georgeclerk/iStock Unreleased by way of Getty Photographs

Expensive readers/followers,

It is a good time to replace on a few of the Asian corporations that I observe and put money into. A type of corporations is Canon (OTCPK:CAJPY). It is a good time to look as a result of whereas the corporate had a bout of short-term outperformance since my final article, it has since dropped again down to reveal outperformance of the broader S&P500, placing me right into a place of in all probability increasing my place within the enterprise.

I consider that Canon continues to be underestimated by buyers. It is a Japanese high quality tech firm with a credit standing of A and a yield of now over 4%. Even conservatively talking, the upside right here is double digits, and on this article, I am going to attempt to present you clearly why I think about this to be a essential funding into the Japanese market you could make.

Have a look at how the corporate moved since my final bullish article.

Searching for Alpha Canon Article (Searching for Alpha)

It is a pretty attention-grabbing pattern – and on this article, I am going to present you the outcomes of 2Q23 and the place we will go from right here.

Canon – 2 good years of progress, let us take a look at the third

After troughing in 2020 along with COVID-19, the corporate has recovered with a vengeance. The native ticker for Canon is 7751, and that is the one which I put money into. Essentially talking, Canon is likely one of the most spectacular corporations on the Japanese market you could make investments your cash in. I am speaking a few sub-3% debt ratio for an A-rated, 3.6T yen firm. That alone, not even mentioning 4%+ yield, ought to be sufficient for the extra conservative buyers of you to cease and take note of this enterprise.

The case for Canon is a reasonably simple one, not less than if we “uncomplicate it”. Canon is a market chief in a number of related markets. On the other aspect, we have now geopolitical macro, inflation, provide chain, and different instability points, which Canon actually can’t affect or do something about. The final quarter, which means 1Q23 and 2Q23, had been completely stellar, persevering with the streak of outperformance we have seen.

How was 3Q23?

As you would possibly count on by share value outcomes, and on condition that we noticed these outcomes lower than 3 days in the past, the outcomes had been…so-so.

We’re speaking a few gross sales and revenue improve – the truth is, the whole lot was up. However I wasn’t up as a lot as the corporate anticipated. It was the primary signal of what we will name comparative weak spot in relation to ahead expectations.

Why was this?

As a result of China’s demand softened, in addition to another areas seeing elevated competitors.

It is necessary to notice although, that outcomes had been on no account dangerous.

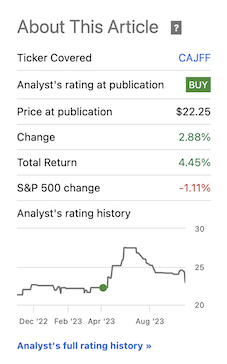

Canon IR (Canon IR)

Other than China, Canon describes an total impact from the downturn in actual property, ongoing financial tightening that is resulting in ongoing weak demand in different areas as effectively – each for printers and for different merchandise, resulting in the corporate formally not reaching its plan in sure segments.

Not all issues had been dangerous although – the corporate noticed progress in community cameras, medical, and different companies. Additionally, a tailwind from favorable FX due to related developments seen in just about all Yen-based corporations, resulted in YoY gross sales progress. Nonetheless, very similar to with different Yen-based corporations, buyers after all perceive that the impact right here is probably going momentary till the FX reverses.

Working revenue, as you see above, truly grew due to price discount results, and FX – Canon truly continued to speculate closely within the promotion to extend gross sales, additionally incurring D&A attributable to sensor manufacturing startups at a brand new manufacturing facility.

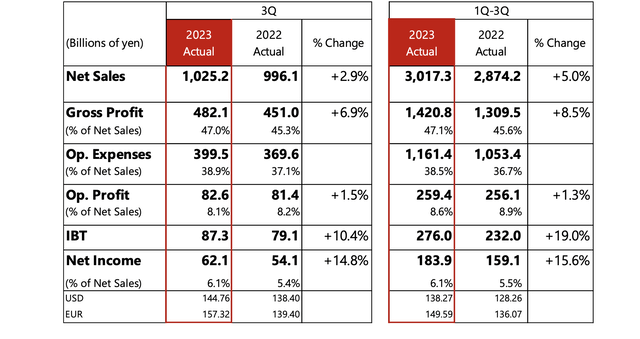

Canon IR (Canon IR)

For 9M23, as a result of we’re shifting into the top of the fiscal now, the corporate has posted a 5% improve in complete working revenue, however a complete web revenue improve of over 15%.

The corporate, regardless of the talked about challenges, nonetheless expects a 400B+ Yen working revenue degree. This was final achieved earlier than the economies crashed in -08, which could be considered being fairly foreboding. The corporate is reducing its projection in gross sales right here, now anticipating 4.2T Yen in gross sales for the total 12 months, in comparison with round 4.36T Yen over the past set of forecasts.

Housekeeping or fundamentals for an organization with A-rated credit score and fewer than 2.9% long-term debt/cap is extra of an train than in optimistic numbers than anything. Canon has an curiosity protection ratio of 200x, which may be the most effective amongst most A-rated corporations on the market. The corporate continues to handle a 46%+ gross revenue margin and is steady at between 6-8% web margin. It isn’t the best, however it’s definitely above common for the sector, the sector, on this case, being {hardware}.

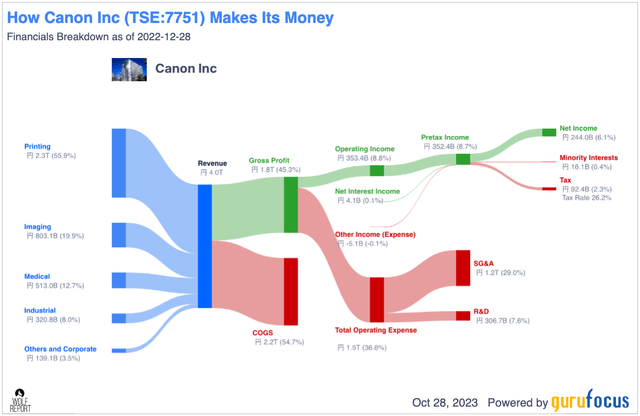

The corporate’s enterprise mannequin, regardless of the continuing macro, is a pleasure to behold, seeing income flip into good quantities of web revenue/revenue with out greater than 55% COGS and 37% of different working bills.

Canon Enterprise Mannequin (GuruFocus)

The corporate stays inherently impressively worthwhile. The little quantity of debt it has truly wasn’t even there till 2016, and the corporate has been slowly chopping this again down ever since taking it on.

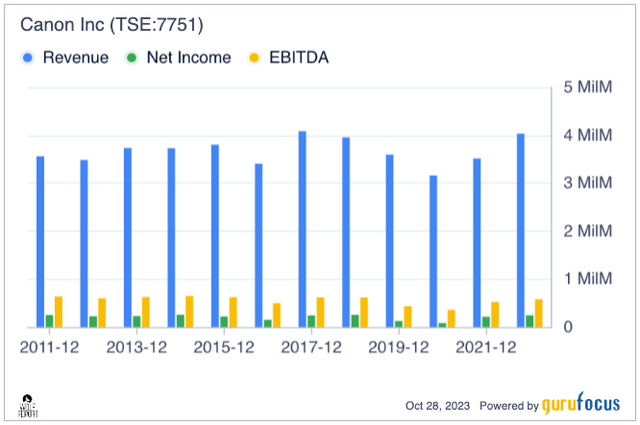

The one factor that may be mentioned about Canon is similar factor that may be mentioned about many Japanese corporations for the previous decade – a good bit of stagnation. As buyers, we are inclined to need progress in most elementary KPIs. The corporate has not likely been in a position to ship spectacular quantities of it.

Canon income/web (GuruFocus)

Since 2017, little or no has occurred. The corporate has been shopping for again pretty spectacular quantities of shares, reducing SO, and SE has been rising as a product of this, which is nice. Optimization of the corporate construction and shareholder fairness isn’t a foul factor as such – however straight-line gross sales and revenue progress would after all be higher.

The place I consider Canon shines is basically fundamentals and reversal potential, as a result of that is one thing I see for the corporate. I consider that even below non-premiumized forecasts, this firm has the potential to outperform the market – and that is at all times what I search for in lots of investments.

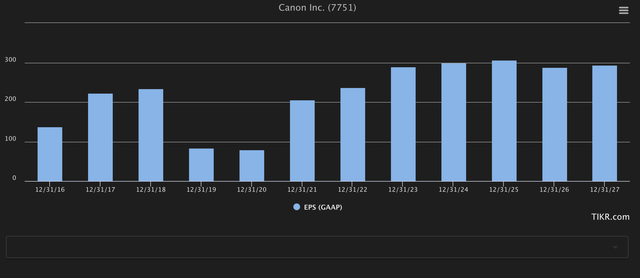

Whereas expectations are for earnings to primarily “peter out” when it comes to progress, that is not but the place we’re. In 2023E and 2024E, we nonetheless have progress estimates, and if these materialize (which I consider they may), then this firm may nonetheless provide vital worth as an funding.

Canon EPS estimates (TIKR.com)

Canon has loads to supply these of us who need worldwide diversification and enticing companies with a superb yield – and we will, I consider, nonetheless decide this firm up at a superb worth.

Let me present you what I imply.

Canon Valuation – Nonetheless a 15%+ annualized upside on a 15x P/E with robust progress estimates.

The corporate continues to outperform the market, because it has since I began my funding in Canon. I used to be tempted when the corporate briefly touched near the native 3,800 Yen degree to divest a part of my holding however in the end determined towards it. I don’t remorse this right here (small actions, which is what I see this as being, do not dictate my funding technique – however I’m by no means against taking interesting income if different funding prospects can be found. And in the present day we have now a variety of choices).

Canon trades at a mean P/E of 12.2x normalized right here for the native 7751 ticker. That is beneath its premium of 17x, and it is beneath a good worth of 15x given the corporate’s 4-6% progress charge and the present estimate of a 23% 2023E progress charge with a 291 Yen EPS estimate for the 12 months (Supply: S&P International).

My goal is 3,500 Yen, and I am sticking to this goal, which means that the corporate continues to be a “BUY” right here. On a ahead estimate, which means for 2025E, I count on it to be completely doable for the corporate to succeed in a 15x P/E even with the present macro, and this is able to suggest someplace alongside the road of 4,500 Yen per share if the corporate’s 2023 and 2024 progress estimates materialize. That might additionally suggest an annualized charge of return of 18.48%, which is above my minimal of 15%.

I view Canon as one among a number of diversification choices for the Japanese market. Some select to go the NIKKEI ETF route, and a few Japan ETFs that concentrate on a broader diversification. As with all of my investments, I’ve not gone the ETF route (I don’t personal a single ETF in my portfolio), however fairly select particular person investments that don’t include administration charges and the place I can “construct” my very own “fund”.

I consider Canon is secure sufficient and interesting sufficient at this value to carry by means of thick and skinny in a market that appears dead-set on being unstable for the close to time period and presumably longer, given the chance of a critical downturn or a recession in 2024E.

I maintain the stance {that a} smooth touchdown is unlikely to the purpose of being unrealistic, which can also be why I’ve included way more defensive investments and likewise maintain a ten%+ money allocation right now, which may be very uncommon for my method. I am normally greater than 95% invested always.

This is not maybe probably the most undervalued or probably the most interesting funding on the whole market. That isn’t what I’m saying. However it’s an funding you could purchase, and one which I consider in the long run will outperform a 15% common.

For that purpose, I am at a “BUY” right here, and will add extra shares now that we’re in decline after 3Q23 outcomes.

Thesis

My thesis for Canon is as follows:

Canon is likely one of the premier imaging, digicam, and printing corporations on the planet. It has a strong basis in addition to wonderful progress prospects. On the proper valuation, this firm goes from being a doable purchase to being a really compelling prospect for long-term investing. At a conservative 12-13x P/E, I not solely think about the corporate considerably enticing however a particular “Purchase”. I’ve established a starter place – my first place in a local Japanese ticker. I observe Canon with a $24.5 ADR value goal or 3,500Y for the native Tokyo ticker. It is closing on my PT, however it’s nonetheless a “BUY” right here.

Bear in mind, I am all about:

Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital beneficial properties and dividends within the meantime. If the corporate goes effectively past normalization and goes into overvaluation, I harvest beneficial properties and rotate my place into different undervalued shares, repeating #1. If the corporate does not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative. This firm is essentially secure/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low-cost. This firm has a sensible upside primarily based on earnings progress or a number of growth/reversion.

This firm fulfills all of my valuation standards for investing besides being low-cost – it is subsequently a “Purchase” right here.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.