Just_Super/iStock by way of Getty Pictures

Thesis

In my earlier evaluation of Hudbay Minerals (NYSE:HBM), I forecasted that the corporate’s share value (then at $4.55/share) was forming a falling wedge sample because of considerations about Chinese language copper demand and the repeated price hikes introduced by the Fed at the moment (to manage growth-led inflation) and that it was more likely to discover assist inside the vary of $4.25-4.35/share over the subsequent three months. As seen in HBM’s latest value chart under, the inventory touched the indicated assist ranges (on the mid-point vary of $4.30) twice in the course of the three months from March 2023 to June 2023.

HBM’s 1-12 months Technical Value Chart – Supply: Finviz

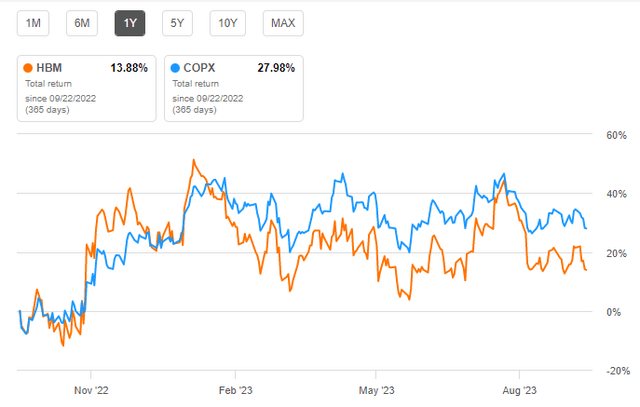

HBM’s 1-year technical value chart’s “peaks and troughs” kind an upward wedge sample, indicating that the share value may transfer north from the present ranges. On the time of writing, HBM’s final traded value of $4.65 was ~7% under the mid-point worth (at $4.98) of its 52-week vary (between $3.62-6.34) and ~8% decrease than its 200-day SMA (Easy Shifting Common) of $5.09. Moreover, HBM’s 1-year complete value returns (of ~14%) have underperformed the returns (~28%) of its benchmark ETF, International X Copper Miners ETF (COPX), by ~50% (notice that HBM includes 2.16% of COPX’s portfolio). Test the chart under.

1-12 months Complete Returns – HBM v/s COPX – Supply: Searching for Alpha Premium

Whereas all of the above technical indicators point out that the inventory is more likely to witness an upside, the basics are extra vital. This text discusses the allowing challenges dealing with HBM’s Copper World mission (in Arizona), HBM’s latest acquisitions that strengthen its Canadian footprint and partly offset the impression of allowing threat in Arizona, the Peruvian threat issue, the turbulence in copper costs, and HBM’s steadiness sheet (which stays sturdy regardless of a big debt). The above dialogue will assist analyze whether or not HBM can present engaging share value progress over the near-term, medium-term, and long-term funding horizons. Let’s get into the main points.

HBM Operates in Tier-1 Jurisdictions, However Dangers Stay

The time period ‘Tier-1 jurisdiction’ within the mining trade refers to comparatively low-risk mining areas with steady economies, investor-friendly mining/taxation insurance policies, truthful and clear allowing processes, and so on. In the meantime, the time period ‘Tier-1 asset’ refers to an asset with engaging mining dynamics, together with important high-grade reserves (and assets), long-life mines, low manufacturing prices, accessibility to infrastructure, and so on.

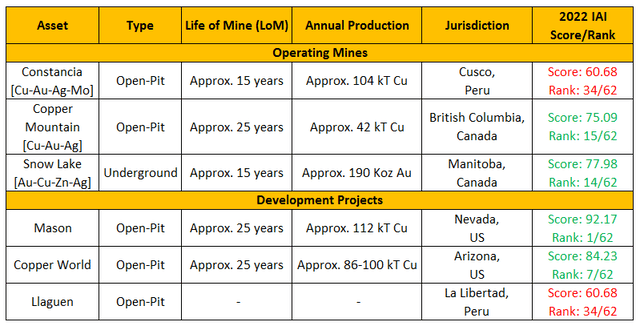

The next desk highlights the important thing traits of HBM’s mining property (together with ‘producing’ mines and ‘future’ initiatives). On this desk, the IAI rating/rank refers back to the relative worth/rank assigned to a mining area within the Funding Attractiveness Index (or IAI) included within the Fraser Institute’s 2022 Annual Mining Survey. This rating broadly considers the jurisdictional dangers primarily based on a number of metrics (the complete report might be accessed right here).

HBM’s Portfolio Key Traits – Supply: Creator

Primarily based on the data within the above desk, we could conclude that HBM is certainly working a portfolio of geographically various property comprising base/treasured metals, and most of those property are positioned in a Tier-1 jurisdiction (such because the US and Canada). Nevertheless, there are exceptions to the overall assumption that Canada/US are low-risk jurisdictions.

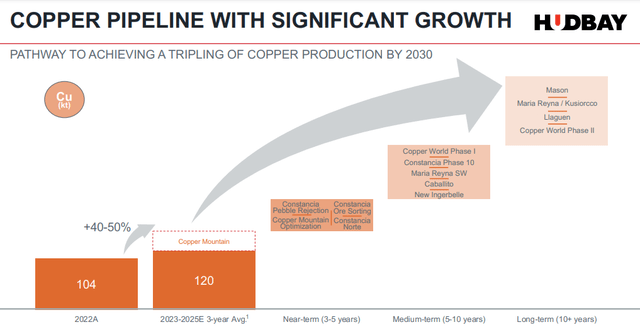

HBM’s timeline for natural progress in copper manufacturing from its current/pipeline initiatives envisions the Copper World’s Part-1 (or CWP-1) to grow to be operational within the medium time period (5-10 years).

Copper Manufacturing Natural Development Timeline – Supply: Presentation

Primarily based on HBM’s not too long ago launched PFS (Pre-Feasibility Research) on CWP-1, the mission entails the next key traits (together with a couple of that modified from the sooner PEA):

Anticipated annual copper manufacturing of ~92,000 tons, up from prior expectations of ~85,000 tons. Anticipated money prices and sustaining money prices of ~$1.53/lb and ~$1.95/lb deteriorated from prior expectations of ~$1.47/lb and ~$1.81/lb, respectively. CWP-1’s mine life is prolonged from 16 years to twenty+ years. Deferral of building of a focus leach facility to yr 4 (and to be financed from the mission’s working money flows) led to a discount of preliminary mission improvement capex from $1.9 BB beforehand to ~$1.3 BB (or ~$1.1 BB internet of the impression of streaming settlement). CWP-1 is estimated to have an after-tax NPV of ~$1.1 BB utilizing an 8% low cost price and assuming LoM common copper costs of $3.75/lb, and is anticipated to generate an IRR of 19%. CWP-1 is anticipated to create ~3,400 (direct and oblique) jobs and pay ~$850 MM in taxes over the LoM.

The great factor is that HBM is not going to require federal permits for CWP-1, solely state and local-level permits. On the allowing entrance, it is vital to notice that the US ACOE (US Military Corps of Engineers) has decided that there aren’t any jurisdictional waters on the positioning of the HBM’s former Rosemont Venture (positioned on the jap slopes of the Santa Rita Mountains versus the CWP-1 which is positioned on the western slopes of those Mountains) and confirmed that HBM’s give up of Part 404 Clear Water Act Allow was accepted and revoked. This resolution additionally confirms HBM’s stance that the brand new CWP-1 was not related to the earlier federal allowing course of associated to HBM’s Rosemont Venture, which was axed in 2019 by a Federal choose.

The unhealthy factor is that the Federal choose’s ruling was upheld by an Appeals Court docket in 2022, shattering HBM’s hopes of constructing a large-scale copper mine on the Rosemont Venture web site. Furthermore, native tribes (together with the Tohono O’odham, Pascua Yaqui, and Hopi tribes) and a few environmental teams resembling ‘Save the Scenic Santa Ritas’ are fiercely opposing any mining exercise within the areas across the Santa Rita Mountains, and have challenged HBM’s mine improvement actions in Court docket. The mine’s opponents cite considerations such because the safety of sacred websites of the native tribes, the danger of extinction of some endangered species/destruction of wildlife and ecosystem linked with the Santa Rita River, destruction of the well-known Arizona mountaineering path, utilization of serious water from the native watersheds, and the longer term environmental impression of dumping tons of mineral waste on the realm close to the mine web site (an identical case was reported right here, additionally in Arizona and on the identical grounds as HBM’s CWP-1). Regardless of the opposition, HBM has laid some preliminary infrastructure on the mission web site (carving of roads and berms) and is awaiting state-level permits to make a building and funding resolution about CWP-1. In the meantime, HBM expects to execute an settlement for a minority JV accomplice (by 2024) earlier than it commences DFS (Definitive Feasibility Research) on CWP-1 (anticipated 2025).

So what’s at stake right here?

A big-scale mining mission (CWP-1) on the Santa Rita Mountains’ western slopes may grow to be the US’s third-largest copper mission and a vital provider of US-based clean-energy metals. Whereas HBM is step by step advancing on state-level allowing milestones for the CWP-1, the corporate’s incapability to proceed with Rosemont mine’s improvement (regardless of securing some preliminary permits), the Copper World Venture opponent’s willpower to someway block the mining actions by the involvement of the Courts and authorities businesses, and the truth that HBM has but to discover a minority JV accomplice for mission funding, spells threat for this in any other case promising asset.

Acquisitions To De-risk HBM’s Mining Property Portfolio

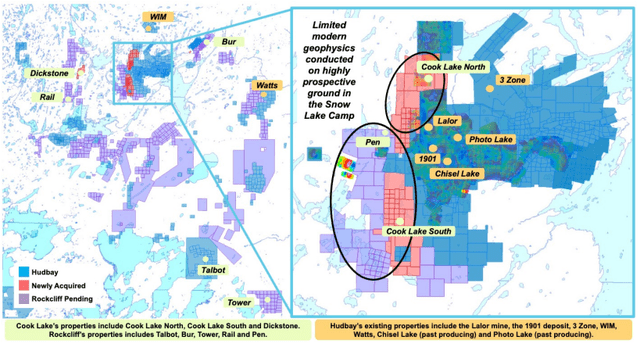

Rockcliff Acquisition: HBM not too long ago accomplished the acquisition of Rockcliff Metals. The acquisition granted HBM 100% possession over the Talbot mission close to HBM’s gold-focused Snow Lake operations. To cite HBM’s CEO on this event,

We’re very excited in regards to the completion of this logical transaction and the potential for Rockcliff’s deposits to increase the mine life and add additional optionality to our operations within the Snow Lake area.

The Talbot deposit is estimated to host ~2,190,000 tons of Indicated assets comprising 2.1 g/t gold, 1.79% zinc, 2.33% copper, and 36 g/t silver (these assets translate to ~213 Mlbs of CuEq useful resource). Moreover, the property can also be estimated to include ~2,450,000 tons of Inferred assets comprising 1.9 g/t gold, 1.74% zinc, 1.13% copper, and 25.8 g/t silver (these assets translate to ~161 Mlbs of CuEq useful resource). Furthermore, the Rockcliff acquisition permits HBM to consolidate a extremely potential land bundle (together with six further 100% owned deposits) within the Snow Lake area.

Snow Lake Land Consolidation – Supply: Presentation

In my opinion, the expansion outlook of HBM’s Snow Lake operations is bettering because of the following optimistic catalysts:

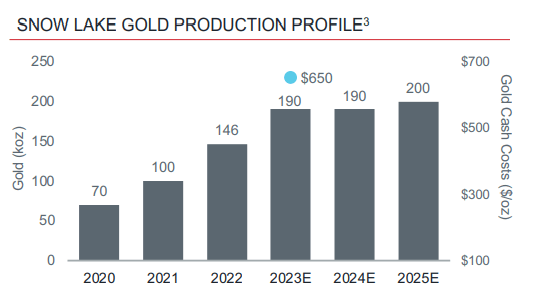

1) Snow Lake’s high-margin (working margin: ~$1,200/oz) gold manufacturing is ramping up YoY, supported by the New Britannia mill that commenced manufacturing in 2021 and is devoted to processing gold ore (the bottom metals ore is processed on the firm’s close by Stall concentrator).

Snow Lake’s YoY Gold Manufacturing Development – Supply: Presentation

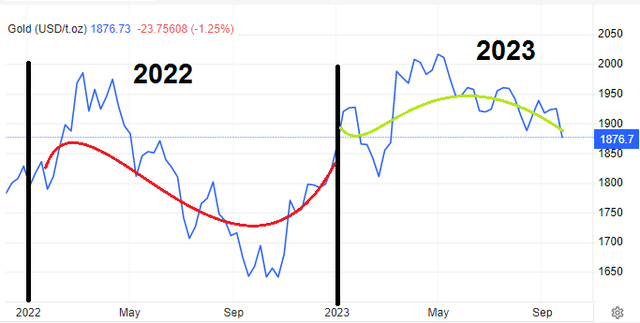

2) Common realized gold costs in 2023 are usually higher than these in 2022. The prevailing gold value of ~$1,870/ouncesis impacted by a strengthening US$, however I see common gold costs over the near-to-medium time period (say, 1-3 years) to stay inside the vary of $1,900-2,000/oz. Greater YoY gold costs will present for greater working margins sooner or later.

Common gold costs (2022 v/s 2023) – Supply: Buying and selling Economics

3) The long-term exploration upside from HBM’s Rockcliffe acquisition additional improves the mining potential of HBM’s operations within the Snow Lake area.

4) The latest optimistic outcomes of step-out drilling carried out ~500 meters northwest of the Lalor mine have led to the invention of a high-grade Cu-Au-Ag zone, bettering the mining economics of the Snow Lake area by a possible extension of the property’s mine life.

5) HBM’s consolidation of the Prepare dinner Lake properties within the Snow Lake area gives important exploration upside in a probably high-grade deposit (primarily based on the historic outcomes of the 60,000-meter drilling program carried out on these properties by earlier homeowners).

Copper Mountain Acquisition: HBM accomplished the acquisition of the Copper Mountain Mining Company (which owns a majority stake within the promising Copper Mountain mission in BC, Canada) in June 2023. Throughout FY 2023, HBM expects to provide 150 kT of copper, of which 42 kT (or ~30%) can be produced on the Copper Mountain mine. The estimated manufacturing from Copper Mountain solely incorporates manufacturing for H2 2023. In 2024, full-year manufacturing will enhance the mine’s proportionate contribution to HBM’s complete annual copper manufacturing (full-year manufacturing/value steering can be confirmed throughout This autumn 2023 when HBM releases Copper Mountain’s up to date technical report).

In contrast to different acquisitions the place mining firms usually purchase future initiatives, Copper Mountain provides a low-cost (low LoM strip ratio), long-life, standard open-pit ‘producing’ mine to HBM’s portfolio. Copper Mountain is successfully a Tier-1 asset in a Tier-1 jurisdiction, which provides to HBM’s natural progress technique in copper manufacturing. Moreover, the prevailing depressed copper value setting (since early 2023) signifies the contribution of accelerating YoY copper manufacturing towards securing greater working money flows.

Depressed Copper Costs Since 2023 – Supply: Finviz

Seems to be Like “Dr. Copper” Has Briefly Handed Out

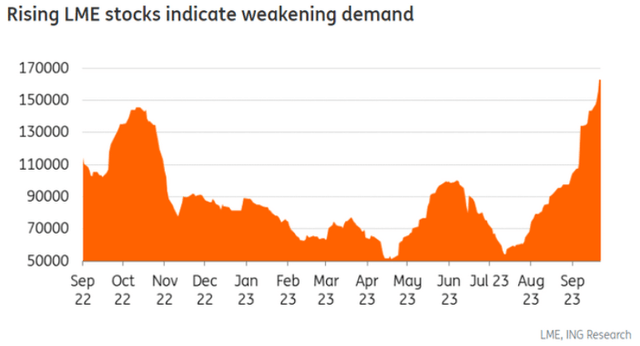

Notably, a slowdown in Chinese language copper demand has adversely impacted world copper costs and resulted within the piling up of copper inventories, as reported by outstanding steel exchanges. As an example, it is reported that the London Metallic Trade’s world warehouses at the moment maintain roughly 163,900 tons of copper (a ~50% enhance from the stock ranges at first of September 2023). As a result of these macroeconomic components, I anticipate near-term turbulence in copper costs.

Rising LME Copper Inventories – Supply: ING Analysis

The Peruvian Danger Issue

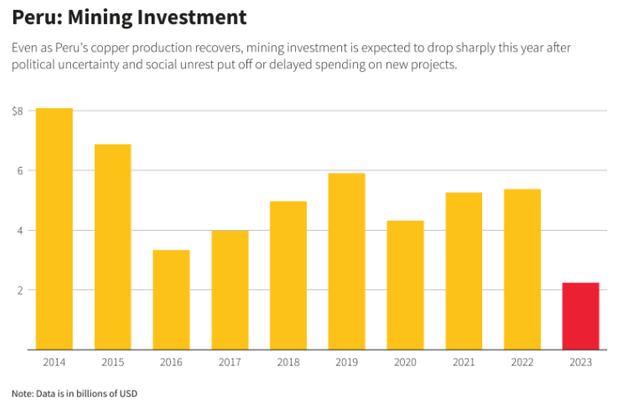

Moreover the commodity value threat (and reward) factored within the share value, I imagine the Peruvian threat issue additionally weighs on HBM’s funding thesis, as the corporate’s Peruvian Constancia mine is a big ‘producing’ asset. Roughly 60% of Peru’s exports are derived from the mining sector, and the nation’s fame because the world’s 2nd largest copper producer (after Chile) comes with a value. Peru must kind out three issues impacting its mining sector concurrently:

(1) Disagreement between mining firms and the Peruvian administration on a regulation limiting the usage of contractual staff within the mining trade.

(2) The Authorities goals to streamline the environmental allowing course of, which acts as a headwind in securing environmental permits for future mining initiatives in Peru.

(3) The above two components result in a big drop in funding in Peru’s mining sector. Have a look at the chart under.

Funding In Peru’s Mining Sector – Supply: Reuters

Though we can’t assess the quantitative impression (if any) of the above Peruvian challenges on HBM’s Constancia mine and the Llaguen mission, it is nonetheless price noting these dangers.

Stability Sheet Stays Sturdy Regardless of Rising Debt

HBM has maintained a powerful steadiness sheet that elevated from ~$4.33 BB (on the finish of December 31, 2022) to ~$5.24 BB (on the finish of June 30, 2022) primarily because of an ~$800 MM enhance in Property, Plant, and Tools, together with the price of strategic acquisitions (mentioned earlier). The overall long-term debt price ~$1.37 BB seems to be a priority (internet debt was ~$1.19 BB on June 30, 2022), because it elevated by ~$186 MM in the course of the previous six months (internet debt rose by ~$232 MM).

Nevertheless, HBM’s sturdy liquidity place covers the excellent debt nicely. On that notice, the present portion of LTD is barely ~$145 MM. In distinction, HBM had money and equivalents price ~$180 MM on the finish of Q2 2023, an undrawn RCF (revolving credit score facility) price ~$184 MM (the undrawn RCF declined by ~$90MM, publish Q2 finish), and robust working money flows. Notably, HBM generated ~$95.8 MM in OCF throughout H1 2023, and I anticipate OCF technology to enhance throughout H2 due to added copper (and gold) manufacturing from the Copper Mountain mine.

That stated, I imagine HBM’s steadiness sheet is robust sufficient (the corporate is concentrating on a internet debt to EBITDA ratio of 1.2x) to supply the liquidity wanted to assist its medium-to-long-term pipeline initiatives.

Investor Takeaway

HBM is a diversified Americas-focused copper/gold producer whose latest acquisitions strengthen its operational footprint in Canada, paving the best way for operational efficiencies/synergies and YoY manufacturing progress.

On the flip facet, allowing uncertainties surrounding HBM’s promising Copper World (Part I) mission, the Peruvian threat issue, and depressed copper costs weigh on an funding thesis within the firm.

Contemplating the above components, we could conclude that whereas HBM’s natural progress prospects look promising over the medium-to-long-term funding horizon, the share value could solely witness reasonable progress within the close to time period. That stated, I see the inventory as a maintain.