Thossaphol/iStock by way of Getty Photos

Funding Rundown

The valuation of USA Compression Companions LP (NYSE:USAC) has elevated an unimaginable quantity all through the previous couple of years. The p/e sits at 75 and this additionally features a dividend yield of over 10%. The payout ratio is extremely summary and I believe traders are clever to imagine it isn’t going to proceed like this. The dividend is distributed from the DCF and never the earnings of the corporate. A excessive yield like that is what loads of traders see as an enormous bonus. However I can not recover from the excessive a number of to kind a purchase case right here. For extra risk-tolerant traders it would very properly be an organization they’re serious about, but when we see a troublesome market atmosphere then the DCF may be in jeopardy.

The very current earnings report from the corporate did nevertheless publish document DCF for USAC and that is having traders nonetheless serious about shopping for at these costs. Provided that assumption, I believe it isn’t unlikely that USAC simply proceed to commerce at a really excessive a number of given this attribute to the corporate. I believe USAC affords an excellent danger/reward ratio for a maintain ranking, however I would like a decrease entry worth for a purchase case to be made.

Dividend Evaluation

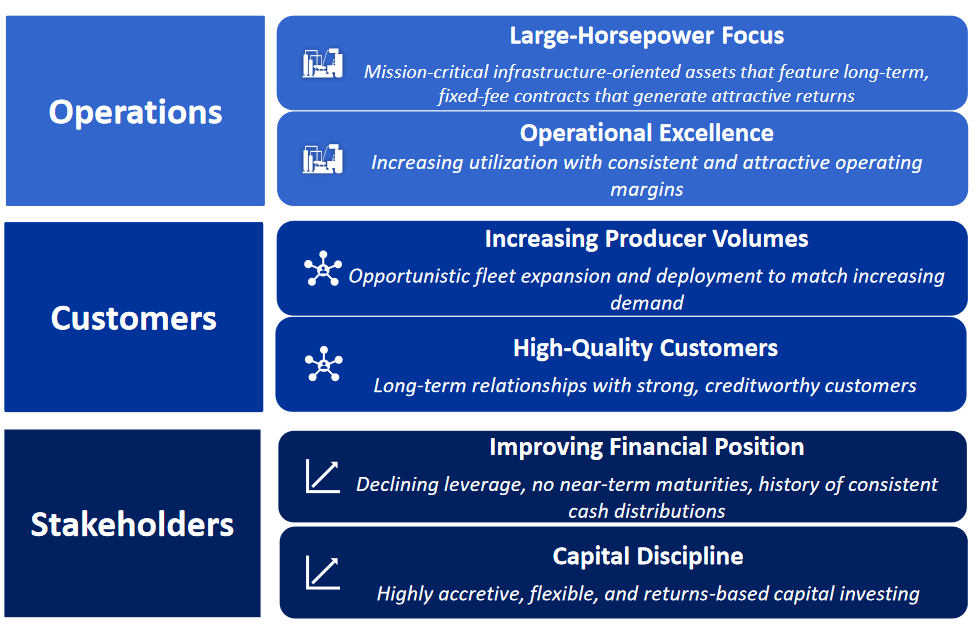

Working within the oil and fuel gear and providers trade USAC has made a reputation for itself right here not just for clients but in addition for traders. The excessive dividend yield that I talked about earlier than has come from the truth that USAC generates secure money flows that are supported by a rigorous and disciplined capital allocation technique.

Firm Overview (Investor Presentation)

The corporate focuses on providing compression providers to grease corporations and pure fuel corporations. The corporate has clients like unbiased producers but in addition loads of processors and gatherers of each pure fuel and crude oil. The providers primarily encompass offering pure fuel compression providers to infrastructure functions. This additionally contains pure fuel gathering methods.

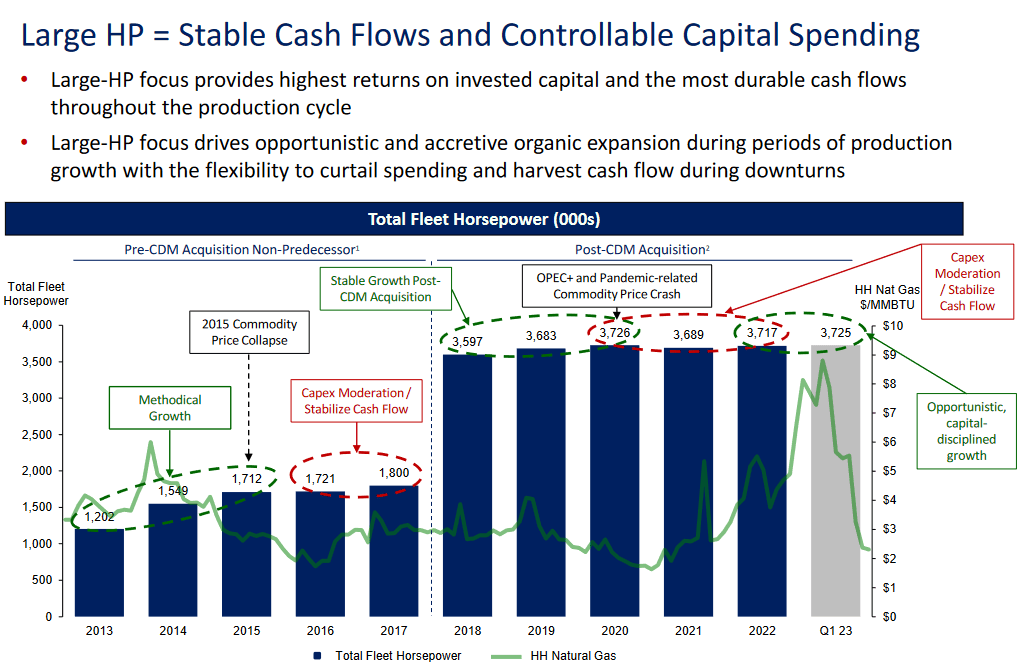

Money Flows (Investor Presentation)

The place I’ve to confess that USAC has been extraordinarily constant is the dividend. It has over the last a number of years been constantly at a quarterly payout of $0.53 creating the excessive yield we’ve got at the moment. Why the yield will be larger than the EPS comes from the truth that it is distributed from the DCF quite than earnings. The precedence for USAC has lengthy been robust money circulate upkeep and managed capital spending. The FCF margin sits above 20% and this has been supported by the truth that USAC locations a deal with having a excessive fleet horsepower. The entire fleet horsepower has remained kind of the identical for the reason that CDM acquisition again in 2018. This doubled the fleet capability and made the present yield very a lot potential.

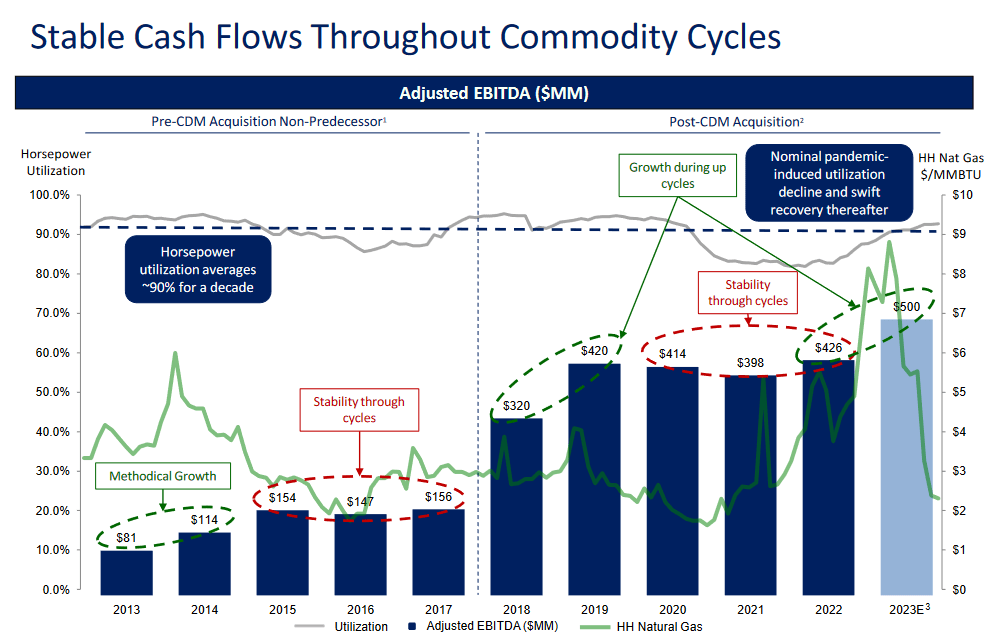

Money Flows (Investor Presentation)

I discussed earlier the truth that USAC trades at a really excessive premium in comparison with the remainder of the sector. The p/e sits at 75 which is barely corresponding to the power sector 10. The place I see some legitimate arguments for this being the case is the actual fact USAC has been extremely robust in sustaining FCF and a excessive dividend yield for traders. But in addition the soundness it has had by means of commodity cycles. Seeing as the corporate is not essentially pushed by commodity costs however quite demand, a constant progress trajectory like this offers proof to the strong enterprise mannequin.

Earnings Highlights

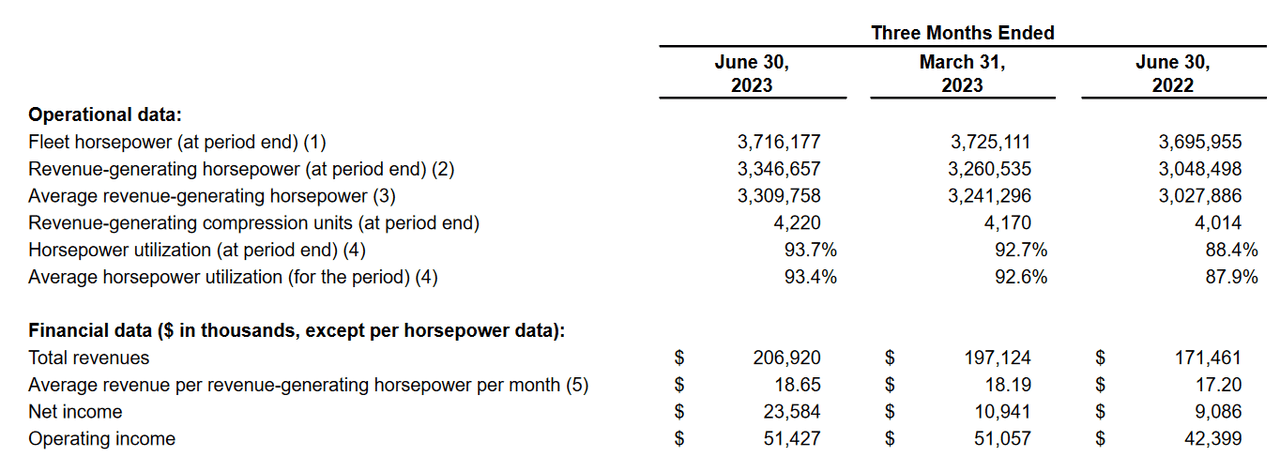

The very current report that got here out from USAC showcases that the corporate continues to be very a lot rising and provides some justification for its present worth level. The revenues grew to $206 million for Q2 FY2023, up from $171 million a yr prior.

What I discovered very intriguing from the report was the truth that the common income per revenue-generating horsepower monthly grew to $18.65, up 8.4% YoY. That is serving to guarantee a powerful DCF that may be distributed to shareholders which for Q2 FY2023 was at $67 million in complete. The horsepower utilization fee was additionally up for the quarter and reached 93.4%.

Revenue Assertion (Earnings Report)

Seeing enhancements like that is making USAC out to be a quite fascinating firm to observe proper now. The outcomes aren’t sufficient to make me a purchaser simply but as my difficulty is with the premium I’ve to pay for the corporate and never the precise efficiency of the enterprise. When it comes to the precise efficiency of the corporate, I believe they did very properly and it is smart why traders are flocking to it in instances like these.

Dangers

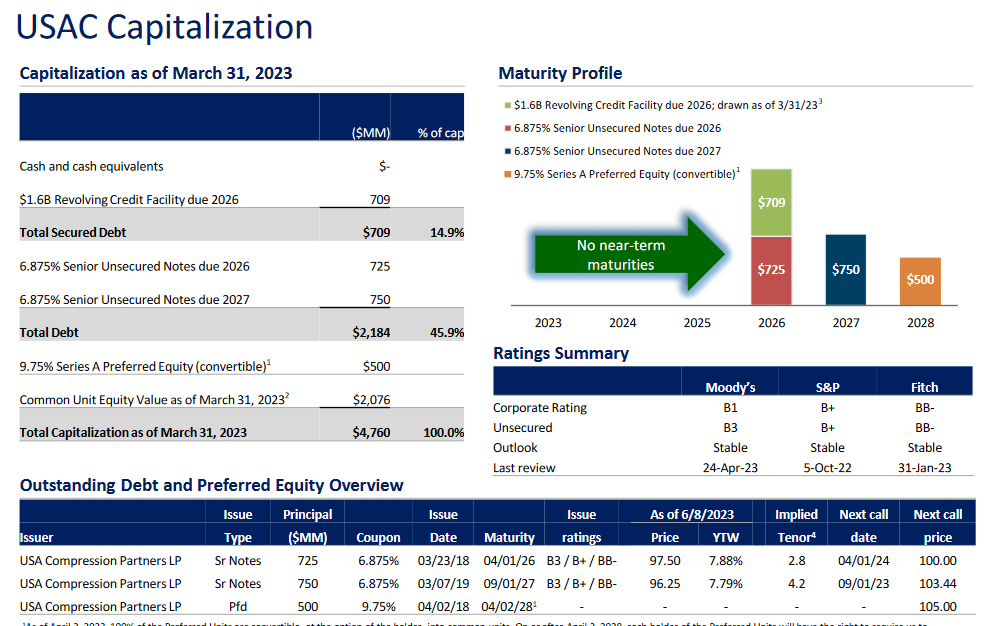

The corporate faces important draw back dangers, primarily tied to its heavy reliance on debt and the continual dilution of its share float. Entry to debt, significantly within the present financial local weather with rising rates of interest, poses a major problem. The upper rates of interest might restrict the corporate’s capacity to safe favorable financing, resulting in elevated borrowing prices and probably stunting fast progress prospects in 2023 and 2024.

USAC Capitalization (Investor Presentation)

The corporate could also be reliant on money owed however it is usually not ready the place the debt is nearing maturity. By 2026 the primary is coming and I believe that USAC is ready the place it can have time to construct up a powerful sufficient money place to battle it effectively by then.

Moreover, the persistent dilution of the share float stays a priority for shareholders. As extra shares are issued, present shareholders’ possession stakes are diluted, decreasing their proportional declare to the corporate’s earnings and property. This ongoing dilution can result in an erosion of shareholder worth and will elevate questions concerning the firm’s dedication to its present traders.

Ultimate Phrases

The explanation USAC may seem on traders’ radars in all probability comes from the excessive dividend yield and the sustained historical past of paying it. What I’ve discovered quite fascinating with USAC is the truth that paying out such a excessive dividend may be very sustainable for the corporate given it comes from DCF quite than earnings. This places much less danger at a lower which I discover most unlikely.

However the share worth is at a really excessive premium to come up with this yield. It is a premium I’m not comfy paying because it does not match my danger profile. From my viewpoint, the corporate is a maintain, however for many who are extra risk-averse, I can see it being a purchase.