SweetBabeeJay

Analysis Transient

Hidden amongst the majestic pine forests of the Pacific Northwest, an space I’ve visited a number of instances, is a dividend fast choose I found this week among the many regional banking sector.

The mother or father agency behind regional banking model Umpqua Financial institution, Columbia Banking System (NASDAQ:COLB), had its Q2 outcomes on July nineteenth which we’ll dive into as a reference for as we speak’s evaluation.

Listed below are a number of related factors in regards to the merger between Columbia and Umpqua, whose completion was introduced in March: mixed firm has $50B+ in property, $37B in loans, $45B in deposits. Financial institution branches proceed to function beneath the Umpqua model, based mostly within the Portland Oregon space. The mixed ticker trades on Nasdaq. The brand new agency will probably be a top-30 US financial institution.

Score Methodology

My simplified technique charges 5 particular person classes with equal weighting: dividends, valuation, share value, earnings development, capital power.

To get a “holistic” purchase ranking, the inventory should move 4 of the 5 classes. 3 out of 5 is a maintain or impartial ranking, and beneath that could be a promote ranking.

An organization might seem like a purchase or promote in one of many classes however the total last ranking could also be totally different.

Dividends

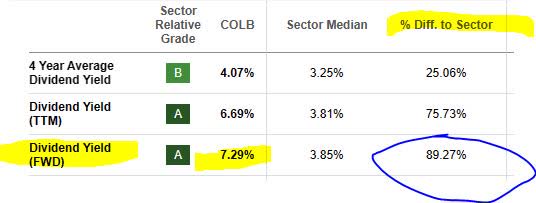

The primary ranking class to think about, however not the one one, is that of dividends. Particularly, what grabbed my consideration was the 7.29% dividend yield this fairness gives, in response to official knowledge as of Aug. twenty sixth.

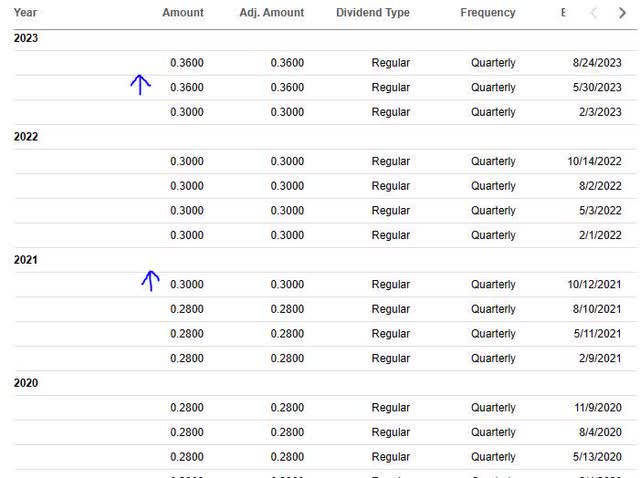

At the moment it gives a payout of $0.36 per share on a quarterly foundation.

Columbia Banking – dividend yield (Looking for Alpha)

When evaluating to its sector common, the ahead dividend yield is a lovely 89% above the sector common, which hovers round 3.8%. Impressively, this earned a grade of “A” from Looking for Alpha, and understandably why.

Columbia banking – dividend yield vs sector common (Looking for Alpha)

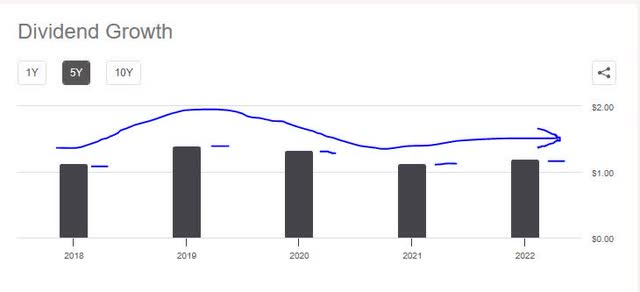

Much less convincing is the 5-year dividend development, as the info beneath reveals. I’m searching for a gentle upward pattern over 5 years, nonetheless this inventory has struggled to develop its dividend considerably in that point, regardless of an enchancment between 2021 and 2022:

Columbia banking – 5 yr dividend development (Looking for Alpha)

To offset that detrimental, one plus to say is that the dividend payouts have been regular every quarter since 2021, with out interruptions. Extra excellent news for a dividend portfolio counting on the regular quarterly earnings.

Columbia Banking – dividend historical past (Looking for Alpha)

Based mostly on the info above, I might suggest this inventory within the class of dividends.

Later, within the part on share value I’ll present how the dividend earnings helps my funding thought for this inventory, which I’ll present by a commerce simulation.

I also needs to point out that dividend yield will not be all the things, even when it goes previous 7% or greater, as that is also the results of a drastic drop in share value, making it potential to purchase extra shares with much less capital invested. This is the reason it is just one of many 5 classes I am going over, however nonetheless an necessary one as it may be an earnings supply for some buyers, although not all are dividend buyers.

Valuation

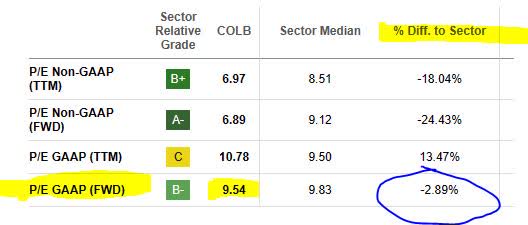

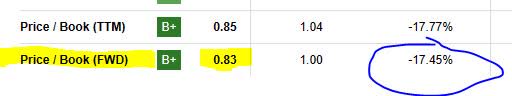

On this class, I’ll zero in on simply two valuation classes that I feel are related and are my normal method in each article: the ahead P/E ratio and ahead P/B ratio. The information is from official Looking for Alpha valuation knowledge as of Aug. twenty sixth.

Within the first metric beneath, this inventory is at present 9.54x ahead earnings, virtually 3% beneath the sector common which is hovering nearer to 9.8x earnings. I might be keen to simply accept as much as 10x earnings on this case, so I feel each the sector and the inventory are fairly valued on this area.

Columbia Banking – P/E ratio (Looking for Alpha)

Within the second metric, I really like the truth that this inventory is at 0.83x ahead guide worth, over 17% beneath its sector common which is at 1x guide worth. I’m searching for shares round not a lot greater than 1x guide worth, so I feel it is a good level to be at, particularly having gotten a “B+” grade from Looking for Alpha.

Columbia Banking – P/B ratio (Looking for Alpha)

I feel the info proves that this inventory can at present be really useful within the class of valuation. What I feel would separate a worth alternative from a worth lure is lack of excellent monetary fundamentals, so that’s the reason valuation is just one of my 5 classes I evaluate and never an important one.

Share Worth

On this class, my aim is to find out if the present share value needs to be really useful as a shopping for alternative, impartial of how this inventory did within the different 4 classes I coated, as this part research the value chart itself.

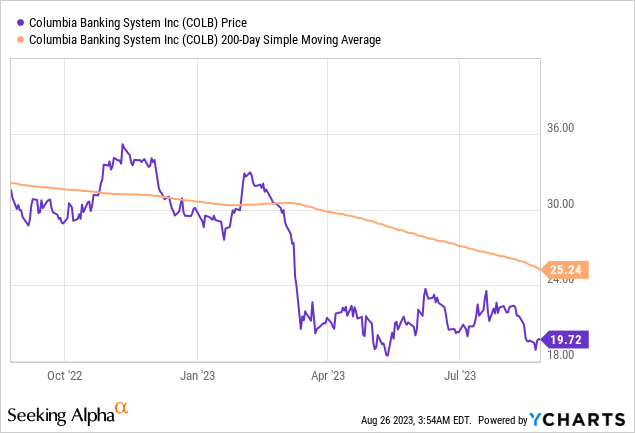

For simplicity, I’m utilizing YCharts to trace the present share value of $19.72 (as of market shut on Friday Aug. twenty fifth) and examine to the 200-day easy transferring common of $25.24, because the chart reveals:

Whereas the share value being nicely beneath the transferring common might appear to be it presents a purchase alternative, I feel it’s extra necessary to first decide your revenue aim for this inventory but additionally your danger tolerance for capital loss as nicely. I view the transferring common as a long-term pattern indicator and good reference level.

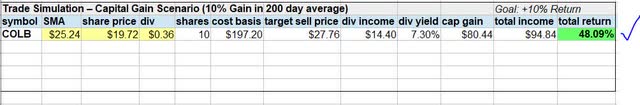

I truly create two buying and selling simulations the place I purchase 10 fictitious shares and maintain them for 1 yr, at which level I promote. My revenue aim is a return on capital of +10% or higher, and my danger tolerance is a detrimental return on capital of -10% or decrease.

Within the first simulation, we purchase on the present share value and assume the present SMA will rise by 10% in a yr, making that our goal promote value. This situation additionally generates dividend earnings, and a complete return on capital of 48.09%, thereby far exceeding my revenue aim. My “assumption” of SMA development in a yr might also be affected by many components within the meantime.

Columbia banking – commerce simulation 1 (creator evaluation)

Within the second simulation, I take a look at the SMA “dropping” by 10% in a yr, making that our new promote value. On this situation, we nonetheless make over 22% constructive return.

Columbia banking – commerce simulation 2 (creator evaluation)

As a result of each eventualities meet or exceed my revenue aim in addition to keep inside my loss limits, I might suggest the present share value of $19.72 as a shopping for alternative proper now.

In actuality, I’m nicely conscious that the SMA can transfer past only a +/- 10% vary, nonetheless it is a simplified framework one can use and will or might not match everybody’s portfolio technique.

Earnings Progress

On this class, I’m searching for longer-term traits in earnings development, with extra emphasis on web earnings and fewer on the highest line.

Nevertheless, it’s price mentioning that on the income aspect this financial institution did very nicely, with web curiosity earnings seeing YoY development, in response to the earnings assertion:

Columbia banking – web curiosity earnings (Looking for Alpha)

Additional, the highest line income quantity additionally grew on a YoY foundation, one other constructive to say. Actually, it appears to have grown every quarter since June 2022:

Columbia banking – revenues (Looking for Alpha)

I feel the sturdy curiosity income may very well be correlated with the general excessive rate of interest atmosphere in that very same 1 yr interval, after a sequence of central financial institution fee hikes.

I feel this tailwind will proceed to favor this financial institution and others, contemplating that the consensus from fee merchants has been that the following Fed assembly will result in charges remaining regular whereas for the November assembly the sentiment factors to a 46% probability of one other fee hike, in response to CME Fedwatch.

The underside line for this firm has additionally seen a really good YoY development, as has the earnings per share. I imagine it is a signal of environment friendly price administration and a step in the fitting course for this financial institution.

Columbia Banking – web earnings YoY (Looking for Alpha) Columbia banking – EPS (Looking for Alpha)

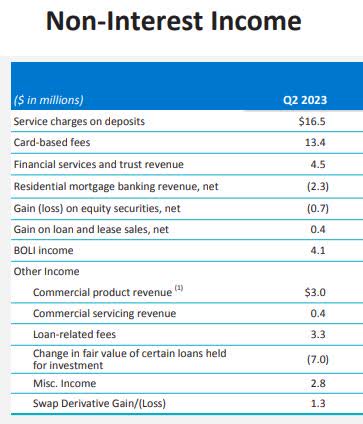

Though it is a regional financial institution, I’m additionally searching for diversification of earnings throughout totally different enterprise segments, not merely curiosity earnings. This financial institution has that as nicely. In keeping with the desk beneath, for instance, two main sources of earnings for the quarter have been service costs and card charges, to the tune of a number of million$ {dollars}.

Columbia banking – non curiosity earnings (firm q2 presentation)

Therefore, the info clearly reveals that this inventory needs to be really useful on the class of earnings development, based mostly on the info proven, which reveals a agency that has income diversification in addition to high line & backside line YoY development.

Capital Energy

On this class, I assess the monetary fundamentals that time to a really solvent and financially sturdy firm with potential to final. This is a vital level, for the reason that market already went by the March banking shock with a handful of regional financial institution failures, so I need to spotlight that not all regionals are in the identical boat as Silicon Valley Financial institution.

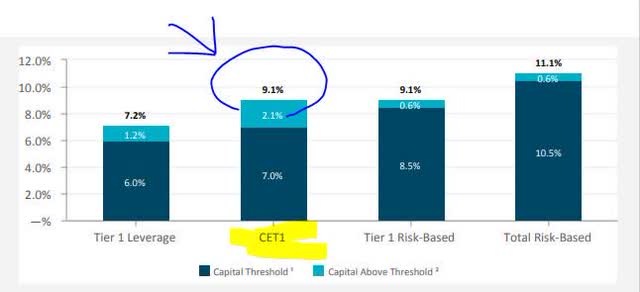

Within the banking sector, the CET1 ratio is a key metric I observe, and this financial institution exceeds its goal with a CET1 of 9.1%, but additionally exceeds its goal in different capital ratios as nicely, a constructive signal I feel.

Columbia banking – CET1 ratio (firm q2 presentation)

Constructive sentiment was shared by the corporate of their Q2 presentation feedback as nicely, pointing to what I feel will probably be a constructive few quarters developing.

We count on to rapidly method and exceed our long-term complete risk-based capital goal of 12%, offering for enhanced flexibility to return extra capital to shareholders whereas persevering with to assist our increasing franchise. We’re already above our long-term CET1 capital goal of 9%.

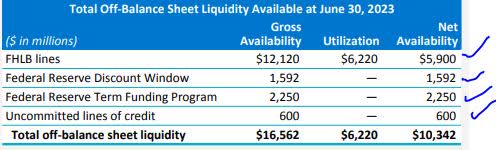

I need to additionally tackle any reader issues about how publicity to uninsured deposits may impression this agency’s liquidity, within the occasion of a run by uninsured depositors.

In keeping with the corporate’s commentary, such deposits are barely 1/3 of complete deposits, and there’s loads of liquidity to cowl them if wanted:

Uninsured deposits have been $13.5 billion at June 30, 2023, representing 33% of complete deposits. Accessible liquidity of $18.1 billion was 134% of uninsured deposits at the moment.

Lastly to say, but additionally related I feel, is that this financial institution has a number of off-balance sheet liquidity sources it could possibly faucet into if wanted. In keeping with the next graphic, it nonetheless has over $10B in untapped obtainable liquidity throughout a number of sources together with the Federal House Mortgage Financial institution and the Federal Reserve packages, amongst others.

Columbia banking – liquidity sources (firm Q2 presentation)

Due to this fact, based mostly on the proof, I might extremely suggest this inventory when it comes to its firm capital power.

Score Rating

In the present day, this inventory gained in all 5 of my 5 ranking classes, incomes a “Robust Purchase” ranking from me as we speak. That is truly extra bullish than each the quant system and the analyst consensus, in response to the graphic beneath.

Columbia banking – scores consensus (Looking for Alpha)

! Nevertheless, I ought to nonetheless warning that despite the fact that I’m ranking it a powerful purchase it’s as much as particular person buyers to find out what stage of danger tolerance to simply accept and for what timeframe.

In my commerce simulation I confirmed earlier, I added simply 10 shares of this inventory to a long-term portfolio that additionally might encompass different banks together with a lot bigger ones & world gamers, which I feel would diversify the chance publicity of getting simply regional banks alone within the portfolio. The purpose is, it’s a sturdy purchase but additionally ought to slot in with a bigger portfolio and its technique.

Threat to Outlook: Publicity to Workplace Loans

My closely bullish outlook on this inventory may very well be impacted by the chance of buyers avoiding regional banks like this one attributable to perceived publicity to workplace loans, which has been a recurring matter currently.

This sentiment was highlighted by a July 14th article in world media big Reuters, which talked about that even JPMorgan Chase (JPM) and Wells Fargo (WFC) are getting ready for losses on workplace loans:

Lenders’ publicity to industrial actual property has come beneath rising scrutiny this yr, because the sector globally – significantly workplace buildings – has been pressured by excessive rates of interest and employees persevering with to remain at residence.

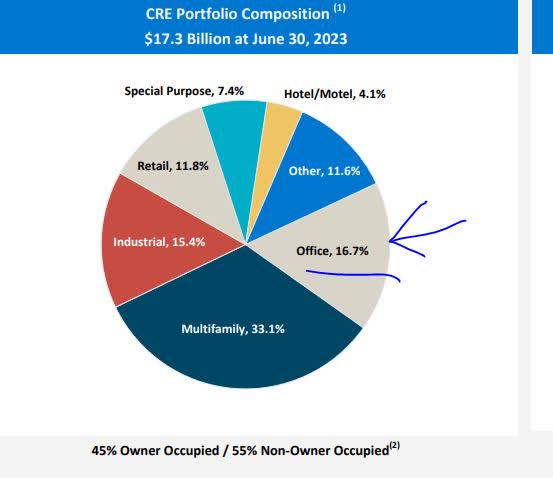

Nevertheless, in response to Columbia Banking System’s personal knowledge, their publicity to workplace is just below 17% of their total CRE portfolio, so not even 1/4th of the mortgage guide. Actually, it appears the vast majority of their guide is targeted on multifamily residential and industrial properties.

Columbia banking – CRE portfolio (firm q2 presentation)

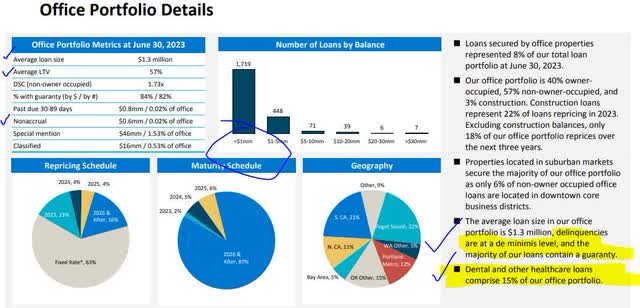

In researching additional, I found that 15% of their workplace publicity is tied to medical sort of workplaces, and we all know these aren’t uncovered to “distant work” danger since they require being within the workplace to work with sufferers. Delinquencies are additionally very minimal, and simply 0.02% of the loans are in a non-accrual standing, which sheds some constructive mild on this matter.

Columbia financial institution – workplace portfolio (firm q2 presentation)

So, my bullish ranking stays as I feel that the positives of this inventory I highlighted outweigh the chance above.

Evaluation Abstract

Here’s a fast recap of what we mentioned in as we speak’s analysis evaluation.

This inventory, which is the primary time I ever coated it, is getting a powerful purchase ranking, as my evaluation factors to a way more bullish sentiment than the consensus from analysts and the quant system.

Positives: dividends, valuation, share value, earnings development, capital power.

Headwinds: none important to say

Threat of publicity to workplace loans has been decided to not be overly impactful to my bullish ranking.

Concluding ideas:

Regional banks are nonetheless in play, and also you simply have to search out hidden gems like this one which are nestled among the many timbers of the Pacific Northwest, however current sturdy monetary fundamentals in addition to a dividend-income alternative, that might slot in as a smaller element of an total financial-sector portfolio.