Up to date on October sixteenth, 2023 by Bob Ciura

Kimberly-Clark (KMB) has elevated its dividend for 51 consecutive years. Consequently, it has joined the checklist of Dividend Kings. The Dividend Kings are a gaggle of simply 51 shares which have elevated their dividends for no less than 50 years in a row.

We imagine the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full checklist of all 51 Dividend Kings. You’ll be able to obtain the complete checklist, together with vital monetary metrics equivalent to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Kimberly-Clark is a world chief in its trade and will proceed to develop its dividend every year, even throughout recessions.

This text will talk about the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

Kimberly-Clark traces its beginnings again to 1872. 4 younger businessmen, John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck, got here up with $30,000 of start-up capital to type Kimberly, Clark and Co.

Right this moment, Kimberly-Clark is a world shopper merchandise firm that operates in 175 nations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates segments that every home many common manufacturers: Private Care Phase (Huggies, Pull-Ups, Kotex, Rely, Poise) and the Shopper Tissue section (Kleenex, Scott, Cottonelle, and Viva), plus knowledgeable section. In all, KMB generates ~$21 billion in annual income.

Supply: Investor Presentation

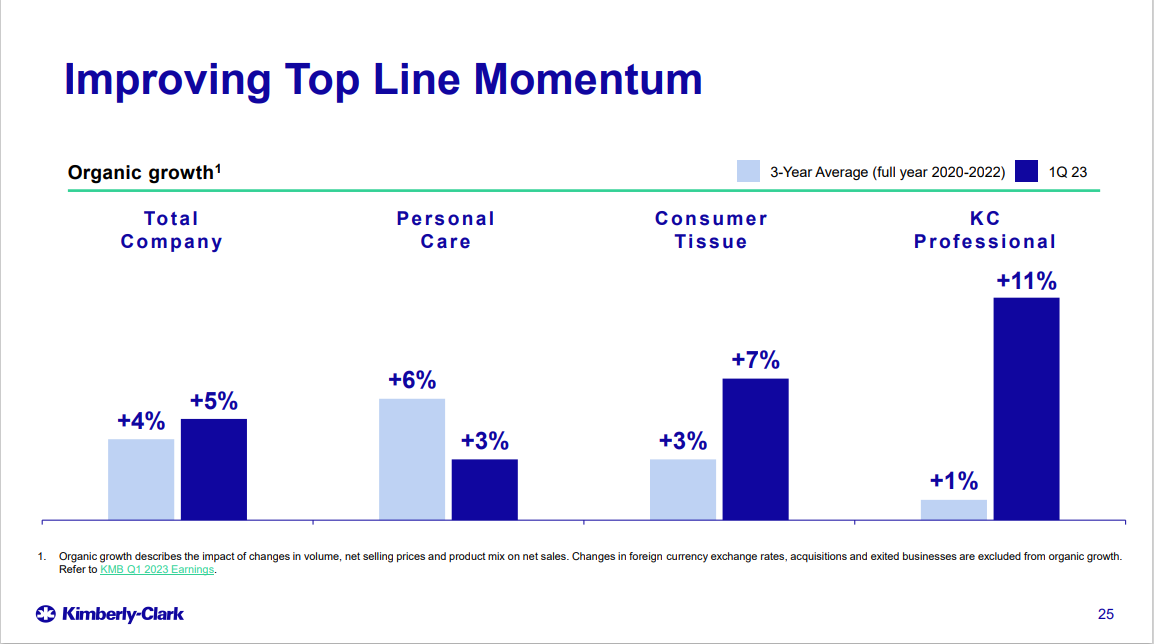

Kimberly-Clark posted second-quarter earnings on July twenty fifth. Adjusted earnings-per-share handily beat estimates by 17 cents, coming in at $1.65. Income elevated 1% year-over-year to $5.1 billion. Natural gross sales rose 5%, which was pushed by a 9% enhance in value and favorable product combine. These had been partially offset by a 3% decline in quantity, and foreign exchange translation was an extra 4% headwind.

North America gross sales rose 6%, together with 6% natural gross sales development. Gross margin rose 380 foundation factors to 34% of gross sales, pushed by larger income and value financial savings, which offset larger enter prices. Steerage for the stability of the yr is for 3% to five% in natural gross sales development.

Progress Prospects

Kimberly-Clark has dedicated to elevating its core manufacturers as one of many three pillars of development within the coming years. It should do that by launching completely different product improvements through extensions of present strains and fully new merchandise. It could additionally leverage its robust manufacturers to extend costs over time.

It should additionally use its important advertising and marketing investments to go after under-penetrated classes to drive market share features and, in the end, larger income and revenue.

Supply: Investor Presentation

The following development pillar is accelerating development in its growing and rising (D&E) markets, which make up a good portion of the corporate’s gross sales. The corporate will deal with its private care {and professional} segments specifically, with its largest alternatives coming from locations the place it has low class penetration and frequency of utilization.

The corporate’s deal with D&E growth in Latin America and China specifically, with smaller markets, additionally seeing a significant push. Kimberly-Clark plans to make use of its important provide chain and advertising and marketing expertise to pursue development in areas the place it underperforms at this time, which ought to assist drive some incremental development.

Kimberly-Clark additionally continues to pursue value financial savings. It has grown its earnings-per-share due to share repurchases and value discount applications. Kimberly-Clark’s administration crew has prolonged this initiative to 2022, aiming for an additional $1.5 billion of cumulative financial savings over the three-year interval.

General, we anticipate 5% annual EPS development over the following 5 years.

Aggressive Benefits & Recession Efficiency

Kimberly-Clark’s most vital aggressive benefits are its manufacturers and world scale. The corporate enjoys a management place throughout its model portfolio and, certainly, the world over.

It retains its aggressive benefits by means of advertising and marketing and innovation. Kimberly-Clark spends over $1 billion yearly on promoting, and analysis and growth. This permits the corporate to remain forward of the competitors. Given its dedication to its development pillars, we anticipate this can solely enhance over time.

As well as, Kimberly-Clark’s world attain gives the corporate with the effectivity to maintain prices low. The FORCE (Targeted On Lowering Prices All over the place) program is an instance of its means to handle prices, whilst income grows, and has seen years of success in decreasing working prices.

Kimberly-Clark stays extremely worthwhile, even throughout recessions. For instance, it carried out effectively by means of the Nice Recession of 2007-2009. Its earnings-per-share by means of the Nice Recession are proven beneath:

2007 earnings-per-share of $4.25

2008 earnings-per-share of $4.06 (4.5% decline)

2009 earnings-per-share of $4.52 (11% enhance)

2010 earnings-per-share of $4.45 (1.5% decline)

As you’ll be able to see, whereas Kimberly-Clark did see earnings decline in 2008 and 2010, it additionally registered a double-digit development price in 2009. The rationale for its robust efficiency over the course of the recession is that the corporate sells merchandise that buyers want no matter financial situations.

Shoppers will all the time want private care merchandise, whatever the situation of the financial system. This provides Kimberly-Clark a sure degree of product demand every year, even throughout recessions.

Valuation & Anticipated Returns

Primarily based on our adjusted earnings-per-share estimate of $6.35 for the fiscal yr 2023, Kimberly-Clark trades for a price-to-earnings ratio of 19.2.

Excluding outlier years, Kimberly-Clark has traded at a median price-to-earnings ratio of about 19.0 during the last decade. That is additionally our estimate of truthful worth for the inventory. The valuation has moderated considerably of late, however shares nonetheless commerce simply above our estimate of truthful worth.

If the inventory valuation declines to 19.0 over the following 5 years, it could cut back annual returns by 0.2% over the following 5 years. As well as, future returns will probably be generated from earnings development and dividends. We anticipate 5% annual EPS development for Kimberly-Clark. The inventory additionally has a 3.9% dividend yield. In whole, we see annual returns of 8.7% over the following 5 years.

Given the robust yield, 50+ yr historical past of dividend will increase, and average development expectations, we price the inventory a maintain for dividend development traders. The inventory will not be a purchase proper now, as whole anticipated returns are beneath 10%.

Closing Ideas

Kimberly-Clark is a high-quality firm with a various portfolio of robust manufacturers. It has constructive development prospects shifting ahead, and it’s a particularly dependable dividend inventory. Rising markets, value reductions, and share repurchases will spotlight future earnings development.

Kimberly-Clark has elevated its dividend for 50 years in a row and presently has a dividend yield of almost 4%. It, subsequently, meets our definition of a blue-chip inventory, and it ought to proceed to ship regular dividend will increase every year.

In case you are interested by discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases will probably be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].