ugurhan

The London Metals Trade is the hub of world base metals buying and selling. China is the world’s main shopper of the metals which can be the constructing blocks of infrastructure and are more and more important for worldwide inexperienced power initiatives. The LME trades copper, aluminum, nickel, lead, zinc, and tin. The trade additionally provides ferrous metals contracts.

In 2012, the Hong Kong Exchanges and Clearing purchased the LME for $2.15 billion after a bidding conflict with different exchanges, together with the U.S.-based Chicago Mercantile Trade and Intercontinental Trade. China’s vital footprint within the base metals enterprise created essentially the most synergies for the LME, established in 1877.

Probably the most liquidly traded base metals on the LME are copper, aluminum, and zinc. The Invesco DB Base Metals Fund (NYSEARCA:DBB) tracks a portfolio of the three metals. Copper, aluminum, and zinc costs have declined over the previous weeks and months.

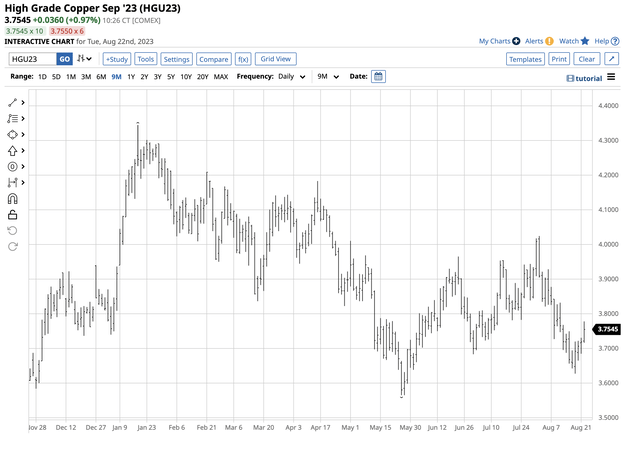

Copper failed at $4 and is trending decrease

Copper isn’t essentially the most liquidly traded base steel, however the pink steel is the bellwether for the nonferrous sector on the London Metals Trade. Copper costs have been beneath stress since failing on the $4 per pound stage on the ultimate day of July and the primary day of August 2023.

9-Month COMEX Copper Futures Chart (Barchart)

The chart exhibits the sample of decrease highs for the reason that January 18, 2023, $4.3440 excessive for this yr. The newest failure on the $4.0240 stage took September COMEX copper futures 9.9% decrease to $3.6270 on August 17. On the $3.7545 stage on August 22, copper futures stay beneath promoting stress and nearer to the August 17 low than the $4 stage. COMEX copper’s development stays bearish in late August 2023.

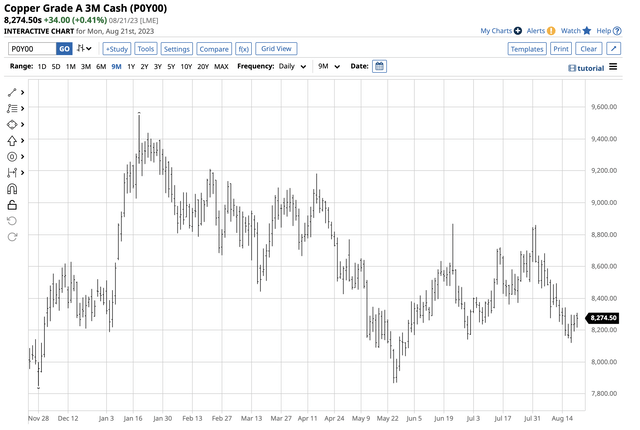

9-Month LME Copper Ahead Chart (Barchart)

The chart of three-month copper forwards on the London Metals Trade highlights the bearish sample on the planet’s main bodily copper market. LME forwards fell 8.3% from $8,860 on August 1 to $8,120 on August 17 and have been under the $8,274 stage on August 21. LME forwards have adopted the identical bearish path because the COMEX copper futures in 2023.

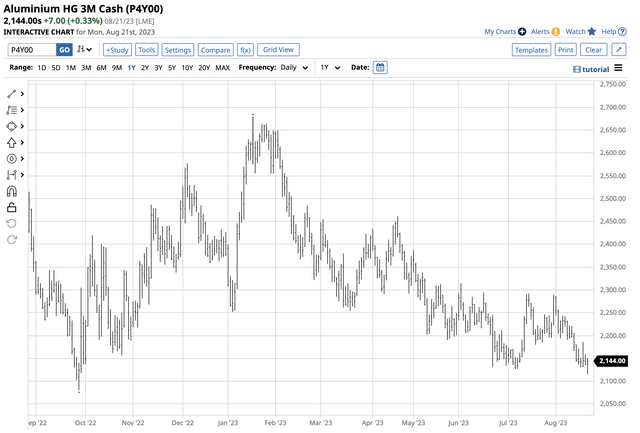

Aluminum costs have been in a bearish development since hovering in 2022

Whereas copper is the chief of the LME metals, aluminum is essentially the most liquid nonferrous steel. LME three-month aluminum forwards reached a $2,679.50 2023 excessive in mid-January.

One-12 months LME Aluminum Ahead Chart (Barchart)

The chart exhibits a 20.6% decline to $2,127 on July 7. Aluminum forwards recovered to $2,289 on July 31, however on the $2,144 per ton stage on August 22, aluminum forwards fell 6.3% and remained close to the current low and in a bearish development.

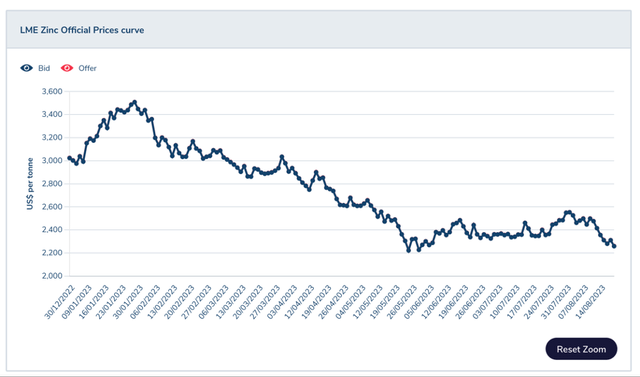

Zinc costs have adopted aluminum and copper

Like aluminum, zinc is a liquid LME nonferrous steel. Zinc inventories have exploded larger for the reason that finish of final yr. On December 30, 2022, LME zinc shares have been at 32,025 metric tons. On August 21, that they had elevated 356% to 145,975 tons.

Three-Month Zinc Ahead Value Chart (LME)

The chart illustrates the three-month zinc ahead market’s bearish development in 2023. Costs fell from the $3,500 stage in early 2023 to $2,222 per ton in late Could. Most lately, zinc fell 9.9% from $2,553 on August 1 to the $2,300 stage on August 21. LME zinc forwards are close to the current low.

DBB is an ETF that holds essentially the most liquidly traded LME metals

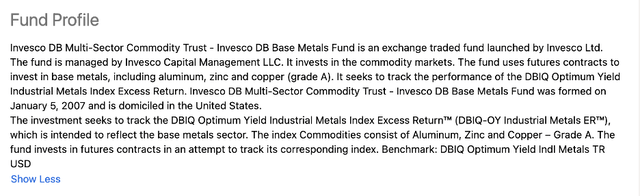

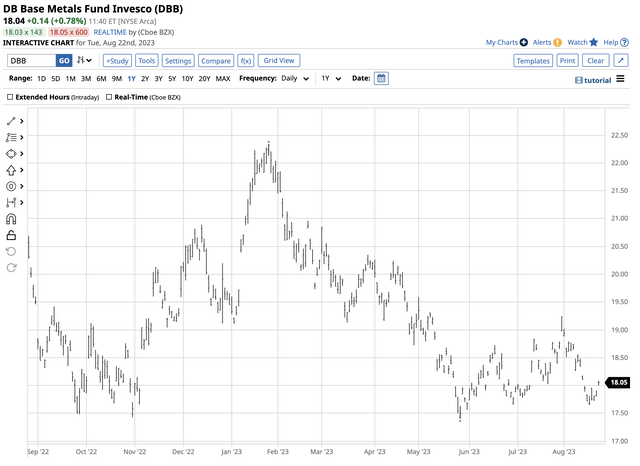

The fund abstract for the Invesco DB Base Metals Fund ETF (DBB) states:

DBB Fund Profile (Searching for Alpha)

DBB owns lengthy positions in aluminum, zinc, and copper. The newest high holdings embrace:

High Holdings of the DBB ETF Product (Searching for Alpha)

As of August 17, DBB had essentially the most publicity to zinc at 28.77% of property. DBB was 20.33% invested in aluminum and 5.57% uncovered to copper costs. At $18.04 per share on August 22, DBB had $162.37 million in property beneath administration. DBB trades a mean of 94,570 shares each day and expenses a 0.75% administration price.

For the reason that July 31/August 1, copper fell 6.6%, aluminum was 6.3% decrease, and zinc forwards declined 9.9%.

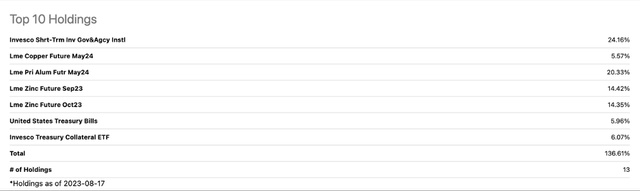

Chart of the DBB ETF Product (Barchart)

The chart exhibits the bearish development in DBB in 2023. Since July 31, the ETF fell 6.2% from $19.24 to $18.04 per share.

The 5 causes to contemplate including DBB to your portfolio and accumulating the ETF on a scale-down foundation

DBB does a wonderful job monitoring a portfolio of zinc, aluminum, and copper costs. Over the previous weeks, the declines within the metals and DBB have created a possibility to load up on the main and most liquid LME metals that provide worth on the present value ranges. The next 5 compelling elements help larger zinc, aluminum, and copper costs over the approaching months and years:

China – China is the world’s main base metals shopper. Weak point in China’s economic system has induced costs to say no in 2023. A restoration would raise Chinese language demand for the metals which can be infrastructure constructing blocks. Local weather change- Because the U.S. and Europe deal with local weather change by supporting various and renewable power sources and inhibiting fossil gas manufacturing and consumption, metals demand will enhance. Inventories and manufacturing may wrestle to maintain tempo with the rising metals demand over the approaching years. Battle in Ukraine – The continued conflict in Ukraine, sanctions on Russia, Russian retaliation, and the bifurcation of the world’s nuclear powers create provide chain points impacting the circulate of commodities, and metals aren’t any exception. Rising geopolitical tensions can affect steel’s provide and demand fundamentals. U.S. rates of interest – Rising U.S. rates of interest to handle the very best inflation in many years since March 2022 have elevated the price of carrying steel inventories. Increased financing prices are inclined to weigh on metals costs as shoppers buy necessities hand-to-mouth. In the meantime, inflation has been trending decrease, with U.S. short-term charges rising from zero to five.375% over the previous seventeen months. The trajectory of rate of interest hikes will sluggish and even pause, taking promoting stress off metals costs. The U.S. greenback – The U.S. greenback has been the world’s reserve foreign money for many years. Whereas the LME is in the UK, the metals contracts use the U.S. greenback as a pricing mechanism. Over the previous months, BRICS international locations, together with Brazil, Russia, India, China, South Africa, and their allies, have been working to introduce a BRICS foreign money to problem the U.S. greenback. The greenback’s dominant function will decline if help for a BRICS overseas trade instrument for cross-border funds will increase. A weakening greenback may trigger metals costs to rise in U.S. greenback phrases.

The case for larger base steel costs over the approaching years is compelling. I favor a scale-down shopping for method to the DBB ETF. It’s just about not possible to choose bottoms in any market as costs are inclined to fall to illogical, unreasonable, and irrational ranges throughout selloffs. Nonetheless, the treatment for low costs is at all times these low costs as manufacturing declines, demand will increase, and costs discover bottoms throughout bear markets. I’m a purchaser of the DBB ETF, leaving loads of room so as to add on additional declines. Zinc, aluminum, and copper are important infrastructure and inexperienced metals for the longer term. I count on the costs will attain vital bottoms sooner somewhat than later, and the DBB ETF will transfer larger with the steel’s costs.