Justin Sullivan

Funding Thesis – This autumn FY23 Replace

Financial institution of America (NYSE:BAC) is among the largest banks in america with an enormous raft of services focused at each client and company shoppers.

The financial institution had a tough FY23 on account of one-off particular gadgets and a tough macroeconomic setting weighing down on earnings. Nevertheless, the financial institution continued to develop its buyer base and shopper relationships all of the whereas retaining a strong steadiness sheet and producing tangible income.

Hypothesis of charge cuts by the FED in early 2024 has improved investor sentiment round BoA’s large $33B paper losses on their HTM securities portfolio with a late 2023 rally sending shares nearly 30% greater in only a month of buying and selling.

Finally, whereas I nonetheless just like the financial institution for its conservative method to enterprise and due to Moynihan’s management, present costs are too expensive for my part to advocate increasing my place within the financial institution.

Maintain score issued.

Firm Background

BAC Investor Relations

Financial institution of America (BoA) is among the “massive 4” banks primarily based within the U.S. rating second by way of market capitalization behind JPMorgan Chase (JPM) and forward of Wells Fargo (WFC) and Citigroup (C).

The agency serves roughly 11% of all American financial institution deposits with its major companies revolving round client banking, international banking, wealth administration, and funding banking.

Brian Moynihan continues to steer the financial institution as CEO into the ‘20s with a deal with continued progress in BoA’s core enterprise segments on the forefront of his technique.

The financial institution can be paying explicit consideration to bills to make sure the financial institution’s operational effectivity doesn’t turn into compromised via any progress achieved.

A really conservative method to HTM funding securities left BoA uncovered to the upper rate of interest setting with the financial institution incurring important paper losses on their property whereas additionally affected by comparatively decreased curiosity earnings.

The reversal in rate of interest hikes as advised by the Fed could result in BoA seeing rising curiosity earnings on securities and will depart the financial institution with an much more strong steadiness sheet ought to charges drop near zero as soon as extra.

Financial Moat – This autumn FY23 Replace

BoA has a large financial moat that’s primarily constructed upon its intensive set of companies and retail banking networking driving a set of tangible switching prices for each client and enterprise-oriented shoppers.

I carried out a full in-depth basic evaluation of BoA’s financial moat and enterprise operations again in October 2023. Little has modified on the financial institution with regard to their financial moat, so I urge readers to take a look at that detailed evaluation right here.

On this replace piece, I wish to talk about the continued energy of BoA’s client banking, wealth administration, international banking, and international markets enterprise segments in This autumn FY23.

BoA’s client banking section continued to see important progress attaining a powerful 20-quarter streak of consecutive progress. The financial institution noticed 600,000 new checking accounts and greater than 4.6MM new bank card accounts being opened in This autumn FY23.

Whereas whole deposit balances continued to fall from $1047 to simply $959, the flexibility of BoA to proceed attracting new customers to the financial institution is spectacular. A mixture of nice high quality monetary merchandise mixed with an excellent department community continues to draw customers to BoA as a substitute of opponents.

The financial institution’s GWIM section additionally noticed large 47% YoY progress with their Merrill and Non-public Financial institution divisions seeing over 40,000 new buyer relationships in FY23.

BoA’s international banking section noticed 100% YoY progress of their company shoppers with greater than 2,500 new shoppers beginning enterprise with the financial institution. This resulted in enterprise lending progress of 15% YoY and a complete of 11.4B in international transaction companies income.

The financial institution’s International Markets section additionally noticed new institutional relationships up 11% YoY with annual common mortgage balances of $130B reaching document ranges.

Such sustained progress throughout all of BoA’s enterprise segments illustrates simply how good of a service the financial institution is at present offering shoppers. I nonetheless imagine their large scale, big selection of merchandise and options, and deal with buyer satisfaction generates a large financial moat for the agency.

This has been evidenced by the financial institution’s potential to draw a document variety of clients to their product choices regardless of the compromised macroeconomic setting and relative competitiveness of different key gamers akin to JP Morgan Chase.

Monetary State of affairs – This autumn FY23 Replace

BAC FY23 This autumn Presentation

The ultimate quarter of FY23 noticed BoA’s whole income web of curiosity expense lower 10% YoY. This weak point was primarily as a result of an FDIC particular evaluation pretax noninterest expense of $2.1B on account of the elevated capital necessities ensuing from the SVB collapse.

On an adjusted foundation, This autumn web revenues have been down $1B to $23.5B. This lower occurred on account of all 4 of BoA’s companies noticed 3-5% decreases in income, respectively.

BAC FY23 This autumn Presentation

The buyer banking section suffered primarily as a result of decrease deposit balances, a rise of .15 within the common price of deposit from 1.21 in This autumn 2022 to 1.36 in This autumn 2023. This occurred as a result of charges being paid on deposits rising a whopping 0.41% to 0.47%.

BoA’s GWIM, International Banking, and International Markets segments noticed falling NII on account of decrease deposits, barely elevated charges paid on deposits, and decrease general buying and selling volumes respectively.

These quantitative figures are in distinction to the in any other case robust progress BoA noticed in shopper numbers, new accounts, and AUM flows and illustrate simply how tough the present macroeconomic setting makes increasing working incomes.

However, I wish to spotlight a couple of key factors that help my thesis that BoA is working enterprise properly regardless of the tough macroeconomic setting.

BAC FY23 This autumn Presentation

From a liquidity perspective, BoA’s CET1 ratio of 11.8% is 0.6% greater YoY due to a $0.7B improve in CET1 capital since Q3 FY23 and standardized RWAs elevated by $18B in the identical interval.

BAC FY23 This autumn Presentation

The financial institution’s whole deposits in extra of loans are at present at $870B. Whereas this delta is smaller than the excellent liquidity seen on the finish of FY21, BoA nonetheless has 92% extra deposits in extra of loans in comparison with the top of FY19.

I’m an enormous advocator for conservative asset allocation and liquidity administration in the case of banking and think about this extra of deposits very favorably, even when it has come down from the instant post-pandemic highs.

BAC FY23 This autumn Presentation

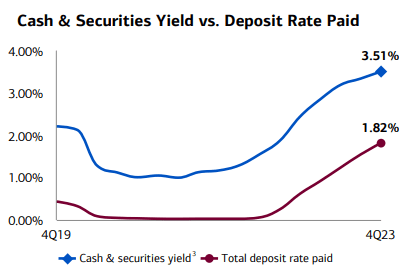

BoA’s margin between securities yield vs deposit charge paid remains to be glorious regardless of the general improve in rates of interest with the financial institution having continued to enhance this key metric.

The present margin of 1.69% gives BoA with a terrific return on property given their conservative securities portfolio with the margin more likely to broaden ought to rates of interest transfer decrease in 2024.

BAC FY23 This autumn Presentation

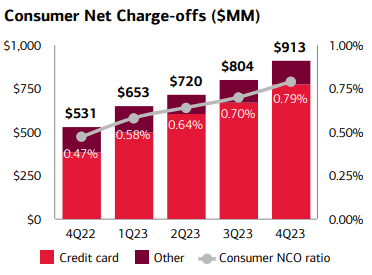

One regarding development arising from the This autumn report is the rise in client NCOs. The bank card NCOs have risen sharply since This autumn FY22 in a worrying development supporting my underlying perception that customers are stepping into important and unsustainable debt.

Whereas the share of client NPAs has not risen YoY and stays fixed at 0.60% (as a % of loans and leases), the rise in web charge-offs may sign that NPAs are about to rise considerably too.

BAC FY23 This autumn Presentation

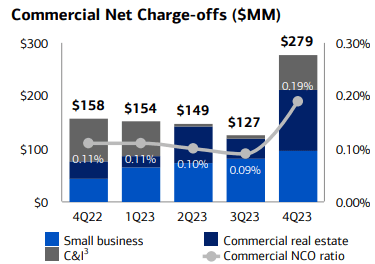

The state of affairs turns into extra regarding with regard to the industrial asset portfolio with a sudden improve in NPAs from 0.18% to 0.47% of whole loans and leases coming largely from struggling CRE loans. BoA’s industrial NPA has elevated by a whopping 160% YoY.

The CRE sector is lastly being hit by the implications of a better rate of interest setting with important debt refinancing at greater charges resulting in quickly deteriorating credit score high quality.

I imagine this worsening development may lead to BoA seeing some actual losses in profitability and effectivity of their industrial loans portfolio which may in the end affect the financial institution’s FY24 outcomes tangibly.

Whereas a sudden reduce to rates of interest may assist the state of affairs and BoA’s mortgage portfolio, predicting when the Fed may take motion is kind of speculative given the slower-than-expected cooling within the financial system in December 2023.

Searching for Alpha | BAC | Profitability

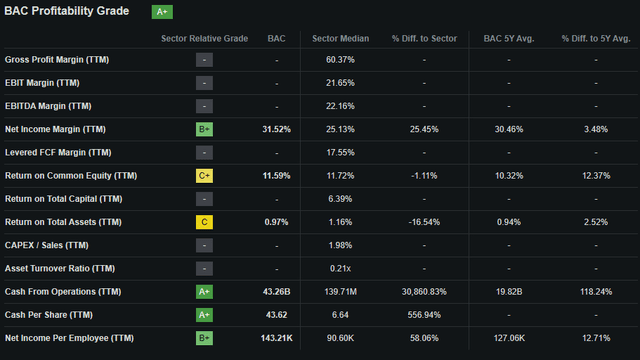

Searching for Alpha’s Quant calculates an “A+” profitability score for Financial institution of America which I nonetheless imagine to be an correct relative illustration of BoA’s fiscal efficiency.

Whereas the general progress in earnings and revenues for FY23 was not stellar, I imagine the financial institution has made essentially the most of a tough macroeconomic setting.

Conservative mortgage underwriting, credit score rating monitoring, and securities investments ought to enable the agency to stay secure and strong even when a hard-landing U.S. recession occasion takes place.

The numerous variety of new shoppers, clients, and relationships cast by BoA in FY23 may additionally show helpful in a extra growth-oriented financial panorama.

Valuation

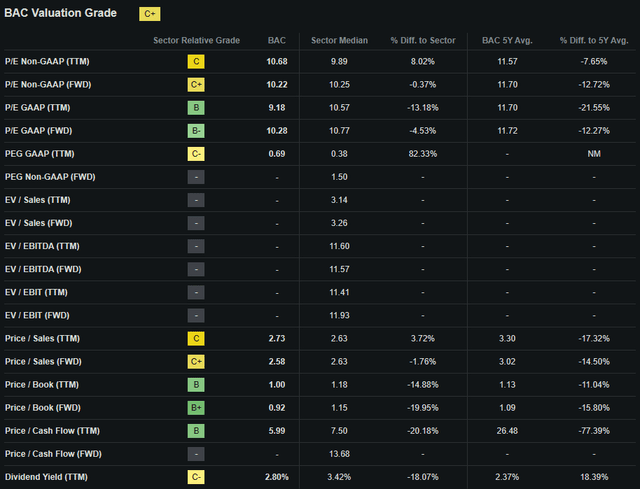

Searching for Alpha | BAC | Valuation

Searching for Alpha’s Quant assigns Financial institution of America with a “C+” Valuation grade. I imagine this can be a principally honest illustration of the worth current in Financial institution of America shares particularly after the huge bull run witnessed on the finish of 2023.

The financial institution at present trades at a P/E GAAP FWD ratio of 10.28x. This nonetheless represents a major 12% lower within the agency’s P/E ratio in comparison with their operating 5Y common however is up 36% since October lows of round 7.50x.

BoA’s TTM Worth/E book of simply 1.00x remains to be fairly low given the 5Y common of 1.13x however as soon as once more up nearly 35% since October lows.

Contemplating these valuation metrics alone I imagine BoA could begin to seem solely barely undervalued.

Searching for Alpha | BAC | 5YAdvanced Chart

From an absolute perspective, BoA shares are buying and selling at what remains to be a major low cost relative to the highs seen in 2022.

Nevertheless, when in comparison with the 84% progress seen within the S&P 500 monitoring SPY index over the previous 5 years, BoA has been soundly outperformed by the U.S. market index as a complete by about 60%.

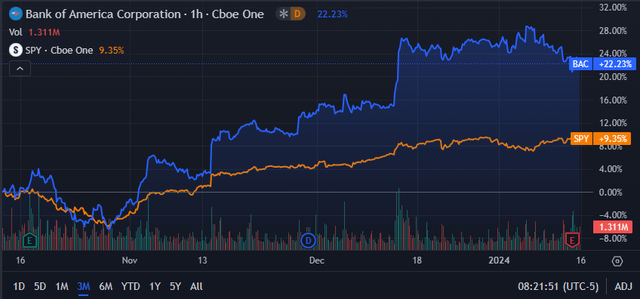

Searching for Alpha | BAC | 3M Superior Chart

On a final 3-month foundation BoA’s inventory has seen an enormous rally with valuations creeping up 23% since late October. This got here largely on the heels of hypothesis concerning the Fed chopping charges in Q1/Q2 of 2024 which prompted important investor optimism relating to BoA’s paper losses reversing.

The Worth Nook

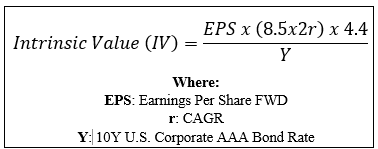

By using The Worth Nook’s specifically formulated Intrinsic Valuation Calculation, we will higher perceive what worth exists within the firm from a extra goal perspective.

Utilizing BoA’s present share worth of $32.80, an estimated 2024 EPS of $3.21, a practical “r” worth of 0.03 (3%), and the present Moody’s Seasoned AAA Company Bond Yield ratio of 4.47x, I derive a base-case IV of $45.80. This represents a nonetheless substantial 28% undervaluation in shares.

When utilizing a extra pessimistic CAGR worth for r of 0.02 (2%) to mirror a state of affairs the place a globally spanning recession causes BoA’s income progress to flatline all of the whereas working prices stay principally unchanged, shares are valued at round $33.00 representing a good valuation within the inventory as of current time.

Contemplating the intrinsic worth calculation and the latest rally in shares, I imagine that Financial institution of America is now buying and selling someplace between a good valuation and a modest undervaluation.

Within the quick time period (3-12 months), it is vitally tough to make any concrete predictions on share worth actions.

Financial indicators stay combined which makes predicting whether or not the U.S. financial system will obtain a soft- or onerous touchdown extremely tough. A soft-landing state of affairs would enable BoA to learn from new buyer relationships which may ignite topline progress whereas a tough recession may lead to declining profitability regardless of the financial institution’s greatest efforts.

Within the long-term (2-10 years), I see Financial institution of America persevering with to learn from a tangible aggressive benefit due to the numerous moatiness generated by its various enterprise segments.

Their large portfolio of companies and merchandise helps create a number of operational synergies whereas their enormous scale assists in maximizing effectivity via minimizing the relative dimension of many mounted prices.

Dangers Dealing with Financial institution of America – This autumn FY23 Replace

Financial institution of America nonetheless faces important danger from each regulatory adjustments and the specter of macroeconomic circumstances impacting client and company fiscal habits.

To learn an in-depth evaluation of BoA’s danger profile, please click on right here.

In abstract, BoA faces a tangible danger from the prevailing macroeconomic circumstances as primarily all their income streams are straight tied to the larger efficiency of the U.S. financial system.

A recessionary interval mixed with unfavorable phases of interest-rate cycles may expose the financial institution to worsening credit score scores and growing ranges of non-performing loans.

From an ESG perspective, BoA faces no tangible threats that would place a pressure on its fame or fiscal state of affairs.

I nonetheless imagine the general lack of main environmental, societal, or governance considerations would make the financial institution a wonderful decide for a extra ESG-conscious investor.

After all, opinions could differ and I implore you to conduct your personal ESG and sustainability analysis earlier than investing in Financial institution of America if these issues are of concern to you.

Abstract

Financial institution of America remains to be a strong and well-run banking operation with conservative core rules underpinning its enterprise practices.

I proceed to love the path Moynihan is taking the financial institution and imagine their deal with rising their buyer base, shopper relationships, and client banking operations regardless of the tough macroeconomic circumstances is a sound technique to pursue.

Some one-off gadgets mixed with a tough macroeconomic setting have resulted in This autumn and FY23 figures being barely extra muted than desired. Nevertheless, I imagine the financial institution is working properly to maximise effectivity and continues to enhance its setup for a extra expansionary fiscal cycle.

I view the rise in NPAs and charge-offs as regarding much less so of BoA’s enterprise mannequin however relatively your entire financial system as a complete. Any additional worsening of credit score may lead to important defaults which can affect profitability and the steadiness of the banking system as a complete.

Moreover, Financial institution of America’s share worth has witnessed a exceptional bull run since late October 2023 which has left shares buying and selling someplace between a 28% undervaluation and a good valuation.

Given the uncertainty current in present macroeconomic circumstances, I have to downgrade Financial institution of America to a Maintain and can’t advocate growing one’s place within the financial institution on account of a decreased margin of security.

I have to reiterate that I cannot be promoting my place within the financial institution, merely not including any additional publicity at current time as a result of shares being too expensive for my liking. I do, nevertheless, nonetheless imagine the financial institution has strong long-term worth technology potential for present shareholders.