Bet_Noire

By Seema Shah, Chief International Strategist

Federal Reserve coverage charges are set to fall in 2024. Nevertheless, clear proof that inflation has been tamed probably must emerge earlier than cuts can start, probably round mid-year.

Whereas a easy touchdown continues to be removed from sure, fee cuts accompanied by recession avoidance would current a constructive backdrop for danger property within the yr forward.

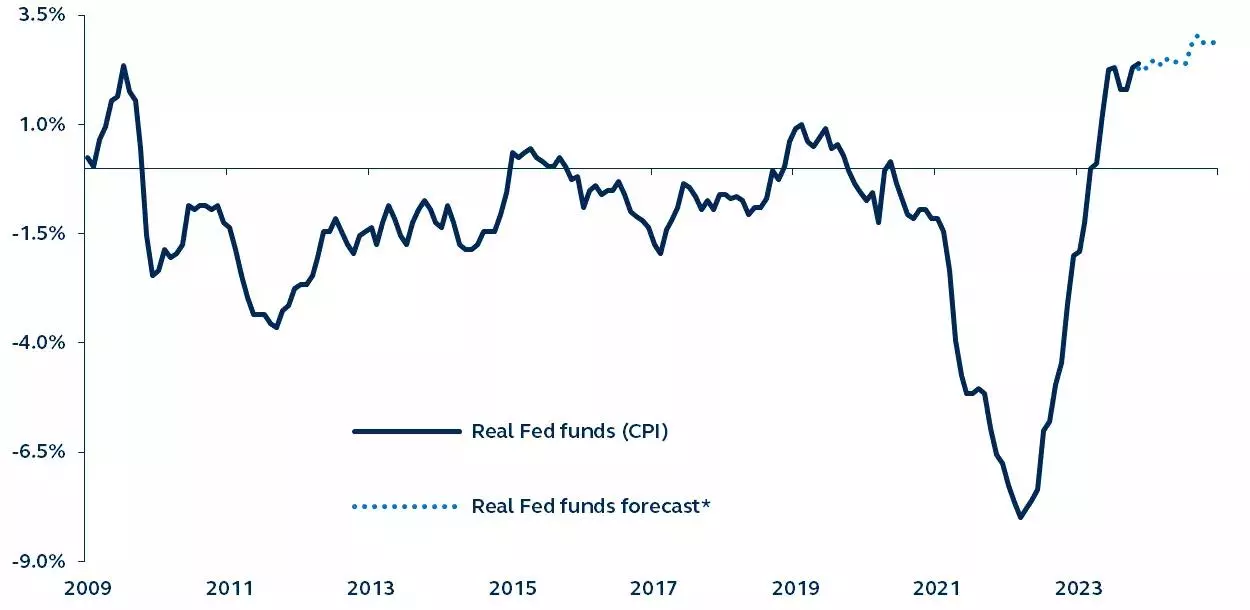

Actual Fed funds fee

January 2009–current

*Assuming Fed funds held at 5.5% and utilizing Headline CPI forecast.Supply: Federal Reserve, Bureau of Labor Statistics, Bloomberg, Principal Asset Administration. Knowledge as of December 31, 2023.

Core U.S. CPI inflation has fallen beneath 4%, opening the door to Federal Reserve (Fed) fee cuts this yr. After all, the inflation journey will not be but over, however the Fed has a stable probability of bringing inflation again to focus on with out triggering recession.

Make no mistake, it’ll nonetheless be a difficult coverage touchdown. Reducing coverage charges too quickly dangers reigniting inflation. Reducing coverage charges too late dangers recession.

To stay the touchdown, the Fed will want a number of months of knowledge displaying inflation is sustainably en path to the two% goal. As soon as it has safe proof, more likely to are available in 2Q, the Fed will wish to act promptly.

In spite of everything, if the Fed had been to maintain coverage charges on maintain at 5.5%, falling inflation would suggest a rising actual coverage fee and, subsequently, a tightening financial stance.

Given inflation’s present path, the Fed might want to minimize coverage charges to keep up the identical degree of financial restriction in actual phrases.

Traditionally, the Federal Reserve has tended solely to ease financial coverage as soon as indicators of a recession emerge.

On this uncommon financial cycle, nonetheless within the pandemic’s shadow, fee cuts accompanied by an financial slowdown – not recession – is a excessive chance, presenting a constructive backdrop for danger property.

Even so, contemplating broad fairness and credit score valuations are stretched, traders should fastidiously search alternatives.

Authentic Submit

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.