different merchandise to meals, beverage and taste corporations world wide.

It additionally acquired Silva Worldwide, a privately-held dehydrated vegetable, fruit, and herb processing firm. Silva procures over 60 sorts of dehydrated greens, fruits, and herbs from over 20 nations.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven beneath):

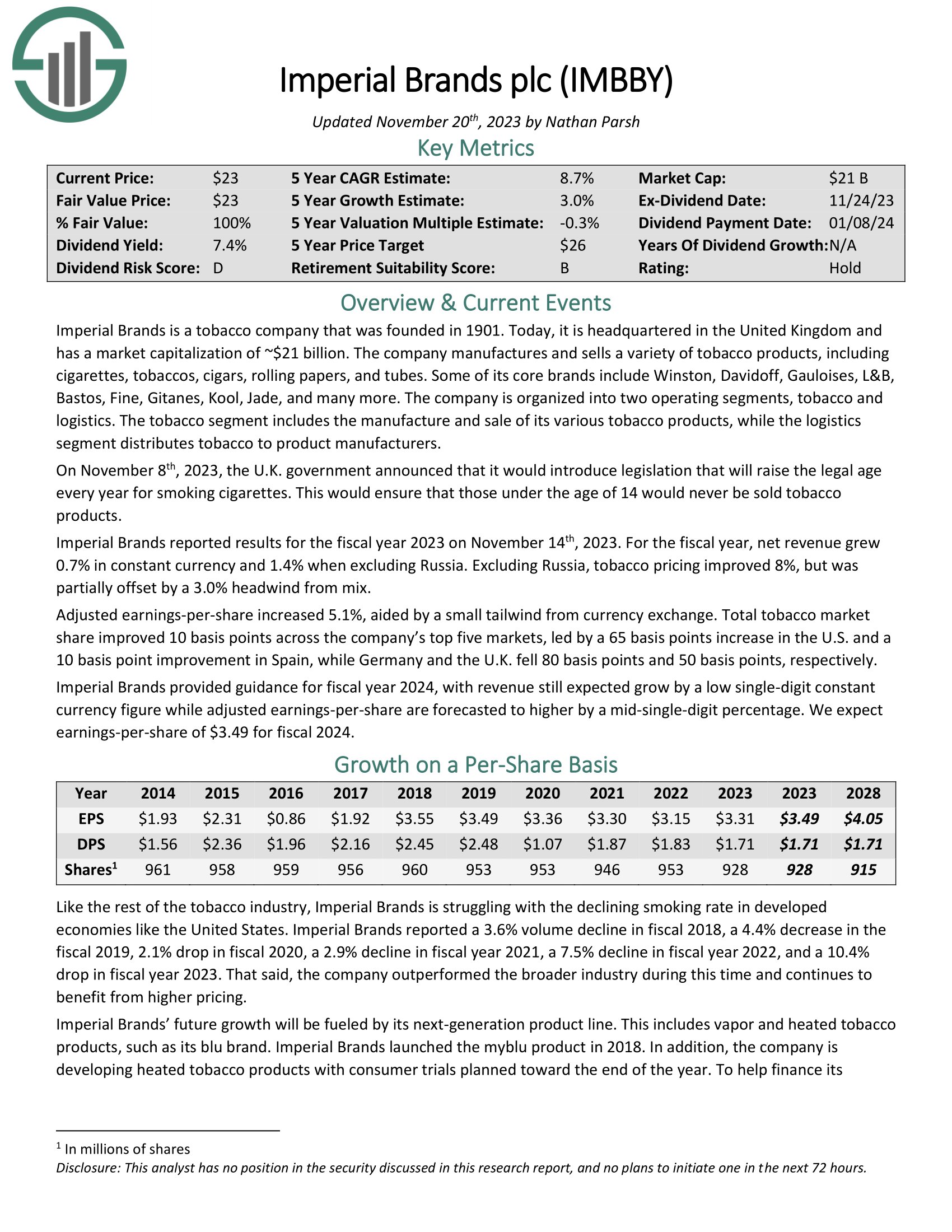

Tobacco Inventory #5: Imperial Manufacturers plc (IMBBY)

5-year anticipated returns: 7.8%

The subsequent inventory on our checklist is Imperial Manufacturers, a British tobacco product conglomerate that was based in 1901. Immediately, the corporate is a market chief in quite a lot of places across the globe and produces simply over $10 billion in annual income.

Imperial Manufacturers reported outcomes for the fiscal 12 months 2023 on November 14th, 2023. For the fiscal 12 months, web income grew 0.7% in fixed forex and 1.4% when excluding Russia. Excluding Russia, tobacco pricing improved 8%, however was partially offset by a 3.0% headwind from combine.

Adjusted earnings-per-share elevated 5.1%, aided by a small tailwind from forex trade. Complete tobacco market share improved 10 foundation factors throughout the corporate’s prime 5 markets, led by a 65 foundation factors enhance within the U.S. and a ten foundation level enchancment in Spain, whereas Germany and the U.Okay. fell 80 foundation factors and 50 foundation factors, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on IMBBY (preview of web page 1 of three proven beneath):

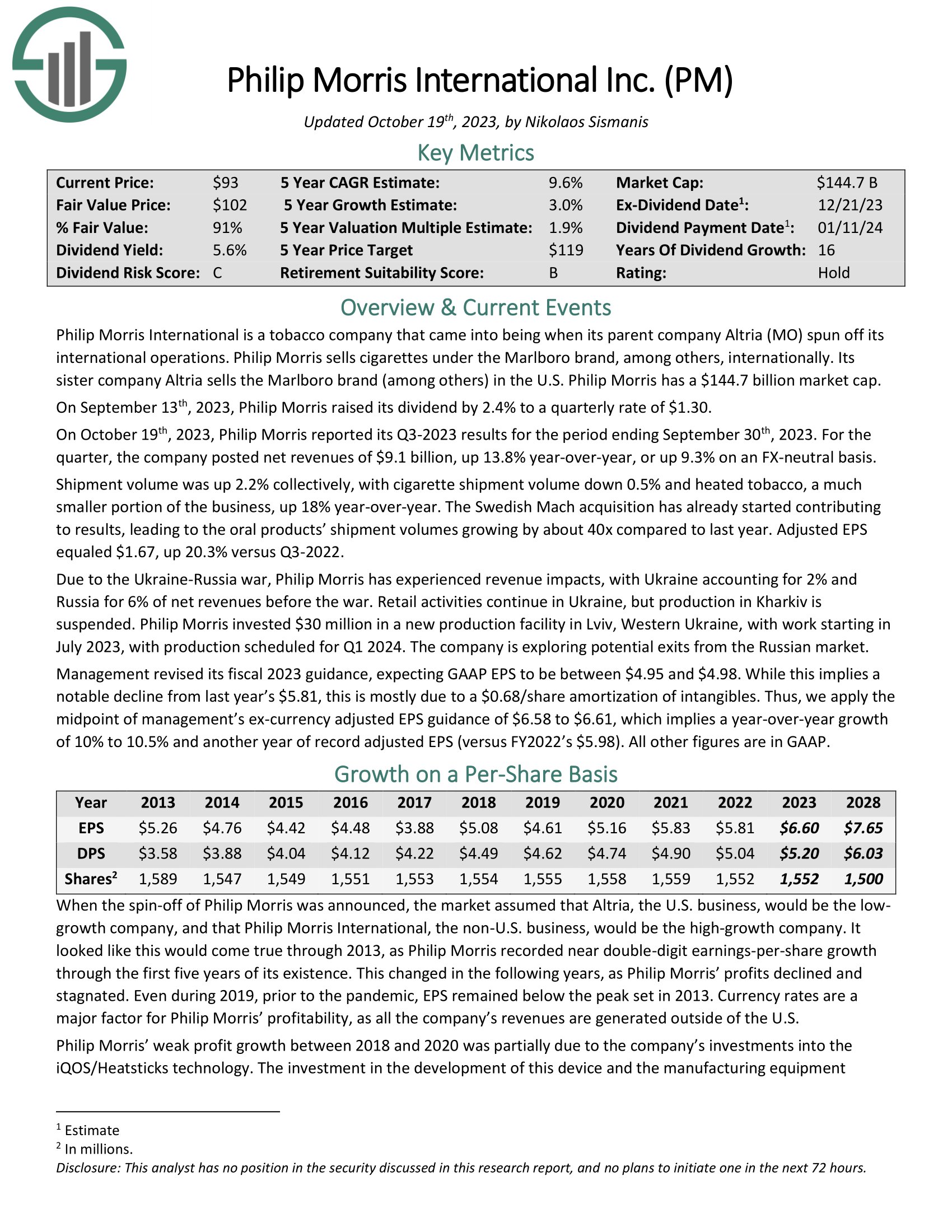

Tobacco Inventory #4: Philip Morris Worldwide (PM)

5-year anticipated returns: 9.5%

Philip Morris Worldwide was spun off from Altria in 2008, and is charged with the manufacturing and distribution of Altria’s merchandise exterior of america. This distribution consists of the exceedingly invaluable Marlboro model.

On October nineteenth, 2023, Philip Morris reported its Q3-2023 outcomes for the interval ending September thirtieth, 2023. For the quarter, the corporate posted web revenues of $9.1 billion, up 13.8% year-over-year, or up 9.3% on an FX-neutral foundation. Cargo quantity was up 2.2% collectively, with cigarette cargo quantity down 0.5% and heated tobacco, a a lot smaller portion of the enterprise, up 18% year-over-year.

The Swedish Mach acquisition has already began contributing to outcomes, resulting in the oral merchandise’ cargo volumes rising by about 40x in comparison with final 12 months. Adjusted EPS equaled $1.67, up 20.3% versus Q3-2022.

Philip Morris has raised its dividend for 16 consecutive years and for greater than 50 years when together with the time the corporate was a part of Altria. Shares yield 5.5%, which helps to compensate for the low development fee of simply 2.8% during the last 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Philip Morris Worldwide (PM) (preview of web page 1 of three proven beneath):

Tobacco Inventory #3: Altria Group (MO)

5-year anticipated returns: 11.4%

Altria Group was based by Philip Morris in 1847 and at present has grown right into a client staples big. Whereas it’s primarily recognized for its tobacco merchandise, it’s considerably concerned within the beer enterprise on account of its 10% stake in world beer big Anheuser-Busch InBev.

The Marlboro model holds over 42% retail market share within the U.S.

On October 26, 2023, Altria Group, Inc. (MO) disclosed its monetary outcomes for the third quarter and 9 months of 2023, narrowing its full-year earnings steerage. The reported web revenues for Q3 2023 stood at $6.281 billion, marking a 4.1% lower in comparison with the identical interval within the earlier 12 months.

The revenues web of excise taxes amounted to $5.277 billion, a 2.5% decline. The reported diluted earnings per share (EPS) for the quarter had been $1.22, whereas the adjusted diluted EPS was $1.28, assembly the earnings expectations.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

Tobacco Inventory #2: British American Tobacco (BTI)

5-year anticipated returns: 12.5%

British American Tobacco is without doubt one of the largest tobacco corporations on the earth, with a market capitalization of $91 billion. British American Tobacco owns the next tobacco manufacturers, amongst others: Kool, Benson & Hedges, Dunhill, Kent, and Fortunate Strike.

Throughout the first half of its present fiscal 12 months, British American Tobacco was in a position to generate income development of 4.4% on a reported foundation, whereas fixed forex revenues had been up by 2.6% over the earlier 12 months’s first half.

Yr-to-date, British American Tobacco has gained some quantity share within the flamable market, primarily on account of elevated advertising efforts in america. British American Tobacco experiences that its non-combustible section is performing effectively, including greater than 1 million new clients throughout the first half of the 12 months, and gaining market share.

In keeping with administration, British American Tobacco is on observe to hit its 5 billion Pound gross sales goal for the non-combustible section in 2025, with profitability being anticipated earlier than that.

Click on right here to obtain our most up-to-date Positive Evaluation report on BTI (preview of web page 1 of three proven beneath):

Tobacco Inventory #1: Vector Group (VGR)

5-year anticipated returns: 13.1%

Vector Group is an uncommon mixture of an actual property funding agency and a tobacco firm. The latter was based in 1873 and continues to function at present because the Liggett Group, whereas the true property enterprise got here later. Vector generates over $1.2 billion in annual income.

Not like a few of the others we’ve checked out, Vector is making no try to diversify away from cigarettes. Its acknowledged objective is to proceed to extend market share of its Liggett model and maximize long-term profitability in that market.

Vector Group has exhibited a unstable efficiency report and has did not develop its earnings-per-share meaningfully during the last decade.

Vector Group had beforehand paid a rising money dividend and a 5% inventory dividend yearly by means of 2019. However its earnings and web working money haven’t lined the dividend in recent times, so the corporate wanted to borrow and use debt to pay the dividend.

The common dividend was reduce for 2020 and is now $0.80 per share, and the inventory dividend was suspended as effectively.

Associated: 3 Causes Why Corporations Reduce Their Dividends (With Examples)

Click on right here to obtain our most up-to-date Positive Evaluation report on VGR (preview of web page 1 of three proven beneath):

Ultimate Ideas

Tobacco shares as a gaggle have had a troublesome time prior to now couple of years. Regulatory and client desire adjustments proceed to plague the group. However valuations are comparatively low, dividend yields are excessive, and most corporations are diversifying away from tobacco. Vector Group now presents the very best complete projected annual returns, however all of those corporations supply excessive dividend yields.

We see Altria, British American Tobacco, and Vector as providing the very best complete returns. And, all supply sizable dividend yields. Dividend sustainability varies by inventory on this group, however general, there’s a lot for earnings buyers to love in terms of these 6 tobacco shares.

Additional Studying

In case you are thinking about discovering high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].