Supertruper

REITs have made a comeback in latest weeks, as fears round a ‘larger for longer’ rate of interest setting have subsided. It pays, nevertheless, to stay cautious, because the restoration should still be too early to inform. Maybe that’s why larger threat segments like resorts and workplace properties stay priced effectively beneath the place they have been only a yr in the past.

This brings me to Summit Lodge Properties (NYSE:INN), which I final coated right here in December of 2020, in what looks like a totally totally different time. Again then, Summit was climbing out of the depths of the pandemic and rates of interest have been traditionally low.

Hindsight is 20/20, and it seems that exuberance was overrated as larger rates of interest have pressured the inventory, with it now buying and selling 30.5% beneath the place it was since my final piece. On this article, I revisit the inventory and talk about whether or not if it’s a purchase or maintain presently, so let’s get began!

Why INN?

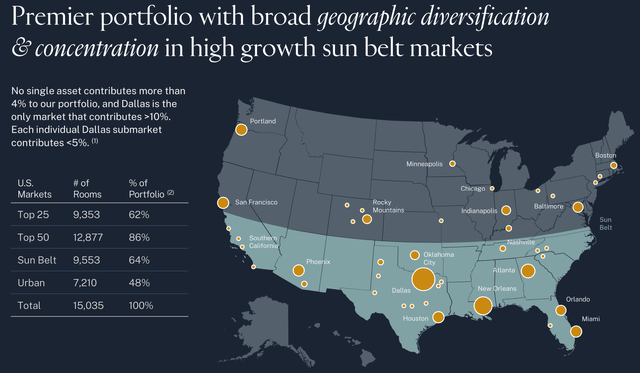

Summit Lodge Properties is a self-managed REIT that owns premium-branded lodging properties with environment friendly working fashions. It has a presence in 43 markets consisting of 101 lodge property, 57 of that are wholly owned with the remaining being owned as a part of joint ventures. As proven beneath, the bulk (86%) of INN’s properties are within the High 50 markets within the U.S.

Investor Presentation

INN is concentrated on select-service, upscale resorts with environment friendly working fashions, with Marriot, Hyatt, and Hilton branded resorts comprising 95% of its room rely. This interprets to raised margins than trade common. That is mirrored by INN’s TTM Lodge EBITDA margin of 36%, sitting above the 34% amongst choose service friends and 30% for all friends.

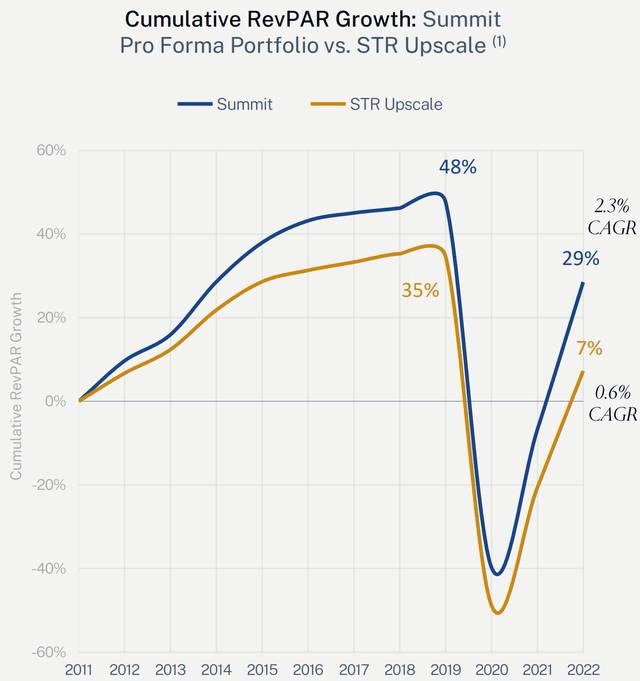

This has enabled INN to shortly climb out of the depths of the early pandemic, throughout which journey basically got here to a halt. As proven beneath, INN noticed encouraging RevPAR (income per out there room) within the pre-pandemic timeframe, and has since made a powerful restoration, with efficiency sitting forward of the STR Upscale chain benchmark over the whole timeframe.

Investor Presentation

In the meantime, INN continued to provide steady and rising top-line tendencies, with identical retailer RevPAR rising by 2.4% YoY to $117.85 and identical retailer occupancy rising by 230 foundation factors YoY to 73.7% in the course of the third quarter, signaling sturdy demand from client and enterprise journey. Encouragingly, top-line progress is being transformed to backside line profitability for INN’s resorts, regardless of wage inflation, as identical retailer Lodge EBITDA grew by 2.8% YoY to $61.4 million throughout Q3.

It’s value noting, nevertheless, that INN’s restoration has slowed, in comparison with identical retailer RevPAR progress of seven.7% YoY for the primary 9 months of the yr. I’m not too involved across the slowdown, nevertheless, as this was attributable to a tricky akin to 2022, when revenge journey was solidly taking maintain. As well as, a powerful U.S. greenback has made abroad journey extra engaging, the place the U.S. greenback strengthened, notably towards the Japanese Yen for instance, as proven beneath.

USD to JPY Change Price (Google)

Wanting forward, INN ought to profit from evolution of labor, during which staff are more and more in hybrid mode in comparison with pre-pandemic. This implies interval visits to their firm’s regional headquarters, with smaller teams and shorter stays, for which INN is effectively suited.

Plus, whereas INN’s value of fairness and debt are at present unattractive attributable to a low share worth and better curiosity prices, portfolio recycling is a manner for INN to generate inner progress. That is mirrored by a signed settlement to promote a Hyatt Place in Maryland for $8.25 million at an attractively low 4.6% cap price, and the proceeds of which may be deployed to larger yielding properties. Since Could of 2022, INN has disposed of 6 resorts totaling $111 million, inclusive of the above-mentioned Hyatt Place.

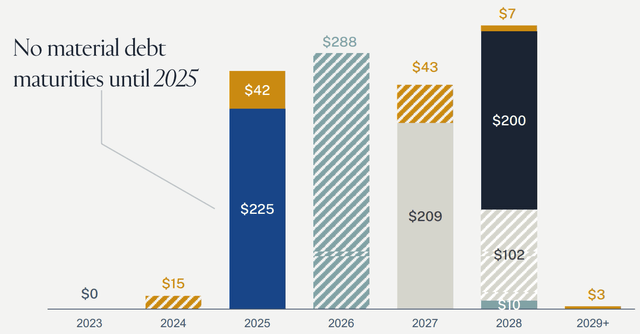

Importantly, INN is modestly leveraged with a web debt to enterprise worth of 51%, a hard and fast cost protection ratio of two.5x, and no materials debt maturities till 2025, as proven beneath.

INN Debt Maturities (Investor Presentation)

Dangers to INN embody the truth that Lodges are extra susceptible to an financial recession in comparison with different REIT asset courses equivalent to web lease, industrial, and group procuring facilities. As such, a possible onerous touchdown within the financial system might reverse a number of the prime and backside line positive aspects that INN has seen over the previous yr.

As well as, larger rates of interest pose a headwind, as INN does have significant debt maturities beginning in 2025, as proven above. Nevertheless, whereas Lodge REITs are among the many most economically susceptible asset courses, they’re additionally resilient in relation to inflation attributable to their capacity to reset charges nearly instantaneously. As such, room price progress attributable to inflation might offset a number of the influence from larger rates of interest, ought to inflation stay elevated.

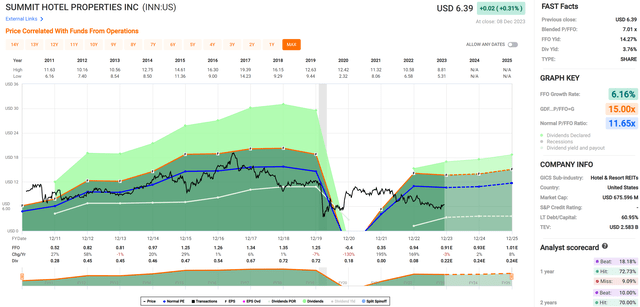

In the meantime, INN at present pays a 3.8% dividend yield, which is well-covered by a 27% payout ratio, based mostly on INN’s ahead FFO/share of $0.89. This leaves INN with loads of retained capital to both pay down debt or to pursue accretive progress. I additionally see worth in INN on the present worth of $6.39 with a low ahead P/FFO of simply 7.2, sitting effectively beneath its regular P/FFO of 11.7. As such, it seems that the market has already priced in loads of dangers into the inventory.

FAST Graphs

Conservative revenue buyers ought to think about Summit’s Most well-liked Collection E Inventory (NYSE:INN.PR.E), which at present yields a excessive 8.4%. On the present worth of $18.70, it trades at a fabric 25% low cost to the $25 Par Worth. This most popular situation can be cumulative, which signifies that missed funds have to be made up as long as INN is solvent. Whereas INN.PR.E at present trades submit its name date of 11/13/2022, I don’t see it being redeemed anytime quickly, contemplating that it has a face yield of 6.25% and was issued in November of 2017, at a time when rates of interest have been a lot decrease.

Investor Takeaway

INN is a well-positioned lodge REIT with a powerful give attention to select-service, upscale properties in prime markets. With excessive margins and spectacular efficiency lately, INN has confirmed its resilience and potential for progress. Moreover, INN’s strategic portfolio recycling strategy permits for inner progress alternatives and continued stability.

In the meantime, the frequent inventory trades effectively beneath its regular valuation whereas providing a well-covered near-4% dividend yield, leaving loads of retained capital to bolster the stability sheet and/or pursue progress alternatives. Extra conservative revenue buyers could wish to take into account the Most well-liked Collection E inventory, which carries an 8.4% dividend yield and trades at a 25% low cost to par worth.