Massimo Giachetti

After a decrease open to start out the week, shares have staged a fairly large intraday restoration (to this point). One catalyst for the rally was a tweet by Invoice Ackman saying his agency had lined its Treasury brief, citing an excessive amount of geopolitical threat and an economic system weakening sooner than present financial information suggests.

Why a weaker economic system would spur a rally in shares is a respectable query, however we’ve all definitely seen stranger issues available in the market, and when markets turn out to be oversold, typically it doesn’t take a lot to spark a rally.

Monday’s rebound additionally coincided with the Nasdaq’s decline from the July closing excessive crossing the ten% threshold, and it’s not unusual for an index within the midst of a decline to bounce at these spherical numbers, as they’re the place discount hunters will look to deploy some dry powder.The Nasdaq is not formally in correction territory as we write this (10%+ decline from a closing excessive and not using a 10% rally in between), however we wished to take this chance to have a look at historic developments for previous Nasdaq corrections and see how the present interval stacks up.

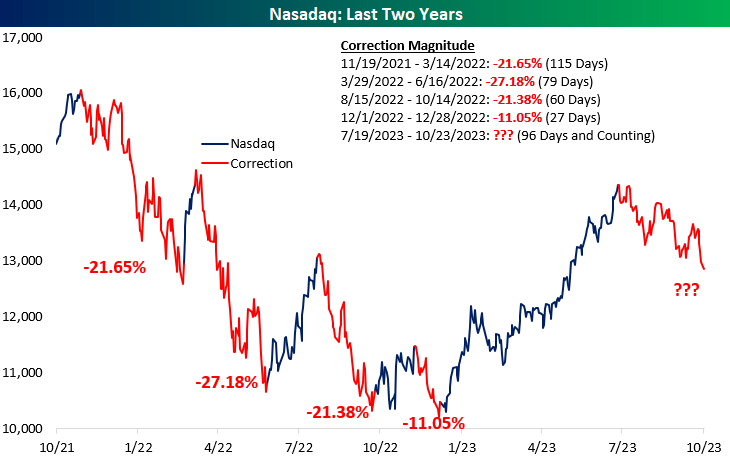

For starters, since hints of the present fee mountain climbing cycle started, there have been 4 prior Nasdaq corrections. Three of the 4 had been deep with declines of greater than 20%, whereas the latest earlier than the present interval was extra tame at simply 11%.

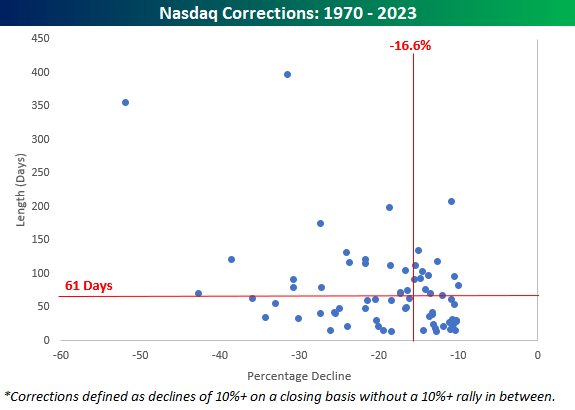

Nasdaq corrections from a longer-term window, the scatter chart beneath exhibits corrections by way of their magnitude (x-axis) and size (y-axis).

Total, the median decline of corrections since 1971 has been a drop of 16.6% over a median size of 61 calendar days. By at present’s shut, the present decline is simply round 10%, so it’s been quite a bit milder, however at 96 days, it’s already been 57% longer than the everyday correction.

If the present decline within the Nasdaq had been to succeed in the median stage for a correction, that will take it down to simply beneath 12,000.

The Nasdaq is thought for being extra risky than the S&P 500, and in relation to corrections, they’ve tended to be steep versus gradual.

Even with respect to the corrections in the course of the present fee hike cycle, three of the 4 prior ones had been shorter than the present interval. The one one which was longer lasted 115 days from 11/19/21 by means of 3/14/22.

Unique Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.