Fahroni/iStock by way of Getty Photos

The Netherlands will begin completely shutting down its Groningen area, the biggest pure gasoline area in Europe, in simply over two weeks on October 1, 2023. Groningen produced 6.5 billion cubic meters of gasoline in 2021 and its shutdown comes as Germany, the continent’s largest financial system, shuttered its remaining three nuclear energy vegetation in spring of this 12 months. Down beneath in Australia, strikes at Chevron’s (CVX) Gorgon and Wheatstone LNG services, which collectively account for five% of world provide, have added volatility to pure gasoline costs going into the standard begin of the heating interval. Critically, the world entered a protracted interval of heightened vitality volatility final 12 months with Russia’s invasion of Ukraine. This implies LNG vegetation will kind vitality backbones for economies world wide, a macro backdrop that underlies Tellurian’s (NYSE:TELL) funding pitch.

The pull of this pitch on traders has dipped over the past 12 months with Tellurian’s widespread shares down almost 70% over this timeframe. This has come in opposition to a five-year chart that has seen the ticker shed important worth from its pre-pandemic degree. A few of this weak spot has been on the again of a Fed funds price presently sitting at a 22-year excessive of 5.25% to five.50%. However Tellurian’s failure to safe FID for its Driftwood LNG manufacturing and export terminal near Lake Charles, Louisiana has shattered investor confidence in its administration. This failure is very jarring in opposition to the LNG increase of final 12 months as Europe scrambled to exchange piped Russian pure gasoline.

The Worst Case State of affairs

To be clear, Tellurian presently faces a storm of headwinds. Its LNG provide cope with Gunvor was terminated final month and got here on the again of final 12 months’s exits from Vitol and Shell (SHEL). Tellurian had signed a 10-year cope with Gunvor to provide as a lot as 3 million metric tons per 12 months of LNG from Driftwood, reaching related offers with Vitol and Shell. The corporate’s pivot to turn into a home gasoline producer has stalled with pure gasoline drilling from Haynesville shale partially halted on the again of weak US pure gasoline costs. Tellurian initially acknowledged it will hold manufacturing roughly flat at 200 million cubic toes per day in 2023.

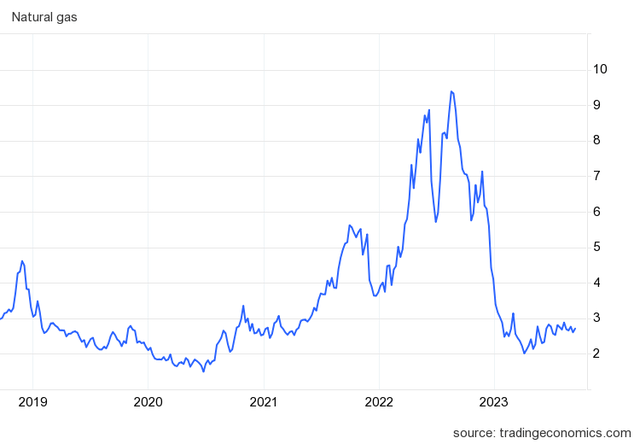

Buying and selling Economics

2022 was an aberration and pure gasoline costs have now fallen again right down to be broadly in step with their historic common. US pure gasoline is presently buying and selling at round $2.7/MMBtu and can possible commerce near this vary for a lot of the remainder of the 12 months with European pure gasoline storage presently at 94%. That is far forward of its common for this time of the 12 months. Therefore, the bears who represent the 14% brief curiosity can be proper to spotlight that Tellurian, at current, is a home gasoline producer that is not producing a lot gasoline as FID for Driftwood continues to maneuver ever past the horizon. In danger is all the firm that now poses a binary return profile as free money outflow ramps up in opposition to money and equivalents.

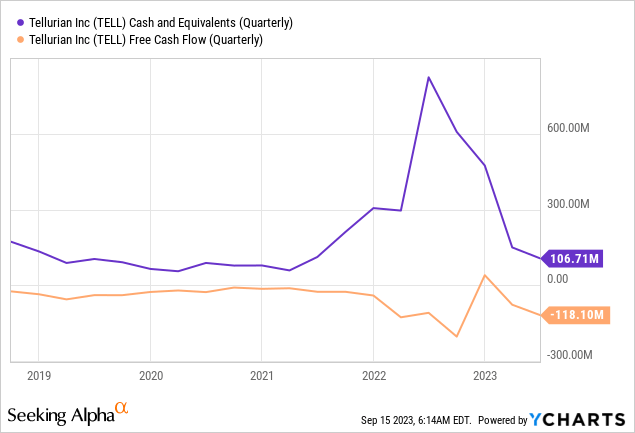

Shareholders needs to be cognizant of the chapter danger. Money and equivalents as of the top of its final reported fiscal 2023 second quarter stood at $107 million, down from $474 million in the beginning of 2023. Heightening the danger profile is whole borrowing which stood at $383.6 million as of the top of the second quarter. Income for the second quarter got here in at $32 million, a 47.8% decline over its year-ago comp and a miss by $12.55 million on consensus estimates even with manufacturing at 17.2 billion cubic toes up from 9 billion cubic toes within the year-ago comp. Free money outflow for the second quarter was excessive at $118.1 million.

The LNG Dream Might Stay On

It is clear that the world is shifting to a worldwide LNG-based vitality system with greater than 23 GW of US coal capability to retire in 2028 alone. Additional, demand for electrical energy is about to rise from the tripartite of GDP progress, inhabitants progress, and the insatiable rise of electrical automobiles. Coal-fired energy vegetation from Australia to the US and UK are set to shut, boosting the significance of pure gasoline for baseload energy era within the period of renewable vitality. Charif Souki, Tellurian’s founder and Chairman, is extensively credited because the architect of the US LNG trade, and his headwinds with Tellurian masks his prior achievements with founding Cheniere Vitality (LNG). Cheniere engineered the primary US export of LNG in 2016 from its Sabine Cross terminal, serving to to kind an trade that has performed a pivotal position in conserving the lights on for US allies responding to Russia’s brutal invasion.

The corporate has additionally entered right into a binding dedication letter with asset supervisor Blue Owl Actual Property Capital for $1 billion in funding via the sale and leaseback of 800 acres of land underpinning Driftwood. It isn’t low-cost with a grasp lease at an 8.75% capitalization price and with 3% annual hire escalators. Tellurian will even be required to put up a letter of credit score equal to 12 months of hire. The deal is not going to shut till Tellurian secures joint and several other contingent guarantors for the grasp lease that maintain an funding grade score of BBB or increased. This comes as Tellurian strikes to promote LNG to non-equity holders, shifting away from a previous fairness possession requirement. Therefore, the corporate might hold its FID dream alive if it slows down its price of burn and faucets its fairness for extra liquidity to increase its money runway. A attainable rise in pure gasoline costs this winter might additionally present a lift to earnings. Nevertheless, I am going to proceed to observe from the sidelines with the ticker a maintain.