Up to date on December twenty eighth, 2023 by Bob Ciura

The “Canine of the Dow” investing technique is a quite simple method for traders to attain diversification and revenue of their portfolios whereas remaining within the sphere of extra conservative blue chip shares.

The technique consists of investing within the 10 highest-yielding shares within the Dow Jones Industrial Common, an index of 30 U.S. shares.

Excessive dividend shares are shares with a dividend yield properly in extra of the market common dividend yield of ~1.7%.

With that in thoughts, now we have created a free record of over 200 excessive dividend shares with dividend yields above 5%. You possibly can obtain your copy of the excessive dividend shares record beneath:

The “Canine of the Dow” technique produces above-average revenue and concentrates on shares that usually commerce at decrease valuations relative to the remainder of the DJIA. Provided that the DJIA represents a number of the largest corporations on this planet, its “canines” are usually corporations with robust monitor information which have hit short-term issues.

It is a nice and easy technique for worth traders trying to buy good companies which can be at the moment out of favor.

To implement this technique, take the amount of cash it’s a must to make investments after which divide it equally among the many 10 highest-yielding shares within the DJIA. Maintain these shares for an entire 12 months after which on the finish of 12 months, have a look at the 30 Dow shares once more and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the method. Along with the simplicity and give attention to high quality, worth, and revenue that this technique generates, it additionally improves self-discipline by stopping extreme emotion-driven buying and selling.

It additionally encourages traders to reap the tax advantages from holding positions for a minimum of one 12 months earlier than promoting, thereby being taxed on the long-term capital positive factors tax fee as a substitute of the short-term fee.

The 2024 Canine of the Dow

The record of the 2024 Canine of the Dow is beneath, together with the present dividend yield of the top-ten yielding DJIA shares. Click on on an organization’s identify to leap on to evaluation on that firm.

Canine of the Dow #10: Johnson & Johnson (JNJ)

Johnson & Johnson is a world healthcare big. The corporate at the moment operates three segments: Client, Pharmaceutical, and Medical Units & Diagnostics. The company consists of roughly 250 subsidiary corporations with operations in 60 nations and merchandise offered in over 175 nations.

Johnson & Johnson’s key aggressive benefit is the dimensions and scale of its enterprise. The corporate is a worldwide chief in a number of healthcare classes. Johnson & Johnson’s diversification permits it to proceed to develop even when one of many segments is underperforming.

The corporate has elevated its dividend for 60 consecutive years, making it a Dividend King. The inventory is owned by many well-known cash managers. For instance, J&J is a Kevin O’Leary dividend inventory.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

Canine of the Dow #9: Cisco Programs (CSCO)

Cisco Programs is the worldwide chief in excessive efficiency laptop networking programs. The corporate’s routers and switches permit networks around the globe to attach to one another via the web. Cisco additionally affords knowledge heart, cloud, and safety merchandise. The corporate went public on February sixteenth, 1990. At present, Cisco employs greater than 79,000 individuals and generates $54 billion in annual revenues.

On February fifteenth, 2023, Cisco introduced a 2.6% dividend improve within the quarterly cost to $0.39. On November fifteenth, 2023, Cisco reported earnings outcomes for the primary quarter of fiscal 12 months 2024. For the quarter, income grew 7.6% to $14.7 billion, which was $40 million above estimates.

Adjusted earnings-per-share of $1.11 in contrast favorably to adjusted earnings-per-share of $0.86 within the prior 12 months and was $0.08 greater than anticipated. For the latest quarter, Networking grew 10%, Safety was larger by 4%, Collaboration improved 3%, and Observability elevated 21%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cisco Programs (CSCO) (preview of web page 1 of three proven beneath):

Canine of the Dow #8: Coca-Cola (KO)

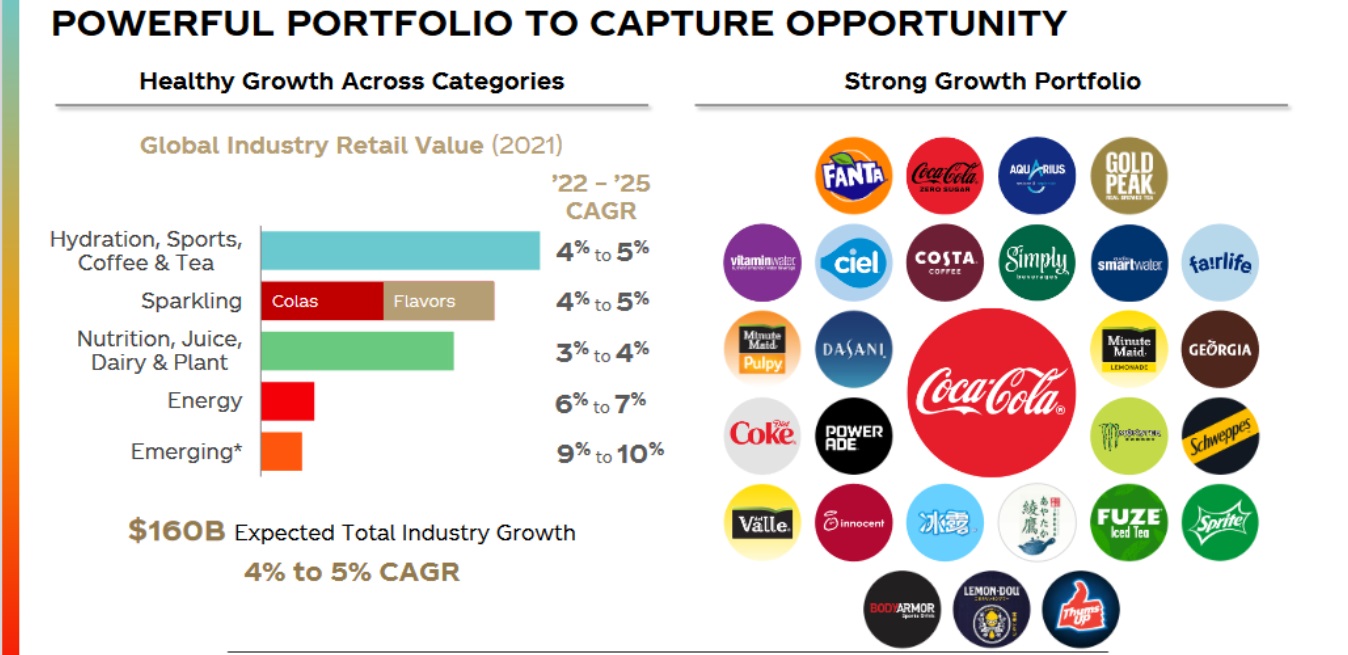

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Supply: Investor Presentation

The corporate additionally has an distinctive 59-year dividend improve streak.

Coca-Cola posted third quarter earnings on October twenty fourth, 2023, and outcomes had been significantly better than expectations. Adjusted earnings-per-share got here to 74 cents, which was a nickel higher than estimates. Income was $12 billion, up 8.1% year-over-year, and a full $580 million forward of expectations.

Natural income was up 11% in the course of the quarter, beating estimates by 4%. The corporate noticed positive factors in Latin America (+20%), EMEA (+20%), North America (+9%), Bottling Investments (+18%), and International Ventures (+9%). Quantity was up 2%, whereas worth and blend accounted for a 9% achieve within the high line.

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven beneath):

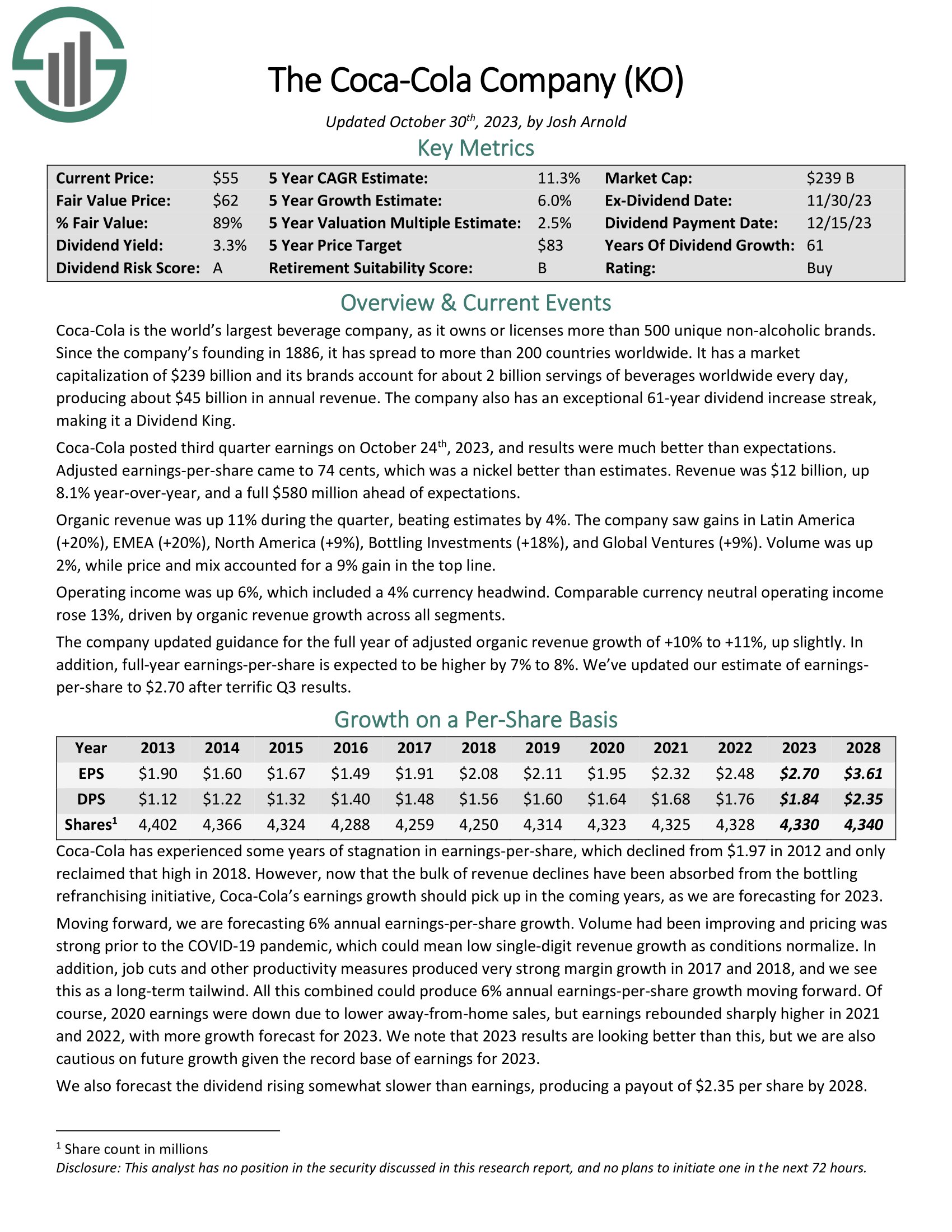

Canine of the Dow #7: Amgen Inc. (AMGN)

Amgen is the most important impartial biotech firm on this planet. Amgen discovers, develops, manufactures, and sells medicines that deal with severe diseases. The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation.

On October thirty first, 2023, Amgen reported third quarter outcomes for the interval ending September thirtieth, 2023. Income grew 3.8% to $6.9 billion, however was $45 million beneath estimates. Adjusted earnings-per-share of $4.96 in contrast favorably to $4.70 within the prior 12 months and was $0.28 above expectations.

Development was pushed by an 11% improve in volumes, offset by 3% decrease web promoting costs and a 3% headwind from unfavorable modifications to estimated gross sales deductions. Gross sales for Enbrel, which treats rheumatoid arthritis, had been decrease by 6% to $1.03 billion, principally on account of unfavorable modifications to estimated gross sales deductions. Prolia, which treats osteoporosis, grew 14% to a $986 million, pushed by an 7% improve in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on Amgen Inc. (AMGN) (preview of web page 1 of three proven beneath):

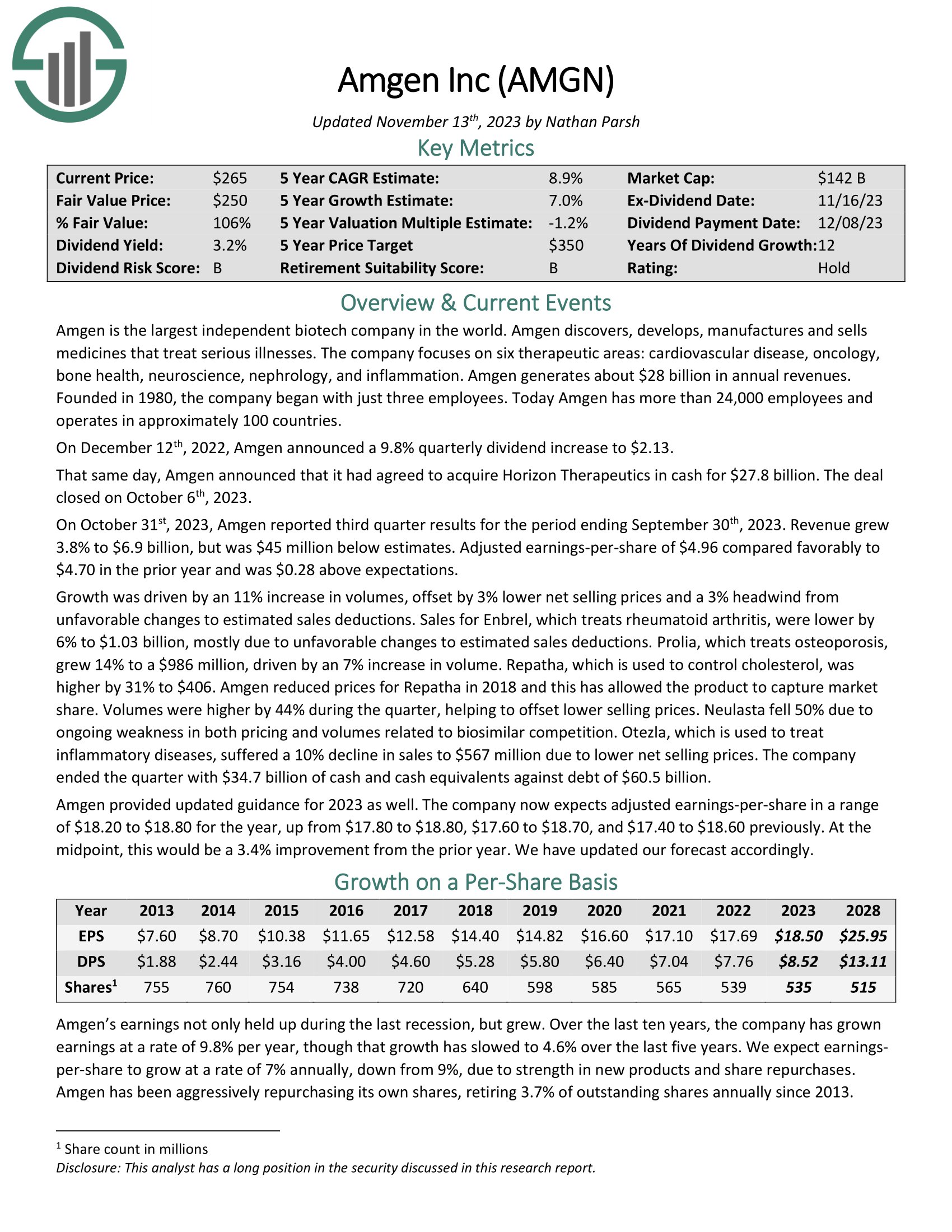

Canine of the Dow #6: Chevron Company (CVX)

Chevron is among the largest oil majors on this planet. This provides the corporate a dimension and scale that many opponents aren’t capable of match.

The corporate sees the majority of its earnings from its upstream section and has a better crude oil and pure fuel manufacturing ratio at 61/39 than most of its friends. Chevron additionally costs some pure fuel volumes primarily based on the oil worth. Ultimately, the corporate is extra leveraged to the oil worth than the opposite oil majors.

In late October, Chevron reported (10/27/23) monetary outcomes for the third quarter of fiscal 2023. Regardless of the rally of the value of oil triggered by a brand new spherical of manufacturing cuts by OPEC and Russia, earnings-per-share dipped -1% sequentially, from $3.08 to $3.05, and missed the analysts’ consensus by a large $0.64, principally on account of manufacturing points within the Permian Basin.

CVX has elevated its dividend for 36 consecutive years, and at the moment yields 4.0%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chevron Company (CVX) (preview of web page 1 of three proven beneath):

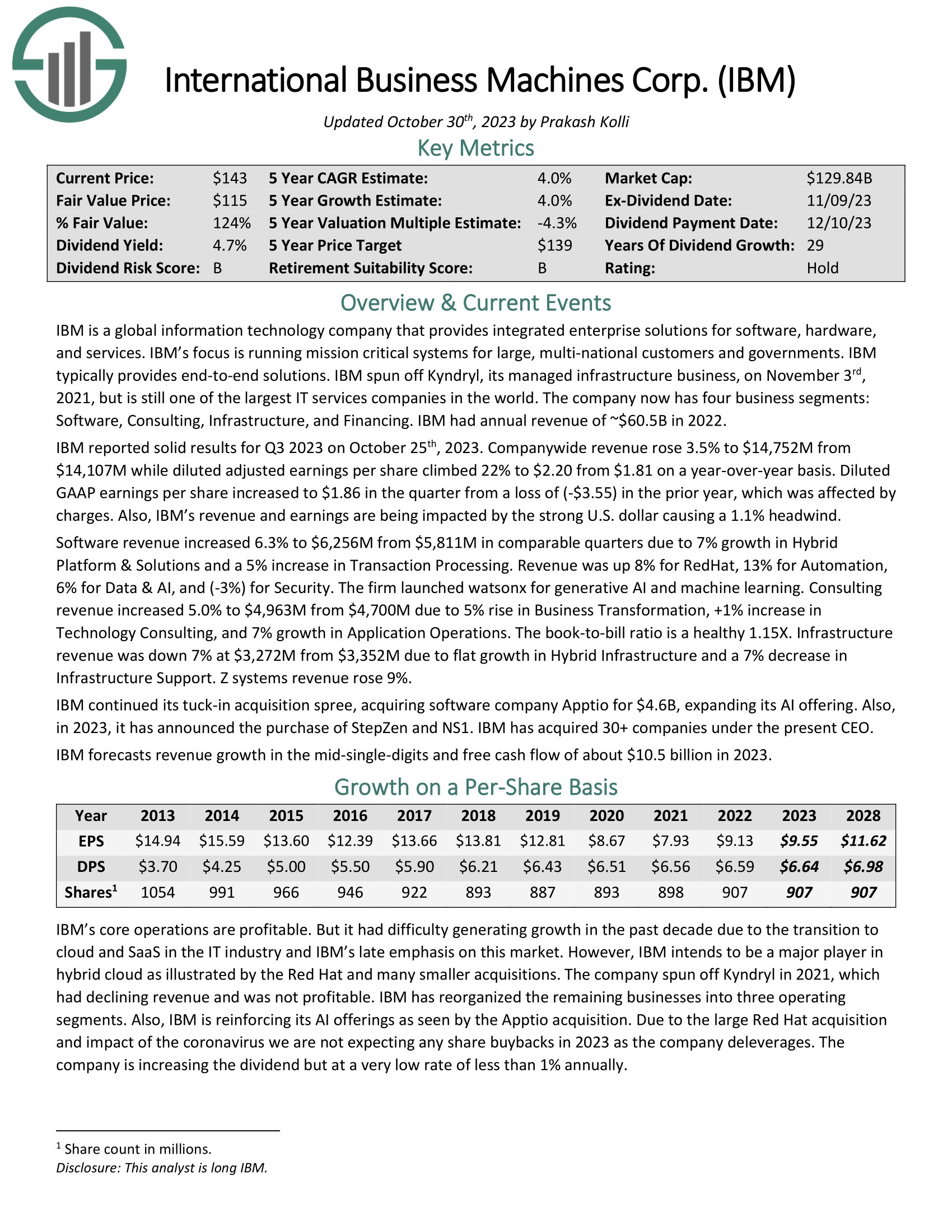

Canine of the Dow #5: Worldwide Enterprise Machines (IBM)

IBM is a world info know-how firm that gives built-in enterprise options for software program, {hardware}, and providers. IBM’s focus is operating mission-critical programs for big, multi-national clients and governments. IBM usually gives end-to-end options. The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$60.5 in 2022.

IBM reported stable outcomes for Q3 2023 on October twenty fifth, 2023. Firm-wide income rose 3.5% to $14,752M from $14,107M whereas diluted adjusted earnings per share climbed 22% to $2.20 from $1.81 on a year-over-year foundation. Diluted GAAP earnings per share elevated to $1.86 within the quarter from a lack of (-$3.55) within the prior 12 months, which was affected by prices.

Additionally, IBM’s income and earnings are being impacted by the robust U.S. greenback inflicting a 1.1% headwind. Software program income elevated 6.3% to $6,256M from $5,811M in comparable quarters on account of 7% development in Hybrid Platform & Options and a 5% improve in Transaction Processing. Income was up 8% for RedHat, 13% for Automation, 6% for Knowledge & AI, and (-3%) for Safety.

Click on right here to obtain our most up-to-date Positive Evaluation report on Worldwide Enterprise Machines (IBM) (preview of web page 1 of three proven beneath):

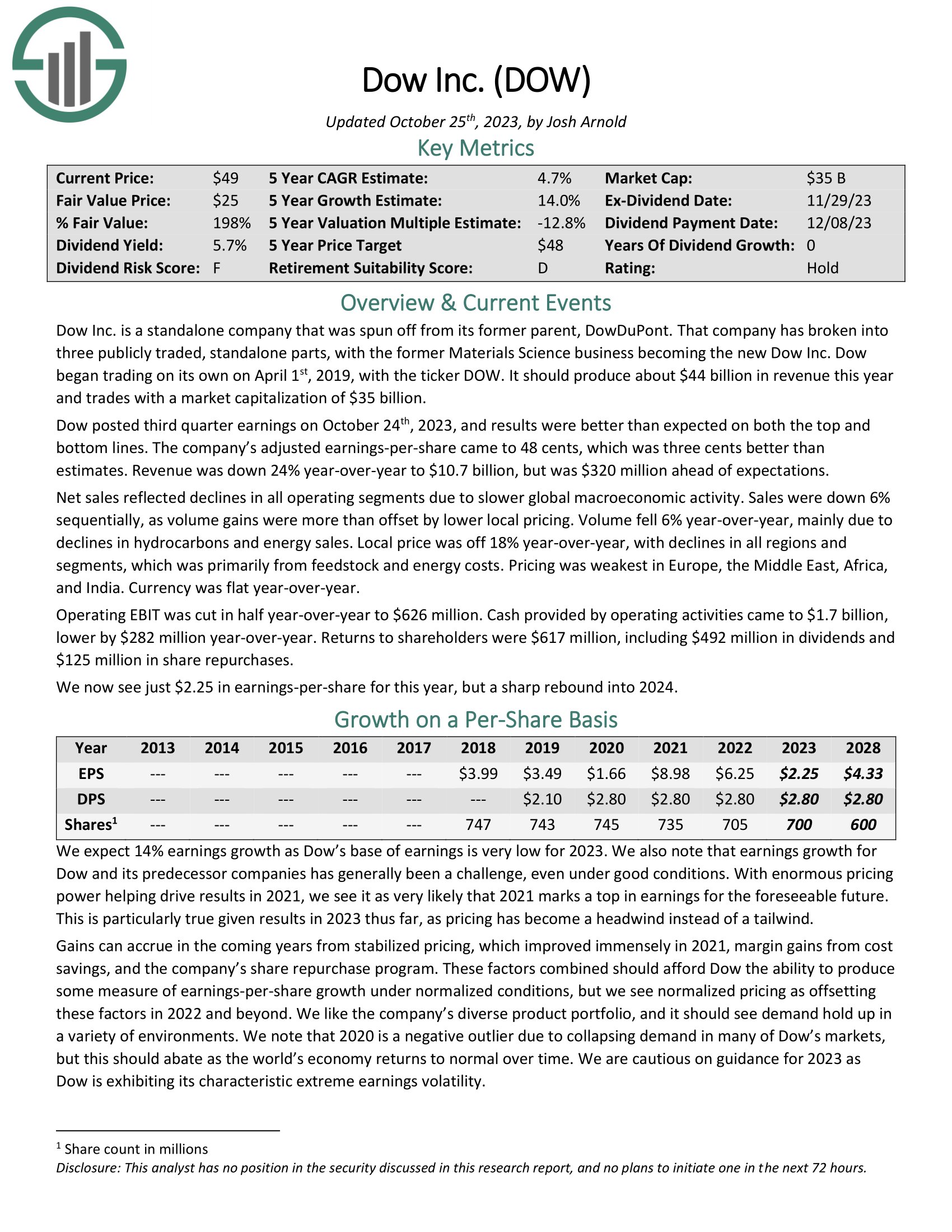

Canine of the Dow #4: Dow Inc. (DOW)

Dow Inc. is a standalone firm that was spun off from its former dad or mum, DowDuPont. That firm has damaged into three publicly traded, standalone components, with the previous Supplies Science enterprise turning into the brand new Dow Inc. Dow started buying and selling by itself on April 1st, 2019, with the ticker DOW. It ought to produce about $44 billion in income this 12 months.

Dow posted third quarter earnings on October twenty fourth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. The corporate’s adjusted earnings-per-share got here to 48 cents, which was three cents higher than estimates. Income was down 24% year-over-year to $10.7 billion, however was $320 million forward of expectations.

Web gross sales mirrored declines in all working segments on account of slower international macroeconomic exercise. Gross sales had been down 6% sequentially, as quantity positive factors had been greater than offset by decrease native pricing. Quantity fell 6% year-over-year, primarily on account of declines in hydrocarbons and vitality gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on Dow Inc. (DOW) (preview of web page 1 of three proven beneath):

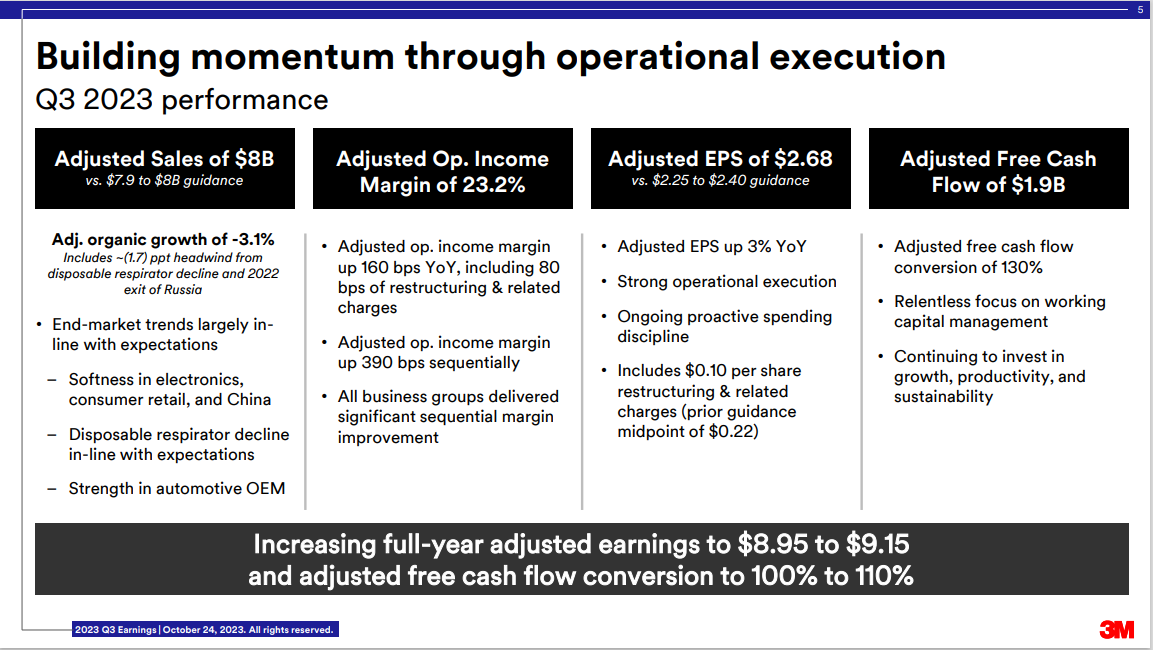

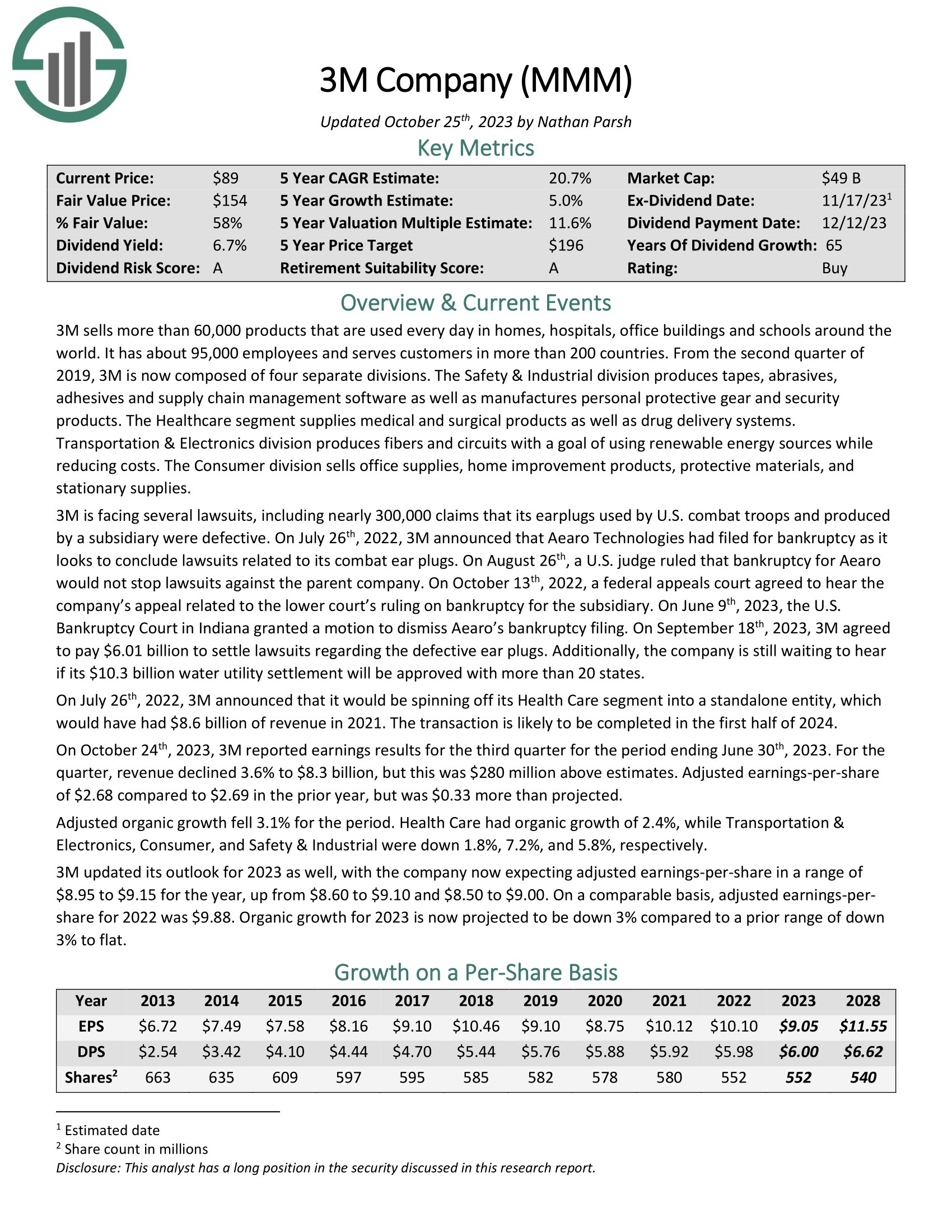

Canine of the Dow #3: 3M Firm (MMM)

3M is an industrial producer that sells greater than 60,000 merchandise used every day in properties, hospitals, workplace buildings, and faculties worldwide. It has about 95,000 workers and serves clients in additional than 200 nations.

On October twenty fourth, 2023, 3M reported earnings outcomes for the third quarter.

Supply: Investor Presentation

For the quarter, income declined 3.6% to $8.3 billion, however this was $280 million above estimates. Adjusted earnings-per share of $2.68 in comparison with $2.69 within the prior 12 months, however was $0.33 greater than projected.

Adjusted natural development fell 3.1% for the interval. Well being Care had natural development of two.4%, whereas Transportation & Electronics, Client, and Security & Industrial had been down 1.8%, 7.2%, and 5.8%, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M Firm (preview of web page 1 of three proven beneath):

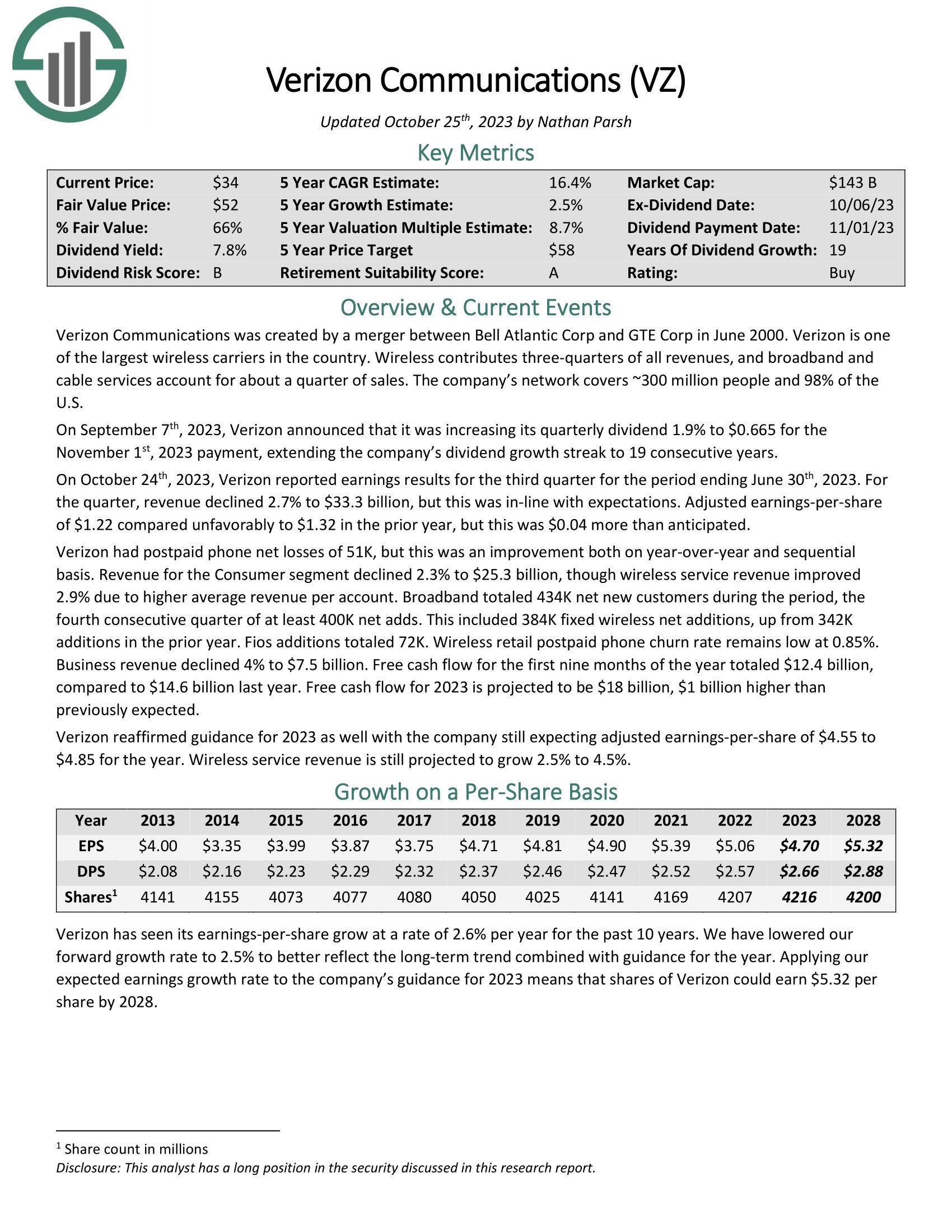

Canine of the Dow #2: Verizon Communications (VZ)

Verizon Communications is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a couple of quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On September seventh, 2023, Verizon introduced that it was growing its quarterly dividend 1.9% to $0.665 for the November 1st, 2023 cost, extending the corporate’s dividend development streak to 19 consecutive years.

On October twenty fourth, 2023, Verizon reported earnings outcomes for the third quarter for the interval ending June thirtieth, 2023. For the quarter, income declined 2.7% to $33.3 billion, however this was in-line with expectations. Adjusted earnings-per-share of $1.22 in contrast unfavorably to $1.32 within the prior 12 months, however this was $0.04 greater than anticipated.

Verizon had postpaid telephone web losses of 51K, however this was an enchancment each on year-over-year and sequential foundation. Income for the Client section declined 2.3% to $25.3 billion, although wi-fi service income improved 2.9% on account of larger common income per account. Broadband totaled 434K web new clients in the course of the interval, the fourth consecutive quarter of a minimum of 400K web provides.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven beneath):

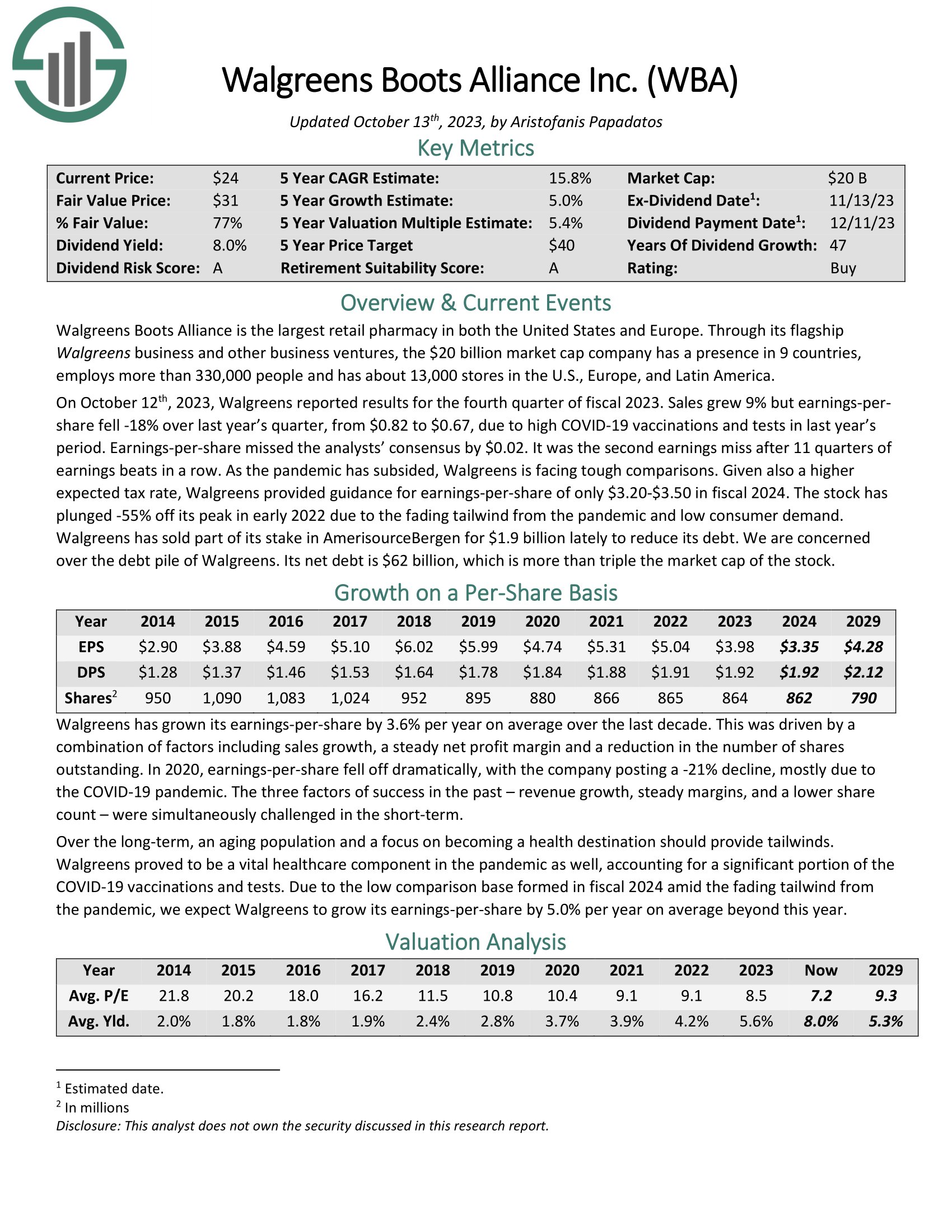

Canine of the Dow #1: Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance is the most important retail pharmacy in the USA and Europe. The corporate has a presence in additional than 9 nations via its flagship Walgreens enterprise and different enterprise ventures.

Supply: Investor Presentation

On October twelfth, 2023, Walgreens reported outcomes for the fourth quarter of fiscal 2023. Gross sales grew 9% however earnings-per-share fell -18% over final 12 months’s quarter, from $0.82 to $0.67, on account of excessive COVID-19 vaccinations and exams in final 12 months’s interval. Earnings-per-share missed the analysts’ consensus by $0.02. It was the second earnings miss after 11 quarters of earnings beats in a row.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven beneath):

Ultimate Ideas

Given the descriptions above, the Canine of the Dow are clearly a really various group of blue-chip shares that every get pleasure from vital aggressive benefits and prolonged histories of paying rising dividends.

In consequence, this investing technique is a superb, low-risk method for unsophisticated traders to strategy dividend development investing.

Whereas it could not outperform the broader market yearly, it’s nearly assured to supply traders with a mix of enticing present yield with steadily rising revenue over time.

In case you are desirous about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].